The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

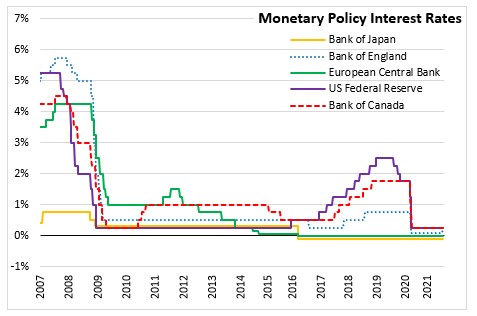

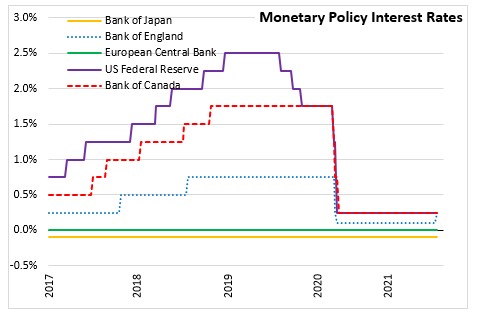

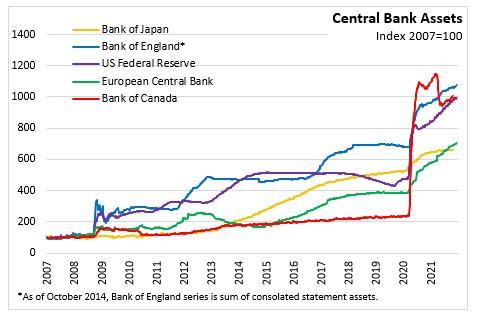

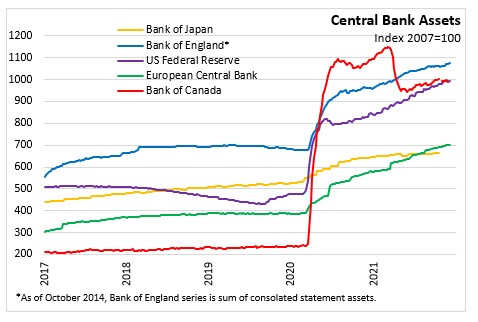

December 16, 2021BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary Policy Committee (MPC) voted to increase the Bank Rate by 0.15 percentage points to 0.25%. The MPC will maintain the stock of non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion and the target for the stock of government bond purchases at £875 billion. The total target stock of asset purchases will be maintained at £895 billion.

In the November Monetary Policy Report (MPR), the Bank had projects global and UK Gross Domestic Product (GDP) to further improve in the near term. However, the new COVID variant and continuing supply disruptions weighted on economic activity in the UK. The first estimates show that UK GDP (seasonally adjusted annualized rate) increased 5.1% in Q3 2021, a little lower than projected in the Bank's November MPR. This level of activity was 2.1% below the pre-COVID level in Q4 2019, and was mainly due to lower than expected private consumption and investment growth.

The unemployment rate declined to 4.2% in the three months to October 2021 while the number of payrolled employees continued to increase in November. Initial available data does not signal that the closure of the Coronavirus Job Retention Scheme at the end of September has led to a weakening in the labour market.

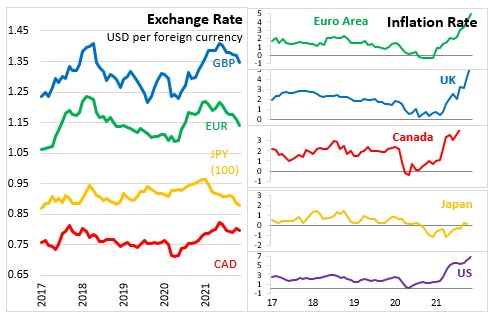

Twelve-month CPI inflation increased from 3.1% in September to 5.1% in November with core inflation increasing to 4.0%. The Bank noted that there had been significant upside news in core good and to a lesser extend, services price inflation. It is expected that CPI inflation will remain around 5.0% through the winter months and peak at around 6.0% in April 2022. The further increase in inflation next spring is expected to be primarily driven by the impacts of the lagged wholesale gas prices on utility bills.

The Bank still expects inflation to fall back in the second half of 2022. Given the large lag between monetary policy and inflation effects the MPC views it as appropriate to focus on medium-term prospects rather than temporary factors.

The Committee continues to judge that there are two-sided risks around the inflation outlook in the medium term, and noted that some modest tightening of monetary policy over the forecast period is likely to be necessary to meet the 2% inflation target sustainably. The MPC's next scheduled meeting is on February 3, 2022. The Bank's updated projections and its assessment on the balance of the risks to medium-term inflation will be published at the same time.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive