The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 16, 2022ANALYSIS OF NOVA SCOTIA'S CONSUMER PRICE INDEX FOR JANAURY 2022 TRENDS – January 2022

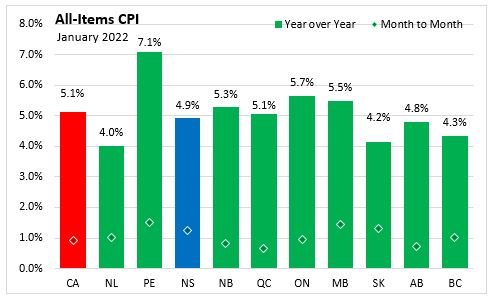

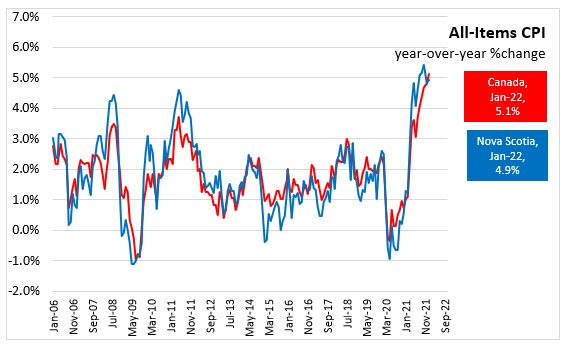

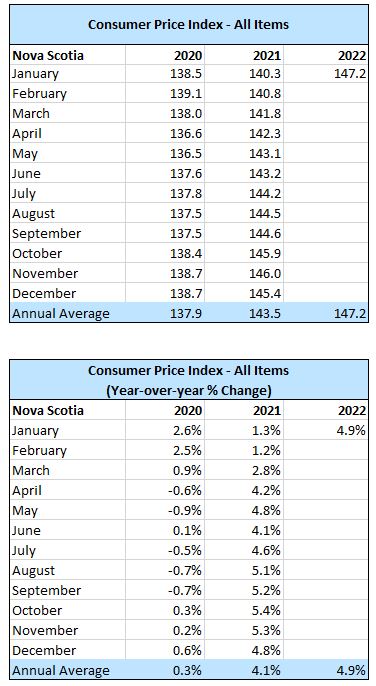

Nova Scotia’s All-Items Consumer Price Index (CPI) increased 4.9% year-over-year in January 2022, up slightly from the 4.8% year-over-year increase in December. Nationally, consumer prices were up 5.1% from a year earlier, moving up from the 4.8% increase in December 2021. The national increase is the first time inflation has been over 5% since September 1991.

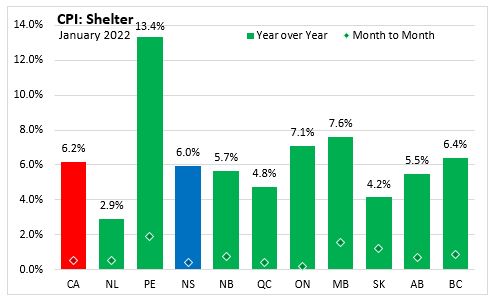

Statistics Canada noted that all major components were up on a year-over-year basis with shelter prices contributing the most to the overall increase. Shelter prices rose at there fastest pace since 1990 with new home prices contributing to higher costs for homeowners' upkeep and replacement costs. The rented accommodation index also increased with a year-over-year 3.2% increase in Canada and 6.4% in Nova Scotia.

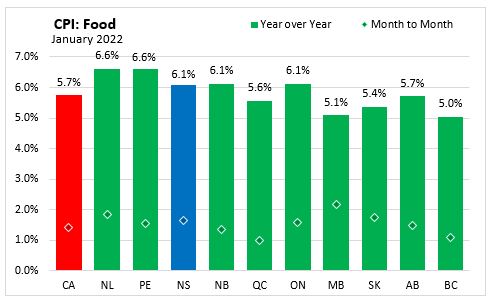

Grocery prices rose 6.5% year-over-year, accelerating from the 5.7% increase in December 2021. This is the largest increase since May 2009. Fresh or frozen beef, chicken and fish were all higher. Margarine (+16.5%), condiments, spices and vinegars (+12.1%), fresh fruit (+8.2%), bakery products (+7.4%), alcoholic beverages from stores (+2.9%) all had year-over-year increases.

Gasoline prices rose 4.8% on monthly basis in Canada with concerns over global oil supplies amid international political events.

Impact of COVID-19 on the Consumer Price Index

Due to COVID-19 restrictions some components in some areas for the spectator entertainment and use of recreational facilities and services indexes were imputed in this months CPI.

Inflation was highest in Prince Edward Island (+7.1%) while Newfoundland and Labrador had the slowest growth (+4.0%). Compared to the previous month, all provinces had increases in the CPI index in January 2022 including Nova Scotia (+1.2%).

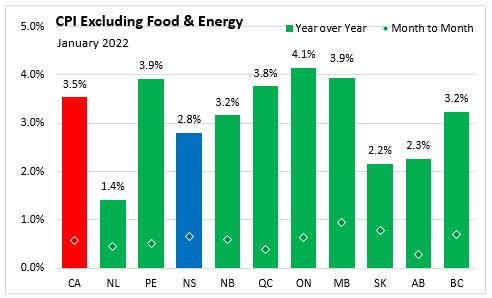

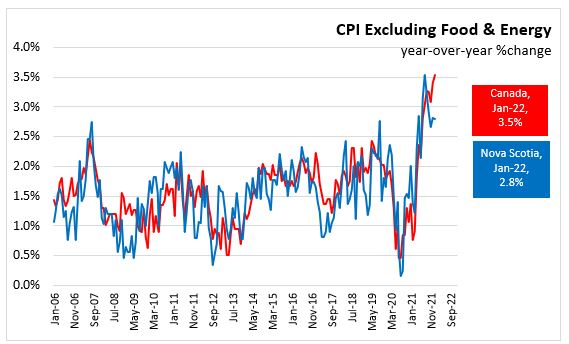

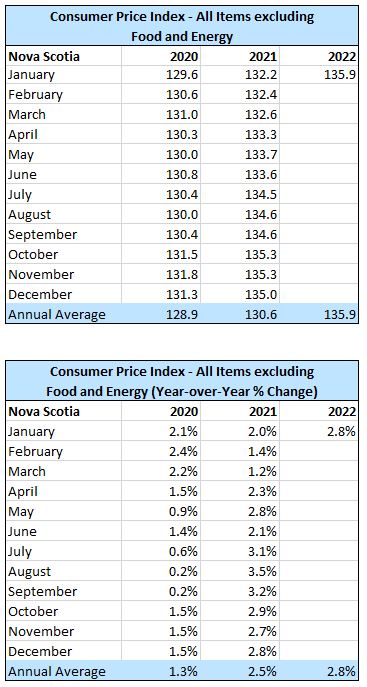

Nova Scotia’s consumer price inflation (year-over-year) excluding food and energy increased 2.8% in January 2022. Consumer prices excluding food and energy were up in all provinces led by Ontario (+4.1%). Newfoundland and Labrador had the smallest increase at 1.4%.

The CPI for food in Nova Scotia increased 6.1% year-over-year in January 2022. Nationally, food prices were up 5.7% from a year earlier. All provinces recorded year-over-year increase in food prices led by Newfoundland and Labrador and Prince Edward Island (both +6.6%). Manitoba had the lowest increase at 5.1%.

Compared to the previous month, food prices in Nova Scotia were up 1.6%, above the national average of 1.4%. All provinces recorded seasonally unadjusted month-over-month gains in food prices in January.

Year-over-year, shelter costs in Nova Scotia increased 6.0% in January 2022, below the national average increase of 6.2%. Compared to January 2021, shelter prices were up in all provinces with the largest increase in Prince Edward Island (+13.4%) and the smallest increase in Newfoundland and Labrador (+2.9%).

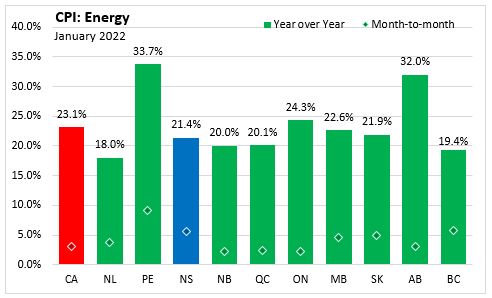

Nova Scotia's consumer price inflation (year-over-year growth in CPI) for energy was 21.4% in January compared to a national rate of 23.1%. Alberta (+32.0%) and Prince Edward Island (+33.7%) posted the largest year-over-year gain while British Columbia (+19.4%) and Newfoundland and Labrador (+18.0%) had the smallest change in the energy index. On a monthly basis, the seasonally unadjusted energy indexes were up in all provinces.

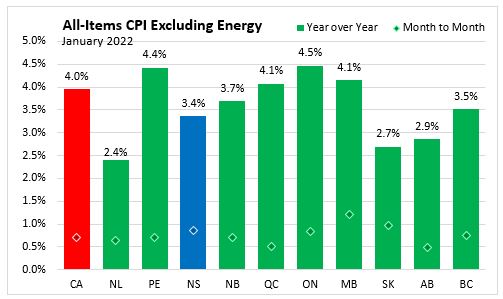

Nova Scotia's consumer price inflation (year-over-year growth in CPI) excluding energy was 3.4% in January compared to a national rate of 4.0%. Ontario (+4.5%) posted the largest year-over-year gain while Newfoundland and Labrador (+2.4%) had the smallest change in the CPI excluding energy.

Major Components for January 2022

The following table shows the price increases specific to Nova Scotia for the major components of the CPI this month.

The main contributors to the monthly change (January 2022 vs December 2021) in Nova Scotia CPI were:

- Gasoline (+8.1%)

- Fuel oil and other fuels (+6.1%)

- Passenger vehicle parts, maintenance and repairs (+4.2%)

- Rent (-0.8%)

- Household textiles (-9.7%)

- Inter-city transportation (-15.0%)

The main contributors to the yearly change (January 2022 vs January 2021) in Nova Scotia CPI were:

- Gasoline (+31.2%)

- Fuel oil and other fuels (+34.4%)

- Purchase and leasing of passenger vehicles (+5.4%)

- Telephone services (-14.5%)

- Mortgage interest cost (negative contribution, percent change not available)

- Travel tours (negative contribution, percent change not available)

Long Run Trends

In January 2022, the all-items CPI year-over-year inflation rate for Nova Scotia was 4.9%, below Canada's rate of 5.1%. Month-to-month movements in the indices can be different, but over time they generally follow the same overall trend. Nova Scotia’s all-items CPI increase of 5.4% in October 2021 was the largest increase since March 2003 (+6.9%).

Nova Scotia’s CPI excluding food and energy increased 2.8%, unchanged from the year-over-year increase reported the previous month. Canada CPI excluding food and energy rose 0.1 percentage points from 3.4% to 3.5%. The NS CPI excluding food and energy was previously above or near 3% in 2003.

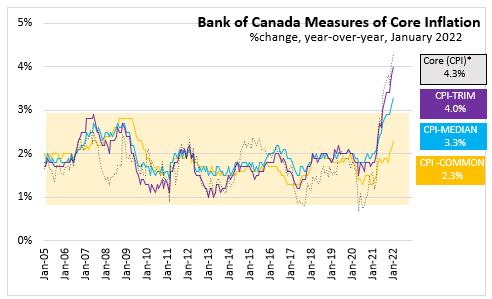

Bank of Canada's preferred measures of core inflation

Compared to January 2021, CPI-Common increased 2.3%, CPI-Median increased 3.3% and CPI-Trim was up 4.0% in Canada. All-items CPI excluding eight of the most volatile components as defined by the Bank of Canada and excluding the effect of changes in indirect taxes (formerly referred to as CPIX), rose 4.3% year-over-year. The change in the core inflation measures was up 0.2 percentage points for CPI-common, up 0.2 percentage points for CPI-median and up 0.2 percentage points for CPI-trim from the previous 12-month period.

Appendix Tables and Charts

Basket Update

With the June 2020 release the CPI basket of goods and services has been updated. The new basket weights are based on 2020 expenditure data, in which spending would reflect pre-pandemic patterns (Jan-Feb), an economy mostly in lockdown (March-June), and the emergence of new consumption patterns as economy re-opened (July-December). Statistics Canada notes that the "The data reflect shifts in spending due to the COVID-19 pandemic that will likely take some time to stabilize across goods and services, and geographic regions" and the June 2021 headline CPI for Canada would be the same if the previous basket weights (2017) were used. The weights for shelter (+2.86 percentage points), households operations, furnishings and equipment (+2.23 percentage points), and alcoholic beverages, tobacco products and recreational cannabis (+1.7 percentage points) are higher in the 2020 basket while transportation had the largest decline falling from a 19.72% share to 15.34% share. New products classes were added for shipping fees and local delivery fees (including restaurant and grocery delivery fees), digital subscriptions services to magazines, and video game consoles. Further information on the update can be found in An Analysis of the 2021 Consumer Price Index Basket Update, Based on 2020 Expenditures

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics - Bank of Canada definitions

<--- Return to Archive