The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

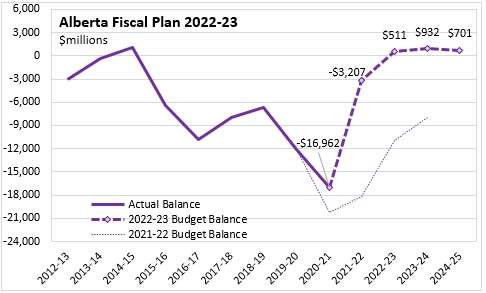

February 25, 2022ALBERTA BUDGET 2022-23 The Province of Alberta released its 2022-23 Budget, featuring a surplus of $511 million for the upcoming fiscal year. Alberta's deficit for the previous fiscal year was estimated at $3.207 billion. Alberta's surplus is projected to rise to $932 million in 2023-24, followed by a decline to $701 million in 2024-25.

After rising by 43% ($18.6 billion) in 2021-22, Alberta's revenue growth is projected to slow to 1.5% for 2022-23 and an average of 1.0% in each of the two subsequent fiscal years. Alberta's expenditures increased by 8.0% in 2021-22 and are projected to fall by 4.3% in 2022-23 with growth averaging 0.8% across 2023-24 and 2024-25.

Alberta's fiscal plan changed dramatically from the 2021-22 Budget Estimate with a large increase in revenues and subsequently slower growth than previously expected. Alberta's expenditures increased in 2021-22 instead of declining as planned, however they are expected to decline in 2022-23 and to grow only slowly thereafter.

Alberta's deficit for 2021-22 was significantly smaller than previously estimated while the projected surpluses represent much stronger fiscal results than estimated in last year's Budget outlook.

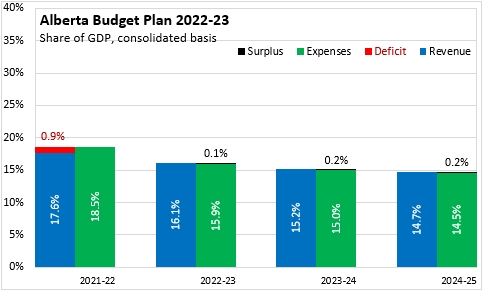

With strong growth in nominal GDP as oil prices recover from their decline in 2020, the footprint of the Alberta government in the economy has declined to 18.5% of GDP. As the economy continues to recovery, Alberta's government footprint in the economy is expected to contract to 16.1% in 2022-23, 15.2% in 2023-24 and 14.7% in 2024-25.

Alberta's net debt to GDP is projected to have peaked at 20.2% in 2020-21 and then fallen to 18.3% in 2021-22. The net debt to GDP is projected to decline to 16.7% in 2022-23, falling to 15.6% in 2023-24 and to 14.8% in 2024-25.

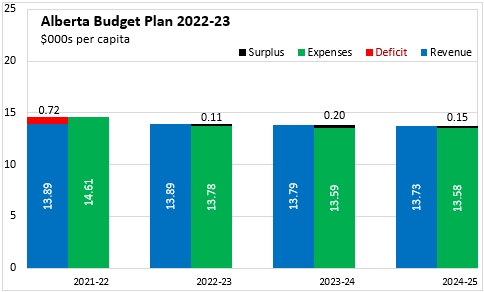

Alberta's projected surplus for 2022-23 amounts to $113 per capita as revenues of $13,894 per capita exceed expenditures of $13,781 per capita.

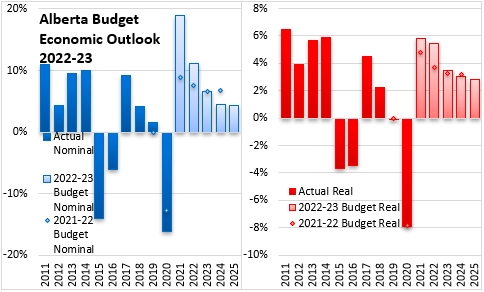

Higher energy prices and expansion of the export pipeline capacity boosted cash flow and exports led Alberta’s economic growth in 2021. Following a 16.1% decline in 2020, the nominal value of Alberta’s GDP increased by an estimated 19.0% in 2021 (5.8% in real terms). While oil production is expected to grow at a slower pace, business investment and a strengthening labour market will support economic growth in 2022. In the next two calendar years, Alberta’s economy is expected to grow 11.2% nominal in 2022 (5.4% real) and 6.5% nominal (3.5% real) in 2023. Alberta’s real GDP is expected to return to 2014 levels in 2022 marking the longest recovery from a recession in province’s modern history. Consumer price index inflation in Alberta is projected to be 3.2% in 2022 and decline to 2.4% in 2023.

Key Measures and Initiatives

- $20 million in new funding for mental health and addiction supports

- $15 million more over 3 years for the creation of a new rural investment attraction stream that will aid in attracting investment and creating jobs.

- Alberta at Work Initiative ($171 million over the next 3 years) to expand enrollment in areas with skills shortages.

- $15 million over three years to create a new non-repayable support to low-income students in qualified high-demand programs.

- consumer protection support through an energy rebate program that begins in October 2022 to help Albertans manage higher natural gas prices.

- New legislative amendments in 2022 to require online marketplaces to collect and remit tourism levy on behalf of their Alberta short-term rental hosts.

- Work with the federal government to explore a coordinated taxation approach to collect a provincial tax on vaping products sold in Alberta

Alberta Budget 2022-23

<--- Return to Archive