The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

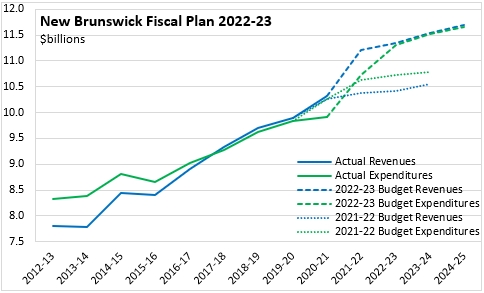

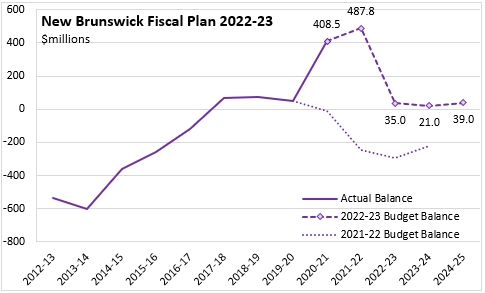

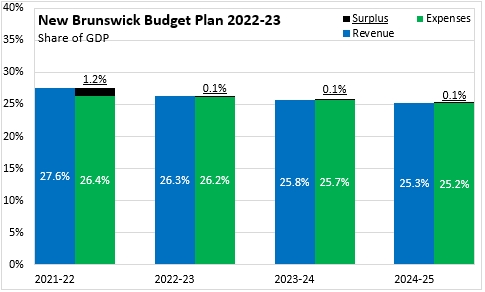

March 24, 2022NEW BRUNSWICK BUDGET 2022-23 The government of New Brunswick released its 2022-23 Budget on March 22, anticipating a surplus of $35 million for 2022-23 and small surpluses in each of the next two fiscal years. Revenues and expenditures are each projected to rise by 1.5% per year from 2022-23 to 2024-25.

New Brunswick reported substantially higher revenues than expected in 2021-22 (+$833 million) through expenditures were only $100 million higher than planned. In 2022-23 and subsequent fiscal years, New Brunswick provincial government expenditures are lifted to match the added revenues expected.

New Brunswick's budget balance has significantly outperformed previous expectations.

New Brunswick's surpluses are very small compared with GDP - amounting to just 0.1% of nominal GDP in each of the next three fiscal years.

The footprint of the provincial government in the New Brunswick economy amounts to 26.3% of GDP in 2022-23. This is projected to decline to 25.3% of GDP by 2024-25.

New Brunswick's net debt to GDP ratio is estimated at 30.1% as of the end of 2021-22. The net debt to GDP ratio is projected to shrink to 28.2% by 2024-25.

On a per capita basis, New Brunswick provincial expenditures are estimated at $14,204 for 2022-23, against revenues of $14,248, leaving a surplus of $44 per capita. over the next two fiscal years per capita spending is projected to rise slightly to $14,411 while revenues grow to $14,459 and the surplus remains mostly stable at $48 per capita.

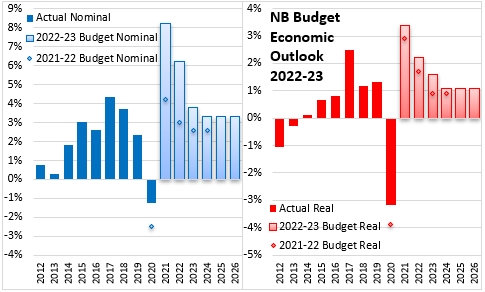

New Brunswick's economic outlook has been increased compared to the outlook in the 2021-22 provincial Budget. New Brunswick's outlook for 2022 anticipates real GDP growth of 2.2% with nominal growth of 6.2% on strong expected price growth. New Brunswick's economic recovery expects support from household consumption, residential investment and government capital spending along with elevated inflation.

Key Measures and Initiatives

The New Brunswick Budget for 2022-23 includes:

- Adjusting personal incomes taxes with a higher basic personal amount (rising from $10,817 to $11,720) and a higher low income tax reduction threshold to offset the effects as the carbon price rises from $40/tonne to $50/tonne.

- Reducing (over 3 years) provincial property tax rates by 50% for non-owner-occupied residential properties as well as by 15% for non-residential properties and nursing homes.

- Capping rent increases to 3.8% (CPI growth) and introducting protections for tenants and increasing compliance efforts for residential tenancies

New Brunswick Budget 2022-23

<--- Return to Archive