The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

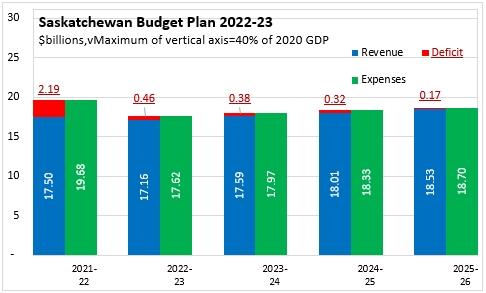

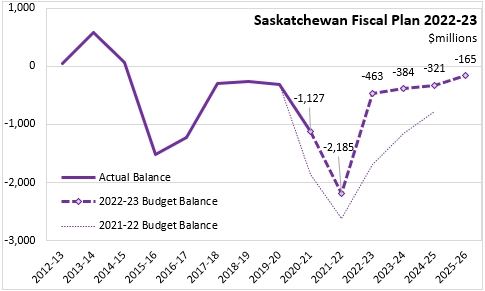

March 24, 2022SASKATCHEWAN BUDGET 2022-23 Saskatchewan's 2022-23 Budget estimates a deficit of $463 million in 2022-23, down from $2.185 billion forecast for 2021-22. Over the next three fiscal years (2023-24 to 2025-26), Saskatchewan's budget deficits are projected to narrow, but not to close as revenues grow by an average annual rate of 2.6% while expenditures rise by 2.0% per year.

For 2021-22 Saskatchewan's revenues and expenditures have been revised up substantially. Revenues for 2021-22 are projected to be $2.7 billion larger than the Budget estimate while expenditures are forecast to be $2.6 billion higher than in the Budget. After these extraordinary revenue and expenditure increases, Saskatchewan's revenues and expenditures are expected to return to a pace of growth that is consistent with pre-pandemic trends, but starting in 2022-23 at higher levels of spending and revenue than were previously included in the fiscal plan.

The increases in Saskatchewan's revenues and expenditures result in narrower deficits than were expected in the previous fiscal plan.

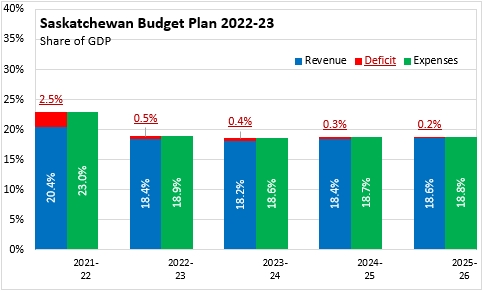

Saskatchewan's deficits amount to 0.5% of GDP for 2022-23 and shrinking thereafter - a large decline from the deficit in 2021-22 (2.5% of GDP). After the extraordinary shocks of COVID-19, the footprint of Saskatchewan's provincial government in the economy is projected to fall to 18.9% of GDP in 2022-23. It is expected to remain between 18.6% and 18.8% of GDP in the subsequent three years.

Saskatchewan's net debt as a share of GDP is estimated at 19.0% of GDP as of March 2022. This is projected to fall slightly to 18.8% by the end 2022-23 before rising to 20.4% of GDP by 2025-26.

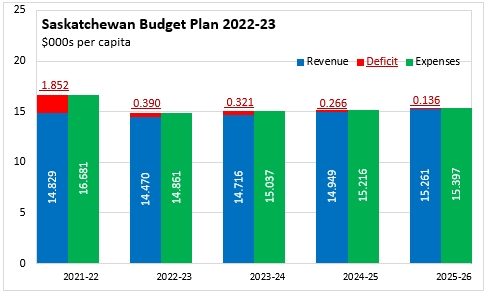

In 2022-23, Saskatchewan's provincial government expenditure plans amount to $14,861 per capita against revenues of $14,470 per capita and a deficit of $390 per capita. In the next three fiscal years, spending per capita is projected to rise to $15,397 while revenues grow to $15,261 per capita and the deficit shrinks to $136 per capita.

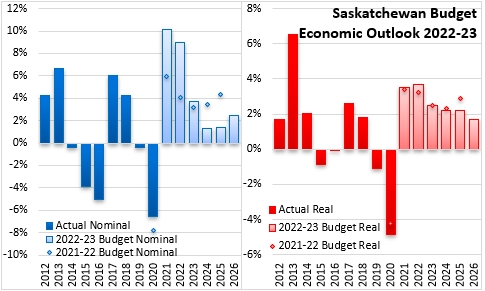

Saskatchewan's economic re-emergence after the COVID-19 shock has been based on higher commodity prices (crops, oil, gas and potash) as well as higher consumer spending, residential investment and exports. After growing by an estimated 3.5% in 2021, Saskatchewan's real GDP is projected to rise by 3.7% in 2022. Saskatchewan's nominal GDP growth is estimated at 10.1% for 2021 and projected to be 9.0% for 2022, both elevated by higher commodity prices. In 2022 and 2023, Saskatchewan's economy is expected to benefit from higher nonresidential investment in resource-producing industries. While the labour market continues its recovery, the global surge in inflation was noted as a risk to the economic outlook. The impacts from Russia's invasion of Ukraine are notable sources of price volatility in some of Saskatchewan's key commodity markets, notably potash, uranium and grains. For 2023, the Saskatchewan Budget assumes real GDP growth slowing to 2.5% while nominal GDP growth decelerates to 3.7%. Growth is expected to slow even further in the out-years of the economic forecast (2024-2026).

Key Measures and Initiatives

Saskatchewan's 2022-23 Budget prioritizes health, education and economic development. Key initiatives include:

- Adding 6,100 new childcare spaces as part of $309.6 million in early learning and childcare funding

- Providing $470 million for mental health and addictions programs

- Establishing the Saskatchewan Indigenous Investment Finance Corporation to provide $75 million in loan guarantees

- Increasing Value-added Agricultural Incentive

- Boosting the Creative Saskatchewan Production Grant Program by $8 million

- Creating new international trade and investment offices in the UK, United Arab Emirates, Mexico and Vietnam

- Making $3.2 billion in capital investments

- Extending collection of Provincial Sales Tax to expenditures on sporting events, concerts, museums, fairs, movies, gym memberships and green fees while exempting audio books from PST.

- Raising tobacco taxes by 2 cents/cigarette

Saskatchewan Budget 2022-23

<--- Return to Archive