The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 08, 2022FEDERAL BUDGET 2022-23 Canada's Federal government has tabled its 2022-23 Budget.

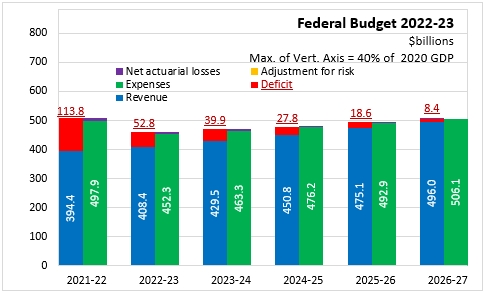

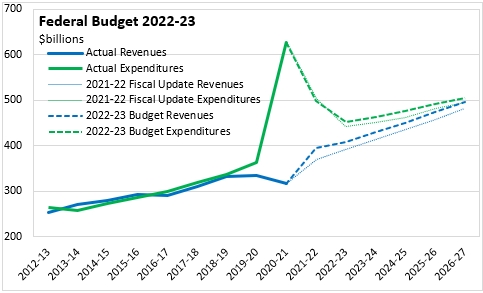

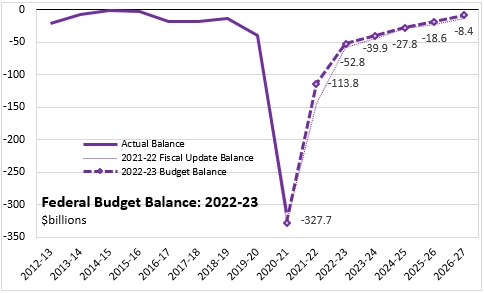

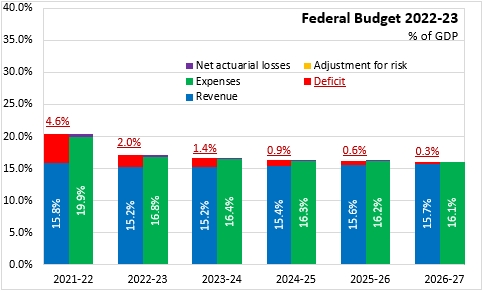

The Federal deficit for 2021-22 is now forecast to be $113.8 billion (4.6% of GDP), which is lower than the $144.5 billion deficit projected in last year's Fall Economic Statement (FES). The deficit in 2021-22 was over $200 billion narrower than in the previous fiscal year, as revenues and expenditures normalize after the effects of the pandemic. Compared with 2020-21, Federal revenues are forecast to have grown by $78 billion (24.7%) as the economy re-opened while expenditures fell by $131 billion (20.8%) as extraordinary support programs were wound down.

For 2022-23, the Federal deficit is estimated to be $52.8 billion (2.0% of GDP). Federal revenues are projected grow by $14 billion (3.6%) to $408.4 billion while expenditures are expected to fall by $45.6 billion (-9.1%) to $452.3 billion.

Beyond 2022-23, Federal deficits are projected to narrow significantly, but not to close:

- -$39.9 billion in 2023-24 (1.4% of GDP)

- -$27.8 billion in 2024-25 (0.9% of GDP)

- -$18.6 billion in 2025-26 (0.6% of GDP)

- -$8.4 billion in 2026-27 (0.3% of GDP)

Over the medium term, the Federal government’s revenues and expenditures are both projected to be higher than previously forecast in last November's FES.

The increases in outlooks for both revenues and expenditures in the 2022-23 Budget (vs FES) leave the path of declinining Budget deficits approximately the same as was estimated last November.

The Federal Budget presents alternative scenarios for the economic recovery. In the slower growth scenario (prolonged conflict in Ukraine, persistent supply disruptions, elevated commodity prices and inflation shock), the deficit actually narrows by about $13.3 billion in 2022-23 due to the impact of higher prices on tax revenues. However, slower economic growth in this scenario results in larger deficits starting in 2023-24 and beyond.

In the more moderate alternate scenario (swift de-escalation of Ukrainian conflict, resilient global demand, easing supply constraints), the deficit moderates on stronger near term economic growth than anticipated in the main Budget forecast. This results in smaller deficits over the full fiscal outlook.

As of 2022-23, the footprint of Canada's Federal government in the national economy is projected to shrink to 17.2% of GDP. By 2026-27, this is projected to shrink further to 16.1% of GDP.

After peaking at 47.5% of GDP at the end of 2020-21, Federal debt is projected to shrink to 45.1% by the end of 2022-23 and further to 41.5% by the end of 2026-27. Longer projections suggest that Canada's debt-to-GDP ratio will return to pre-pandemic levels by the mid-2030s.

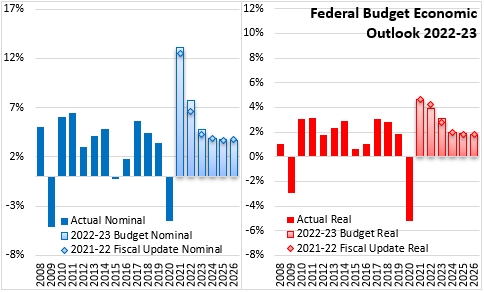

Canada’s real GDP declined 5.2% in 2020 amid the COIVD-19 and began recovering with 4.6% growth in 2021. As of January 2022, the Canadian economy is estimated to be only 0.4% larger than pre-pandemic February 2020 level. The recovery from the pandemic has been uneven. Rising inflation has led the Bank of Canada to start raising interest rates and tightening of monetary policy is expected to continue into 2023.

Canada's real GDP is projected to expand 3.9% in 2022 and 3.1% in 2023 while nominal GDP projected to grow 7.7% in 2022 and 4.8% in 2023. The Budget 2022-23 economic outlook shifts real GDP growth out of 2022 into 2023 while elevated inflation remains for longer than previously projected.

The impact of pandemic is still being felt by workers and businesses with ongoing shifts in consumer demand, supply chain issues, and increase remote work and digitization. However, Federal fiscal guardrail measures (unemployment rate, employment rate, hours worked) have largely recovered to pre-pandemic levels.

Some advanced economies have seen inflation pressures broaden with wage pressures building amid tight labour markets. Canada’s CPI was 5.7% in February 2022, highest level since August 1991. There is uncertainty about how quickly and at what cost central banks will be able to rein in inflation, but the Bank of Canada has been clear that it will use monetary policy to return inflation (and expectations of inflation) back to target. Canada's CPI inflation is projected to remain elevated at 3.9% in 2022 before declining to 2.4% in 2023. Inflation is also expected to ease in 2024 and 2025, but only gets back to 2.0% by 2026.

Strong demand, and insufficient supply growth, for housing has led to surging home price. Low borrowing costs and desire for space being key factors. Going forward, housing demand is expected to ease as interest rates rise while more new construction will slow price growth. However, it would take several years of strong supply growth to address affordability challenges in many regions.

The global outlook has deteriorated due to Russia’s invasion of Ukraine and resulting sanctions. Russia and Ukraine account for less than 2% of global GDP, but are major suppliers of key commodities including wheat, energy, potash, palladium and nickel. Sanctions on Russia are expected to remain in place for some time and a shift in economic activity away from Russia are likely to keep commodity prices elevated and volatile. European economies with trade and financial links to Russia are most exposed to negative impacts and deteriorating outlooks if the conflict persists. Higher commodity prices and further supply disruptions in the outlook will exacerbate inflation pressures globally.

The Canadian economy with limited ties to Russia and it’s own commodity production is partially insulated from the economic shock. Higher global commodity prices will lower consumers’ purchasing power and raise business costs. Canada does benefit form higher export commodity prices that are now in more limited supply, while uncertain of the global situation tilt the overall risk to downside.

Key Measures and Initiatives

Canada's 2022-23 Federal Budget includes several new initiatives and changes. These focus on: making housing more affordable, supporting economic growth, supporting clean air, increasing child care, adding more immigration, improving employment quality, strengthening national defence, investing in public health care, moving forward on reconciliation and supportive safe and diverse communities.

Key initiatives include:

Housing

- $4 billion over five years for a Housing Accelerator Fund

- $1.5 billion over two years to extend the Rapid Housing Initiative

- Introducing a Multigenerational Home Renovation Tax Credit with up to $7,500 for constructing a secondary suite for a senior or an adult with a disability (2023 start)

- Introducing the Tax-Free First Home Savings Account allowing tax-deductible savings and tax-free withdrawals (up to $40,000)

- Doubling the qualifying expense limit of the Home Accessibility Tax Credit to $20,000

- Introducing new rules so that any person who sells a property they have held for less than 12 months would be subject to full taxation on their profits as business income (exemptions for circumstances such as death, disability, the birth of a child, a new job, or a divorce)

- Proposing restrictions to prohibit foreign commercial enterprises and people who are not Canadian citizens or permanent residents from acquiring non-recreational, residential property in Canada for a period of two years

Climate

- $1.7 billion over five years to extend the Incentives for Zero-Emission Vehicles program until March 2025

- $547.5 million over four years to launch a new purchase incentive program for medium- and heavy-duty ZEVs

- Funding to build a national network of electric vehicle charging stations

- $250 million over four years to support pre-development activities of clean electricity projects of national significance (inter-provincial electricity transmission projects and Small Modular Reactors). The federal government is already advancing similar work on the Atlantic Loop and Prairie Link projects

- $600 million over seven years for the Smart Renewables and Electrification Pathways Program

- $25 million to establish Regional Strategic Initiatives to work with provinces, territories, and relevant stakeholders to develop net-zero energy plans

- An additional $2.0 billion over nine years and $136.4 million per year ongoing to renew and expand the Oceans Protection Plan

- $43.5 million over five years and $8.7 million ongoing to create a new Canada Water Agency in 2022

- $19.6 million in 2022-23 to sustain the Freshwater Action Plan

- $25.0 million over five years to support the Experimental Lakes Area

- $44.9 million over five years and $9 million ongoing to support the Great Lakes Fishery Commission

- Establishing an investment tax credit of up to 30 per cent, focused on net-zero technologies, battery storage solutions, and clean hydrogen.

Jobs and Growth

- Introducing a Labour Mobility Deduction, which would provide tax recognition on up to $4,000 per year in eligible travel and temporary relocation expenses to eligible tradespersons and apprentices

- $84.2 million over four years to double funding for the Union Training and Innovation Program, helping 3,500 apprentices from underrepresented groups—including women, newcomers, persons with disabilities, Indigenous peoples, and Black and racialized Canadians

- Establishing the Canada Growth Fund capitalized at $15 billion over the next five years, seeking three dollars of private capital for every one public dollar invested in reducing emissions, diversifying the economy, boosting exports and restructuring critical supply chains

- Making the small business tax rate available to larger businesses, with access to be fully phased out when taxable capital reaches $50 million, rather than at $15 million

Affordability

- $5.3 billion to provide dental care for Canadians with family incomes of less than $90,000, with full implementation by 2025

- Doubling support provided through the First Time Home Buyers’ Tax Credit from $750 to $1,500

- $475 million in 2022-23 to provide a one-time, $500 payment to those facing housing affordability challenge.

Canada's Federal Budget 2022-23

<--- Return to Archive