The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 13, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by 50 basis points to 1.0%, with the Bank rate at 1.25% and the deposit rate at 1.0%. The Bank will end reinvestment and begin quantitative tightening (QT) effective April 25. Maturing Government of Canada bonds on the Bank's balance sheet will no longer be replaced resulting in a decline in the size of balance sheet over time.

Russia's invasion of Ukraine has introduced significant uncertainty to the global economic outlook. This is impacting global economic conditions through higher commodity prices, supply chain disruptions and higher volatility in financial markets. As a result, inflation has increased in most economies.

Canadian economic activity is expected to remain strong driven by consumer spending, exports and business investment. Higher interest rates are expected to moderate spending and gradually reduce excess demand in the economy. With easing of supply challenges, high immigration levels and recovery in business investment, potential output will see strong growth.

The Bank notes that while long-term inflation expectations remain anchored on the target, short-term expectations have increased along with inflation. Inflation is expected to average just below 6% through the first half of 2022 and remain well above the control range through the rest of the year.

Global Economy

Russia's invasion of Ukraine is taking a tragic human toll and disrupting the global economic recovery at a time when most economies are trying to emerge from the impacts of the Omicron variant. The war has caused global supply shortages and lowered imports of products from both Ukraine and Russia. As a result, energy and commodity prices have increased along with volatility in financial markets.

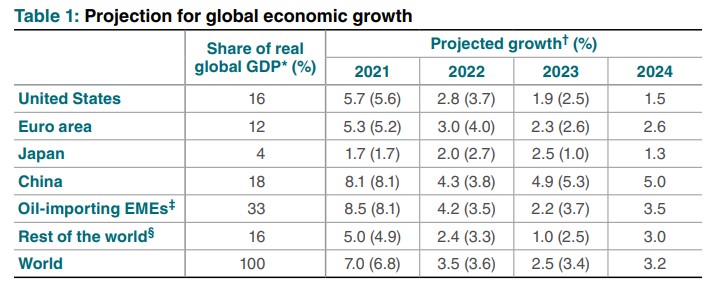

The Bank of Canada has lowered its global economic outlook from the January Monetary Policy Report (MPR). Downgraded revisions are more pronounced for oil-importing economies and regions with closer trade ties to Ukraine and Russia.

Global growth is projected to moderate from about 7.0% in 2021 to 3.5% in 2022 and 2.5% in 2023. As the initial impacts of the Russia-Ukraine war subsides, global growth is expected to strengthen to 3.2% in 2024.

Because the United States is a net exporter of petroleum products and has limited trade exposure to Russia and Ukraine, the negative impact of the war on the US economy is expected to be moderate. A tight but strong labour market combined with the use of savings accumulated during the pandemic will support household consumption. Healthy domestic demand is expected to drive robust business investment growth. However, recent increases in mortgage rates will lower growth in residential investment.

Total and core measures of US personal consumption expenditures (PCE) inflation have continued to increase and are at their highest levels in nearly 40 years. Large increases in energy prices as well as supply constraints amid high demand for goods continue to be important contributors to inflationary pressures. US inflation is projected to start decreasing in the third quarter but is expected to stay above 2% over the projection horizon as the economy remains in excess demand.

US real Gross Domestic Product (GDP) is projected to moderate to 2.8% in 2022, 1.9% in 2023 and 1.5% in 2024 as the government withdraws fiscal and monetary policy stimulus.

In the Euro Area, household and business confidence are being hit hard by the increased uncertainty caused by the war in Ukraine, higher energy prices and continuing supply challenges. Both core and total inflation have risen more quickly than anticipated in recent months and are now well above target. The recent increase in energy prices and additional supply constraints are expected to push inflation higher in the near term.

The continuing property market correction is weighing on China's economic growth. Reflecting soft demand and uncertainty around the financial viability of major property developers, the housing market remains weak. Concerns around regulatory changes and financial vulnerabilities have also caused a reaction in Chinese stock markets. China's economic growth is expected to moderate to 4.3% in 2022 before recovering to 4.9% in 2023 and 5.0% in 2024.

Market concerns about supply disruptions caused by the war in Ukraine have led to a sharp rise in most commodity prices. Oil prices have been volatile since the January MPR Report. The Russian invasion led to sharply higher prices, with the daily price of Brent crude oil peaking at nearly US$130 a barrel in early March. The scope of sanctions against Russia combined with increased supply coming from the reserves of the United States and other countries have lowered the Brent oil prices.

The Bank assumes that the price of Brent crude oil will fall from US$105 per barrel in the second quarter of 2022 to about US$90 at the end of 2024. West Texas Intermediate and Western Canadian Select crude oil prices are assumed to follow similar patterns, remaining US$5 and US$15, respectively, below Brent prices.

Canadian Economy

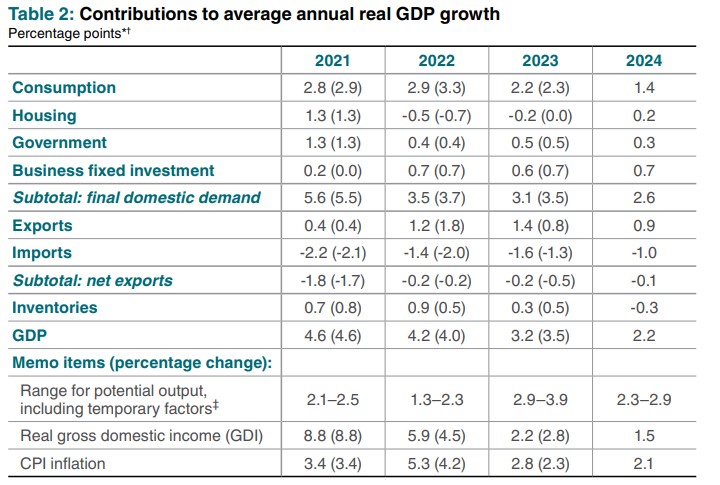

Canadian economy continues to show strong growth supported by the removal of public health restrictions, solid foreign demand and higher commodity prices. Economic growth is expected to pick up to about 6.0% in the second quarter of 2022 from a solid pace of 3.0% in the first quarter.

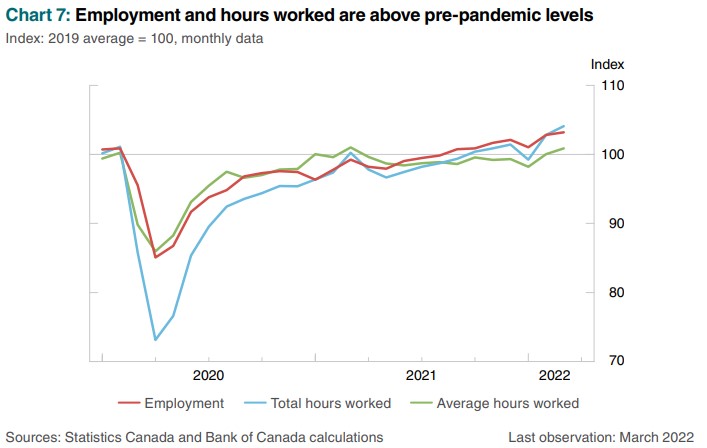

While some sectors are still recovering from the effects of the Omicron variant, employment growth has been strong resulting in rising wage growth. The Bank noted that recent indicators suggest that slack has been absorbed and the economy is moving into excess demand.

Continued recovery in services consumption, exports and investment growth combined with population growth are expected to support potential output growth. Higher interest rates will moderate domestic demand to better align it with the supply growth.

The war in Ukraine is affecting the Canadian economy predominantly through higher commodity prices, especially for gasoline, fuel oil and food.

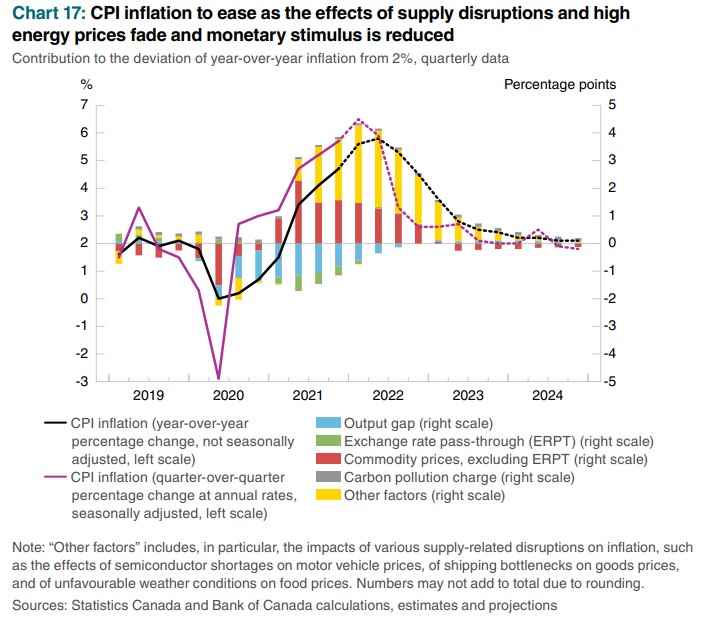

Canada GDP is expected to increase 4.2% in 2022 and moderate to 3.2% in 2023 and 2.2% in 2024. Consumer price index (CPI) inflation is forecast to average just under 6% in the first half of 2022. As the impacts of higher energy and food prices dissipate and monetary policy accommodation is removed, CPI inflation is anticipated to ease to about 2.5% in the second half of 2023 before declining to the 2% target in 2024. The Bank noted that the inflation outlook is both higher and more persistent than in the January Report.

Housing activity remains strong as demand for more housing space along with still-low borrowing rates boost activity. As borrowing rates start to increase, resales are expected to moderate. Low levels of inventories and existing homes for sale are expected to support new construction and renovations in the near term. This growth in housing supply, combined with slowing demand, should help rebalance housing markets over time and help moderate house price growth.

Employment has increased in recent months. Both employment and total hours worked have surpasses pre-pandemic levels. Wage growth has also increased to near pre-pandemic levels. Elevated job vacancies, workers’ increased willingness to switch jobs and a record-low unemployment rate are expected to support wage growth over the near term.

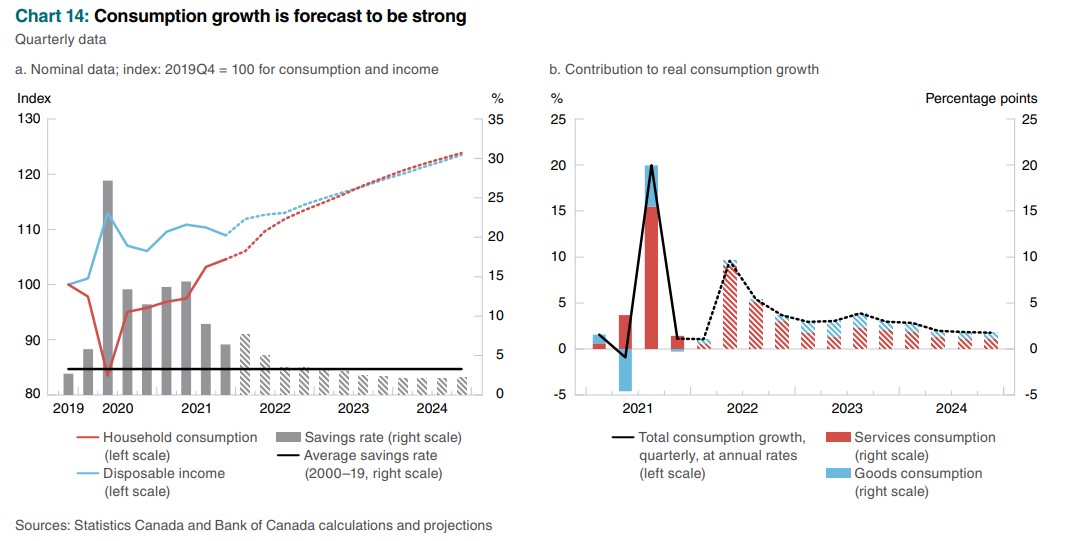

Job gains and the spending of some of the savings accumulated during the pandemic will support consumption growth. Services sector spending is expected to benefit from the lifting of public health restrictions. With goods consumption growing at a more moderate pace, the balance of consumption between goods and services will return toward pre-pandemic levels over the projection horizon.

Export growth is expected to be strong in 2022 and 2023, boosted by elevated commodity prices and solid foreign demand coupled with easing supply constraints. High energy prices and increased transportation capacity will support energy exports. As global supply chain disruptions dissipate, non-energy goods exports are expected to grow. Services exports and imports are anticipated to strengthen as travel recovers, but the recovery is expected to take time given the slow return of international tourism.

Investment in the oil and gas sector is expected to be robust because of high energy prices. However, investment will be restrained by labour shortages and ongoing uncertainty about long-term demand and the transition to a low-carbon economy. Outside the oil and gas sector, investment will be supported by robust demand, the gradual easing of supply constraints and improved business confidence.

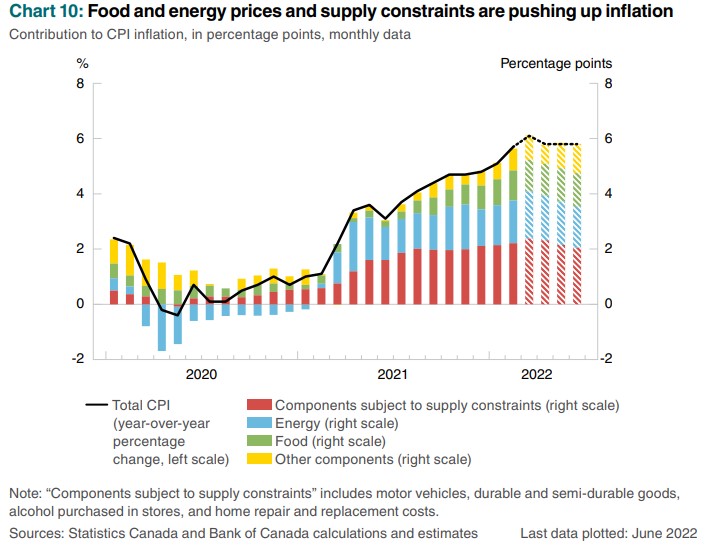

Consumer prices in Canada increased 5.7% in February 2022. Supply constraints along with strong domestic and global demand are contributing to the rise in prices of a wide range of goods and services. The Bank noted that price pressures are broadening, with about two‑thirds of CPI components growing above 3%. Measures of core inflation continue to rise alongside widening inflationary pressures, with CPI-trim, CPI-median and CPI-common at 4.3%, 3.5% and 2.6%, respectively.

With elevated energy and food prices, CPI inflation is expected to hover around 6.0% in the first half of the year. The boost from higher gasoline prices is expected to fade over the next quarter. With the anticipated easing of inflationary pressures, year-over-year inflation is anticipated to decrease from about 5.8% in the second quarter of 2022 to about 2.5% in the second half of 2023. Inflation is then expected to decline to the 2.0% target in 2024.

The next scheduled date for announcing the overnight rate target is June 1, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on July 13, 2022.

Bank of Canada: Rate Announcement, Monetary Policy Report – April 2022

<--- Return to Archive