The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

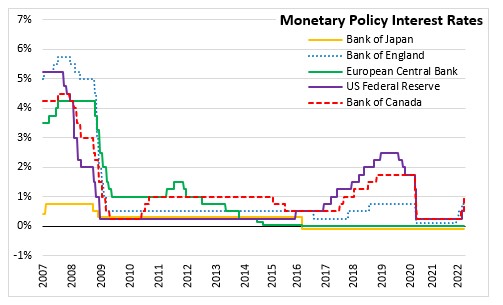

April 14, 2022EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced that key interest rates would remain unchanged at their current levels. The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Bank noted that any adjustments to key interest rates will take place some time after the end of the net purchases under the APP program and will be gradual.

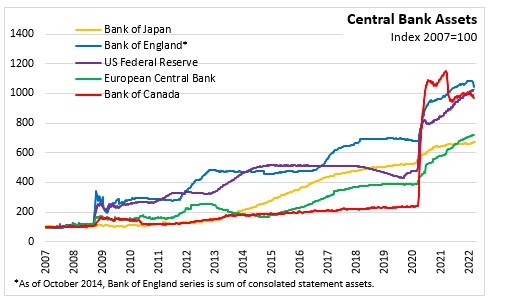

Monthly net purchases under the Asset Purchase Program (APP) will amount to €40 billion in April, €30 billion in May and €20 billion in June. The Governing Council noted that recent indicators reinforce its expectation that net asset purchases under the APP should be concluded in Q3 2022. The calibration of net purchases in the third quarter will be driven by recent data and Governing Council's assessment.

The Governing Council intends to reinvest the principal payments from maturing securities purchased under the Pandemic emergency purchase programme (PEPP) until at least the end of 2024. The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy.

Russia's invasion of Ukraine is severely affecting economic activity in the Euro Area. The conflict has created increased uncertainty that is weighing on business and consumer confidence. Increased energy and commodity prices are reducing demand and production.

The Euro Area economy grew by 0.3% in the final quarter of 2021. Reflecting the Omicron variant restrictions and the situation in Ukraine, the European Central Bank estimates that economic growth remained weak in Q1 2022.

Supply bottlenecks caused by the war and a new set of pandemic measures in Asia are disrupting production. The labour market continues to improve. The unemployment rate declined to a historical low of 6.8% in February. Job postings across many sectors signal robust demand for labour while wage growth remains muted overall. The reopening of those sectors most affected by the pandemic, a strong labour market and increased savings during the pandemic are expected to support economic growth.

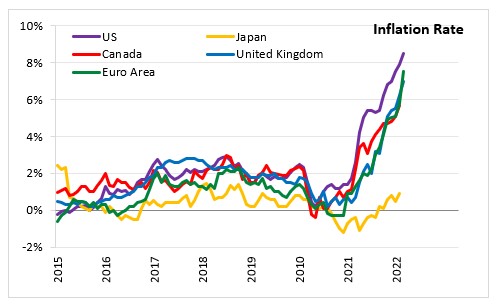

Inflation increased from 5.9% in February to 7.5% in March. The main driver behind March's high rate of inflation was higher energy prices. Energy prices are expected to stay high in the near term and than moderate to some extend. Price increases have also become more widespread as rising energy prices push up prices across other sectors. Measures of underlying inflation have risen to levels above two per cent in recent months.

The next scheduled monetary policy meeting will be on June 9, 2022.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive