The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 27, 2022REAL TIME LOCAL BUSINESS CONDITIONS: MAY 16 - MAY 22, 2022 Statistics Canada has recently added Halifax to its experimental data on real-time local business conditions.

The latest release provides real-time local business conditions from May 16 to 22, 2022. Throughout this article, reference dates mean the start of the week.

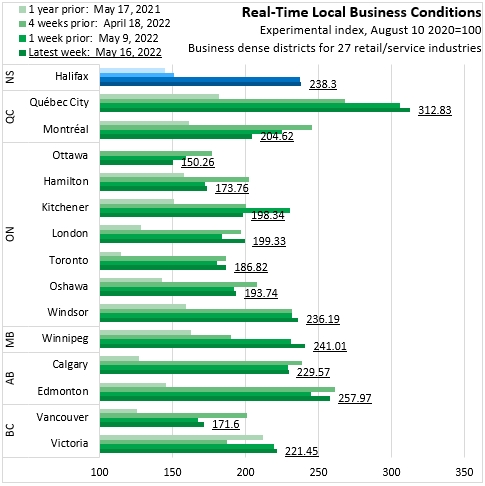

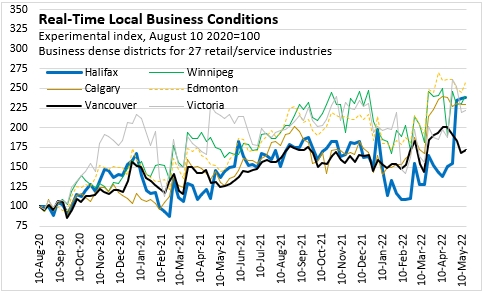

From August 10 of 2020 to the week starting May 16 of 2022, the local business conditions index for Halifax has increased by 138.3%. Ottawa and Vancouver had smallest gains. Québec City reported the strongest growth in business conditions over this period.

From the week starting May 9 to the week starting May 16, business conditions in Halifax improved by 0.3%. Halifax's business conditions improved for the fifth consecutive week after declines in early April, but the pace of improvement slowed in the most recent week.

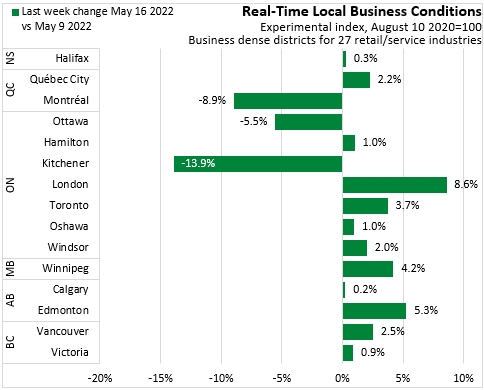

London reported the strongest improvements in business conditions last week while Kitchener and Montréal reported the biggest declines.

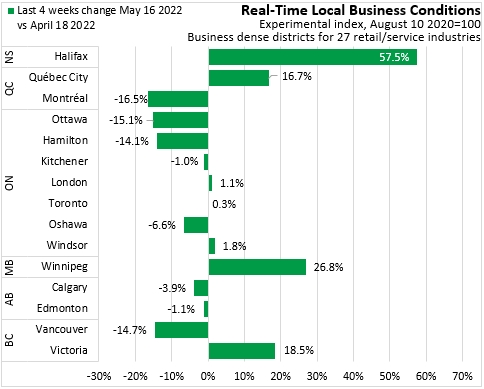

Compared with 4 weeks prior (week starting April 18, 2022 vs week starting May 16, 2022), business conditions were 57.5% higher for Halifax - the strongest improvement among the cities measured in this index over that period. Business conditions in Montréal, Ottawa, Vancouver and Hamilton reported the largest contractions from four weeks ago. Note that these data are not adjusted for seasonality and changes in May may simply reflect regular seasonal patterns.

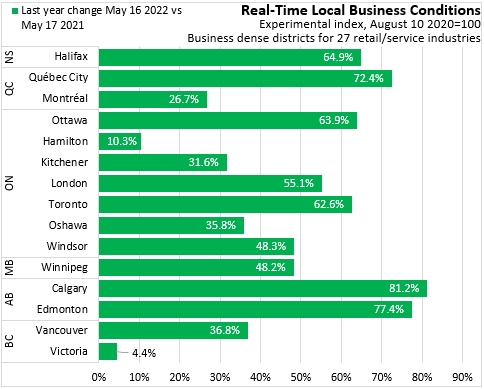

Compared with the same week a year ago, Halifax business conditions have improved by 64.9%. Victoria and Hamilton reported slower gains while Calgary and Edmonton posted the largest gains.

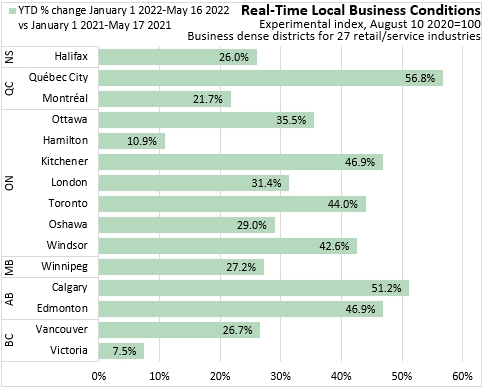

As the experimental business conditions index is both volatile and unadjusted for seasonality, a comparison of year-to-date averages may generate more stable (if less current) insights into changing business conditions. Comparing the year-to-date average of the business conditions index with approximately the same weeks of 2021, business conditions were up 26.0% in Halifax. Victoria and Hamilton reported the slowest year-to-date growth while Québec City, Calgary, Edmonton and Kitchener reported the fastest gains.

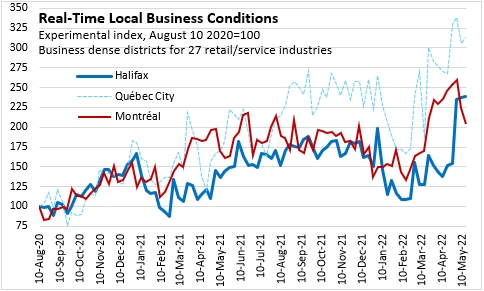

Starting from August 2020, Halifax business conditions improved through the fall of 2020 before contracting in the winter. Halifax business conditions started to improve through the spring of 2021 with little clear impact from restrictions imposed in late April that year. Business conditions stabilized in the fall of 2021 and contracted in the winter months of 2022. Halifax business conditions have seen larger improvements compared to those observed in other major centres over the last month.

Halifax business conditions follow business condition changes in Montréal with the notable exception of winter months, during which conditions erode more sharply and are slower to recover. Rising business conditions in Québec City continue to outpace those in Halifax.

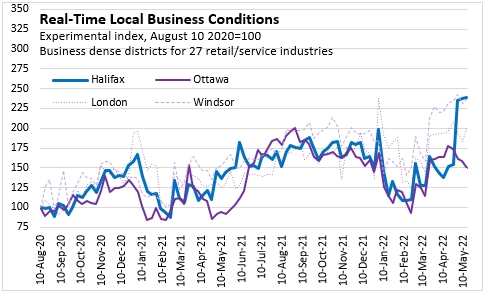

Halifax's business conditions compare closely with Ontario urban centres outside the Greater Toronto Area (notably Ottawa since last summer). It is only in the last few weeks that contractions in business conditions for Halifax have deviated from trends and pulled substantially ahead of business conditions in Ottawa.

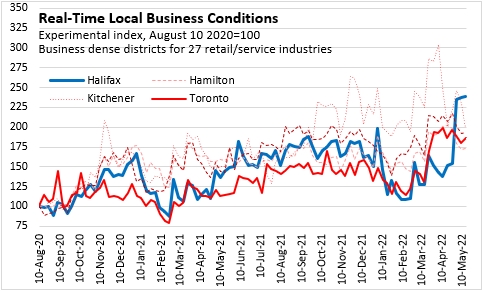

Until the start of 2022, Halifax business conditions generally grew more rapidly than observed for Toronto (which reported notable improvements in March), but lagged conditions in communities around the Greater Toronto Area (Hamilton, Oshawa, Kitchener). However, in the last two weeks, local business conditions in Halifax have pulled ahead of all cities around the Greater Toronto Area.

Business conditions in major centres of western Canada have generally improved more rapidly than in Halifax. Halifax business conditions tracked those of Vancouver throughout the summer and fall of 2021. However, Vancouver's business conditions did not experience the same decline in the winter months of 2022 as were observed in Halifax; they also grew in March 2022 before declining in recent months. With strong gains in the last month, improvements in Halifax business conditions are now keeping pace with growth reported in Victoria, Calgary, Edmonton and Winnipeg.

Notes

This experimental data product starts from information on the number of businesses listed in the business register in "business dense areas" of a large urban centre. Data from 2019 business locations provided baseline (ie: pre-pandemic) insight on business revenue and employment.

The data focus on 27 industries in particular: retail bakeries, furniture stores, electronics/appliance stores, building materials/garden supply stores, food/beverage stores, gas stations/convenience stores, clothing stores, cycling stores, book stores, general merchandise stores, florists, cinemas, dental offices, museums, zoos/gardens, amusement/theme parks, casinos, fitness/recreation centres, bowling alleys, drinking places, restaurants, and personal care services (such as hair care or esthetics).

Data on current operating conditions (open vs. closed) were collected from commercial application-program interfaces (API). Most of the information is drawn from Google's Places API, which is similar to what is available publicly on Google Maps, with supplementary information from APIs offered by Yelp Fusion and Zomato. Queries to the API are based on a sampling approach ('density-based cursory search') that focuses on the densest areas for business locations in the selected industries. Statistics Canada cautions that the sampling methods used do not follow standard statistical methods due to cost and technical limitations.

Data on current traffic volumes were drawn from TomTom's historical traffic information. As with operating conditions, the information was drawn from a sample of routes within identified business-dense areas. Statistics Canada cautions that traffic volume estimates and their relationship to business conditions may be sensitive to changing traffic patterns, construction/detours, and changes to business models such as curbside pickup or delivery.

The index of real-time local business conditions is estimated as the value of retail revenue, adjusted for both percentage of reported business closures as well as changes in traffic volumes from pre-pandemic levels.

The value of the index was set to 100 as of August 2020. As such, the index shows changes since then, but does not represent the variations in business conditions that existed in the initial period. A location with strong local business conditions in August 2020 would have less opportunity to grow than a location with weak conditions in the same month.

Source: Statistics Canada. Table 33-10-0398-01 Real-time Local Business Condition Index (RTLBCI)

Statistics Canada catalogue 71-607X. Real-Time Local Business Conditions Index: Concepts, data, methodology, https://publications.gc.ca/collections/collection_2021/statcan/71-607-x/71-607-x2021017-eng.pdf, July 15, 2021

<--- Return to Archive