The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

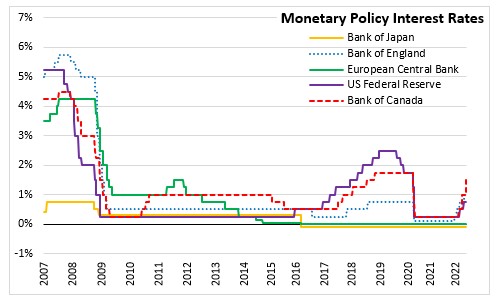

June 01, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by 50 basis points to 1.50%, with the Bank rate at 1.75% and the deposit rate at 1.5%. The Bank is also continuing its policy of quantitative tightening.

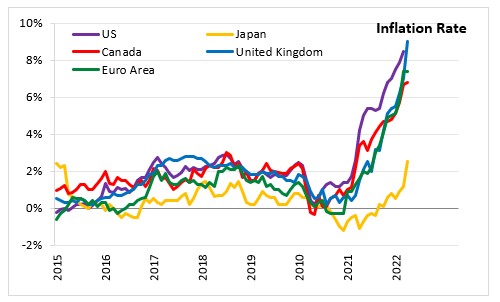

The Russian invasion of Ukraine, China’s COVID-related lockdowns, and ongoing supply disruptions are all weighing on activity and boosting inflation. The war has increased uncertainty and is putting further upward pressure on prices for energy and agricultural commodities which is negatively impacting the economic outlook, particularly in Europe. Global financial conditions have tightened and markets have been volatile.

In Canada, real GDP increased 3.1% in the first quarter of 2022, in line with the Bank's April Monetary Policy Report. Job vacancies are elevated with wage growth increasing and broadening across sectors. Housing market activity is moderating from exceptionally high levels. Supported by robust consumer spending and exports, the Canadian economy is expected to register a solid growth in the second quarter of the year.

Inflation globally and in Canada continues to rise, largely driven by higher prices for energy and food. In Canada, CPI inflation reached 6.8% in April 2022. This was well above the Bank’s forecast. The Bank expects that inflation will likely move even higher in the near term before beginning to ease.

As pervasive input price pressures feed through into consumer prices, inflation continues to broaden, with core measures of inflation ranging between 3.2% and 5.1%. Almost 70% of CPI categories now show inflation above 3%. The risk of elevated inflation becoming entrenched has risen. The Bank noted that it will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.

Against the backdrop of persistent inflation and the economy operating in excess demand, the Governing Council continues to judge that interest rates will need to rise further. The policy interest rate remains the Bank’s primary monetary policy instrument, with quantitative tightening acting as a complementary tool. The pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation, and the Governing Council is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target.

The next scheduled date for announcing the overnight rate target is July 13, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection will be published at the same time.

Bank of Canada: Rate Announcement

<--- Return to Archive