The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 09, 2022EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced that key interest rates would remain unchanged at their current levels. The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Bank noted that they expect to raise interest rates in September and that further increases will be appropriate afterwards.

The ECB decided to end net asset purchases under the Asset Purchase Program (APP) as of July 1, 2022 while continuing to reinvestment principal payments from maturing securities for an extended period of time past when the key ECB interest rates increases are started. The Governing Council intends to reinvest the principal payments from maturing securities purchased under the Pandemic emergency purchase programme (PEPP) until at least the end of 2024. The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy.

Russia's invasion of Ukraine continues to weigh on euro area economy. Trade has been disrupted, leading to shortages of materials and contributing to high energy and commodity prices. These factors will slow growth and lower confidence, particularly in the short-run. Supportive growth conditions are coming from the strong labour market, fiscal support, and accumulated savings. Real GDP is projected to grow 2.8% in 2022, 2.1% in 2023 and 2.1% in 2024, significantly revised down for 2022 and 2023 compared to the March projections.

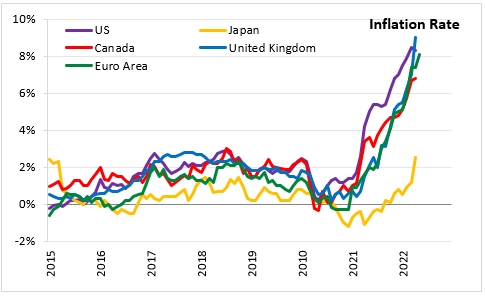

Inflation continued to increase significantly in May. Rising energy and food prices being the main drivers. However, inflation pressures have broadened and intensified into many other goods and services. The update projections point to inflation continuing to be elevated for a some time, before more moderate energy costs, eased supply disruptions, and normalisation of monetary policy led to a decline. The inflation projection are higher than March with expectation of 6.8% in 2022, 3.5% in 2023, and 2.1% in 2024. Excluding energy and good, inflation is projected to average 3.3% in 2022, 2.8% in 2023, and 2.3% in 2024.

The next scheduled monetary policy meeting will be on July 21, 2022.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive