The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 22, 2022REAL TIME LOCAL BUSINESS CONDITIONS: JULY 11 - JULY 17, 2022 Statistics Canada has recently added Halifax to its experimental data on real-time local business conditions.

The latest release provides real-time local business conditions from July 11 to July 17, 2022. Throughout this article, reference dates mean the start of the week. Note that data for Ottawa were unavailable for this week

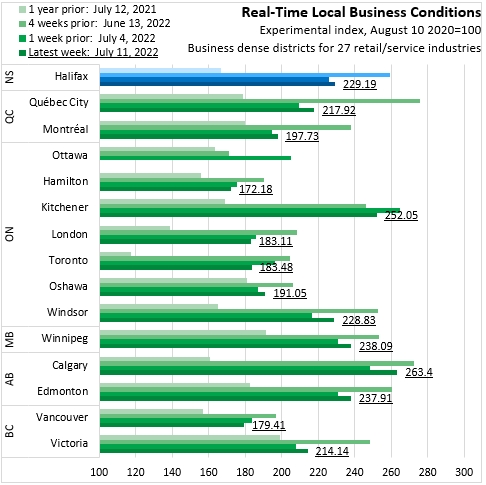

From August 10 of 2020 to the week starting July 11 of 2022, the local business conditions index for Halifax has increased by 129.19%. Hamilton had the smallest gain. Calgary and Kitchener reported the strongest growth in business conditions over this period.

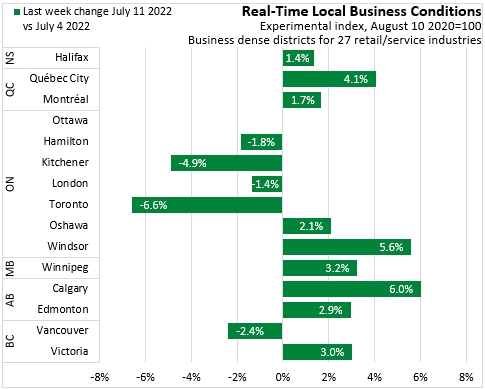

From the week starting July 4 to the week starting July 11, business conditions in Halifax increased by 1.4%. Windsor and Calgary reported the strongest gains while Toronto and Kitchener reported the largest declines.

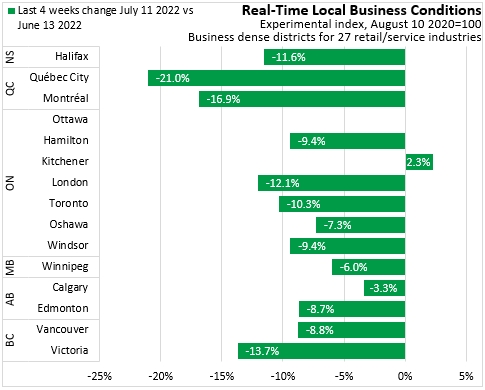

Compared with 4 weeks prior (week starting June 13, 2022 vs week starting July 11, 2022), business conditions were down 11.6% for Halifax. All reporting cities except Kitchener had declines with Québec City reporting the largest decline over this period. Note that these data are not adjusted for seasonality and changes may simply reflect regular seasonal patterns.

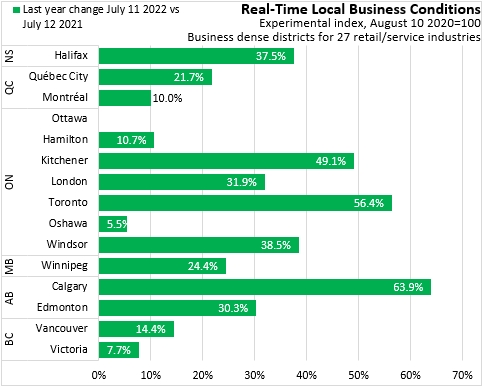

Compared with the same week a year ago, Halifax business conditions have improved by 37.5%. Only Calgary, Toronto and Kitchener have reported larger improvements over this period. Although all reporting cities had better business conditions than a year ago, Oshawa and Victoria reported slower gains than others.

As the experimental business conditions index is both volatile and unadjusted for seasonality, a comparison of year-to-date averages may generate more stable (if less current) insights into changing business conditions.

Comparing the year-to-date average of the business conditions index with approximately the same weeks of 2021, business conditions were up 34.7% in Halifax. Victoria and Hamilton reported the slowest year-to-date growth while Calgary and Québec City reported the fastest gains.

Starting from August 2020, Halifax business conditions improved through the fall of 2020 before contracting in the winter. Halifax business conditions started to improve through the spring of 2021 with little clear impact from restrictions imposed in late April that year. Business conditions stabilized in the fall of 2021 and contracted in the winter months of 2022. Halifax business conditions have improved in the previous few months.

Halifax business conditions follow business condition changes in Montréal with the notable exception of winter months, during which Halifax reports a larger contraction. Business conditions in both Montréal and Québec City have both contracted sharply in recent weeks and currently report slower growth than business conditions in Halifax.

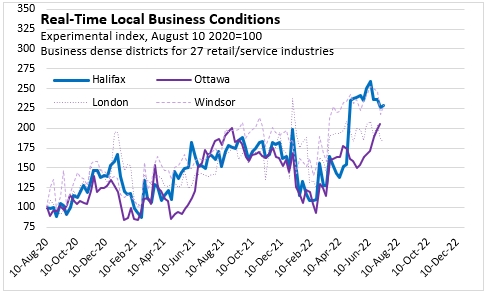

Prior to the most recent months Halifax's business conditions compared closely with Ontario urban centres outside the Greater Toronto Area - notably Ottawa since last summer. In the last few weeks that business conditions for Halifax have pulled substantially ahead of business conditions in Ottawa (though these have improved for recent weeks in which Ottawa has reported) as well as London, comparable to levels observed in Windsor.

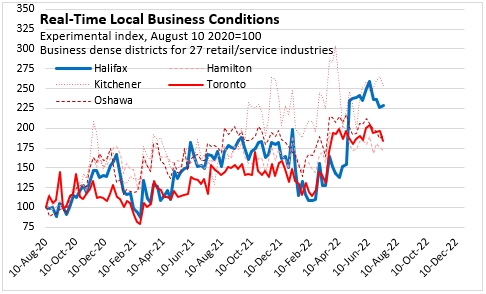

Until the start of 2022, Halifax business conditions generally grew more rapidly than observed for Toronto, but lagged conditions in communities around the Greater Toronto Area (Hamilton, Oshawa, Kitchener). Despite some declines in recent weeks, local business conditions in Halifax remain ahead of those in all the cities around the Greater Toronto Area except Kitchener.

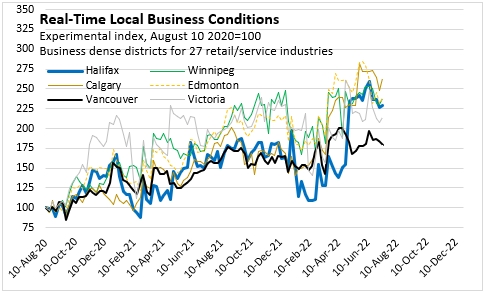

After declines in the last few weeks. Halifax business conditions remain behind those in Winnipeg, Edmonton and Calgary, but ahead of those in Vancouver and Victoria.

Notes

This experimental data product starts from information on the number of businesses listed in the business register in "business dense areas" of a large urban centre. Data from 2019 business locations provided baseline (ie: pre-pandemic) insight on business revenue and employment.

The data focus on 27 industries in particular: retail bakeries, furniture stores, electronics/appliance stores, building materials/garden supply stores, food/beverage stores, gas stations/convenience stores, clothing stores, cycling stores, book stores, general merchandise stores, florists, cinemas, dental offices, museums, zoos/gardens, amusement/theme parks, casinos, fitness/recreation centres, bowling alleys, drinking places, restaurants, and personal care services (such as hair care or esthetics).

Data on current operating conditions (open vs. closed) were collected from commercial application-program interfaces (API). Most of the information is drawn from Google's Places API, which is similar to what is available publicly on Google Maps, with supplementary information from APIs offered by Yelp Fusion and Zomato. Queries to the API are based on a sampling approach ('density-based cursory search') that focuses on the densest areas for business locations in the selected industries. Statistics Canada cautions that the sampling methods used do not follow standard statistical methods due to cost and technical limitations.

Data on current traffic volumes were drawn from TomTom's historical traffic information. As with operating conditions, the information was drawn from a sample of routes within identified business-dense areas. Statistics Canada cautions that traffic volume estimates and their relationship to business conditions may be sensitive to changing traffic patterns, construction/detours, and changes to business models such as curbside pickup or delivery.

The index of real-time local business conditions is estimated as the value of retail revenue, adjusted for both percentage of reported business closures as well as changes in traffic volumes from pre-pandemic levels.

The value of the index was set to 100 as of August 2020. As such, the index shows changes since then, but does not represent the variations in business conditions that existed in the initial period. A location with strong local business conditions in August 2020 would have less opportunity to grow than a location with weak conditions in the same month.

Source: Statistics Canada. Table 33-10-0398-01 Real-time Local Business Condition Index (RTLBCI)

Statistics Canada catalogue 71-607X. Real-Time Local Business Conditions Index: Concepts, data, methodology, https://publications.gc.ca/collections/collection_2021/statcan/71-607-x/71-607-x2021017-eng.pdf, July 15, 2021

<--- Return to Archive