The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 26, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by 50 basis points to 3.75%, with the Bank rate at 4.0% and the deposit rate at 3.75%. The Bank will continue its policy of quantitative tightening.

Inflation around the world remains high and broad-based, despite falling commodity prices and easing supply challenges. Ongoing uncertainty due to Russia's invasion of Ukraine, energy shortages and tightening in financial conditions worldwide is slowing down global economic growth.

Canadian economy continues to operate in excess demand with tight labour market. The demand for goods and services is outpacing the supply, putting an upward pressure on inflation. The Bank notes that the effects of recent policy rate increases are becoming evident in interest-sensitive areas of the economy such as softer housing activity, household spending and business activity. The slowdown in international demand is weighing on exports.

As the impacts of higher interest rates start to spread through the economy, Canada's economic growth is expected to stall through the end of this year and the first half of next year. The Bank projects Gross Domestic Product (GDP) growth in Canada to slow from 4.5% in 2021 to 3.3% in 2022 and 0.9% in 2023. Economic growth is expected to pick up to 2.0% in 2024.

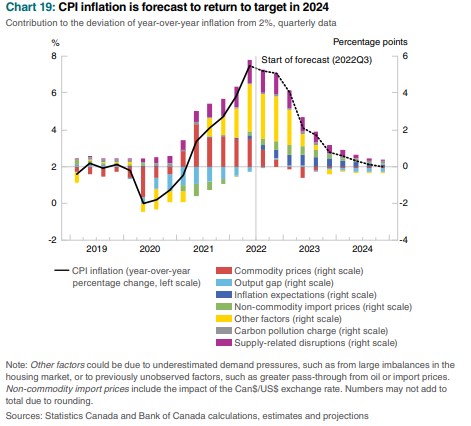

Inflation is projected to ease as the economy responds to higher interest rates and as the effects of elevated commodity prices and supply disruptions fade. The Bank expects inflation to decline to around 3% in late 2023 and return to 2% by the end of 2024.

Global Economy

The tightening of global monetary and financial conditions and Russia’s invasion of Ukraine are weighing on business and consumer confidence as well as on economic activity around the world. In response to increasing inflation, many central banks have started increasing interest rates and tightening monetary policies. As a result, global economic activity is expected to slowdown over the rest of the year.

Globally, inflation is expected to decline in 2024 to levels that are close to central banks’ targets. Lower commodity prices, easing supply challenges and slower demand growth due to monetary policy tightening are expected to reduce inflation.

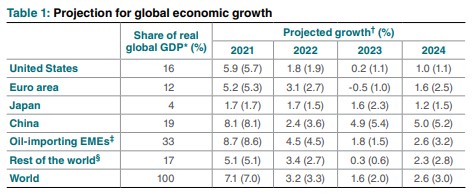

The Bank of Canada has lowered its global economic outlook from the July Monetary Policy Report (MPR) specifically in regions that are important for the Canadian outlook such as the US, Euro Area and China.

Global growth is projected to moderate from about 7.1% in 2021 to 3.2% in 2022 and 1.6% in 2023. As the initial impacts of the Russia-Ukraine war subsides, global growth is expected to strengthen to 2.6% in 2024.

Following a contraction in the first half of the year, economic activity in the United states has started to expand. However, components of US economic activity that are important for Canadian exports are expected to weaken over the short-term. Consumption growth wanes as demand for in-person services stabilizes and household budgets are squeezed by high inflation and rising interest rates. Together, the slowdown in domestic demand and tighter borrowing conditions are projected to hamper business investment and industrial production.

In the United States, measures of near-term inflation expectations have fallen slightly but are still considerably higher than the Federal Reserve’s inflation target. US real Gross Domestic Product (GDP) is projected to moderate to 1.8% in 2022, 0.2% in 2023 due to tighter financial conditions. Economic growth is expected to increase to 1.0% in 2024.

In the Euro Area, severe supply shortages caused by Russian restrictions of natural gas exports, tighter monetary policy and lower household and business confidence are weighing on economic activity. Inflation across the region remains high and broad across categories. Energy shortages are the main factor behind inflationary pressures, particularly after Russia further restricted natural gas exports.

Economic growth in the Euro Area is expected to moderate to 3.1% in 2022 and decline 0.5% in 2023. While economic activity is expected to increase 1.6% in 2024, the outlook for the region remains highly uncertain.

The impacts of the pandemic related lockdowns on China's economic activity appear to have faded. As manufacturing sector recovers and in-person activities gradually resume, economic activity is expected to pick up further. Ongoing challenges in the property market will continue to slowdown growth. China's economic growth is expected to moderate to 2.4% in 2022 before recovering to 4.9% in 2023 and 5.0% in 2024.

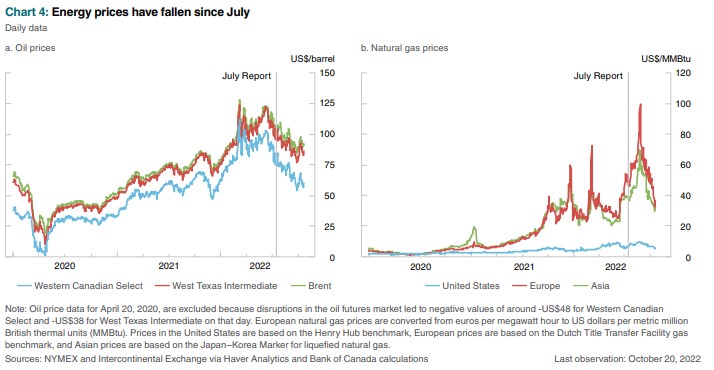

Softer global demand and tighter monetary policies have contributed to the decline in commodity prices. Since the July Report, the Bank’s non-energy commodity price index has declined by roughly 5%. The largest drop was in forestry prices, due to slowing housing activity in North America.

The Bank assumes that the price of Brent crude oil is expected to stay near current levels. West Texas Intermediate and Western Canadian Select crude oil prices are assumed to follow similar patterns, remaining US$5 and US$20, respectively, below Brent prices.

Canadian Economy

The easing of public health restrictions and high commodity prices have boosted Canadian economic activity in the first half of 2022. Rising interest and mortgage rates contributed to a sharp slowdown in housing resales in the spring. Economic growth is expected to ease to around 1.5% in the third quarter, and is expected to slow to 0.5% in the final quarter.

Demand for goods and, in particular, services has outpaced supply, and measures of core inflation continue to be elevated. Household and business expectations for inflation over the next two years remain high.

Canada GDP is expected to increase 3.3% in 2022 and moderate to 0.9% in 2023 and 2.0% in 2024. Consumer price index (CPI) inflation is forecast to average around 6.9% in 2022, 4.1% in 2023 and return to 2.2% in 2024.

Housing activity is slowing down from its high pace during the pandemic. Reflecting high borrowing rates and lower consumer confidence, resales are declining across most regions and prices are decreasing in some markets. Residential construction, including renovations, is also predicted to drop over the next year. Housing activity and prices are forecast to stabilize later in the projection horizon as both population and income growth boost housing demand.

The labour market is tight along all dimensions. The Bank noted that most indicators suggest the labour market has surpassed maximum sustainable employment including the unemployment rate. Tight labour market conditions are pushing wages higher. However, employment has been softening in recent months, particularly in some sectors that are sensitive to interest rates, such as manufacturing and construction.

The Bank estimates that the output gap—the difference between GDP and supply— was between 0.25% and 1.25% in the third quarter of 2022, similar to the estimate for the second quarter. With soft demand growth and solid potential output growth, excess demand in the Canadian economy is expected to turn into excess supply in early 2023.

Household spending is expected to contract modestly in the fourth quarter of 2022 and through the first half of 2023. Higher borrowing costs are also impacting spending on bigger items such as automobiles, furniture and appliances. Population growth and increasing disposable income are expected to support demand with household spending beginning to strengthen in the second half of 2023 and extend through 2024.

Growth in business investment in 2023 is expected to be slow reflecting higher financing costs, softening demand and moderating capacity constraints. Investment growth in the oil and gas sector is anticipated to be solid due to relatively high energy prices. However, investment will be restrained by ongoing uncertainty about long-term demand and the transition to a low carbon economy. As demand strengthens across the economy, investment growth is expected to pick up in 2024.

Exports are expected to grow moderately over the next two years. While the recovery in international travel and the recent appreciation of the Canadian dollar have offset some of the softening due to lower foreign demand, growth in non-commodity exports are expected to slow throughout 2023. Energy exports will be supported by high prices and increased transportation capacity.

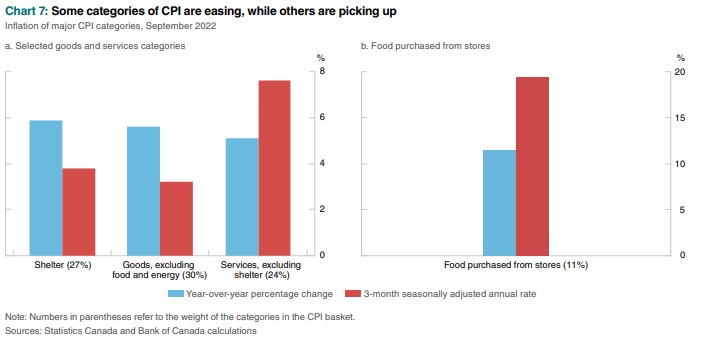

Consumer prices in Canada increased 6.9% in September, declining from its peak of 8.1% in June. Recent declines in gasoline and commodity prices are contributing to slower inflation. However, inflation remains broad-based. According to the Bank of Canada, almost two-thirds of the components of the consumer price index (CPI) showed price increases of greater than 5% over the past year. This strong and persistent demand is reflected in the Bank’s measures of core inflation. CPI-median and CPI-trim are currently at 4.7% and 5.2%, respectively.

As the effects of past increases in commodity prices dissipate and the inflationary pressures from global supply disruptions fade, inflation is forecast to decline from around 7% in the fourth quarter of 2022 to within the 1%–3% target range by the end of 2023 and to return to the 2% target by the end of 2024.

The increase in interest rates is expected to reduce demand, slow spending and help return inflation back to target range. The recent depreciation of the Canadian dollar will provide a modest boost to import prices and inflation in 2023.

Consumer price inflation in Canada is expected to average 6.9% in 2022 and slow down 4.1% in 2023 and 2.2% in 2024. All years projected lower compared to the July MPR of 7.2% in 2022, 4.6% in 2023 and 2.3% in 2024.

The next scheduled date for announcing the overnight rate target is December 7, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on January 25, 2023.

Bank of Canada: Rate Announcement, Monetary Policy Report – October 2022

<--- Return to Archive