The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 16, 2022HIGH INCOME TRENDS AND EFFECTIVE TAX RATES, 2020 Statistics Canada has released the latest data for high income earners as well as effective income tax (Federal income, Provincial income, Federal payroll) and cash transfer rates (Federal and Provincial cash transfers). The latest data are from the 2020 taxation year, during which there was extraordinary employment income loss and government income support transfers attributable to the pandemic.

High income earners

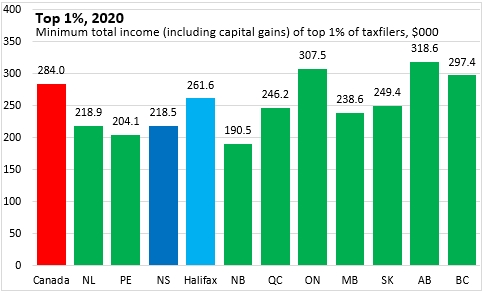

The threshold for the top 1 per cent of tax filers varies from Province to Province and from City to City. In Canada, those reporting total income (including capital gains) over $284,000 in 2020 represented the top 1 per cent of taxfilers.

In Nova Scotia, there are fewer individuals with higher incomes and the threshold of the top 1 per cent was $218,500. In Halifax, the threshold of the top 1 per cent of earners was $261,600.

The top 5% of Canadian taxfilers had total income (including capital gains) of $137,900. In Nova Scotia, the top 5% of taxfilers had income of at least $115,200. Halifax's top 5% of taxfilers had incomes of at least $130,900.

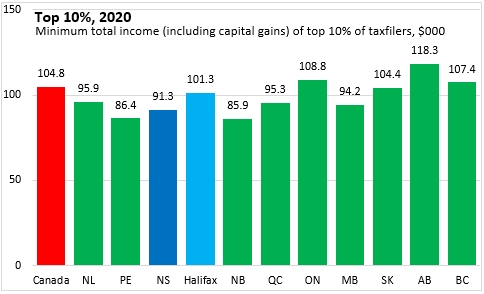

The top 10% of taxfilers in Canada had total income (including capital gains) of $104,800. For Nova Scotia, the top 10% of taxfilers had income of $91,300 or more; for Halifax the top 10% of taxfilers had income of $101,300.

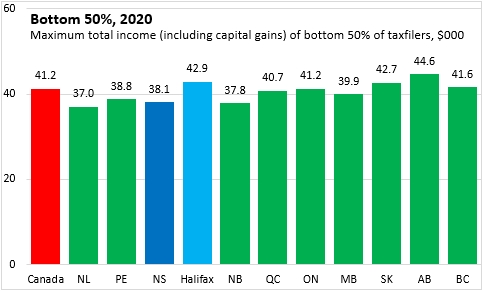

The upper threshold of income for the bottom 50% of taxfilers was $41,200 in Canada. It was $38,100 in Nova Scotia and $42,900 in Halifax.

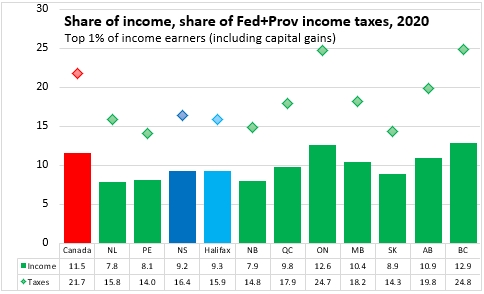

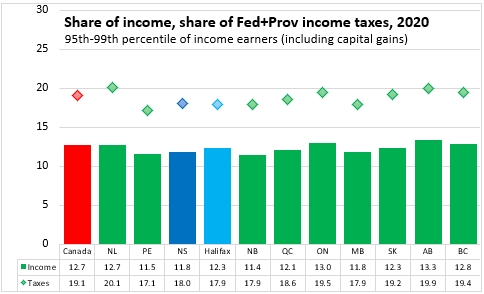

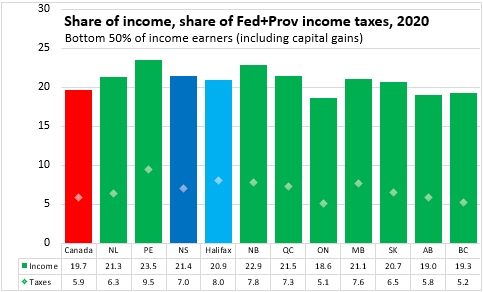

The top 1% of earners in Canada accounted for 11.5% of the total income (including capital gains) reported in 2020 and paid 21.7% of Federal and Provincial income taxes. In comparison, the bottom 50% of taxfilers accounted for 19.7% of total income and paid 5.9% of income taxes.

In Nova Scotia, the top 1% reported a lower share of total income than the national average at 9.2%, but also paid a lower share of combined Federal and Provincial income taxes at 16.4%. The bottom 50% of Nova Scotia taxfilers received a higher share of total income than the national average (21.4%) while paying a higher share of income taxes (7.0%).

Across Provinces, there is some variation in the share of total income accounted for by the top 1% of filers - with the highest shares reported in Ontario and British Columbia (note that each province has a different threshold that defines the top 1 per cent).

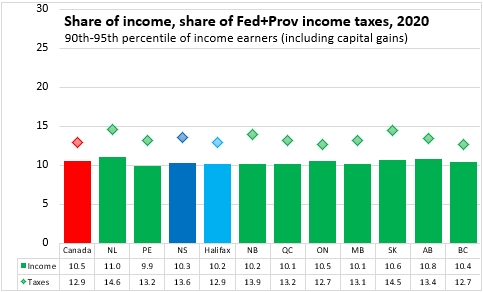

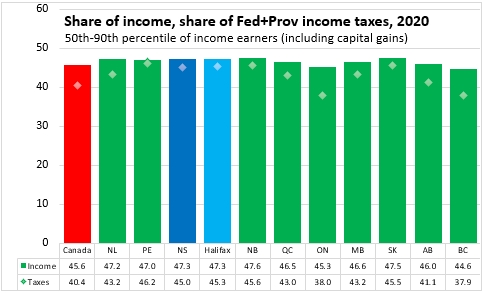

In general, those with the highest income bear a larger portion of Federal and Provincial income taxes than their shares of income. Across Canada, those in the 50th through 90th percentiles of income earners (including capital gains) pay a somewhat lower portion of combined Federal and Provincial income taxes than their share of income. Those in the bottom 50% of taxfilers earned a disproportionately lower portion of total income, but paid an even lower share of combined Federal and Provincial taxes.

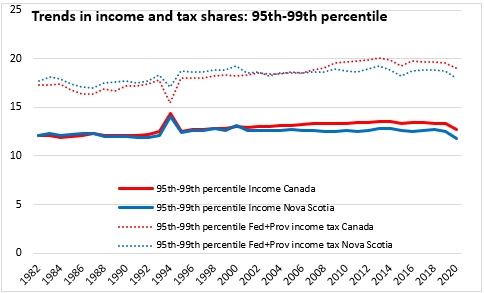

Over the period 1982-2020, the share of income accruing to the highest earners (top 1%, 95-99th percentile) has risen, though the portion of Federal and Provincial income taxes paid by these groups has risen even faster.

There was some decline in the share of income earned by those in the 95-99th percentiles as income growth in 2020 was strongest in the bottom 50% of earners (who were the bulk of recipients of extraordinary government income support transfers).

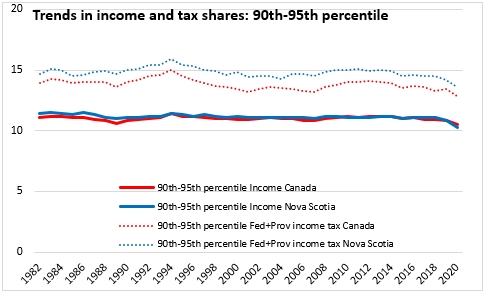

Prior to 2020, the share of income accruing to the 90-95th percentiles of earners has been relatively stable while the share of taxes paid by this group has declined at both a national and provincial level. The share of income for these earners fell in 2020.

The share of incomes for the 50-90th percentiles has declined over the 1982-2020 period, particularly in the last year. The share of taxes paid by these groups has fallen faster.

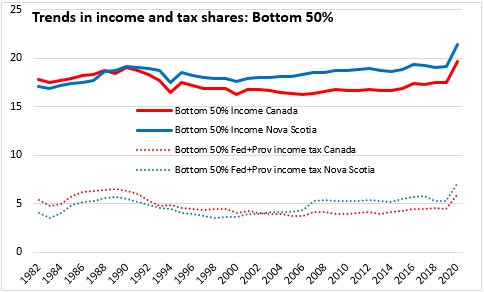

In Nova Scotia, the share of income earned by the bottom 50% of taxfilers has risen over the last 20 years, before growing sharply in 2020 with the extraordinary government transfer income.

Note: Total income consists of income from earnings, investments, pensions, spousal support payments and other taxable income plus government transfers and refundable tax credits. Federal Income taxes are derived from line 420 of the federal income tax return and exclude the Quebec abatement.

Effective tax and transfer rates

Statistics Canada's review of income trends also provides effective tax rates and transfer rates.

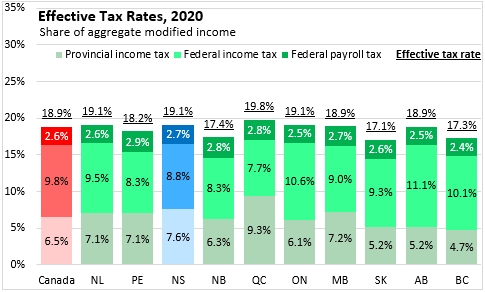

Effective tax rates measure the sum of Federal income tax, Provincial income tax and Federal payroll taxes as a share of modified total income.

Effective transfer rates measure the sum of Federal cash transfers plus Provincial cash transfers as a share of modified total income.

In the analysis below, those that report taxes in excess of transfers pay a positive net tax rate while those whose transfers exceed their taxes report a negative net tax rate.

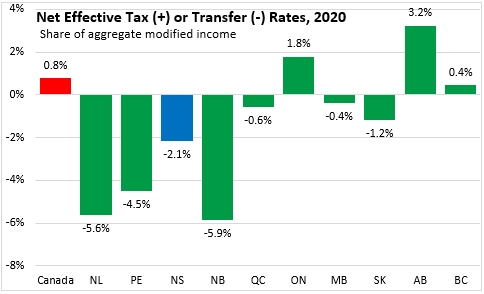

Across Canada, the effective tax rate was 18.9% in 2020. Nova Scotia's effective tax rate was just above this at 19.1%. The highest effective tax rates were reported in Quebec while the lowest were reported in Saskatchewan, New Brunswick and British Columbia.

Transfer rates were highest in Newfoundland and Labrador while the lowest rate of transfers was reported in Alberta. Nova Scotia's transfer rate was 21.2% of modified total income while the national average was 18.1%. Many of the extraordinary federal transfers in 2020 were paid at uniform national rates - resulting in a higher effective transfer rate for Atlantic Canada where aggregate modified income are typically lower.

Nova Scotia's net effective rate (taxes less transfers) was a transfer of 2.1% of total income. Nationally, the net effective tax rate was 0.8%. The only positive net tax rates (taxes>transfers) were reported in Alberta, Ontario and British Columbia. Atlantic Canada reported the largest net effective transfer rates. This atypical net transfer rate was attributable to extraordinary transfers paid during the pandemic.

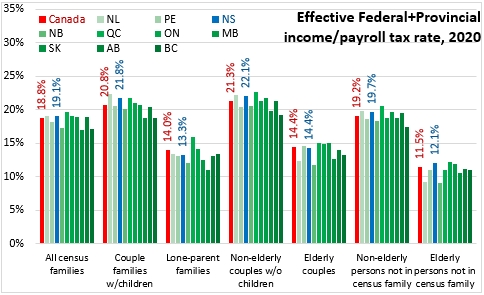

Canada's system of taxes and transfers make different provisions for certain family types and age cohorts. Tax rates were higher for non-elderly couple families and non-elderly persons not in a census family. There were lower effective tax rates for lone-parent families and elderly persons (whether in couples or not in census families).

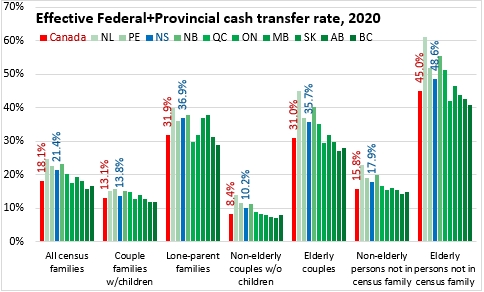

Transfers were notably higher for elderly persons (reflecting public pension systems) as well as for lone-parent families. Other parents and non-elderly persons received much lower transfers as a share of income.

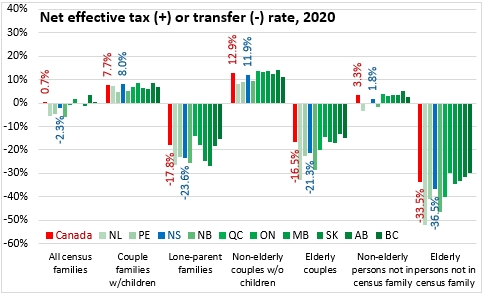

With higher transfer rates and lower tax rates, transfers exceeded taxes for the elderly as well as for lone parents. The highest net taxes were paid by non-elderly couples without children.

Source: Statistics Canada. Table 11-10-0054-01 Federal and provincial individual effective tax rates; Table 11-10-0056-01 High income tax filers in Canada, specific geographic area thresholds

<--- Return to Archive