The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

December 09, 2022BUSINESS AND EMPLOYMENT DYNAMICS, NOVA SCOTIA 2020 Statistics Canada has released the 2020 results for provincial and territorial business and employment dynamics. This covers incorporated and unincorporated businesses in the private sector that issue at least one T4 slip in any given calendar year, but excludes self-employed individuals or partnerships where the participants do not draw salaries.

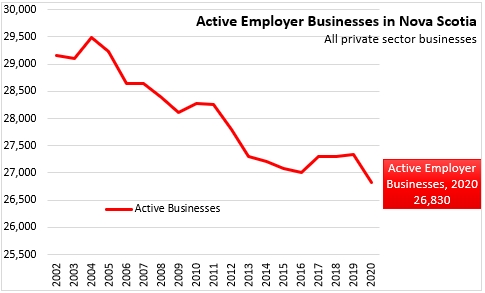

With widespread business activity restrictions and employment losses in the early stages of the COVID-19 pandemic, the number of active private sector businesses in Nova Scotia fell by 510 to 26,830.

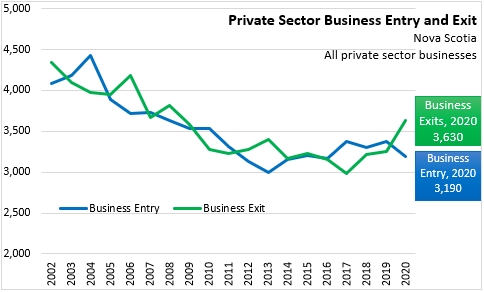

Among the 26,830 active private sector businesses, there were 23,640 incumbent businesses (continuing operations from previous years) as well as 3,190 new entrants. This was offset by exit of 3,630 firms from the numbers of previous incumbents. Entrants in any given year are enterprises that have current payroll data, but that did not have payroll data in the previous year. Similarly, exits in any given year are identified by the absence of current payroll data, where such data had existed in the previous year.

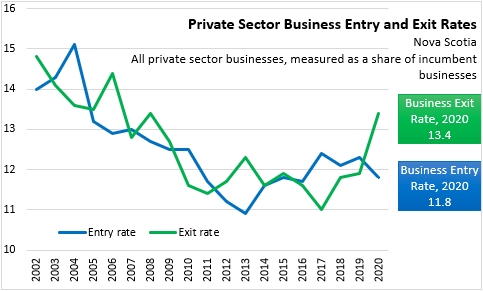

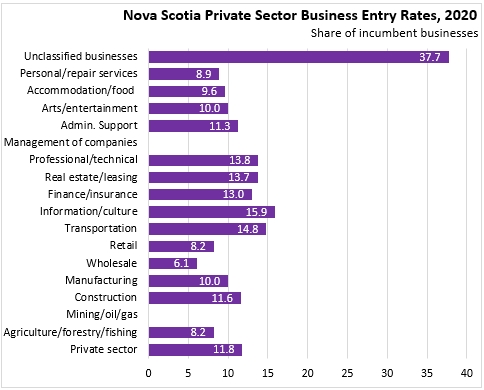

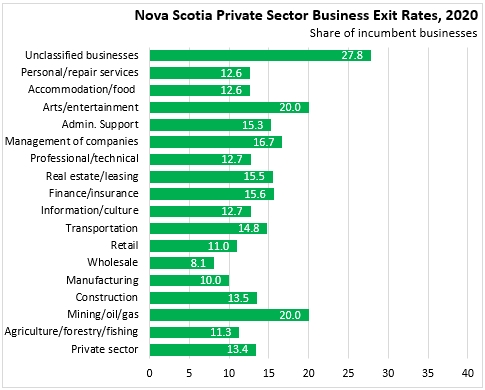

Measured in percentage terms (relative to an average of prior and current year totals), the entry rate for new firms fell to 11.8% in 2020, down from 12.3% in 2019. The exit rate for firms increased to 13.4% in 2020, up from 11.9% in 2019. Prior to the pandemic, the pace of business entry and exit had slowed and stabilized in Nova Scotia.

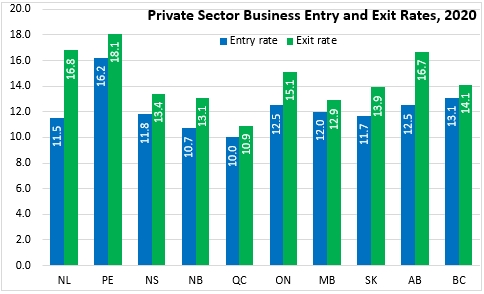

All provinces reported higher exits than entrants in 2020. Prince Edward Island reported the highest rates for both business entry and business exit. Quebec reported the lowest business entry and business exit rates. Quebec, Manitoba and British Columbia reported the smallest gaps between exit and entry rates while Newfoundland and Labrador reported the largest gaps between exit rates and entry rates.

By sector, unclassified businesses accounted for a notably faster entry rate. Among classified sectors, the fastest entry rates were reported in information/culture and transportation/warehousing. Entry rates were slower for wholesale trade, retail trade, agriculture/forestry/fishing and personal/repair services.

The fastest exit rates were also reported among unclassified businesses. Within those businesses classified to a sector, the fastest exit rates were reported in mining/oil/gas (a small number of companies to begin with) as well as arts/entertainment. The slowest exit rates were observed in wholesale and manufacturing.

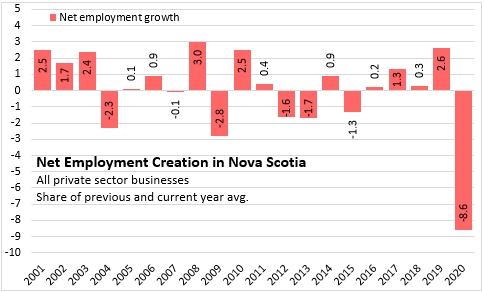

Statistics Canada's business employment dynamics data also examines employment changes in the private sector. In 2020, there was net private sector employment destruction of 8.6% in Nova Scotia during the first waves of the pandemic and its associated business restrictions and employment losses.

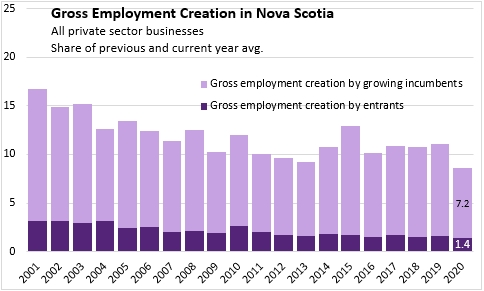

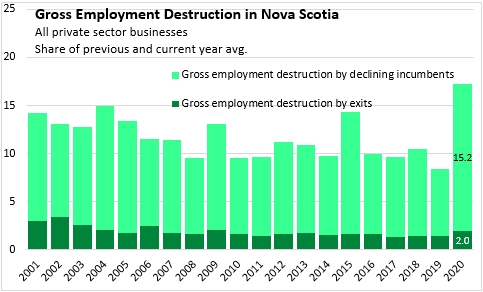

Net employment growth is broken down into four subcomponents of gross employment creation and destruction: employment creation by entrants (1.4%), employment creation by growing incumbents (7.2%), employment destruction by exits (2.0%), and employment destruction by declining incumbents (15.2%).

In all years since 2000, most net private sector employment change is explained by employment creation or destruction by incumbents rather than by new entrants or exiting firms. In 2020, the largest shifts in employment came from employment destruction among incumbent firms that remained in operation (as opposed to those who exited).

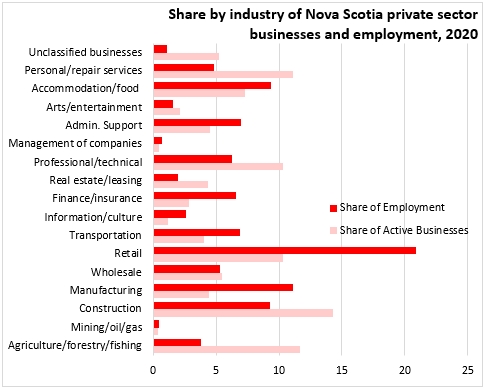

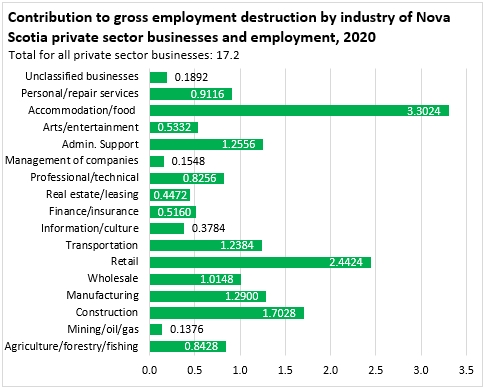

The contribution that each industry makes to overall employment dynamics depends on its share of overall employment and its gross employment creation or destruction. Industries such as manufacturing, retail, wholesale, finance/insurance, administrative and support services, information and culture, and accommodation/food account for a larger share of total employment than their share of active businesses (indicating a larger number of employees per business). Agriculture/forestry/fishing, construction, personal/repair services and professional/technical services are examples of industries with a greater share of active businesses than their share of employment (fewer employees per business).

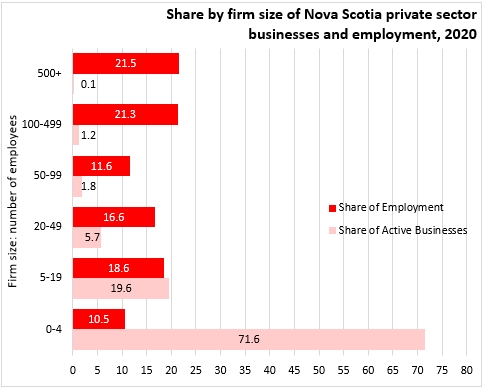

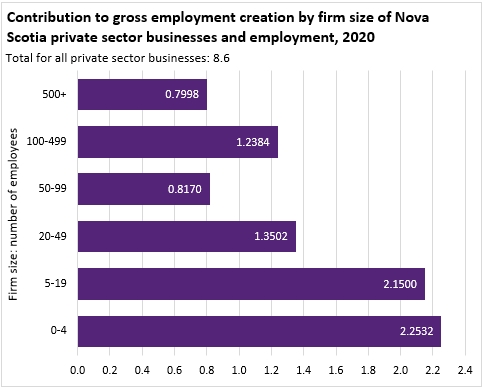

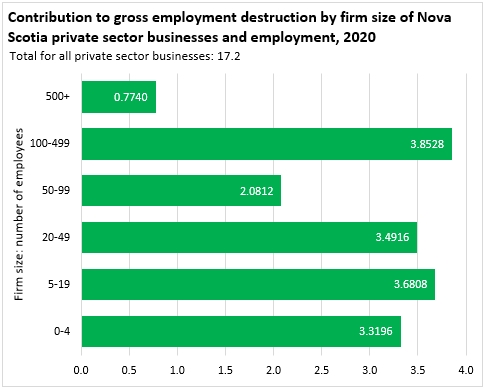

The share of businesses by firm size (as measured by number of employees) is highest for those firms employing fewer than 5 people. However, these small firms account for 10.5% of private sector employment. In contrast, firms with over 500 employees make up just 0.1% of all firms in Nova Scotia, but employ 21.5% of private sector employees.

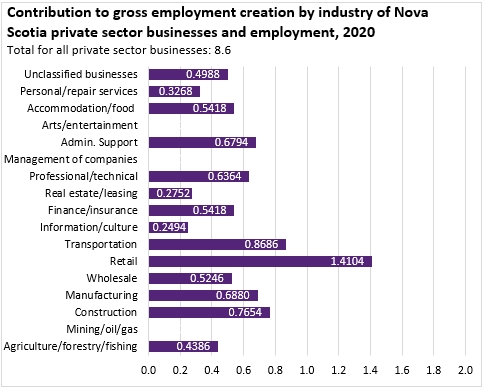

The largest contributions to gross employment creation in 2020 came from retail, transportation/warehousing and construction businesses.

Gross employment creation had stronger contribution from firms with fewer than 20 employees. Contributions to employment creation from Nova Scotia's larger firms was more modest.

The largest contributions to gross employment destruction in 2020 were reported among accommodation/food services, retail and construction businesses.

Unlike in gross employment creation, there was widespread contributions to employment destruction across almost all firm sizes. Larger firms with 500 or more employees were the exception, with a lower contribution to employment destruction in 2020.

Source: Statistics Canada. Table 33-10-0087-01 Business Dynamics measures, by industry, per province or territory; Table 33-10-0088-01 Business Dynamics measures, by firm size, per province or territory; Table 33-10-0090-01 Business Sector employment flow rates by firm size, provinces and the territories; Table 33-10-0089-01 Business Sector employment flow rates, by industry, provinces and the territories; Table 33-10-0091-01 Contribution to private sector employment, gross employment creation and destruction, by Industry, per province or territory; Table 33-10-0093-01 Contribution to private sector employment, gross employment creation and destruction by firm size, provinces and the territories

<--- Return to Archive