The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

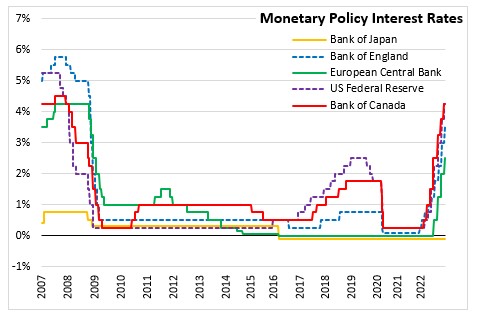

December 15, 2022BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee of the Bank of England voted to increase the Bank Rate by 0.5 percentage points to 3.5%.

According to the first estimates, UK Gross Domestic Product (GDP) had fallen by 0.2% in the third quarter of 2022, below the expected decline in the November Monetary Policy Report. Household consumption and business investment both reported declines while government spending was estimated to increase by 2.1%. The Bank expects UK GDP to decline by 0.1% in the final quarter.

The UK labour market remains tight however the Bank noted that the conditions appear to pass its peak tightness. Unemployment rate increased to 3.7% in the three months to October 2022 while employment was up 0.1%. While the earlier strength in the labour market had partly reflected the recovery in demand following the pandemic, recent weakness in labour participation rate seem to reflect an ageing population.

UK twelve-month CPI increased 10.7% in November, down from 11.1% recorded in October. Core CPI inflation, excluding energy, food, beverages and tobacco, had eased slightly from 6.5% in October to 6.3% in November. Although the introduction of the Energy Price Guarantee (EPG) in October has limited the rise in CPI inflation, the contribution of household energy bills to inflation has risen further. CPI inflation is expected to stay elevated in the near term but start to decline gradually over the first quarter of 2023 as earlier increases in energy and commodity prices dropped out of the annual comparison. These effects are expected to outweigh continuing strength from food and services price inflation.

The Committee noted that further increases in the Bank Rate may be required to return inflation to target should the economy evolve generally in line with the November Monetary Policy Report projections.

The Monetary Policy Committee of the Bank of England will announce its next interest rate decision on February 2, 2023. An updated Monetary Policy Report will be provided at the same meeting.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report, November 2022

<--- Return to Archive