The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

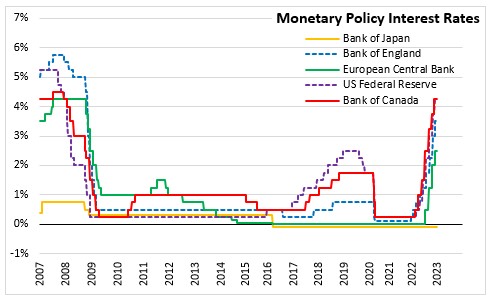

January 18, 2023BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan decided to maintain a negative interest rate of 0.1% for the Policy-Rate Balances in current accounts held by financial institutions at the Bank. The Bank of Japan will also purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit in order to keep the 10-year JGB yields at around zero per cent. In order to implement this guideline, the Bank will offer to purchase 10-year JGBs at 0.5 per cent every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted.

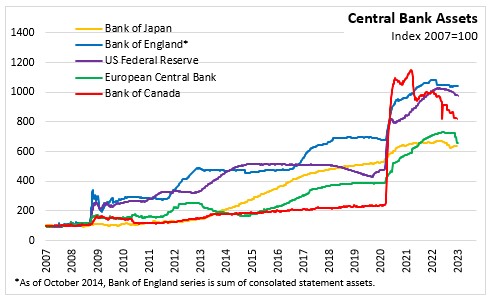

In addition, the Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces with upper limits of about 12 trillion yen and about 180 billion yen, respectively. The Bank will purchase Commercial Paper (CP) and corporate bonds at about the same pace as before the COVID-19 pandemic with their amounts outstanding gradually returning to about 2 trillion yen for CP and about 3 trillion yen for corporate bonds.

The Bank decided to extend by one year the deadline for loan disbursement under the Fund-Provisioning Measure to Stimulate Bank Lending, expand the range of eligible counterparties for the Funds-Supplying Operations to Support Financing for Climate Change Responses to include member financial institutions of central organizations of financial cooperatives, and enhance the Funds-Supplying Operations against Pooled Collateral.

The Bank will continue with “Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control”, aiming to achieve the price stability target of 2 per cent, as long as it is necessary for maintaining that target in a stable manner. The Bank also noted that it will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 per cent and stays above the target in a stable manner.

Japan's economic activity has picked up as the resumption of economic activity progressed. Exports and industrial production continue to increase as the effects of supply-chain constraints wane. Corporate profits have been at high levels on the whole with business fixed investment remaining stable.

The employment and income situation has seen moderate improvements at the whole despite some continued weakness in some sectors. Private consumption has also increased with a focus on services consumption. Housing investment has been relatively weak.

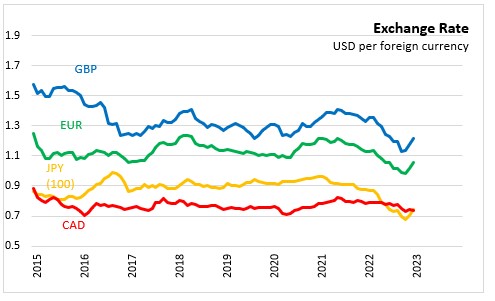

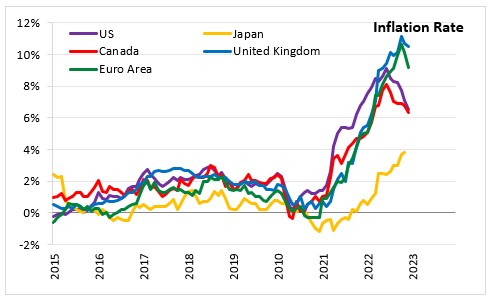

The year-on-year rate in the consumer price index (CPI, all items) increased to 3.8% in November, the eight consecutive month with inflation above 2.0%. This increase reflects the rise in prices of energy, food and durable goods. Inflation expectations have also increased. The year-on-year rate of increase in the CPI (all items less fresh food) is expected to be relatively high in the short run due to the effects of a pass-through to consumer prices of cost increases led by a rise in import prices. The rate of increase is then expected to decelerate toward the middle of fiscal 2023 due to a waning of these effects, as well as to the effects of pushing down energy prices from the government's economic measures.

As the impacts of the pandemic and supply chain disruptions wane, increased external demand, accommodative financial conditions and the government's economic measures are expected to support Japan's economic activity. Although a rise in energy and commodity prices due to the war in Ukraine is expected to put some downward pressure on recovery. Thereafter, as the negative impact of high commodity prices wanes and a virtuous cycle from income to spending intensifies gradually, Japan's economy is projected to continue growing at a pace above its potential growth rate.

The Bank expects real GDP to increase 1.9% in 2022, 1.7% in 2023 and 1.1% in 2024. These represent a downgrade for the next three years from the October 2022 Outlook. Inflation is expected to average 3.0% in 2022 and decrease to 1.6% in 2023 and 1.8% in 2024. Inflation projections are revised up from the October Outlook for 2022 and 2024 and remained unchanged for 2023.

The Bank of Japan noted that it will continue to closely monitor the impacts of the COVID-19 and will take additional easing measures if needed. The Bank expects short- and long-term policy interest rates to remain at their present or lower levels.

Source: Bank of Japan, Statement on Monetary Policy (January 18, 2023), Outlook for Economic Activity and Prices (January 2023)

<--- Return to Archive