The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 25, 2023BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by 25 basis points to 4.50%, with the Bank rate at 4.75% and the deposit rate at 4.50%. The Bank will continue its policy of quantitative tightening.

The Bank of Canada release noted that inflation has peaked and begun to ease in many countries with declines in energy prices, improved supply-chains and lower demand. Core inflation has not yet fallen, and labour markets remain tight. Russia’s invasion of Ukraine continues to disrupt commodity markets and economic activity, particularly in Europe. Central bank tightening cycles have recently slowed in several countries while other central banks communicated need for further policy rate increases.

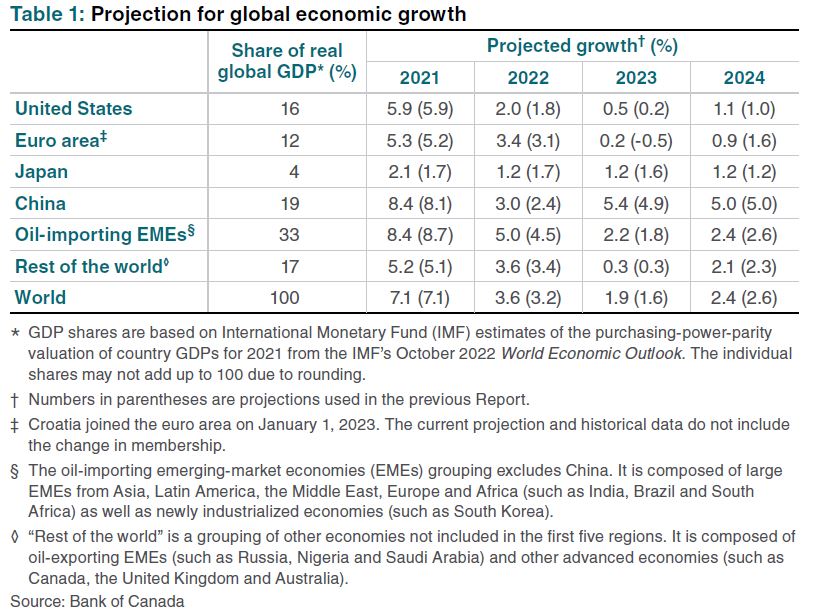

The global economic outlook was revised upwards with more robust consumption in many regions and China re-opening earlier than expected. Global real GDP is projected to grow 1.9% in 2023 as pent-up demand from the pandemic fades and higher interest rates slow activity. Growth in 2024 is expected to increase to 2.4% with monetary policy still restraining activity. The Bank of Canada expects inflation to move closer to central bank targets with declines in commodity prices, further supply-chain improvements, and slower demand growth.

Core inflation has been persistent in the US, Canada, and Europe. Service price inflation has remained strong and broad-based with a tight labour market driving labour costs higher. Near-term inflation expectations remain high. With major central banks tightening, financial conditions become more restrictive in 2022; both real and nominal long-term government bonds yields have risen substantially.

US economic activity is expected to remain flat through 2023 due to the rise in interest rates before picking up gradually over 2024. In the euro area, elevated natural gas prices constrain industrial production, inflation erodes purchasing power and business and consumer confidence have weakened. China’s lifting of COVID-19 restrictions resulted in rapid spread of the virus which has weighed on economic activity. With China economy reopening, growth is expected to have a strong rebound as case numbers decline. The Chinese property sector continues to slow as regulation were put in place to reduce speculation and excess leverage, the outlook for this market remains uncertain.

Oil prices have declined since October with improved global oil supply, Western sanctions are expected to have less of an effect of Russian oil production. Western Canadian Select (WCS) spreads have widened with discounted Russian heavy oil on the global market but are anticipated to narrow as refineries come back online in early 2023 and the completion of Trans Mountain pipeline in 2024. Natural gas prices have declined with warmer-than-normal weather in Europe but concerns around shortages caused by Russia’s decision to restrict gas exports remain. The Canadian dollar in recent months has been stable, around 74 US cents, while depreciating against other trading partner currencies, reversing the appreciation that occurred through first half of 2022.

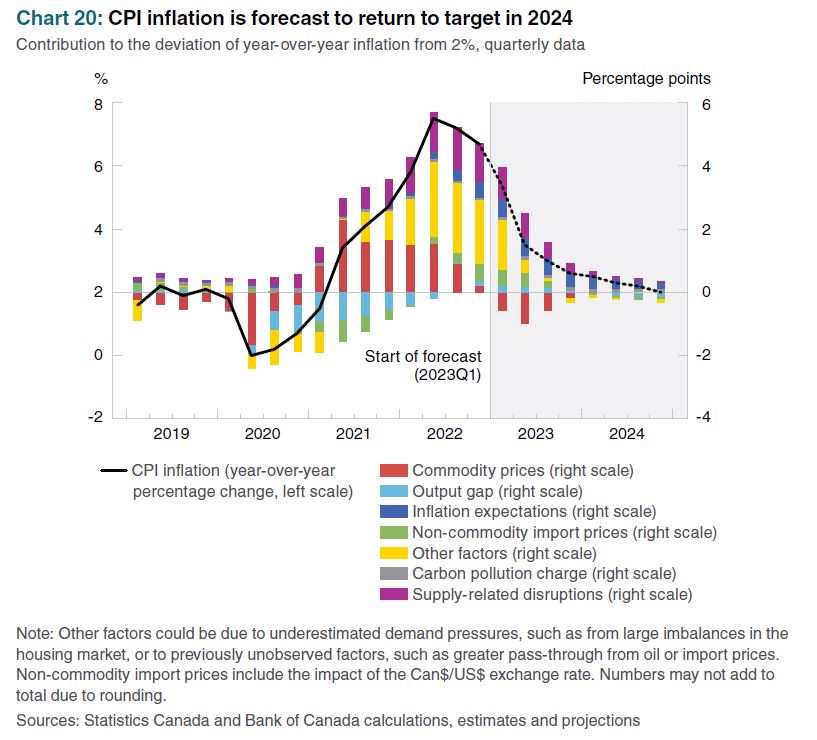

Inflation in Canada was 6.3% in December and it remains high and broad-based with core inflation around 5%. The decline in inflation in recent months was mostly due to lower gasoline prices, but also lower non-energy and non-food goods demand and improved global supply conditions. Inflation for services, excluding shelter, has been more persistent. Food and shelter inflation remain high with cost pressure lifting food prices and rising mortgage rates offsetting falling home prices.

Inflation expectation of business and consumer are for well above 2% inflation to continue and be higher than Bank of Canada’s forecast over the next two years. Short-term inflation expectations have come down and fewer firms are expecting significant price increases. A large share of firms in surveys noted that they expect pressure on input costs and output prices to be less intense going forward and are returning to pre-pandemic price-setting practices (reducing size/frequency of price changes, less intense tracking of competitors pricing, waiting for cost increases to materialize) that could narrow margins.

Inflation is forecasted to decline to 3% by middle of 2023 and reach the 2% target in 2024. Weaker inflation in goods expected to come from slower global demand, improved supply chains, decline in some material costs, and return to more normal pricing behaviour. Inflation for service excluding shelter is projected to remain elevated over first half of 2023 with robust demand and strong unit labour costs. Shelter and food in stores inflation remains elevated and above CPI inflation.

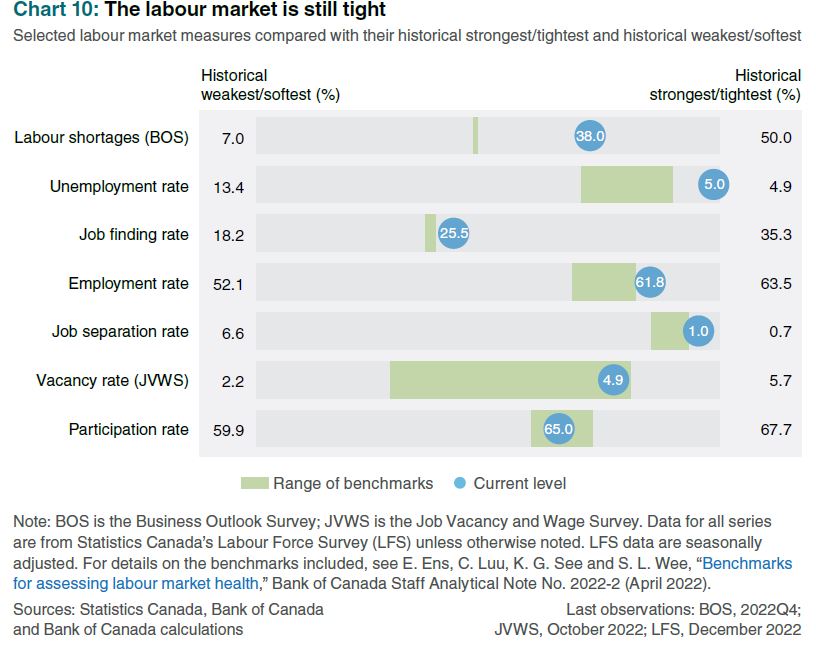

Economic growth is slowing, but demand continues to exceed supply. The labour market remains tight across many measures, suggesting it’s above maximum sustainable employment. Job gains in Q4 2022 were robust, the unemployment rate is near all-time low, and job vacancies are elevated. Wage growth remains broad-based and seems to have plateaued in 4-5% range. The risk of a wage-price spiral has declined, but the current 4-5% wage growth, with a surge in productivity, is not consistent with achieving 2% inflation target. Monetary policy has showed signs of slowing labour demand with employment growth weakening in interest rate sensitive sectors such as manufacturing, construction, and trade. The estimate of the output gap is between 0.5% and 1.5% of GDP in Q4 2022.

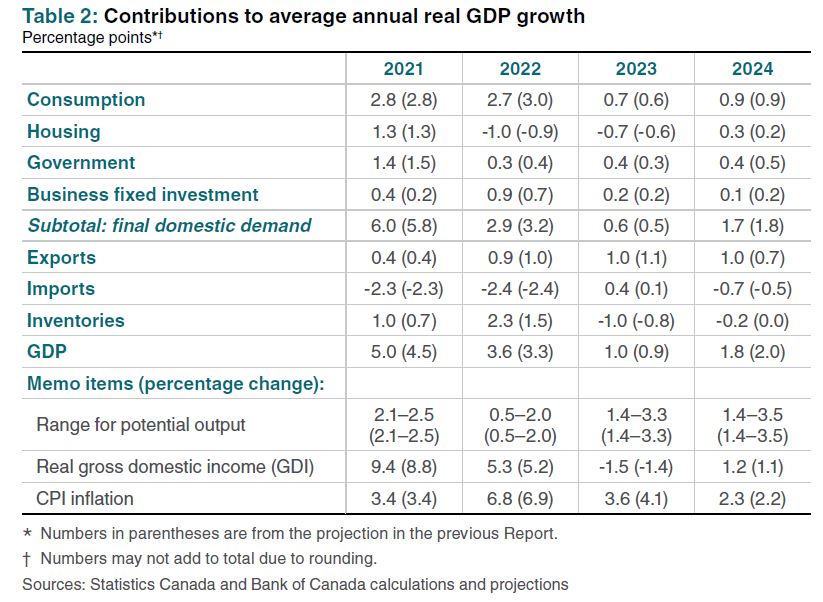

Economic growth is estimated to have slowed in Q4 2022 and expected to stall through the middle of 2023. The likelihood of negative vs. growth is similar during this period. Higher interest rates have started to slow demand for housing and big-ticket items, and are expected to have broader effects in 2023 with spending on consumer services and business investment slowing. Growth is projected to pick up later in 2023 and grow 1.8% in 2024.

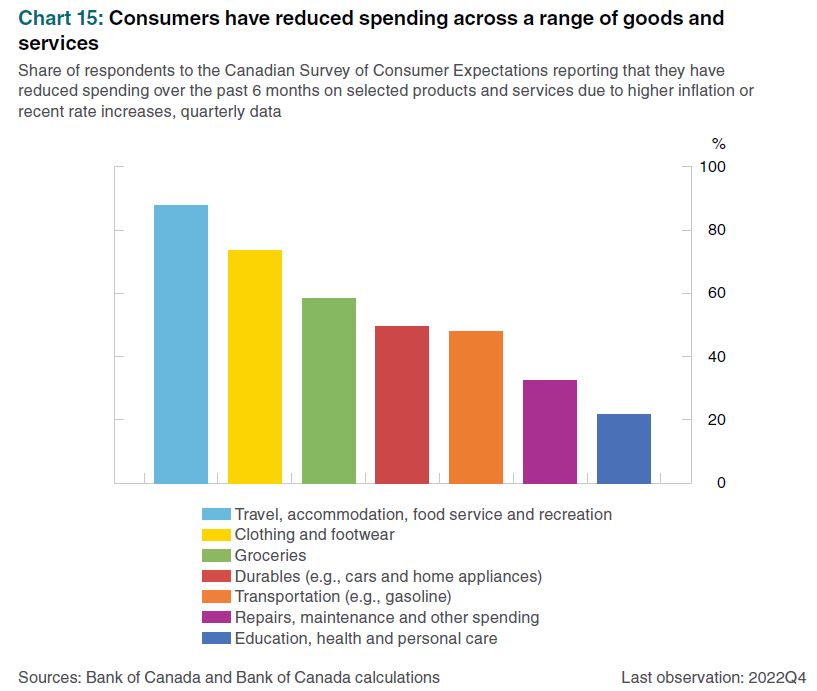

Consumer spending is projected to remain subdued in 2023, consumer indicate that are cutting spending and delaying purchases become of high interest rates and inflation. Higher borrowing costs strain household budgets with mortgage payments estimated to be 4.5% of disposable income at beginning of 2023 compared to 3.2% a year earlier. Decreasing spending on furniture and appliance has occurred and service spending is expected to decline with communication services, travel, hotels and restaurant meals being the most likely affected components. Towards the end of 2023, consumption growth should begin anew supported by population growth. Savings rates are expected to remain above long-run average due to elevated interest rates and more precautionary savings.

The housing pullback is expected to continue in 2023 with further declines in house prices particularly in market with significant increases during the pandemic. New construction and home resales will likely pick up in the second half of 2023 due to low inventories and demand from immigration.

Exports are projected to have moderate growth as foreign demand softens in the near terms but pick up in 2024 with the globally recovery. Energy exports and non-commodity exports are expected to be modest. Non-energy commodity exports are expected to continue at solid pace in 2023 with shipments from abundant 2022 harvest. Business investment is projected to slow and only pick up towards the end of 2024 with slowing demand, higher borrowing costs and elevated uncertainty weakening prospects outside oil and gas sector.

The next scheduled date for announcing the overnight rate target is March 8, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on April 12, 2023.

Bank of Canada: Rate Announcement, Monetary Policy Report – January 2023

<--- Return to Archive