The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 03, 2023HOUSING OWNED AS INVESTMENTS, 2020 Statistics Canada has released new data from the Canadian Housing Statistics Program that reports on the ownership of residential properties as investments.

Of Nova Scotia's 444,990 residential properties in 2020, the largest number were single-detached houses (296,165), followed by vacant land (81,605 properties) and multi-unit dwellings (25,305). Properties held for investment made up 35.0% of all Nova Scotia residential properties. Investment properties made up 19.5% of Nova Scotia's single-detached dwellings, while investment properties were the bulk of both vacant land (85.5%) and multi-unit dwellings (95.0%, including those with owner occupancy). Investment properties accounted for 36.6% of Nova Scotia's 11,905 condominium apartment units, 31.3% of 13,705 mobile homes and 21.1% of 12,110 semi-detached houses.

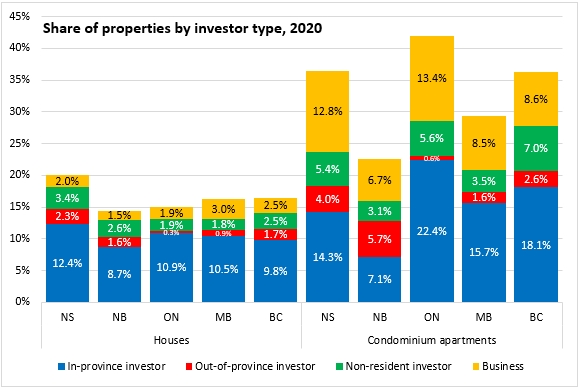

Nova Scotia reported a higher portion of houses held for investment purposes (20.1%) than in other reporting provinces: New Brunswick (14.4%), Ontario (15.0%), Manitoba (16.2%) and British Columbia (16.5%).

The majority of investors in the province's houses were from within Nova Scotia (12.4%). A further 2.3% were from elsewhere in Canada while 3.4% were non-residents of Canada. Business/government ownership accounted for 2.0% of houses in Nova Scotia.

Nova Scotia's portion of condominium apartments held as investments (36.5%) was higher than in all other reporting provinces except Ontario (42.0%). Among all condominium apartments in Nova Scotia, 14.3% were held by investors from within the province while 12.8% were held by businesses/governments. A further 5.4% of condominium apartments were investments from outside the country and 4.0% of condominium apartments were investments from elsewhere in Canada.

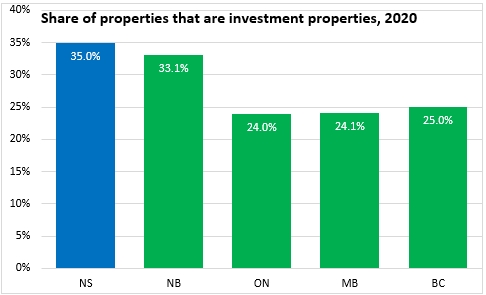

Among reporting provinces, Nova Scotia reported the highest portion of residential properties held as investments, though vacant land accounts for the largest portion of residential investment properties in Nova Scotia (44.7% of all residential investment properties in Nova Scotia were vacant land). In New Brunswick, vacant land accounted for an even higher share of residential investment properties (58.5%) while vacant land made up 21.7% of investment properties in Ontario, 27.4% of investment properties in Manitoba and 17.5% of investment properties in British Columbia.

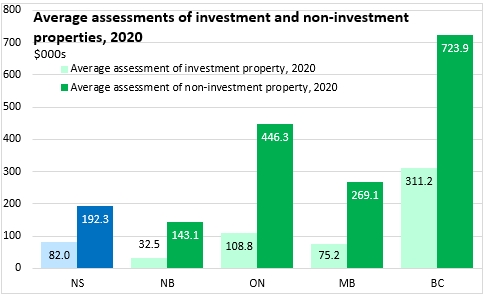

Because vacant land typically has a lower assessed value than dwellings, investment properties made up a lower the share of total assessment values in Nova Scotia (29.2% of the $79 billion in assessed properties).

The average assessed value of investment properties is typically lower than for non-investment properties.

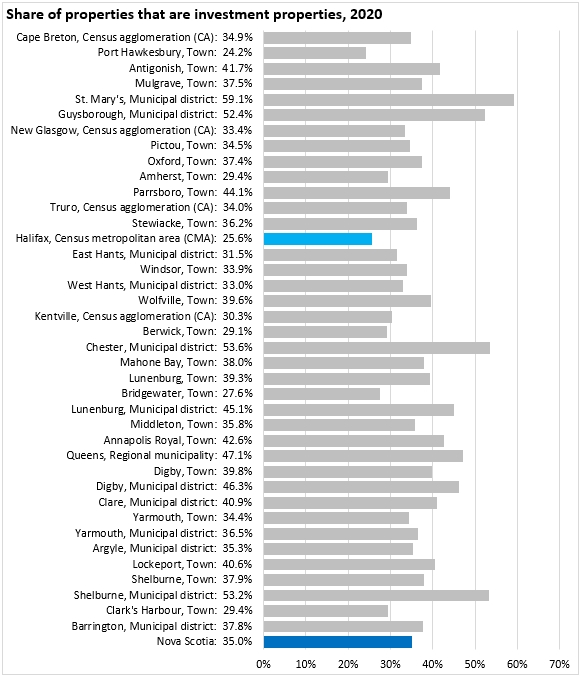

Across the municipal units reporting in Nova Scotia, St. Mary's, Guysborough, Chester and Shelburne Municipal Districts all had investment properties that amounted to more than 50% of their residential properties. Halifax reported the lowest share of investment properties among its residential properties (25.6%).

Definitions:

An investment property refers to a residential property owned by at least one investor and is not used as a primary place of residence by any of the owners. This category excludes owner-occupied investment properties.

An owner-occupied investment property refers to a property with multiple residential units where at least one of the owners occupies a unit.

A non-investment property refers to a property held solely by non-investors or a property being used as a primary place of residence by at least one of the owners and that is not an owner-occupied investment property.

Source: Statistics Canada. Table 46-10-0070-01 Investment status of residential properties; Table 46-10-0069-01 Investor status of residential property owners; Residential real estate investors and investment properties in 2020

<--- Return to Archive