The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

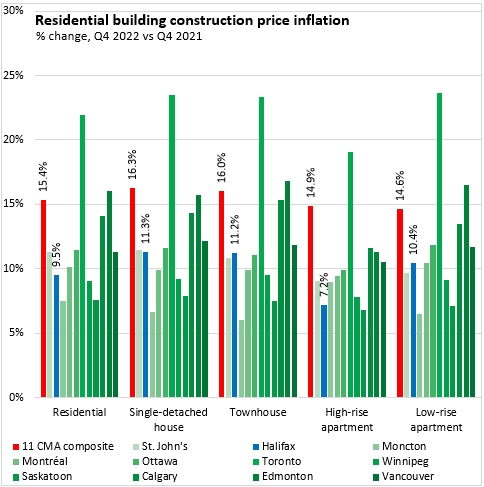

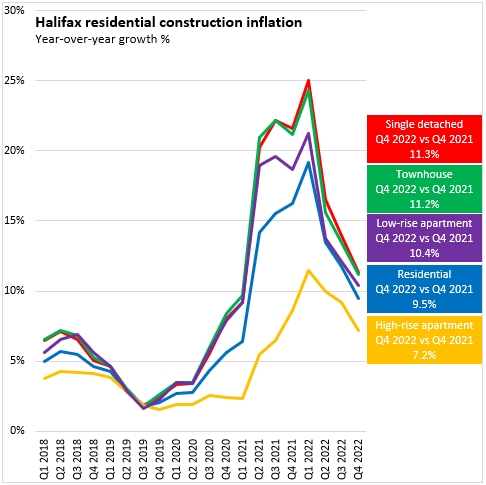

February 08, 2023BUILDING CONSTRUCTION PRICE INDEX, Q4 2022 Halifax's residential building construction prices increased by 9.5% from Q4 2021 to Q4 2022. Building costs for single detached (+11.3%) and townhouse (+11.2%) units were up by the largest percentages. Building costs for low-rise apartment buildings (under 5 stories) were up by 10.4% while high-rise apartment building costs were up by 7.2%.

For each type of residential unit, the increase in Halifax's building costs was below the national average for similar structures. Residential building cost growth was notaly faster in Toronto as well as in Calgary and Edmonton. Moncton reported the slowest growth in building costs for all categories except high-rise apartment buildings, for which Saskatoon reported the least growth.

Halifax's residential building cost inflation peaked at +19.1% from Q1 2021 to Q1 2022. In the two subsequent quarters, the pace of inflation slowed, but not to the modest pace of price growth observed before the pandemic. Construction cost inflation for all types of residential projects peaked in Q1 2022 and have subsequently decelerated.

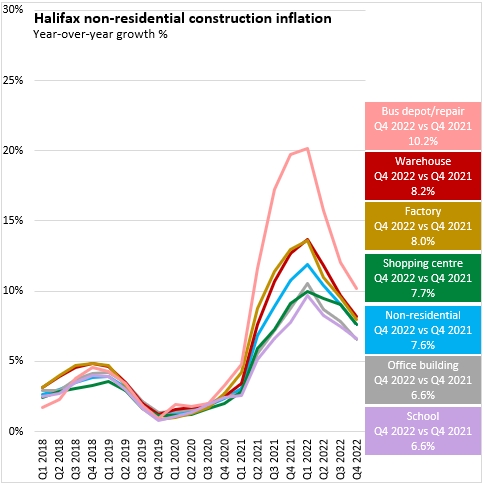

Non-residential building cost inflation is generally slower than residential building cost inflation. Overall non-residential building costs were up 7.6% in Halifax from Q4 2021 to Q4 2022. The pace of building cost inflation was slower for office buildings (+6.6%) and schools (+6.6%). There was faster growth for warehouses (+8.2%), shopping centres (+7.7%), factories (+8.0%) and bus depots with repair/maintenance facilities (+10.2%).

Across the 11 major Census Metropolitan Areas, non-residential building construction costs generally grew at a faster pace than in Halifax. Moncton, Montreal and Toronto reported the fastest year-over-year growth in non-residential building construction costs while St. John's reported the slowest paces of growth across all categories.

As with residential building costs, Halifax's non-residential building construction cost growth peaked in Q1 2022 and subsequently decelerated. This is the case across all categories of non-residential construction projects.

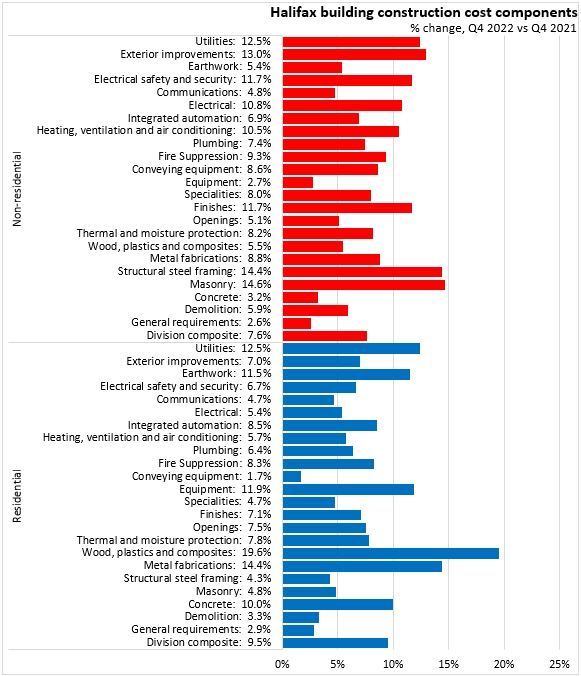

Among components of building costs, residential construction inflation is up most (>10%) for: wood/plastics/composites, fabricated metal, utilities, equipment, earthworks and concrete. Non-residential building construction costs grew most rapidly for: masonry, structural steel framing, exterior improvements, utilities, finishes, electrical safety/security, electrical and heating/ventilation/air conditioning.

Statistics Canada Notes on the Building Construction Price Index: The building construction price indexes are quarterly series that measure the change over time in the prices that contractors charge to construct a range of commercial, institutional, industrial and residential buildings in 11 census metropolitan areas: St. John's, Halifax, Moncton, Montréal, Ottawa–Gatineau (Ontario part), Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, and Vancouver.

These buildings include six non-residential structures: an office building, a warehouse, a shopping centre, a factory, a school, and a bus depot with maintenance and repair facilities. In addition, indexes are produced for five residential structures: a bungalow, a two-storey house, a townhouse, a high-rise apartment building (five storeys or more) and a low-rise apartment building (fewer than five storeys).

The contractor's price reflects the value of all materials, labour, equipment, overhead and profit to construct a new building. It excludes value-added taxes and any costs for land, land assembly, building design, land development and real estate fees.

With each release, data for the previous quarter may have been revised. The index is not seasonally adjusted.

Source: Statistics Canada. Table 18-10-0135-01 Building construction price indexes, by type of building

<--- Return to Archive