The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 01, 2023BRITISH COLUMBIA BUDGET 2023-24 British Columbia and Alberta released their 2023-24 Budgets on February 28 - the first of Canada's Provincial Budgets.

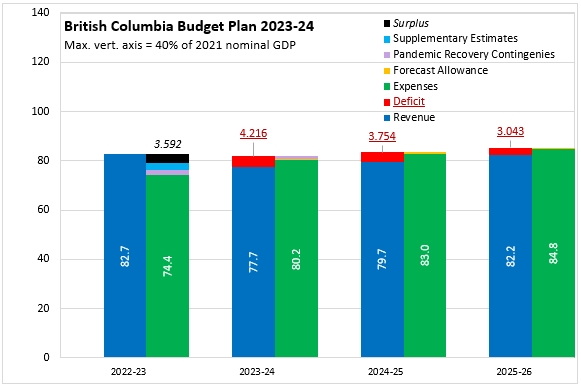

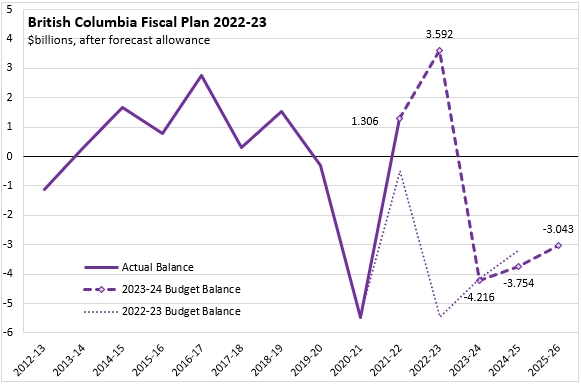

British Columbia's 2023-24 Budget projects a $4.2 billion deficit. This follows a $3.6 billion surplus forecast for 2022-23 (which still includes a pandemic recovery contingency as well). British Columbia's deficits are projected to decline in the next two fiscal years as revenue growth outpacing spending growth. British Columbia's expenditure vote include contingencies of $5.5 billion in 2023-24, $4.8 billion in 2024-25 and $4.7 billion in 2025-26.

Instead of the anticipated decline in revenues for 2022-23, British Columbia's revenues actually grew substantially, generating an unanticipated surplus, despite a sizable increase in spending above the 2022-23 Budget plan. Revenues are now projected to contract in 2023-24, causing a deficit as expenditures continue to grow.

British Columbia's budget anticipates deficits in each of the next three fiscal years. Previously anticipated deficits in 2021-22 and 2022-23 turned out to be surpluses.

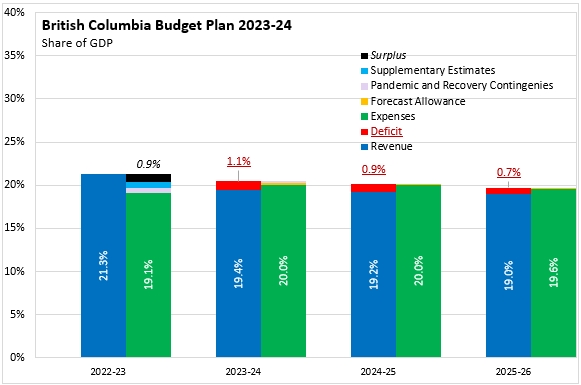

British Columbia's budget surplus for 2022-23 amounted to 0.9% of GDP. For 2023-24, the deficit is projected to be 1.1% of GDP. The British Columbia government's footprint in the provincial economy is expected to contract from 21.3% of GDP in 2022-23 to 20.0% of GDP in 2023-24, and to 19.6% of GDP by 2025-26.

British Columbia's taxpayer-supported debt is forecast to be 16.4% of GDP as of the end of 2022-23. This is projected to rise to 18.9% of GDP by the end of 2023-24 and to 23.0% of GDP by the end of 2025-26.

On a per capita basis, the British Columbia budget spent a forecasted $13,985 per resident in 2022-23. This is projected to rise to $14,719 per resident in 2023-24 and to $15,011 by 2025-26. The provincial government's surplus amounted to $675 per capita in 2022-23. The deficit is projected to be $774 per capita in 2023-24, falling to $539 per capita by 2025-26.

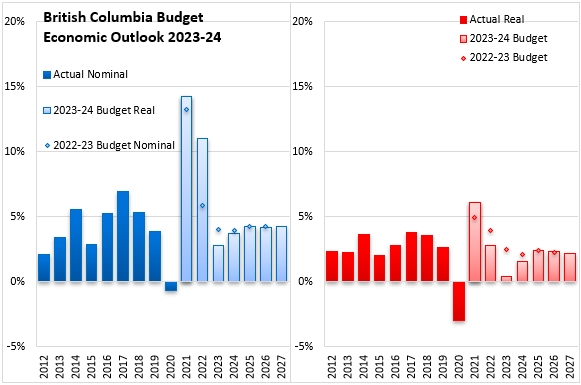

British Columbia's economic growth outperformed expectations in nominal terms, though it was actually below projections in real term. For 2023, British Columbia's economic outlook has dimmed with mixed results at the end of 2022. Higher interest rates are lowering home sales and prices while lower commodity prices are easing inflation pressures that built up earlier in 2022. Economic cooling in domestic and export markets is expected in 2023 as tight monetary conditions continue. As inflationary pressures fade in the medium term, British Columbia's economic outlook is expected to improve on export growth (including an LNG terminal) as well as stable labour markets.

Key Measures and Initiatives

The British Columbia Budget for 2023-24 prioritizes:

- Improved health and mental health care, including funding for cancer screening/treatment, health workforce recruitment/retention, a new payment plan for doctors and strengthened mental health/addictions services.

- Affordable and attainable housing, including: $4.2 billion to build and unlock more homes, to support transit-oriented development as well as to provide supports and protections for both renters and those living without homes

- Helping reduce costs, including: expanding school food programs, providing free prescription contraception, increasing the climate action tax credit and family benefit, introducing a renter's tax credit ($400 annually, income-tested)

- Safe and healthy communities, including: improving public safety and access to justice services, adding more policing and enforcement services, expanding Indigenous justice centres and increasing support for British Columbia's human rights tribunal

- Sustainable and clean economy, including: inclusive economic development, climate resiliency, a new job skills plan, faster natural resources permitting

British Columbia Budget 2023-24

<--- Return to Archive