The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

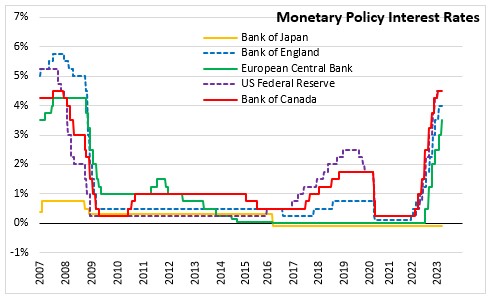

March 16, 2023EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) raised the three key ECB interest rates by 50 basis points. The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility will be increased to 3.50%, 3.75% and 3.00% respectively, effective 22 March 2023.

As announced in the February Monetary Policy Meeting, the asset purchase programme (APP) portfolio is declining at a measure and predictable pace, as the Eurosystem does not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of June 2023 and its subsequent pace will be determined over time.

The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) until at least the end of 2024. The Governing Council noted that the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

According to Eurostat’s preliminary flash estimate, the euro area economy grew by 0.1% in the fourth quarter of 2022. While this pace of growth was above the Eurosystem staff projections from December 2022, it showed that economic activity has slowed since mid-2022. High geopolotocal uncertainty, slower global demand and high inflation dampen consumer spending and production. However as supply bottleneck are gradually easing and the supply of gas becoming more secure, firms continue to work off large order backlogs and confidence is increasing. Activity in the services sector has been holding up.

Despite slower economic activity, the labour market remains strong. Employment grew by 0.3% in the fourth quarter of 2022 and the unemployment rate stayed at its historical low of 6.6% in January 2023. Rising wages and the recent decline in energy price inflation are also set to ease the loss of purchasing power that many people have experienced owing to high inflation.

According to Eurostat’s flash estimate, inflation was 8.5% in January. This would be 0.7 percentage points lower than the December inflation rate driven mainly by lower energy prices. Price pressures remain strong, partly because high energy costs are spreading throughout the economy Food price inflation continue to increase as the past surge in energy and other input prices still feed through to consumer prices. Government measures to compensate households for high energy prices will dampen inflation in 2023 but are expected to raise inflation once they expire.

GDP growth in the Euro Area is expected to strengthen in the first half of 2023 supported by easing supply bottlenecks, moderating inflation and lower uncertainty around energy supplies. Economic activity in the second half of 2023 is projected increase further as real incomes rise and foreign demand strengthens. Following an estimated 3.6% growth in 2022, real GDP is expected to increase 1.0% in 2023 and 1.6% in 2024 and 2025. Compared to the December 2022 projections, this represents an upward revision for 2023 but a downward revision for both 2024 and 2025.

Headline inflation is expected to fall significantly in the course of 2023 while remaining at elevated levels, driven by downward energy-related base effects, declines in energy prices and easing pipeline pressures. Inflation is expected to average 5.3% in 2023 before declining to 2.9% in 2024 and 2.1% in 2025. Compared with the December 2022 projections, headline HICP inflation has been revised down by 1.0 percentage point for 2023, by 0.5 percentage points for 2024 and by 0.2 percentage points for 2025.

The Governing Council noted that they are monitoring current market tensions closely and stand ready to respond as necessary to preserve price stability and financial stability in the euro area. Future policy rate decisions will be based on a data-dependent approach and its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on May 4, 2023.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference), Macroeconomic Projections - March 2023

<--- Return to Archive