The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

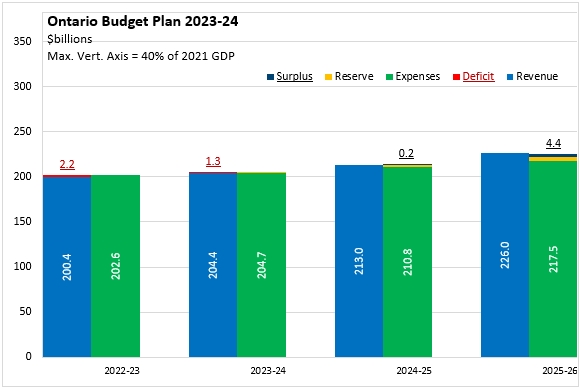

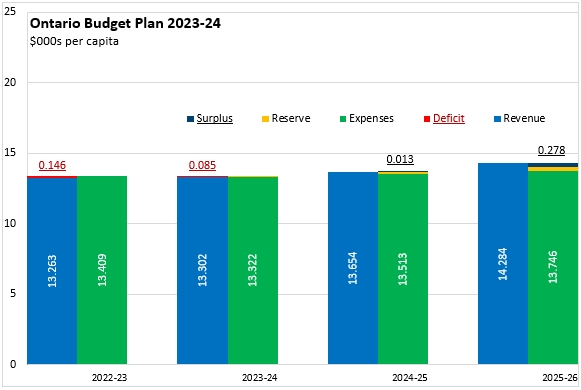

March 24, 2023ONTARIO BUDGET 2023-24 The Province of Ontario released it's 2023-24 Budget on March 23. The 2023-24 deficit is expected to narrow to $1.3 billion. Thereafter, Ontario's provincial government expects surpluses of $0.2 billion and $4.4 billion. The Province of Ontario also makes contingency provisions.

Ontario's revenues are projected to increase by 2.0% in 2023-24 while expenditures grow by 1.0%.

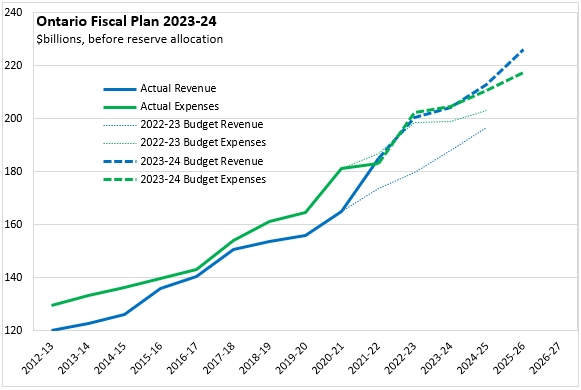

As in many provinces, Ontario's 2022-23 revenues are now forecast to be higher than expected in the 2022-23 Budget plan. Ontario's expenditures have increased somewhat, while the bottom-line projection has improved considerably. Ontario's projected revenues are now better aligned with its new elevated expenditure levels.

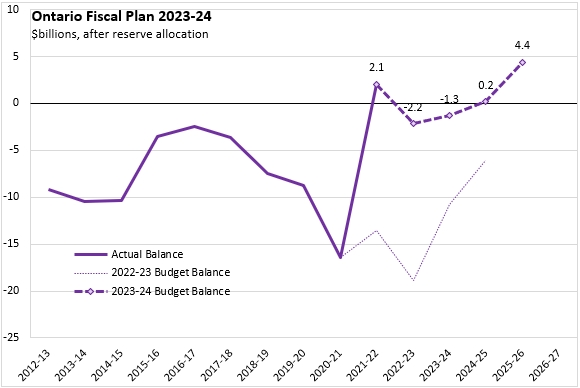

Ontario's 2022-23 fiscal plan had expected significant and ongoing deficits. The 2023-24 Ontario fiscal plan now anticipates that small deficits in 2022-23 and 2023-24 will be followed by rising surpluses in the outer years of the forecast horizon.

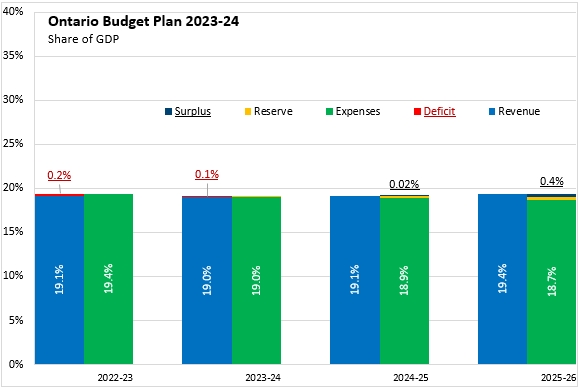

Ontario's deficits in the last two fiscal years were very small as a share of GDP: 0.2% in 2022-23 and 0.1% in 2023-24. Likewise, rising surpluses amount to small share of GDP: 0.02% in 2024-25 and 0.4% in 2025-26.

The Ontario government's footprint in the economy is expected to be 19.0% of GDP in 2023-24, rising to 19.4% of GDP by 2025-26.

Ontario's net debt as a share of GDP is expected to remain stable at 37.8% in 2023-24, before falling slightly to 37.7% of GDP in 2024-25 and 36.9% of GDP in 2025-26.

Ontario's provincial Budget projects expenditures of $13,322 per capita in 2023-24, rising to $13,746 per capita by 2025-26.

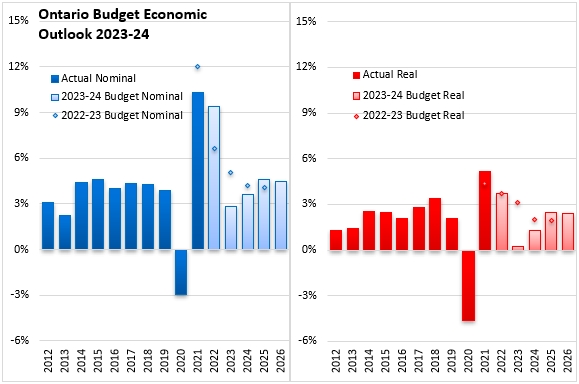

Ontario's economic growth was strong in 2022 - rising by 9.4% in nominal terms because of price increases and strong demand. Both inflation (3.6%) and nominal GDP (2.8%) are projected to slow in 2023 as the Bank of Canada's higher interest rates slow rate-sensitive domestic demand and the global economy cools under monetary tightening abroad. Real GDP in Ontario is projected to slow to just 0.2% growth before rebounding to 1.3% in 2024 and 2.5% in 2025.

Key Measures and Initiatives

Ontario's Budget emphasizes its efforts for: building the economy, building transportation infrastructure, building skills, lowering household costs, improving services, protecting families. Initiatives include

- Building the Ontario economy

- Launching the Ontario Made Manufacturing Investment Tax Credit, a 10 per cent refundable Corporate Income Tax credit

- $6 million over two years for the Ontario Junior Exploration Program to search for mineral deposits

- Building the roads to the Ring of Fire mineral deposits

- Increasing the phase-out range for the small business Corporate Income Tax rate

- Launching a voluntary clean energy credit registry

- Building highways, transit and infrastructure projects

- $27.9 billion for highway construction, expansion and rehabilitation projects

- $70.5 billion for transit over the next 10 years

- $48 billion in hospital infrastructure over the next 10 years, including more than 50 hospital projects that would add 3,000 new beds

- $15 billion in capital grants over 10 years to expand and renew schools and to create 86,000 new child care spaces

- Worker skills

- $224 million for a new capital stream of the Skills Development Fund

- $25 million over three years for the Ontario Immigrant Nominee Program

- Expanding dual credit opportunities in health care-related courses

- Expanding the Ontario Bridge Training Program to help internationally trained immigrants find employment in their fields

- Keeping costs down

- Continuing gas tax rate cuts until December 31, 2023

- Eliminating double fares for most local transit services

- Expanding the seniors' Guaranteed Annual Income System (GAINS) by 100,000 recipients and adjusting annually to inflation

- $202 million for the Homelessness Prevention Program and Indigenous Supportive Housing Program

- Better services

- $33 million over three years to add 100 undergraduate seats as well as 154 postgraduate medical training seats (prioritizing Ontario residents)

- Allowing pharmacists to prescribe over-the-counter medication for common ailments

- Accelerating investments to expand home care services, increase care workers' pay and improve the quality of care

- $22 million to hire up to 200 hospital preceptors for mentorship, supervision and training of newly graduated nurses

- $15 million to keep 100 mid‐to‐late career nurses in the workforce

- $4.3 million to help at least 50 internationally trained physicians get licensed

- $425 million over three years to support mental health and addictions services

- $170 million over three years to support the Ready, Set, Go program to help youth leaving the care system achieve financial independence

- Protecting families

- $13.4 million in 2023–24 for the Guns, Gangs and Violence Reduction Strategy

- Investing $110 million over three years to fund, train, coordinate and improve Ontario Corp and the province’s emergency preparedness system

Ontario Budget 2023-24

<--- Return to Archive