The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 12, 2023BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 4.50%, with the Bank rate at 5.75% and the deposit rate at 4.50%. The Bank will continue its policy of quantitative tightening.

The Bank of Canada release noted that inflation has started to slow down in many countries supported by lower energy prices, normalizing global supply chains, and tighter monetary policy. However, labour markets remain tight and measure of core inflation in many advanced economies point to persistent price pressures, especially in the services sector.

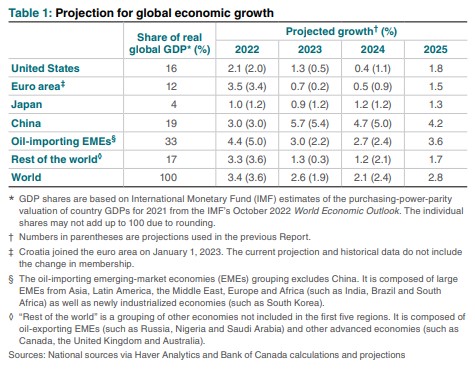

Tightening monetary policies and stress in the financial sector are expected to constrain global economic growth through 2023 and the first half of 2024. Growth is then projected to pick up in 2025 as the effects of policy tightening fade.

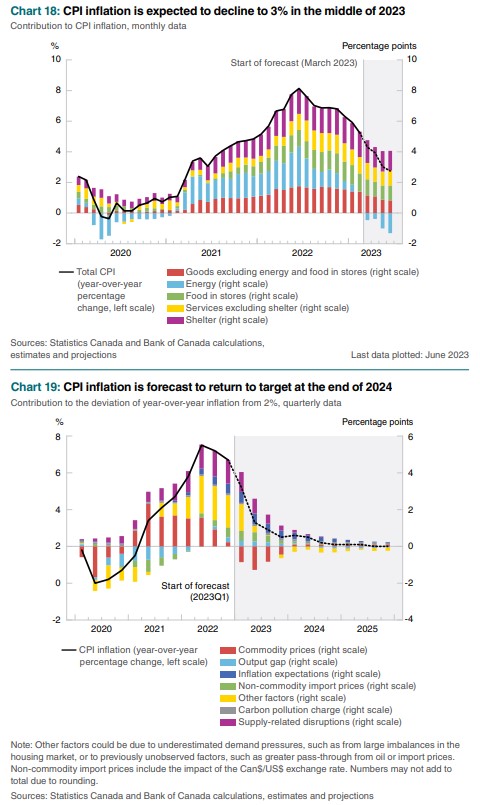

In Canada, demand still exceeds supply and the labour market remains tight. Economic growth is expected to be subdued through the remainder of this year, with the economy moving into excess supply in the second half, and then pick up gradually through 2024. Consumer price index (CPI) inflation is expected to come down

quickly to around 3% in the middle of 2023 and then decline more gradually, reaching the 2% target by the end of 2024.

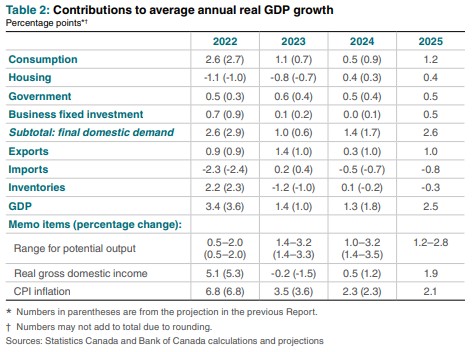

On an annual average basis, growth in gross domestic product (GDP) in Canada is projected to be 1.4% this year and 1.3% in 2024. As the economy adjusts to higher interest rates and inflation returns to the 2% target, GDP growth is projected to pick back up in 2025, reaching 2.5%.

Global Economy

Global economic growth has been stronger than anticipated supported by increased activity in the United States and Europe and a rebound of activity in China. Global growth is expected to weaken through the second half of 2023 to the first half of 2024, weighed down by restrictive monetary policy in advanced economies. Global real GDP is projected to grow 2.6% in 2023, 2.1% in 2024 and 2.8% in 2025.

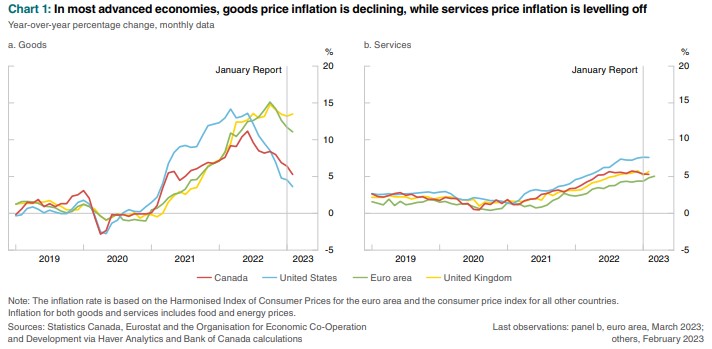

Goods price inflation has slowed down in many economies reflecting improvements in supply chains and lower energy prices. Demand for goods is also slowing due to past increases in interest rates and a shift in spending patterns back toward high-contact services. Falling goods prices are expected to account for most of the expected decline in inflation across advanced economies in 2023.

Services price inflation, however, continues to be elevated and is projected to decline more slowly as demand for services remain strong and labour markets conditions are still tight. Overall, inflation is expected to remain above central bank targets throughout the year. Over time, monetary policy tightening is anticipated to reduce demand for services, soften employment and better align growth in labour costs with productivity.

In the United States, economic activity has been stronger than anticipated in the January Monetary Policy Report. With tightening monetary policy and credit conditions, growth in the US is expected to slow in the second quarter of 2023 and stall through the first quarter of 2024. As US consumers moderate their spending on goods, US demand for Canadian exports will grow more slowly than US economic activity.

Russia’s invasion of Ukraine continues to greatly affect the euro area economy. Disruptions to energy supplies have dampened production in the manufacturing sector. Elevated inflation is eroding purchasing power and weighing on household demand. Higher interest rates are expected to reduce demand and ease inflation toward the European Central Bank’s target over the next two years. Economic growth is forecast to remain below potential until the second half of 2024 and then pick up.

Strengthening domestic demand will boost economic growth in China in the first half of 2023. While residential investment has picked up recently, past overbuilding and regulatory tightening are still expected to constrain activity in the property sector. Fiscal and monetary policy remain accommodative. The pace of economic growth is projected to slow in the second half of 2023 as the effects of reopening the economy dissipate. An ongoing decline in the working-age population is expected to weigh on economic activity in 2024 and 2025.

Following a volatile period, global oil prices have returned to the levels observed at the time of the January MPR Report. The Bank expects the price for Brent oil to be US$85 per barrel, while the price for West Texas Intermediate (WTI) is assumed to be US$80, the same level as in the January MPR. The value of the Canadian dollar is broadly unchanged against the US dollar, stable around 74 US cents since the January MPR.

Canadian Economy

Following a rebound in the first quarter of 2023, Canada’s economic growth is expected to be weak for the remainder of the year. Tightening monetary policy conditions continue to weigh on household spending and business investment. Weak global demand is limiting export growth.

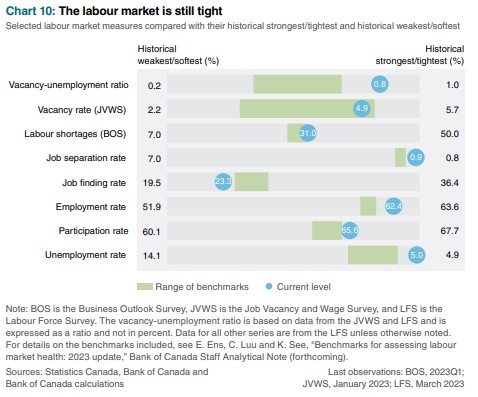

Strong population growth is supporting aggregate consumptions and increasing labour supply. Ongoing excess demand in the economy and a still-tight labour market continue to exert upward pressure on domestic prices.

Canada GDP is expected to increase 1.4% in 2023 and moderate to 1.3% in 2024. .Economic growth is expected to pick up in 2025 and reach 2.5% as foreign demand strengthens and the effects of past monetary policy tightening fade. Consumer price index (CPI) inflation is forecast to average 3.5% in 2023, 2.3% in 2024 and 2.1% in 2025.

The pace of economic activity in Canada has slowed since mid-2022, but demand still exceeds supply. Overall, the estimate of the output gap—the difference between GDP and potential output—is between 0.25% and 1.25% in the first quarter of 2023.

The labour market remains tight, and a broad range of indicators suggest that it is still above maximum sustainable employment. Most wage growth measures remain around the 4% to 5% range, with increases broadly based across sectors.

Consumer spending is anticipated to be subdued beginning in the second half of 2023 and into 2024 as the effects of the tightening in monetary policy work their way through the economy. There are several channels through which higher interest rates impact household spending including the impact on debt-servicing costs, financing of big-ticket item sales and low consumer confidence and reduced wealth. As the impacts of interest rates wane and wealth starts to recover, consumer consumption is expected to pick up gradually over 2024. The savings rate is anticipated to remain above its pre-pandemic average because of elevated interest rates and precautionary savings.

Growth in residential investment is anticipated to resume in the second half of 2023, supported by strong demand from immigration.

Following an increase in the start of the year, exports are expected to stall over the rest of the year due to weak global demand. Non-commodity exports are projected to decline through 2024. Elevated oil prices and completion of the Trans Mountain Expansion project in 2024 will support energy exports in the near term.

Import growth and domestic demand growth are both forecast to slow by the middle of 2024, but import growth picks up later as the economy strengthens.

Consumer prices in Canada increased 5.2% year-over-year in February 2023, following a 5.9% increase in January. The year-over-year deceleration in February 2023 was due to a base-year effect, for the second consecutive month, which is attributable to a steep monthly increase in prices in February 2022. While inflation has slowed down in recent months, it remains elevated.

Core inflation has eased slightly, to just below 5%. With measures of three-month core inflation around 3.5%, core inflation is expected to decline in the coming months.

Inflation expectations have edged down in recent months. Results from the Business Outlook Survey (BOS) for the first quarter of 2023 indicate that views about inflation have continued to decline. Long-term inflation expectations remain consistent with the 2% target.

CPI inflation is forecast to decline quickly to about 3% in the middle of 2023, largely due to falling gasoline prices and weakening inflation in goods excluding food and energy. Inflation is then projected to slowly moderate to 2.0% by the end of 2024 reflecting the slower response in services prices to tighter monetary conditions. As pressures in domestic product and labour markets ease, wage and price growth moderate while productivity growth picks up.

The next scheduled date for announcing the overnight rate target is June 7, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on July 12, 2023.

Bank of Canada: Rate Announcement, Monetary Policy Report – April 2023

<--- Return to Archive