For additional information relating to this article, please contact:

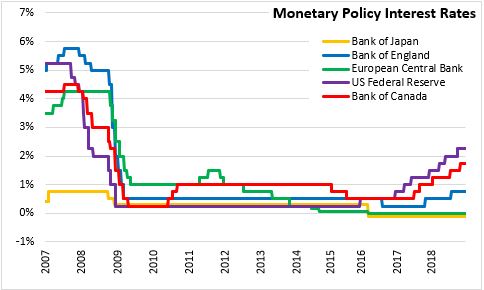

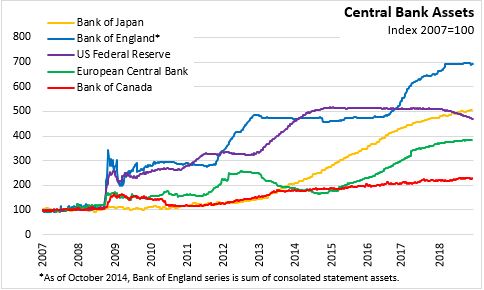

December 13, 2018MONETARY POLICY: EURO AREA At today’s meeting, the Governing Council of the European Central Bank (ECB) announced that the key ECB interest rates are unchanged with the interest rates on main refinancing operations, marginal lending facility and the deposit facility at 0.00%, 0.25% and -0.40% respectively. The rates are expected to remain at their present levels at least through the summer of 2019, and for as long as necessary in order to converge inflation levels to around 2 per cent over the medium term. Net purchases under the asset purchase programme (APP) will end this month, while the ECB intends to continue reinvesting the principal payments from maturing securities purchased under the APP for as long as necessary.

Euro area real GDP grew 0.2 per cent in the third quarter of 2018, following growth of 0.4 per cent in the previous two quarters. The latest economic indicators have been weaker than expected, reflecting a reduced contribution from external demand and some country and sector specific factors. Domestic demand continues to underpin growth in the euro area, while employment gains and rising wages continue to support private consumption. Business investment is being supported by domestic demand, favourable financing conditions and improving balance sheets. Expansion in the global economy is expected to continue supporting euro area exports, though at a slower pace.

Euro area inflation was 2.0 per cent in November, down from 2.2 per cent in October on declining energy inflation. Given oil future prices, headline inflation is likely to decline over the coming months. Measures of underlying inflation remain generally low, but domestic cost pressures are strengthening with high levels of capacity utilization and tight labour markets. Underlying inflation is expected to pick up over the medium term, supported by monetary policy measures, the ongoing economic expansion, and wage growth.

Sources:

European Central Bank