For additional information relating to this article, please contact:

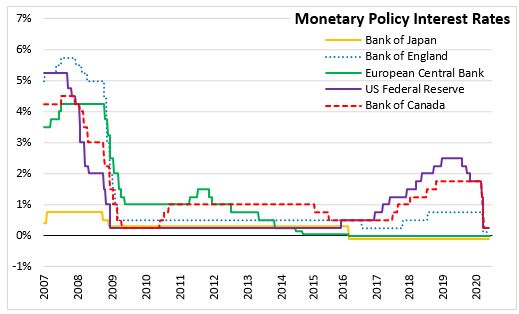

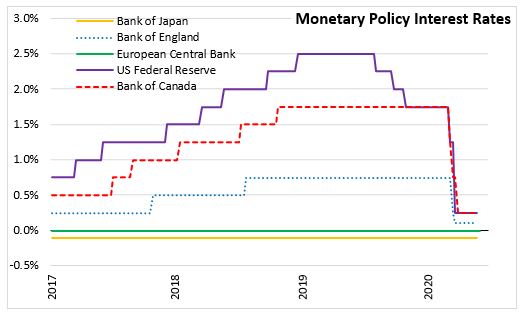

June 04, 2020EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank announced today that key interest rates would remain unchanged. They are expected to remain at present or lower levels until the inflation outlook converges (consistently and robustly) near to the 2 per cent target.

With the impact of the COVID-19 pandemic, the Euro Area faces an economic contraction that is unprecedented in peacetime. Consumer and business sentiment measures have plunged, suggesting a sharp contraction is underway in economic growth and labour markets. Severe job and income losses and exceptionally elevated uncertainty about the economic outlook have led to a significant fall in consumer spending and investment. While survey data and real-time indicators for economic activity have shown some signs of a bottoming-out alongside the gradual easing of the containment measures, the improvement has so far been tepid compared with the speed at which the indicators plummeted in the preceding two months. Current estimates indicate that Euro Area GDP growth declined at an unprecedented pace in the second quarter of this year, before it will rebound in the second half, with sizeable support from fiscal and monetary policy. In the economic outlook baseline scenario, Euro Area GDP is expected to fall by 8.7 per cent in 2020 and rebound by 5.2 per cent in 2021 and 3.3 per cent in 2022.

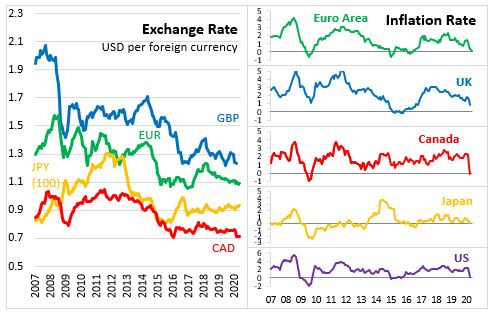

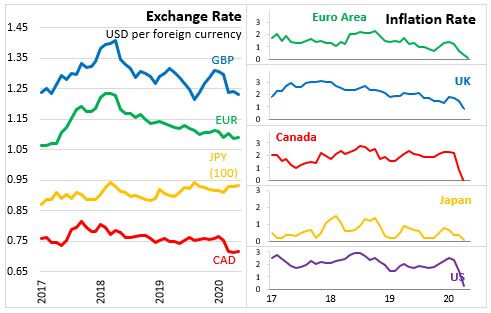

In the baseline scenario, Euro Area HICP inflation is expected at 0.3 per cent in 2020, 0.8 per cent in 2021 and 1.3 per cent in 2022.

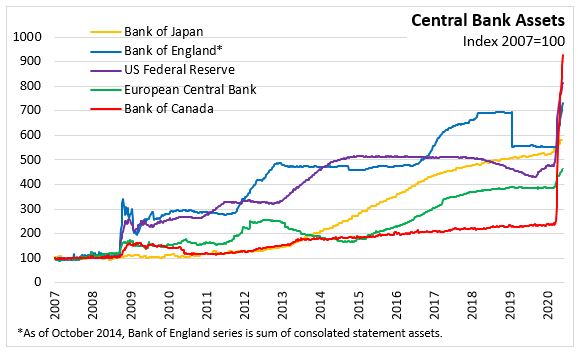

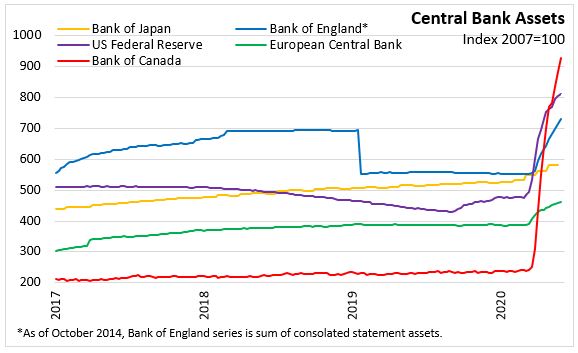

The ECB has already undertaken significant easing measures since March, complemented by fiscal initiatives by governments across the Euro Area. The Governing Council of the ECB added to these measures today with further easing:

- The envelope for the pandemic emergency purchase programme (PEPP) will be increased by €600 billion to a total of €1,350 billion.

- The horizon for net purchases under the PEPP will be extended to at least the end of June 2021. In any case, the Governing Council will conduct net asset purchases under the PEPP until it judges that the coronavirus crisis phase is over.

- The maturing principal payments from securities purchased under the PEPP will be reinvested until at least the end of 2022.

- Net purchases under the asset purchase programme (APP) will continue at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

- Reinvestments of the principal payments from maturing securities purchased under the APP will continue, in full, for an extended period of time past the date when the Governing Council starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

The Governing Council of the ECB is committed to ensure the necessary degree of monetary accommodation and a smooth transmission of monetary policy across sectors and countries. To that end, the ECB decided on a set of monetary policy measures to support the economy during its gradual reopening and to safeguard medium-term price stability.

The Governing Council will do everything necessary within its mandate and is fully prepared to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

European Central Bank: Monetary Policy Decision, Remarks