To view previous releases, select one from the dropdown box:

Currently displaying information released on: November, 2017

ANALYSIS OF NOVA SCOTIA'S CONSUMER PRICE INDEX FOR OCTOBER 2017

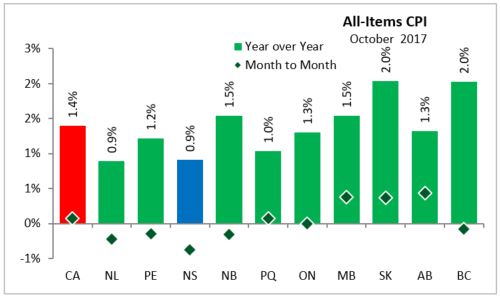

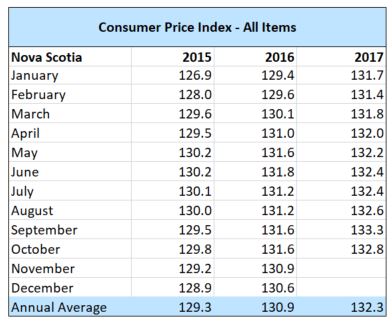

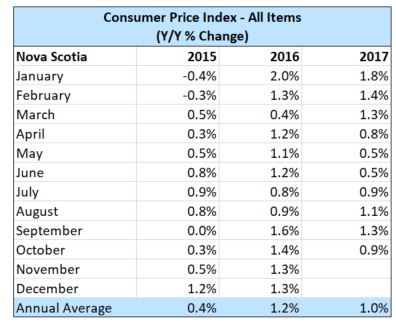

In Nova Scotia October 2017, annual consumer price inflation (year-over-year growth) was 0.9 per cent, below the national average of 1.4 per cent. Monthly consumer prices were down 0.4 per cent in Nova Scotia and up 0.1 per cent in Canada.

Within Atlantic Canada, New Brunswick (+1.5 per cent), PEI (+1.2%) had higher inflation than Nova Scotia and Newfoundland and Labrador (also +0.9%). On July 1, 2016, the provincial component of the harmonized sales tax (HST) increased in both Newfoundland and Labrador and New Brunswick. In Prince Edward Island, the provincial component of the HST was increased effective October 1, 2016.

All other provinces experienced positive annual inflation in September.

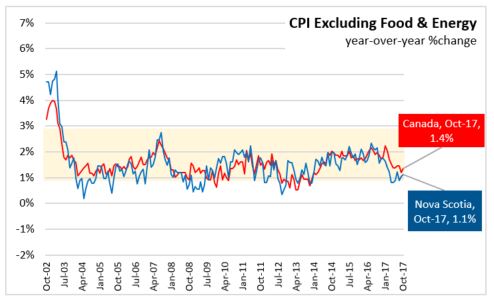

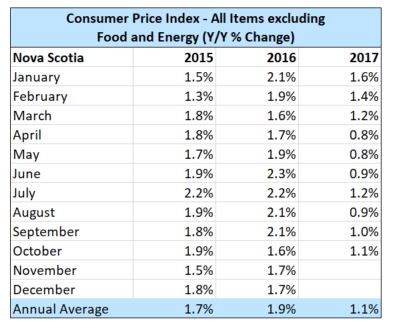

Nova Scotia's annual consumer price inflation (year over year growth in CPI) excluding food and energy rose 1.1 per cent in October, below the national rate of 1.4 per cent. Price level gains for this index were largest in BC (+1.9 per cent), and lowest in Alberta and Quebec (both +0.9 per cent). On a monthly basis, Nova Scotia's index excluding food and energy was unchanged.

The main contributors to the monthly (October 2017 vs. September 2017) NS CPI movement:

Sugar and confectionery (+4.7%)

Dairy products (+3.0%)

Fresh vegetables (-7.9%)

Traveller accommodation (-13.6%)

The main contributors to the annual (October 2017 vs. October 2016) NS CPI movement:

Traveller accommodation (+12.4%)

Inter-City transportation (+10.7%)

Household appliances (-6.3%)

Fresh or frozen beef (-13.1%)

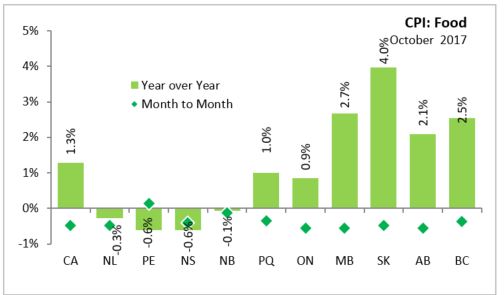

The CPI for food in Nova Scotia declined 0.6 per cent year-over-year with a 0.4 per cent decrease month-over-month. CPI growth in food (year over year) declined in all Atlantic provinces . Nationally, annual food prices increased 1.3 per cent.

The Nova Scotia energy index increased by 2.2 per cent compared to a year ago. Energy price growth was smallest in Ontario on a year over year basis. Nationally, the index was up 1.0 per cent. Energy prices saw the largest increase in Alberta and BC.

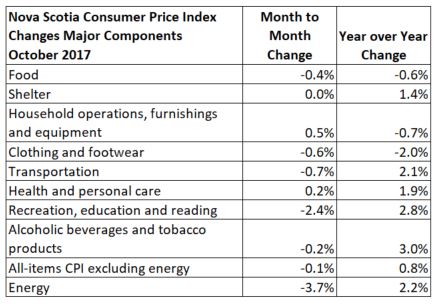

Major Components for October 2017

The following table shows the price increases specific to Nova Scotia for the major components of the CPI this month:

Long Run Trends

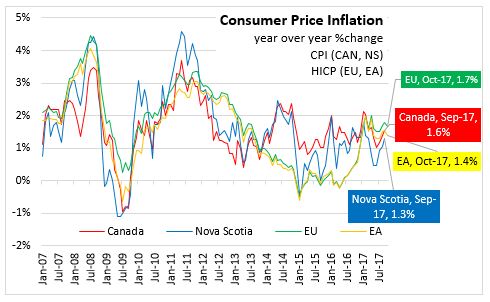

The All-Items CPI annual inflation rate for Nova Scotia was below Canada's in October 2017. Since July 2014, Nova Scotia's annual inflation has been below the Canadian average except for three months in 2016: January, September and November. While month to month movements in the indices can be different, over time they generally follow the same overall trend.

Annual inflation for the CPI excluding food and energy was lower for Nova Scotia (+1.1 per cent) than for Canada (+1.4 per cent).

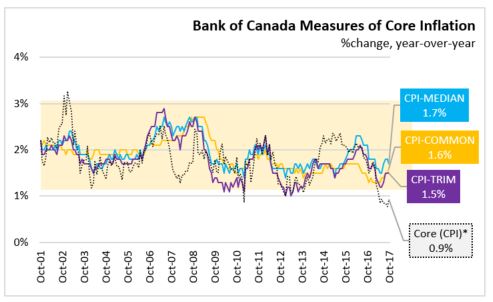

Bank of Canada's preferred measures of core inflation

Compared with October 2016, CPI-Common rose 1.6 per cent, CPI-Median rose 1.7 per cent, and CPI-Trim rose 1.5 per cent in Canada. All-items CPI excluding eight of the most volatile components as defined by the Bank of Canada and excluding the effect of changes in indirect taxes (formerly referred to as CPIX) rose 0.9 per cent year over year in October 2017.

Appendix Tables

Source: Statistics Canada CANSIM Tables 326-0020 , 326-0023 CONSUMER PRICE INDEX OCTOBER 2017

NOVA SCOTIA

In Nova Scotia October 2017, the consumer price index (2002=100) decreased 0.4% from September 2017 to 132.8 and increased 0.9% over October 2016.

The CPI, excluding food and energy, remained unchanged from September 2017 at 125.2, and increased 1.1% over October 2016.

CANADA

In Canada October 2017, the consumer price index (2002=100) increased 0.1% from September 2017 to 130.9 and increased 1.4% over October 2016.

The CPI, excluding food and energy, increased 0.3% from September 2017 to 126.2, and increased 1.4% over October 2016.

Compared with October 2016, CPI-Common rose 1.6%, CPI-Median rose 1.7%, and CPI-Trim rose 1.5%.

HALIFAX

In Halifax October 2017, the consumer price index (2002=100) decreased 0.5% from September 2017 to 131.6 and increased 0.8% over October 2016.

Statistics Canada Note: Since 2001, the Bank of Canada's main measure of core inflation has been "core" consumer price index (CPIX) inflation, which excludes eight of the most volatile components of the CPI and adjusts the remainder for the effect of changes in indirect taxes. Following a review of a wide selection of measures of core inflation in 2015, in the context of its most recent renewal of the inflation-control target, the Bank chose three preferred measures of core inflation: (i) a measure based on a trimmed mean (CPI-trim); (ii) a measure based on the weighted median (CPI-median); (iii) a measure based on the common component (CPI-common). For more information see The Daily.

Statistics Canada Cat. No. 62-001, CANSIM 326-0020 326-0023 EU AND EURO AREA CONSUMER PRICE INFLATION, OCTOBER 2017

In October, annual inflation was 1.4 per cent in the Euro Area (down from 1.5 per cent last month) and 1.7 per cent in the European Union (down from 1.8 per cent last month). In October 2016, inflation in both the Euro Area and EU was 0.5 per cent.

The highest annual rates were recorded in Lithuania (4.2 per cent), Estonia (4.0 per cent), and the United Kingdom (3.0 per cent). The lowest rates were registered in Cyprus (0.4 per cent), Ireland, Greece and Finland (all 0.5 per cent).

The largest upward impacts to euro area annual inflation came from fuels for transport, accommodation services, and milk, cheese and eggs. Telecommunication, garments and social protection showed the biggest downward impacts.

Source: Eurostat

|