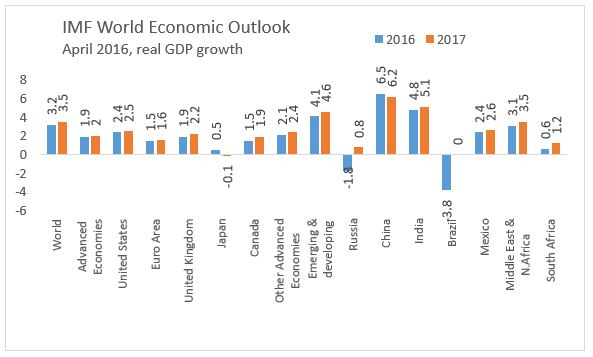

April 21, 2016CURRENT ECONOMIC ENVIRONMENT AND OUTLOOK - GLOBAL ECONOMY The global economy in 2016 is poised for another year of modest growth, with the forecast from earlier in the year being revised down, in light of recent developments and slow solutions to ongoing issues. The International Monetary Fund (IMF) lowered their forecast from 3.4 per cent (January 2016) to 3.2 per cent (April 2016) for 2016. The persistently modest pace of recovery for five consecutive years, and declining growth in emerging market economies, are both playing roles in the outlook for 2016. The IMF expects a pick-up in 2017 to 3.5 per cent growth.

Advanced economies are expected to maintain their pace from 2015 into 2016 and 2017. The economies continue to face challenges in terms demographics, low productivity and legacy issues post global financial crisis that will continue to keep growth modest. Monetary policy and lower oil prices will support broadly support the domestic demand. In 2015, growth in emerging markets slowed for the fifth consecutive year. Emerging market and developing economies, outside of China, are projected to have faster growth in the coming years. The IMF forecasts that Brazil and Russia will return to positive growth in 2017 and India’s growth will be more important to global activity as it benefits from policy reforms and lower commodity prices. Oil exporters will continue to face difficulties with weakened terms of trade and tighter external financial conditions.

China’s economy continues to slow and shift as it moves away from growth driven through investment and manufacturing. The service sector and market-driven consumer spending are expected to play a greater importance in the economy going forward, but the transition process may lead to increased volatility in China and globally. The Chinese government is supporting domestic demand growth with infrastructure spending and tax relief for business.

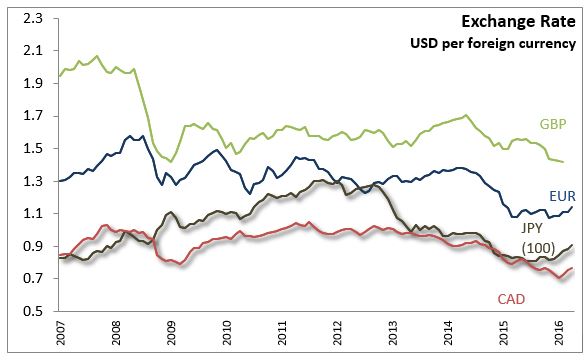

Oil prices made a small rebound during the summer of 2015, but continued to slide thereafter. The benchmark US dollar price for a barrel of West Texas Intermediate (WTI) crude oil fell to US$30.32 in February 2016, 70 per cent lower than 18 months ago. The price of oil is expected to eventually increase as higher cost producers exit the market. However the medium term price path is still highly uncertain given current inventory accumulation, efficiency improvements, and new sources of supply, Organization of Petroleum Exporting Countries (OPEC) policy, and geopolitical factors. Natural gas prices have slid over the past two years and are expected to remain at subdued levels in the short term. Metal prices have fallen with China shifting growth away from investment and heavy manufacturing. Agriculture prices in US dollars were lower in 2015 due to stronger supply. Lumber prices are expected to increase as the US housing market improves.

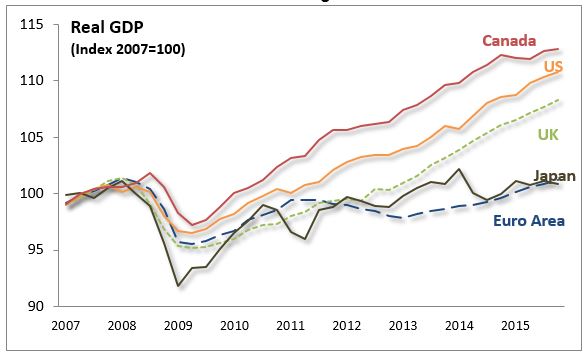

The euro area economy made further improvements in 2015 and was able to grow at 1.6 per cent. Private consumption showed positive signs in 2015 and eased financial conditions, progress on fiscal consolidation, structural reforms, and lower oil prices are expected to continue to lift demand into 2016. Persistently low inflation and economic slack led the European Central Bank to pursue monetary policy easing through negative interest rates. The United Kingdom’s GDP grew at 2.2 per cent, reflecting a strong domestic private sector, robust consumer confidence, real income growth, and positive corporate investment intentions.

Japan’s economy grew 0.4 per cent in 2015, an improvement from the 0.0 per cent of 2014. Private consumption and residential investment declined for the second year in a row. Export growth and higher non-residential investment and government consumption lifted growth. The Bank of Japan has eased monetary policy further introducing negative interest rates to balance against the risk that a disinflationary mindset would persist.

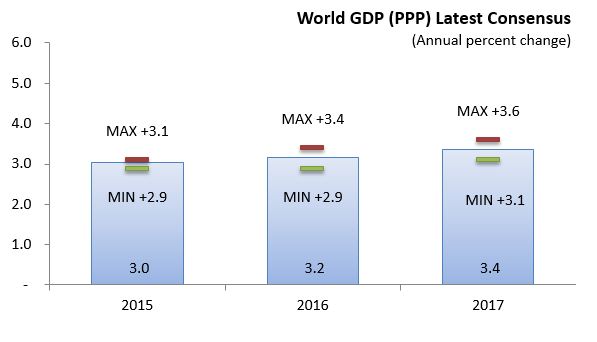

The consensus for world GDP growth is that world economy was slower in 2015 at 3.0 per cent growth before it picks up to 3.2 per cent in 2016 and 3.4 per cent in 2017.

Note: The Nova Scotia Department of Finance monitors private sector forecasts from major financial institutions as well as the Conference Board of Canada, IMF, World Bank, central banks and OECD to prepare a consensus outlook for the world, the US, Canada. The latest consensus was prepared March 22, 2016.