The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

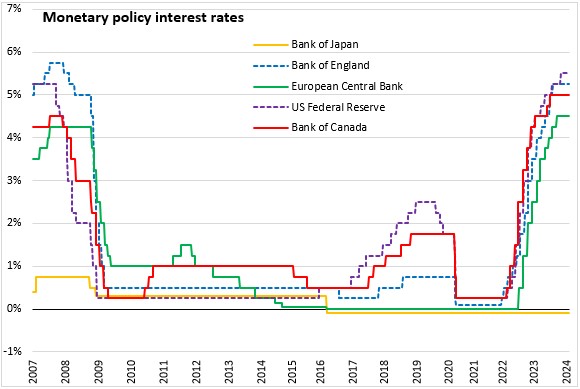

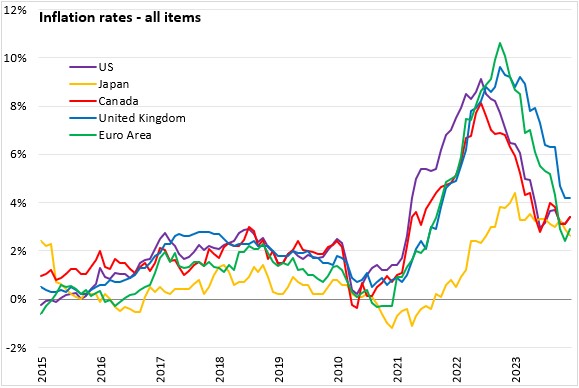

February 02, 2024BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%. In February's Monetary Policy Report projections, inflation is expected to slow to the 2% target in Q2 after slowing in late 2023. However, this achievement of the inflation target is projected to be temporary as inflation is expected to re-emerge in Q3 and Q4 of this year after base year effects from previous energy price spikes fade. UK inflation is projected to continue above the target over the entire forecast horizon due to domestic inflationary pressures. Following the initial global commodity price shocks of 2022, second-round effects in domestic pricing and wages are now driving the UK inflation outlook; these are taking longer to unwind than they took to emerge. Risks to UK inflation are skewed to the upside because of geopolitical instability.

The Bank of England's outlook for the global economy was slightly stronger in the February Monetary Policy Report than the forecast published in November. Looser monetary conditions are partially responsible for the upgraded outlook. Notably, US potential GDP is revised up on rising population. UK real GDP growth is only expected to recover gradually over the forecast period as weak supply growth and tight fiscal conditions weigh on the outlook. With limited potential supply growth, the outlook anticipates longer persistence of excess demand (tight labour markets, high capacity utilization) in the UK.

The MPC will continue to monitor for persistent inflationary pressures, including tightness of labour market conditions, behaviour of wage growth and services inflation. The Bank of England no longer indicates that further tightening could be necessary, but cautions that monetary policy will need to remain restrictive for an extended period long to achieve the 2% inflation target sustainably over the medium term.

The next scheduled monetary policy meeting will be on March 21, 2024.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive