To view previous releases, select one from the dropdown box:

Currently displaying information released on: February, 2026

AVERAGE RETAIL PRICES, DECEMBER 2025

Year-over-year (December 2025 vs December 2024)

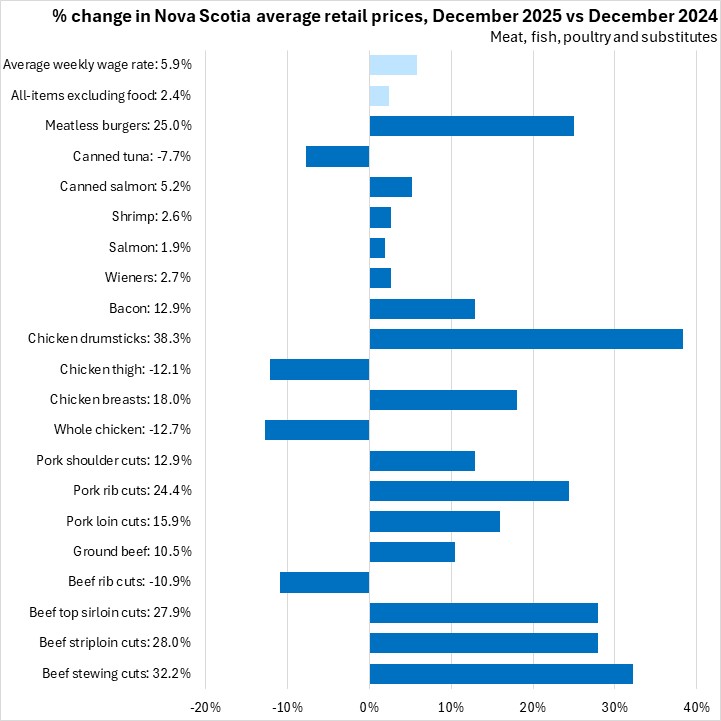

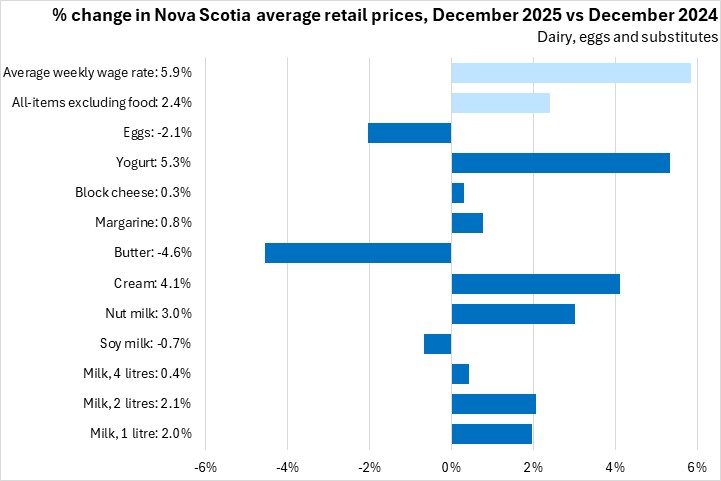

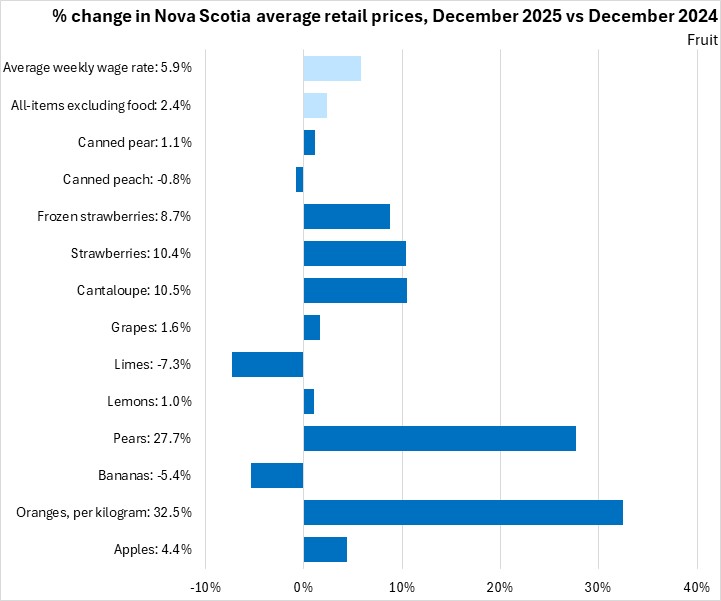

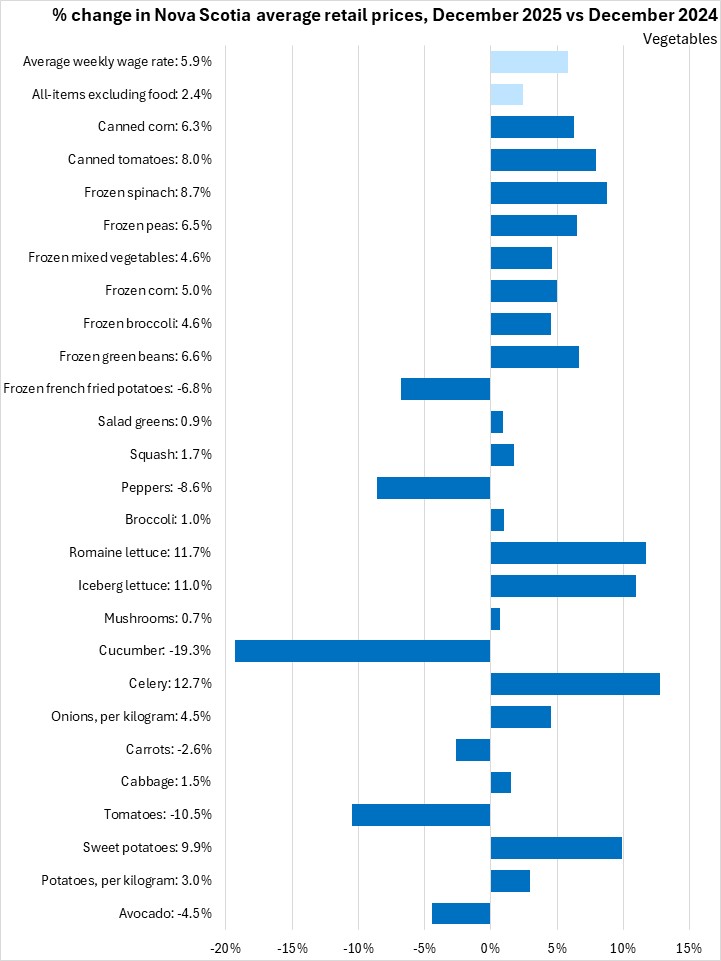

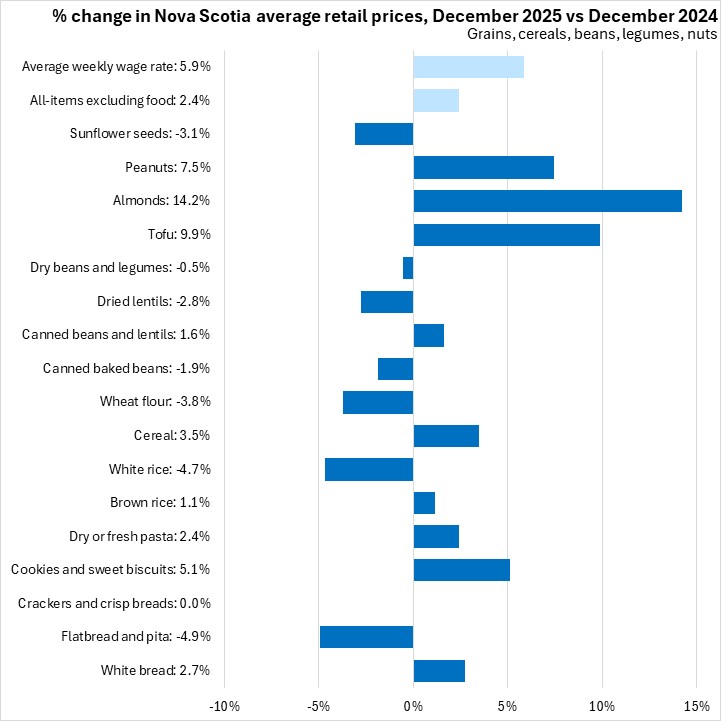

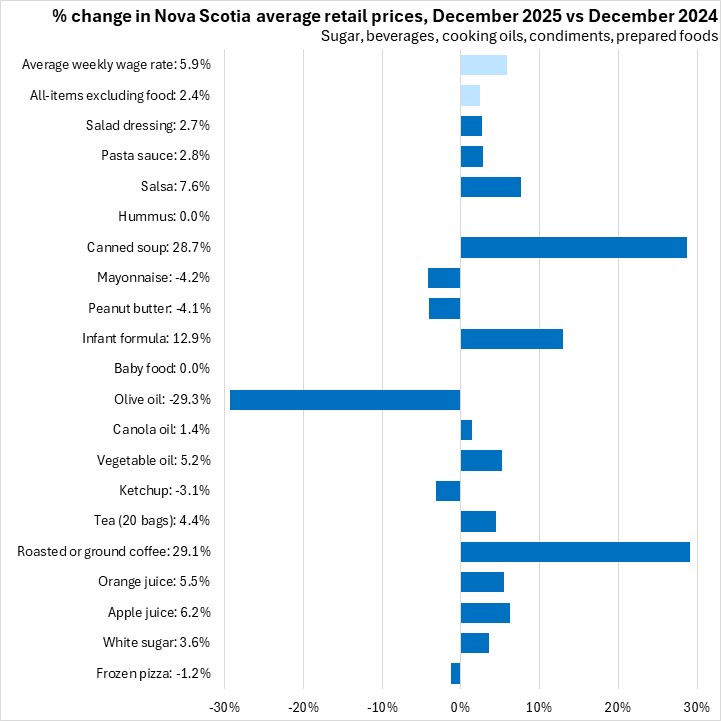

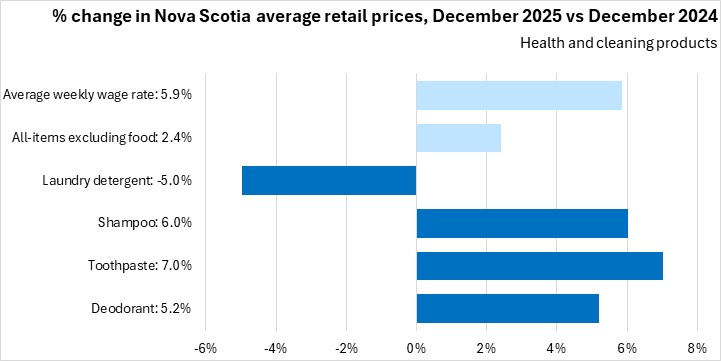

Over the last year (December 2025 vs December 2024), the consumer price index for all items in Nova Scotia excluding food increased by 2.4%. Food prices as a whole rose 6.9%. At the same time average weekly earnings across all Nova Scotia industries increased by 5.9%.

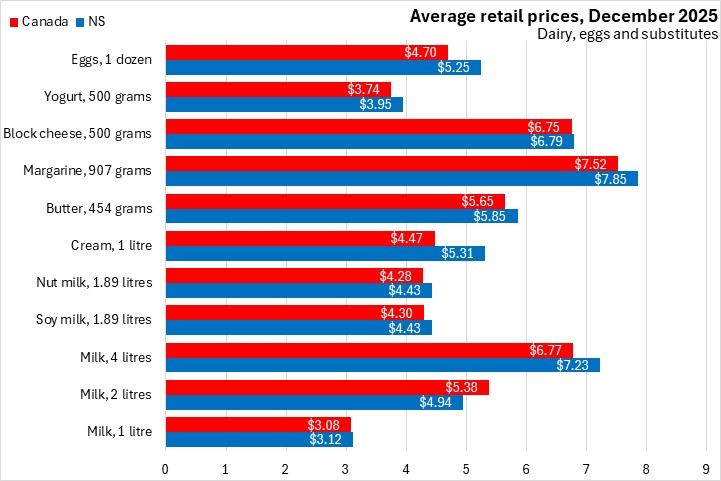

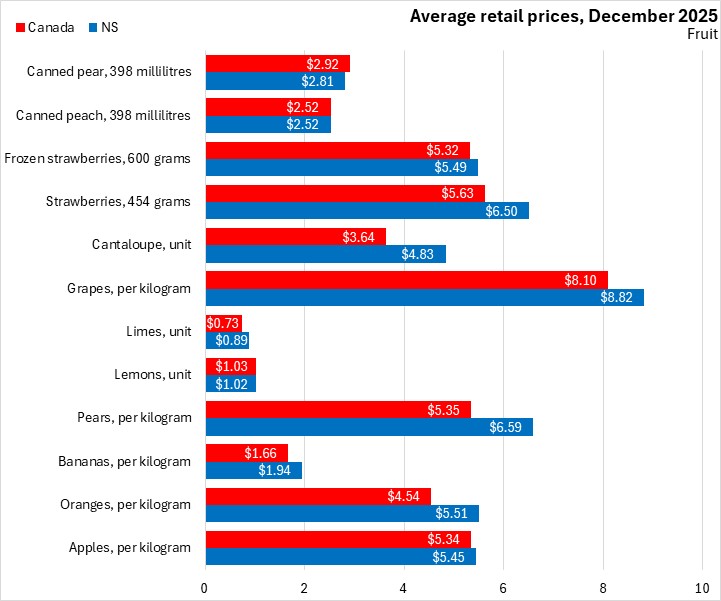

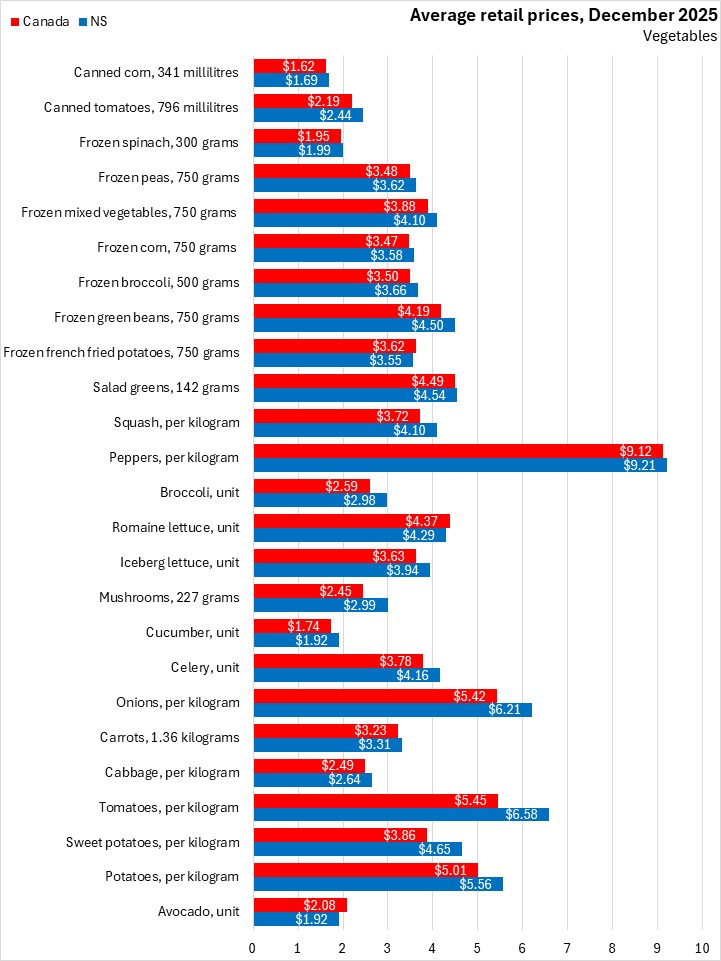

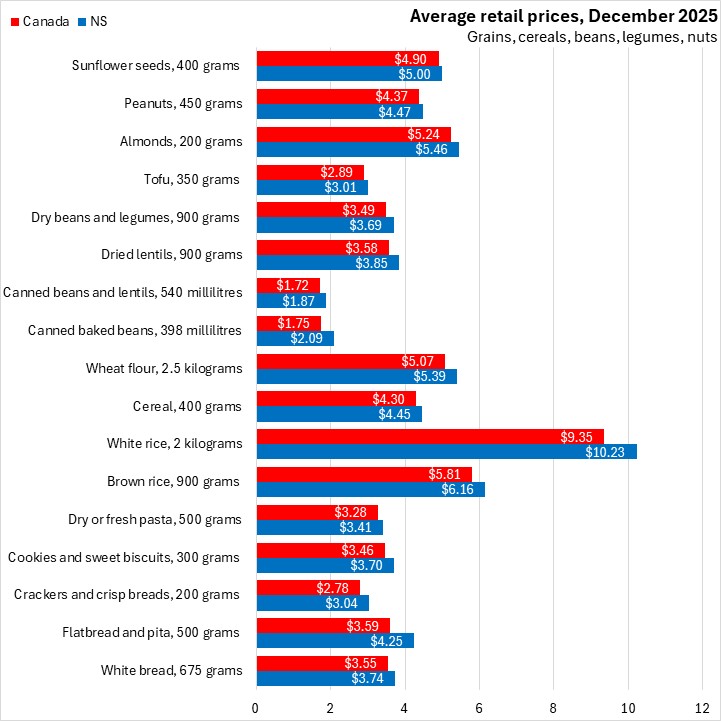

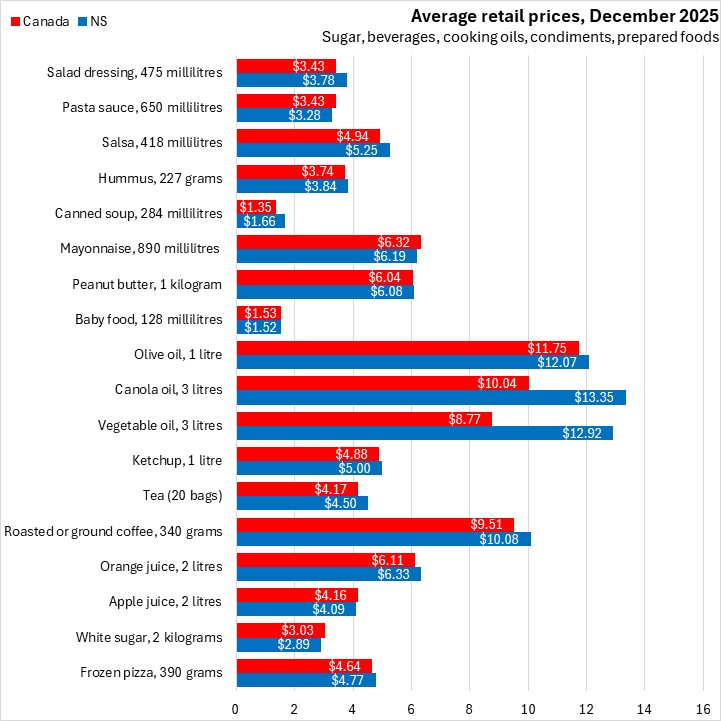

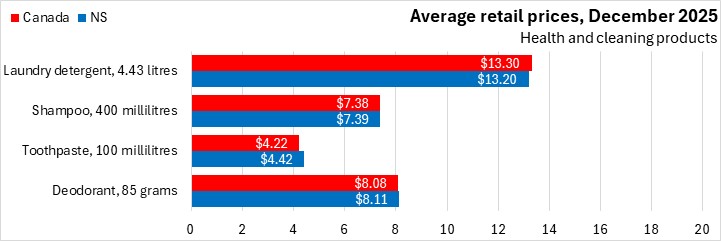

In the last year, the following products reported lower prices in Nova Scotia: beef rib cuts, whole chicken, chicken thigh, canned tuna, soy milk, butter, eggs, bananas, limes, avocado, tomatoes, carrots, cucumber, peppers, frozen french fried potatoes, frozen pizza, flatbread and pita, white rice, wheat flour, ketchup, olive oil, peanut butter, mayonnaise, canned baked beans, canned peach, dried lentils, dry beans and legumes, sunflower seeds, and laundry detergent.

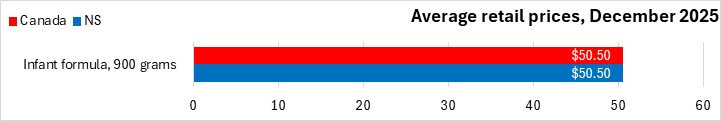

The following products reported price growth that exceeded the gains in average weekly earnings: beef (stewing, striploin, top sirloin, and ground), pork (loin, rib, shoulder cuts), chicken breasts and drumsticks, bacon, meatless burgers, oranges, pears, cantaloupe, strawberries, sweet potatoes, celery, iceberg and romaine lettuce, frozen green beans, frozen peas, spinach, and strawberries, apple juice, roasted or ground coffee, infant formula, canned tomatoes, soup, and corn, tofu, salsa, almonds, peanuts, toothpaste, and shampoo.

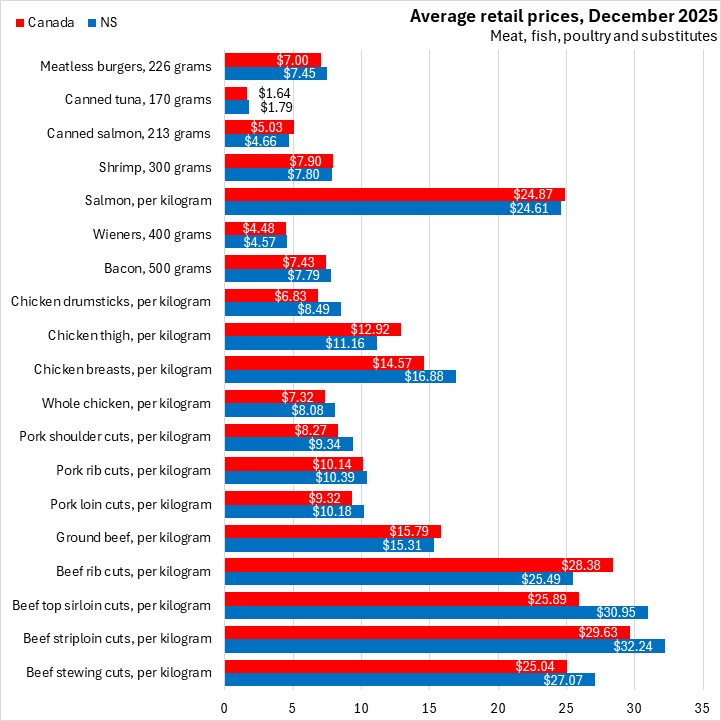

Nova Scotia prices relative to national average (December 2025)

Nova Scotia food prices were below national averages for the following products: beef rib cuts, ground beef, chicken thighs, salmon, shrimp, canned salmon, milk (2 litres), lemons, avocado, romaine lettuce, frozen french fried potatoes, white sugar, apple juice, baby food, mayonnaise, canned pears, pasta sauce, and laundry detergent.

Nova Scotia food prices were more than 10% higher than the national averages for the following products: beef top sirloin cuts, pork shoulder cuts, chicken (whole, breasts, and drumsticks), cream, eggs, oranges, bananas, pears, limes, cantaloupe, strawberries, potatoes (per kilogram), sweet potatoes, tomatoes, onions (per kilogram), celery, cucumber, mushrooms, broccoli, squash, flatbread and pita, vegetable oil, canola oil, canned baked beans, canned tomatoes, canned soup, and salad dressing.

Notes: Statistics Canada makes available scanner data on prices collected for a range of food and personal care items. These prices are collected through point-of-sale (transaction) data obtained directly from Canadian retailers. The data represent commonly purchased items (which do change over time), but are not representative of the Consumer Price Index weights. Over time, products are rotated and quantity or quality may change. Comparisons of prices from one time period to another reflect quantity and quality changes as well as price changes.

For the purposes of this analysis, the 110 items reported by Statistics Canada will be grouped into:

- Meat, fish, poultry and meat substitutes

- Dairy, eggs and substitute products

- Fruit (including canned and frozen products)

- Vegetables (including canned and frozen products)

- Grains, cereals, beans, legumes and nuts

- Sugar, juices, cooking oils, condiments and prepared foods

- Health and cleaning products

Source: Statistics Canada. Table 18-10-0245-01 Monthly average retail prices for selected products; Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted

|