The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

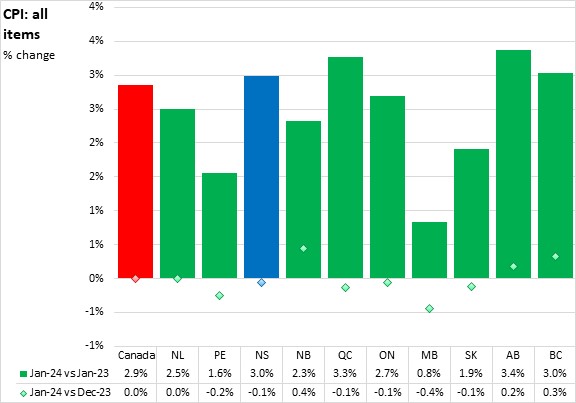

February 20, 2024ANALYSIS OF CONSUMER PRICE INDEX FOR JANUARY 2024 Nova Scotia’s all items Consumer Price Index (CPI) increased 3.0% year-over-year in January 2024, down from a pace of 3.6% year-over-year in December 2023. January all items CPI was down 0.1% compared the previous month.

Nova Scotia's inflation had been slowing after peaking at 9.3% in June 2022. Inflation started to accelerate again in July 2023, particularly due to gasoline prices, as the large monthly drop in July 2022 is no longer included in 12-month calculations while Federal carbon charges came into effect over the summer. However, in October 2022 there was an increase in global oil prices as a result of OPEC production cuts, which drove up fuel prices in the fall of 2022. Energy prices in Nova Scotia declined on a year-over-year basis in October and November 2023, and increased at a slower pace in December 2023 and January 2024.

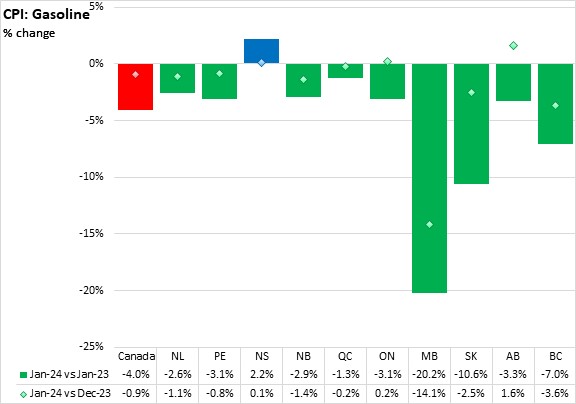

Nationally, consumer prices increased 2.9% year-over-year in January 2024, down from 3.4% in December. Inflation was highest in Alberta and Québec and slowest in Manitoba. Statistics Canada notes that the largest contributor to the deceleration in headline inflation was due to lower year-over-year prices for gasoline in January compared to December. In January 2023, there was a winter storm in the United States that closed refineries, leading to higher gas prices at the pump. Year-over-year gasoline prices fell 4.0% in January at the national level. On a monthly basis, gasoline prices fell for the fifth consecutive month. In Nova Scotia, gasoline prices were up 2.2% in January 2024, down from 7.2% in December 2023.

The most significant upward contributors (combining price increase as well as share of the consumption basket) to Nova Scotia's 3.0% year-over-year inflation were: rent,

mortgage interest cost, electricity, food purchased from restaurants, and purchase and leasing of passenger vehicles. The largest downward year-over-year contributions were from: fuel oil and other fuels, telephone services, recreational equipment and services (excluding RVs), homeowners' replacement cost, and home entertainment equipment, parts and services.

On a monthly basis, Nova Scotia's all items CPI was down 0.1% from December 2023 to January 2024. National prices were unchanged with decreases reported in six provinces. Manitoba reported the fastest percentage decline on a monthly basis. New Brunswick reported the fastest monthly increase.

Major downward contributors to Nova Scotia's monthly decline in consumer prices included inter-city transportation, rent, travel tours, children's clothing, and women's clothing. There were upward contributions from electricity, telephone services, food purchases from restaurants, fresh vegetables, and mortgage interest cost.

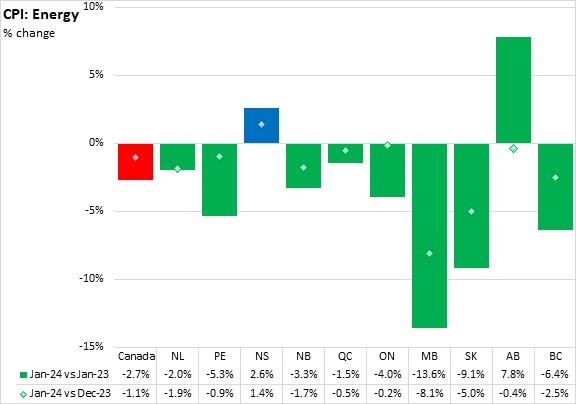

Energy prices play a significant role in inflation rates. Nova Scotia's energy prices were up 2.6% from January 2023 to January 2024. Year-over-year energy prices were down 2.7% nationally with decreases in eight provinces. Manitoba reported the largest decline while Alberta reported the fastest increase.

On a monthly basis, Nova Scotia's energy prices increased 1.4% from December 2023 to January 2024. Nova Scotia was the only province to report higher energy prices compared to the previous month. National energy prices were down 1.1% with declines in nine provinces. Manitoba reported the largest monthly decrease in energy prices while Ontario posted the smallest monthly decline.

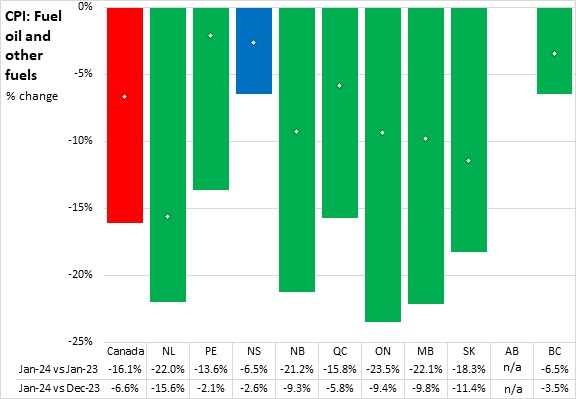

Because fuel oil for home heating is a larger component of Nova Scotia's consumption basket than in other provinces, Nova Scotia's energy prices (and overall inflation) are more sensitive to fluctuations in the global price of crude oil. Nova Scotia's energy prices accelerated dramatically after Russia's invasion of Ukraine in March 2022. Nova Scotia energy prices peaked in June 2022, and then trended down before rising substantially in October and November 2022 as the Organization of Petroleum Exporting Countries cut production to raise global oil prices. Energy prices in Nova Scotia rose again in August and September 2023 with the introduction of the federal carbon levy in July.

Nova Scotia's year-over-year price decline for fuel oil was 6.5%. Gasoline prices increased 2.2% compared to a year ago.

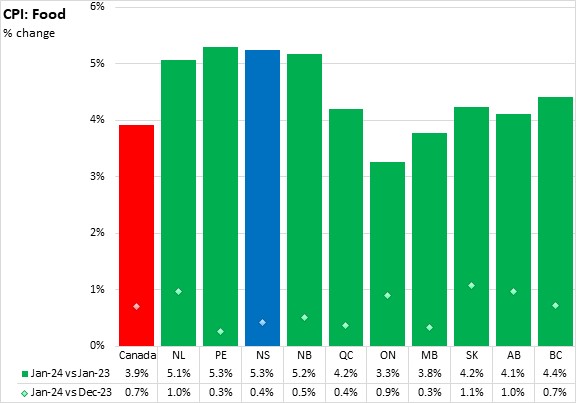

Food price inflation was 5.3% in Nova Scotia (January 2024 vs January 2023). National food prices increased 3.9% in January. Food prices were up in all provinces; the Atlantic Provinces reported the highest food price inflation while Ontario reported the slowest food price growth. All provinces reported a deceleration in year-over-year food price inflation in January 2024.

On a monthly basis, Nova Scotia's food prices rose 0.4% from December to January. National food prices were up 0.7% with increases in all provinces. Saskatchewan reported the fastest growth in food prices while Prince Edward Island and Manitoba reported the slowest growth.

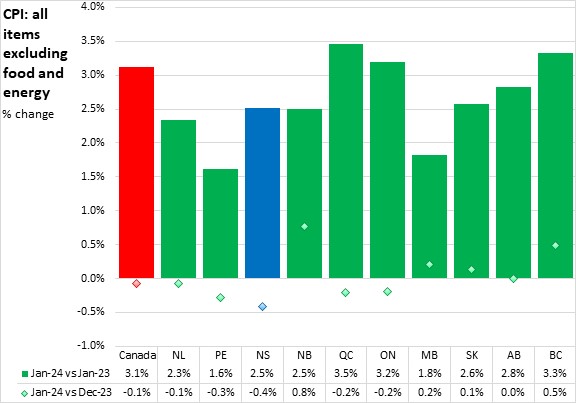

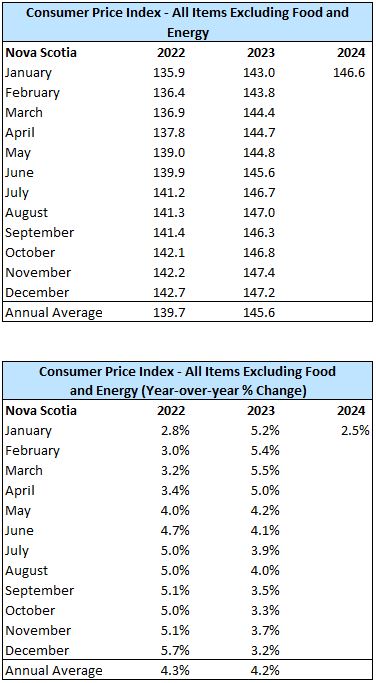

Food and energy prices are heavily influenced by volatile global commodity markets. Nova Scotia's underlying inflation rate excluding food and energy was 2.5% from January 2023 to January 2024. Nationally, inflation excluding food and energy was 3.1%. Quebec reported the fastest growth while Prince Edward Island reported the slowest growth in inflation excluding food and energy prices.

On a monthly basis, Nova Scotia's inflation for all items excluding food and energy was down 0.4% from December 2023 to January 2024. Nationally, prices for all items excluding food and energy were down 0.1% with decreases in five provinces. Nova Scotia reported the largest monthly decline while New Brunswick reported the fastest increase.

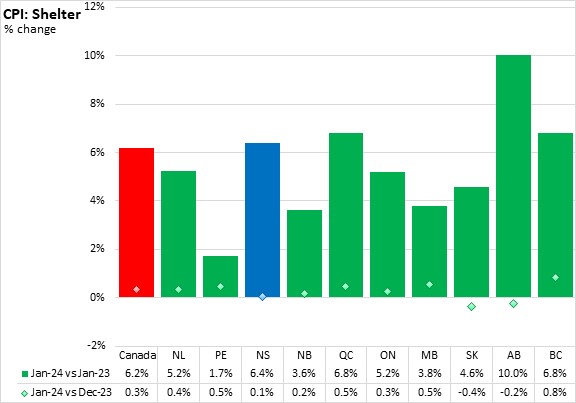

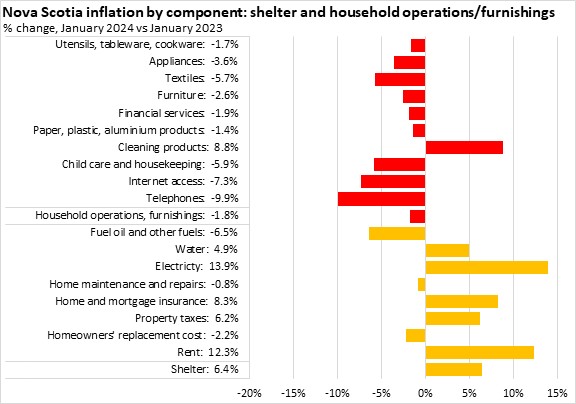

Year-over-year shelter cost inflation accelerated to 6.4% in Nova Scotia in January 2024, up from 5.8% in December. In January 2024, rising shelter costs contributed more to all items inflation in Nova Scotia than energy prices. National shelter prices were up 6.2% with gains in all provinces. Alberta reported the largest year-over-year increase in shelter prices while Prince Edward Island reported the slowest increase.

Monthly shelter costs were up 0.1% in Nova Scotia from December 2023 to January 2024. Nationally, shelter costs were up 0.3% with increases in eight provinces. British Columbia reported the fastest monthly growth in shelter costs. Saskatchewan and Alberta reported monthly declines in shelter costs in January.

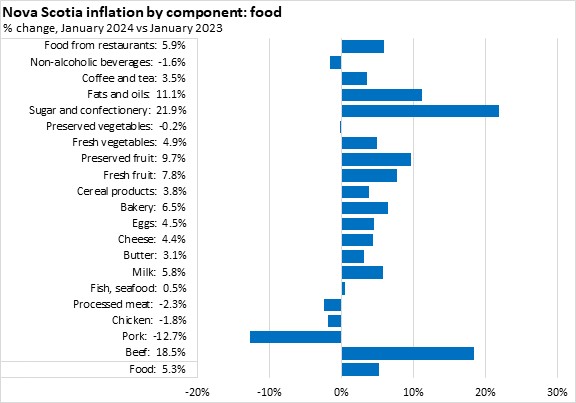

Among detailed food products with available data, Nova Scotia's year-over-year inflation was fastest for sugar and confectionary. The largest year-over-year price decline was for pork.

In detailed shelter cost components, electricity reported the fastest year-over-year price increase, followed by rent. Fuel oil reported the largest year-over-year decline.

Household operations/furnishings costs were down 1.8% overall. Prices were down for all components except cleaning products. The largest declines were in telephones, internet, and child care and housekeeping.

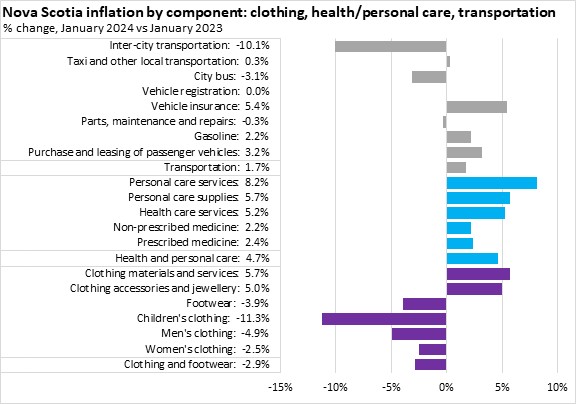

Overall transportations costs were up 1.7% year-over-year in January. Inter-city transportation had the largest decline while vehicle insurance had the largest increase.

Health and personal care costs were up 4.7% year-over-year on gains in all sub-components led by personal care services.

Clothing and footwear prices were down 2.9% year-over-year in January with declines in clothing (all categories) and footwear. Clothing accessories and jewellery and clothing materials and services reported the only increases in January.

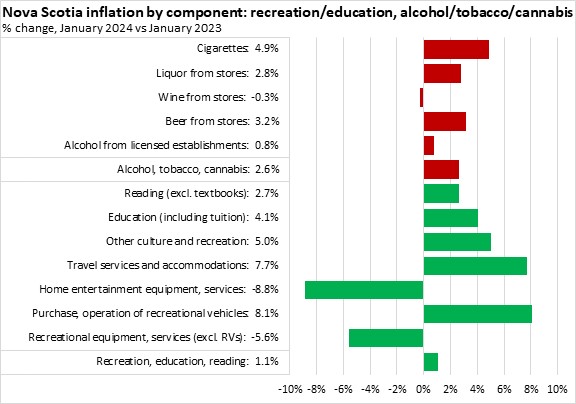

Nova Scotia's overall prices for recreation, education and reading were up 1.1% from January 2023 to January 2024, with faster increases for purchase/operation of recreational vehicles and travel services/accommodations. Prices declined from the previous year for home entertainment equipment and services and recreational equipment/services (excluding RVs).

Nova Scotia's prices for alcohol, tobacco and recreational cannabis were up 2.6% year-over-year with growth in all categories except wine from stores. Cigarette prices had the largest increase.

Trends

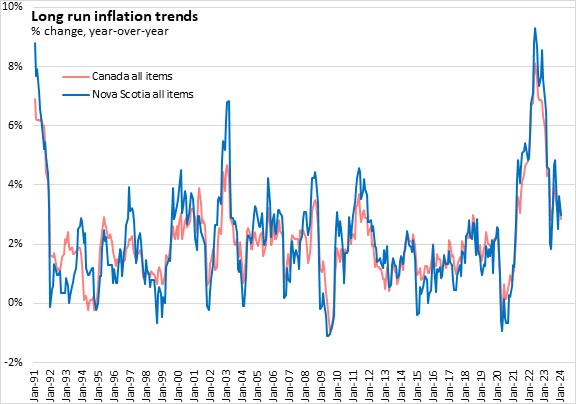

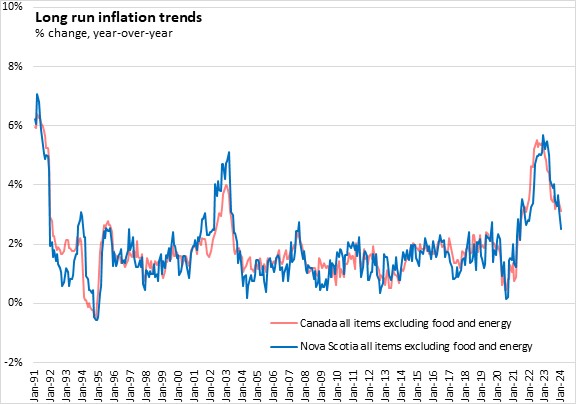

Since the start of the Bank of Canada's inflation-targeting monetary policy regime, inflation for all items has generally been in the 0-4% range. Periods of above target inflation are typically followed by periods of slow price growth or declines. The most recent acceleration in inflation was the strongest since the inflation-targeting era began, though this inflation is starting to fade with tighter monetary policy and lower commodity prices.

Many of these periods of accelerated and slowed inflation are attributable to volatile commodity prices, especially energy prices. Once the more volatile commodity prices are excluded, inflation in Nova Scotia has largely been below 2% for much of the last 20 years. However, the recent rise in inflation through 2021-2023 spreads beyond commodity prices, resulting in the longest period under the Bank of Canada's inflation-targeting regime with Nova Scotia's CPI excluding food and energy above 3%.

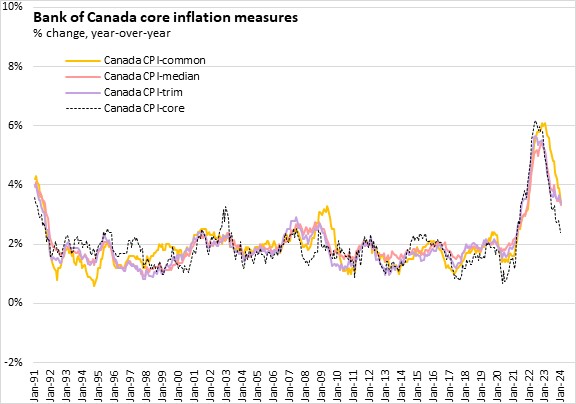

The Bank of Canada examines 'core' measures of inflation that are intended to remove the effects of volatile components and capture underlying inflation trends that are more connected to capacity in the Canadian economy. Core measures of inflation may also indicate where all items inflation is headed.

Canada's core measures of inflation remained mostly at or below the Bank's target of 2% for over a decade prior to 2021. However, after prices accelerated in 2022, core inflation measures also started to rise, peaking at over 6% for the CPI-common measure before declining. Compared to the previous month, year-over-year core inflation measures in January 2024 were down for all core measures: CPI-common (3.4%), CPI-median (3.3%), CPI-trim (3.4%), CPI-core (2.4%).

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics - Bank of Canada definitions; Table 18-10-0005-01 Consumer Price Index, annual average, not seasonally adjusted

<--- Return to Archive