The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

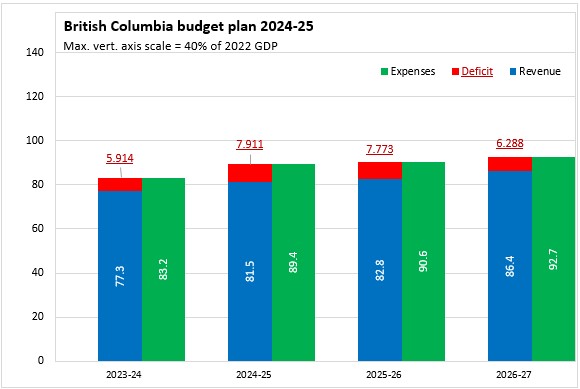

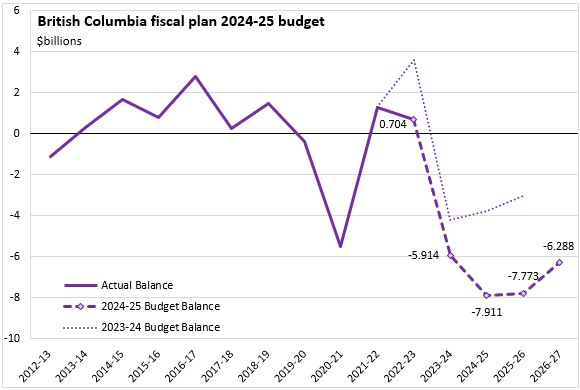

February 23, 2024BRITISH COLUMBIA BUDGET 2024-25 The Province of British Columbia released the first provincial budget for 2024-25. British Columbia's budget deficit is expected to widen from $5.914 billion now forecast for 2023-24 to $7.911 billion in 2024-25. The deficit is projected to narrow slightly to $7.773 in 2025-26 and to $6.288 billion in 2026-27.

British Columbia's revenues are projected to grow by 5.4% from the 2023-24 forecast to the 2024-25 budget estimate while expenditures grow by 7.4%. In 2025-26 revenue growth is projected to slow to 1.6% while expenditures grow by 1.3%. Revenue growth (4.3%) is again projected to outpace expenditure growth (2.3%) in 2026-27.

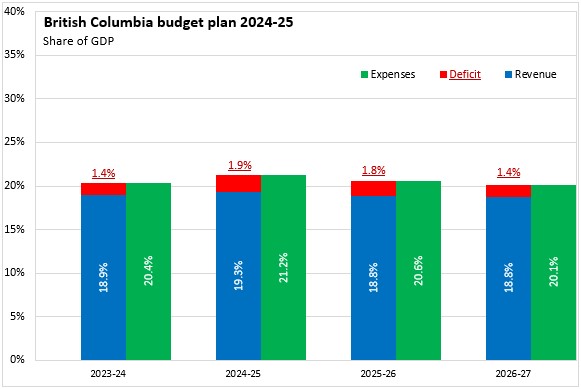

Measured as a share of GDP, the footprint of government in the British Columbia economy is projected to grow to 21.2% in 2024-25 before contracting to 20.1% by 2026-27. The British Columbia budget deficit amounts to 1.9% of GDP in 2024-25. The British Columbia budget deficit is projected to shrink to 1.4% of GDP by 2026-27 (the same level as forecast for 2023-24).

British Columbia's taxpayer-supported debt is projected to rise from 17.6% of GDP as of 2023-24 to 21.0% of GDP in 2024-25. British Columbia's fiscal plan anticipates that taxpayer-supported debt will rise to 27.5% of GDP by 2026-27.

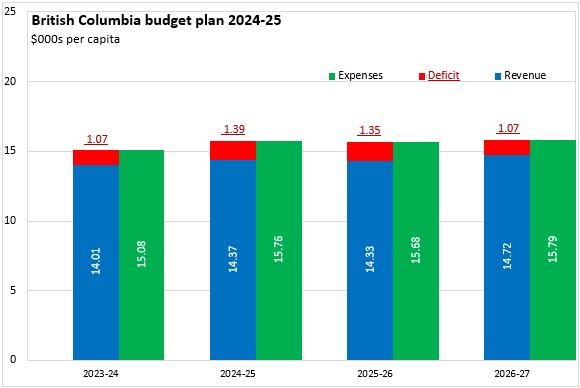

The British Columbia government anticipates expenditures of $15,762 per capita in 2024-25 against revenues of $14,368 per capita. This leaves a deficit of $1,394 per capita. In the next two fiscal years, expenditures per capita are projected to remain largely stable while revenues per capita only grow in 2026-27. By 2026-27, the British Columbia deficit still exceeds $1,000 per capita.

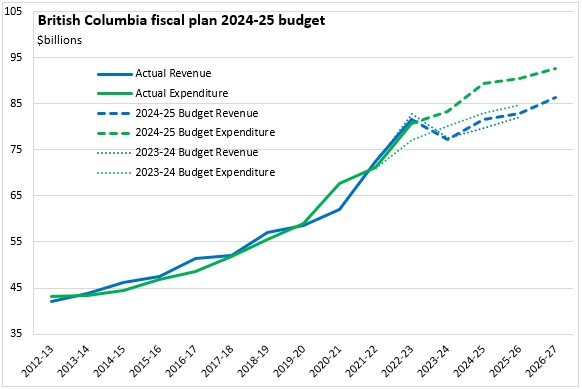

Compared with last year's fiscal outlook, the British Columbia government expects slightly more revenue, but substantially higher expenditures.

With a plan for higher expenditures and an assumption of mostly similar revenues, British Columbia's projected budget deficits for the next two fiscal years are each over $4 billion larger than anticipated in last year's fiscal plan.

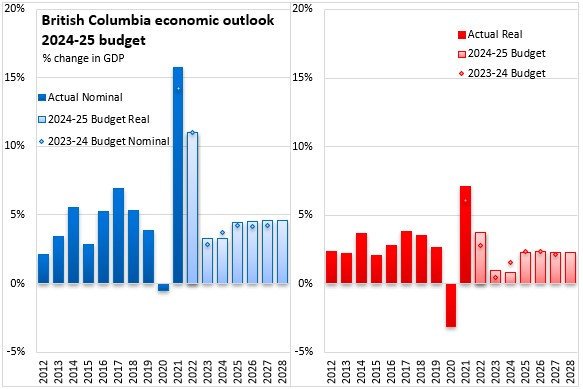

British Columbia's economic outlook in the 2024-25 Budget is little changed compared to the projection from the 2023-24 Budget. Real GDP growth slowed to 1.0% in 2023 due to weaking global conditions caused by monetary tightening, climate events and geopolitical disruptions. The moderating effects of higher interest rates on global activity and domestic investment are expected to peak in 2024. Real GDP growth is projected to remain weak at 0.8% in 2024 before rebounding to 2.3% in 2025. The recovery in 2025 is based on rising incomes and household spending along with recovery in investment and exports. The economic outlook notes risks from more persistent inflation (and higher interest rates), housing market slowdown, climate impacts, geopolitical conflicts, commodity/financial market volatility and weaker global activity.

Key Measures and Initiatives

British Columbia's Budget prioritizes helping with everyday costs, accelerating homebuilding, strengthening health care and building a cleaner economy. Key initiatives include:

- Helping with everyday costs

- 25% increase in BC Family Benefit Bonus

- One-time Electricity Affordability Credit (appearing on electricity bills for 12 months starting in April)

- Increasing quarterly Climate Action Tax Credit payments

- Doubling the business exemption threshold for the Employer Health Tax to $1 million

- Accelerating homebuilding

- Introducing a Home Flipping Tax (effective starting in 2025) on profits from selling residential property within 2 years of buying. Exemptions for life circumstances will be available (divorce, death, illness, work relocation, etc)

- Increasing First Time Homebuyers program property transfer tax exemptions

- Exempting purpose-built rental homes (4+ units) from property transfer tax

- Adding funding to BC Builds to support rapid construction of housing for middle-income households

- Strengthening health care

- $13 billion over 3 years for construction of long-term care, acute care and cancer care facilities

- Adding $270 million for cancer screening and prevention programs

- Launching a publicly-funded in-vitro fertilization program in 2025

- Building a cleaner economy

- $405 million over 4 years for climate emergency response, including wildfire management and flood mitigation

- $93 million for heat pumps, active transportation grants, public electric vehicle charging and youth involvement in climate action

British Columbia Budget 2024-25

<--- Return to Archive