The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 29, 2024CANADIAN ECONOMIC ACCOUNTS Q4 & ANNUAL 2023

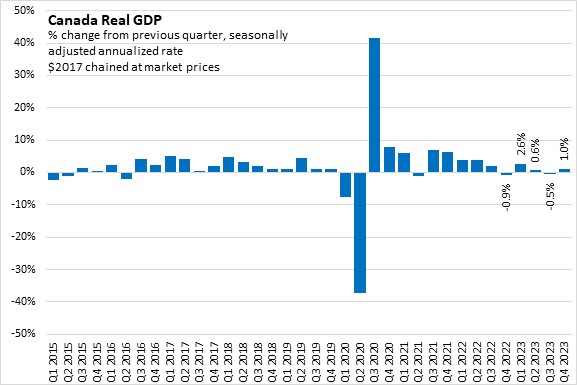

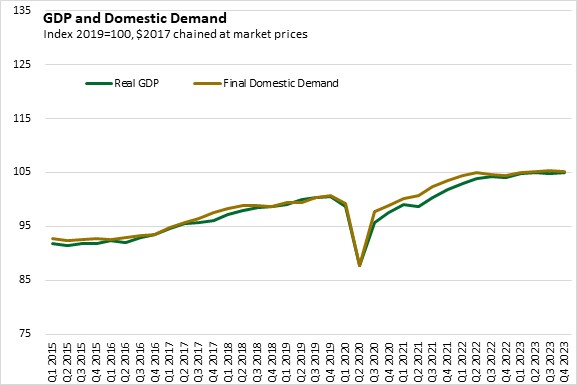

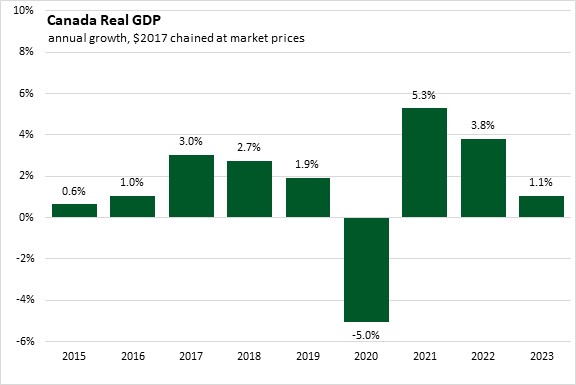

Canada’s Real Gross Domestic Product (GDP) grew 1.0% (all figures seasonally adjusted at annual rates) in the final quarter of 2023, following a 0.5% decline in Q3 2023.

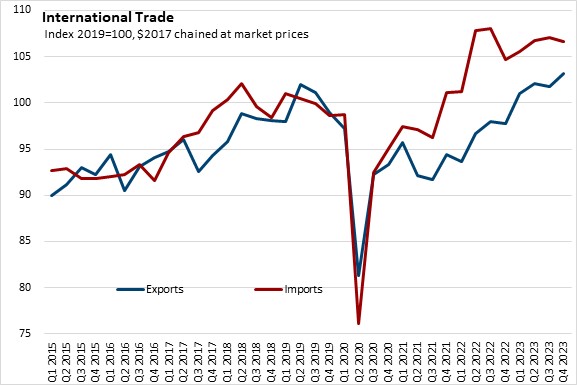

Statistics Canada attributed the quarterly increase to higher exports and slower imports, partially offset by a decline in business investment. Higher exports of crude oil and bitumen led the increase, with notable contributions from travel services and other transportation equipment and parts. Final domestic demand declined 0.7% in the fourth quarter.

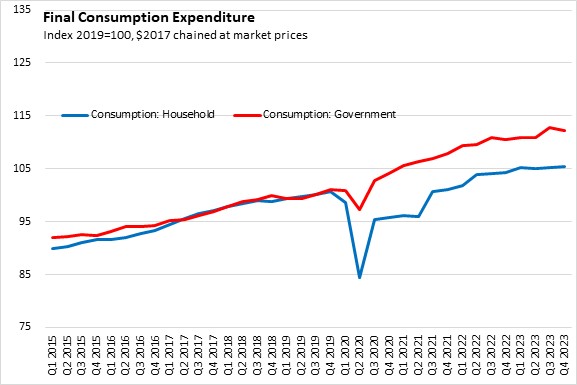

Household consumption growth increased 1.0% in Q4. The increase was led by higher spending on new trucks, vans and utility vehicles as a further easing of supply chain issues allowed for back orders to be fulfilled. Population growth continued to outpace growth in household spending resulting in the third consecutive quarterly decline in spending per capita. Government consumption declined 1.9% in Q4.

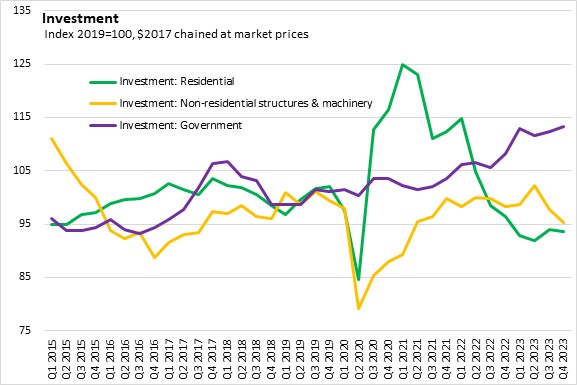

Residential investment declined 1.7% in the fourth quarter of 2023. Weakness in the resale market (i.e., a decline in ownership transfer costs) was not offset by quarterly increases in new construction and renovations. All provinces except Prince Edward Island reported higher housing starts for the quarter.

Non-residential investment declined 9.5% in Q4 with declines in non-residential structures, machinery and equipment and intellectual property products.

Government investment was up 3.2% in the final quarter of 2023.

Exports increased 5.6% in Q4 on higher crude oil and crude bitumen, coinciding with sustained production of crude oil in Alberta. Imports declined 1.7% led by lower imports of intermediate metal products, tires, motor vehicle engines and parts, and passenger cars and light trucks. Terms of trade (the ratio of the price of exports to the price of imports) fell in the fourth quarter as the price of imported products increased faster than the price of exports.

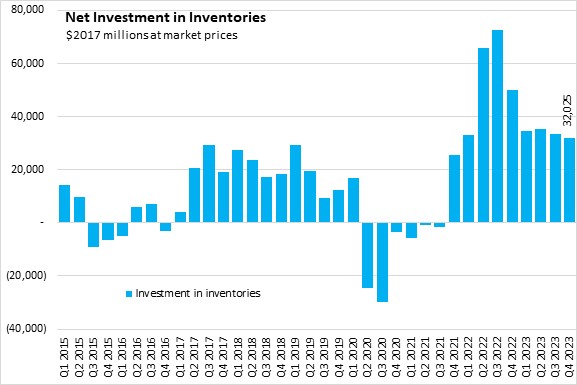

Investment in inventories was $32.0 billion in Q4, as inventories continue to slow after peaking in Q3 2022. Statistics Canada reported that lower accumulations in retail and wholesale were partially offset by higher manufacturing inventories, particularly for refined petroleum, primary metals, machinery and motor vehicles.

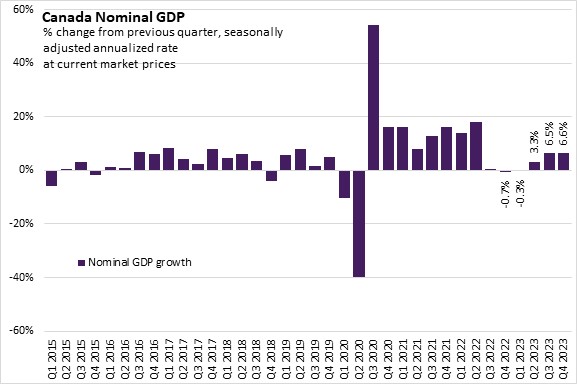

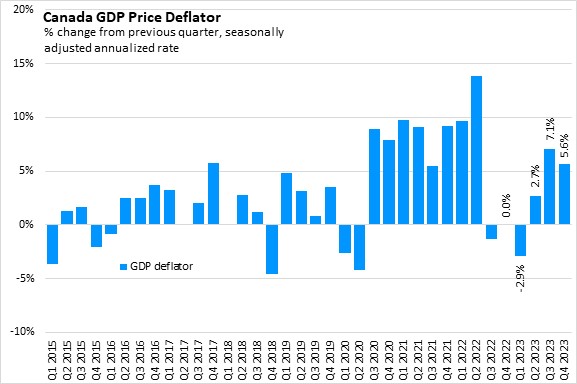

Nominal GDP increased at a seasonally adjusted annualized rate of 6.6% in Q4, following the 6.5% increase in Q3 2023.

The overall GDP deflator (reflects overall price of domestically produced goods and services) was up 5.6% on annualized basis.

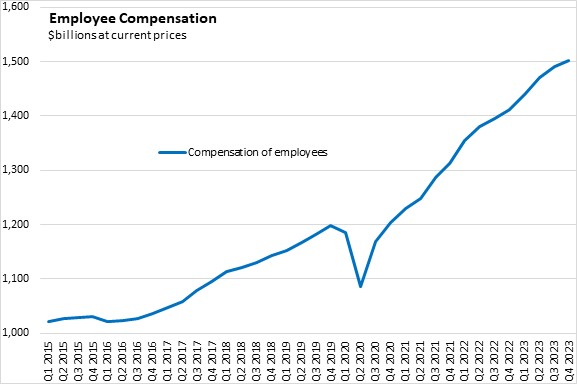

Employee compensation (measured in current prices, not real volumes) was up by a seasonally adjusted annualized rate of 3.3% in Q4. This was the slowest pace of growth since the second quarter of 2020. Wage growth slowed in service producing industries while wages declined for goods producing industries in Q4. Statistics Canada notes that wages and salaries in federal government public administration increased in the fourth quarter due to a significant retroactive payment to federal government employees, and wages and salaries declined in education due to strike action in Quebec's education industry.

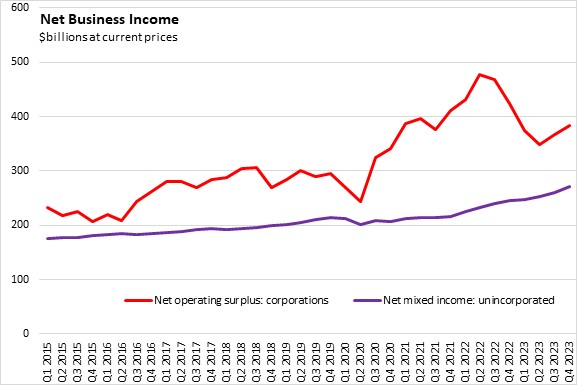

Higher operating surplus for non-financial companies was partly offset by declines for financial corporations in Q4. Growth in the non-financial sector was led by wholesale and retail trade, as well as telecommunications and other services. The energy sector has a lower operating surplus due to lower prices and temporary maintenance related shutdowns. Net mixed income continued to increase in Q4.

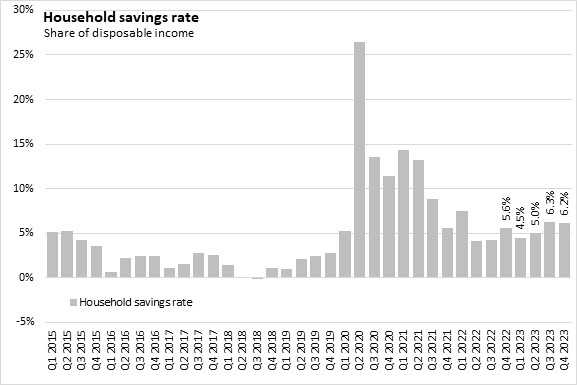

The household savings rate edged down to 6.2% of disposable income in Q4.

ANNUAL (2023 VS 2022)

In 2023, Canada's real GDP growth slowed to 1.1%. Excluding 2020, this pace of growth was the slowest since 2016.

Household consumption growth slowed to 1.7% in 2023 from 5.1% in 2022. Growth in 2023 was supported by increased spending on new trucks, vans and utility vehicles.

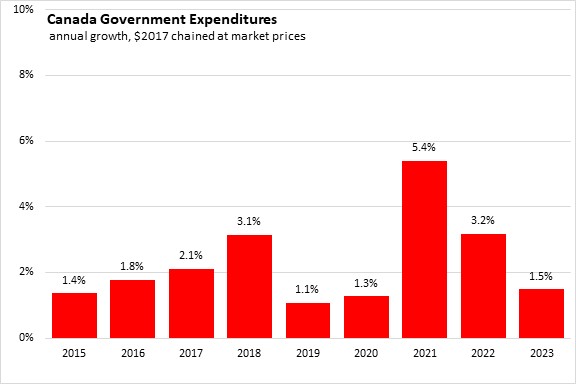

Government expenditure growth slowed to 1.5% in 2023 after 3.2% growth in 2022.

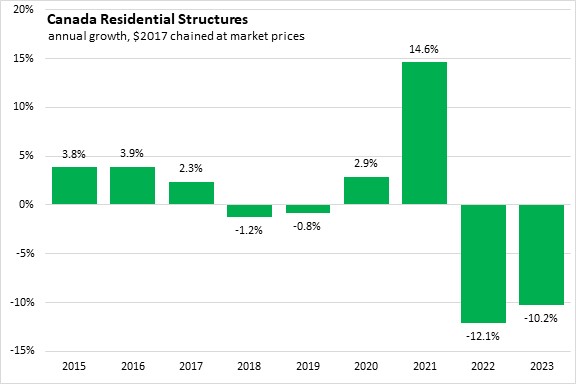

Residential investment declined 10.2% in 2023 with declines in new construction, renovations and ownership transfer costs.

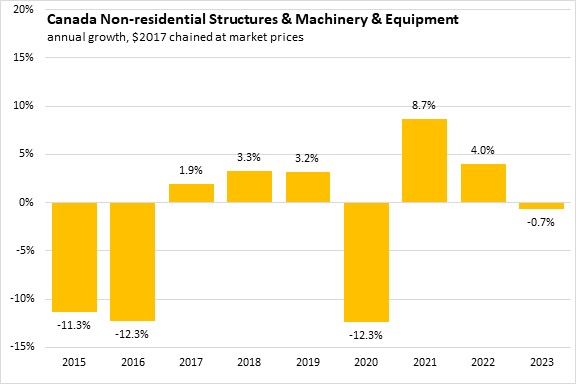

Business investment in non-residential structures and machinery and equipment declined 0.7% in 2023 after growing 4.0% in 2022.

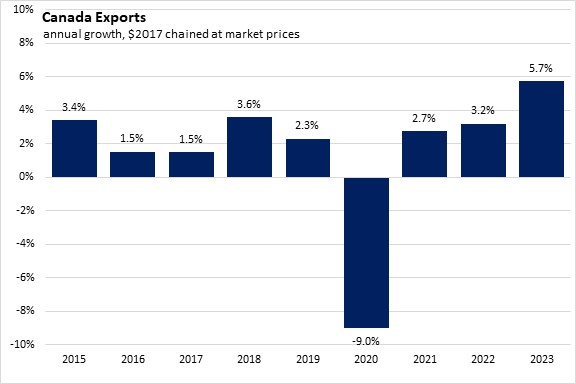

Growth in exports picked up to 5.7% in 2023 due to higher exports of passenger cars and light trucks, as well as travel services.

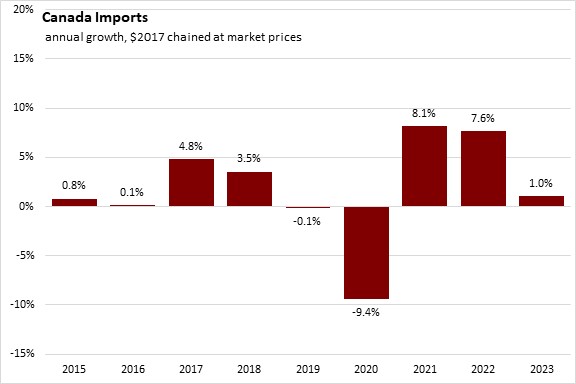

Export growth outpaced import growth in 2023. Imports of goods and services grew 1.0% in 2023 on Canadians demand for travel services and passenger cars and light trucks.

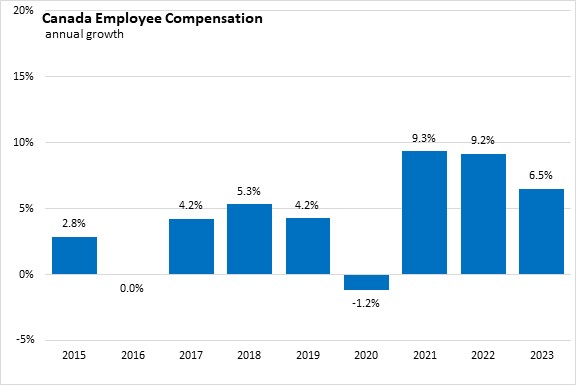

Compensation of employees grew 6.5% in 2023 following 9.2% in 2022. Statistics Canada notes that growth was strongest in the Maritime provinces and the slowest in Saskatchewan.

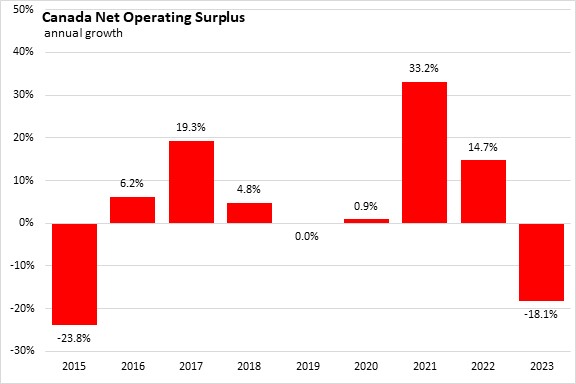

Following two years of double-digit growth, net operating surplus fell 18.1% in 2023.

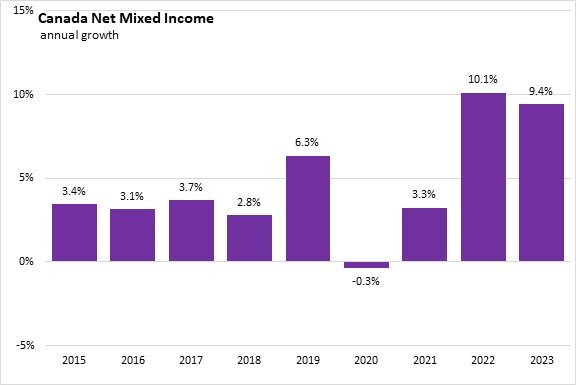

Net mixed income continued to grow following the decline in 2020, posting 9.4% growth in 2023.

Source: Statistics Canada. Table 36-10-0103-01 Gross domestic product, income-based, quarterly (x 1,000,000), Table 36-10-0104-01 Gross domestic product, expenditure-based, Canada, quarterly (x 1,000,000), Table 36-10-0111-01 Current and capital accounts - National, Canada, quarterly

<--- Return to Archive