The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 01, 2024PRINCE EDWARD ISLAND BUDGET 2024-25 The Province of Prince Edward Island has released its provincial budget for 2024-25.

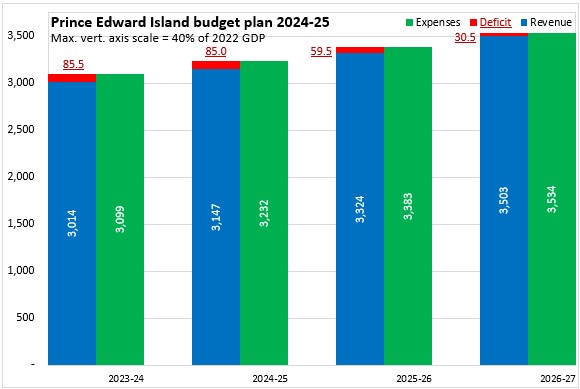

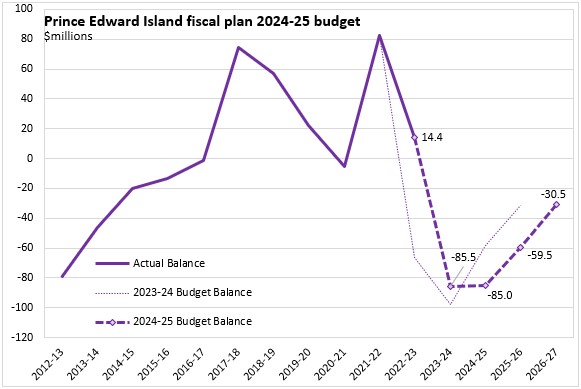

Prince Edward Island expects that the 2024-25 deficit will be $85.0 million, little changed from the deficit forecast for 2023-24 ($85.5 million). In 2025-26, the deficit is projected to contract to $59.5 million. The deficit is projected to shrink again in 2026-27, falling to $30.5 million.

In 2024-25, Prince Edward Island's revenues are projected to increase by 4.4% while expenditures rise by 4.5%. In 2025-26, revenue growth of 5.6% is projected to pull ahead of the expenditure rise of 4.7%. In 2026-27, Prince Edward Island expects revenue gains of 5.4% while expenditure growth is projected to be 4.5%.

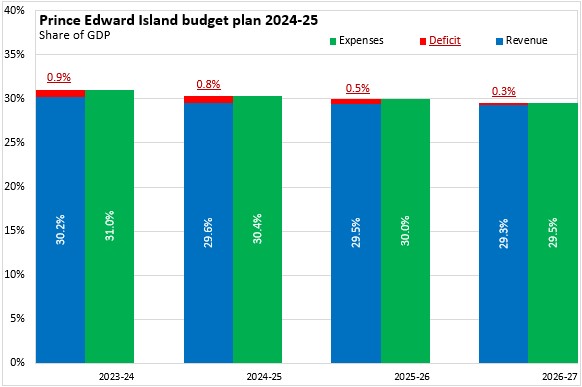

Measured as a share of GDP, the footprint of government in the Prince Edward Island economy is expected to decline slowly from 30.4% in 2024-25 to 29.5% in 2026-27. Prince Edward Island's deficit amounts to 0.8% of GDP in 2024-25. This is projected to contract to 0.3% by 2026-27.

Prince Edward Island's net debt is projected to rise from 28.8% of GDP in 2024-25 to 29.5% in 2025-26 before contracting to 29.3% of GDP in 2026-27.

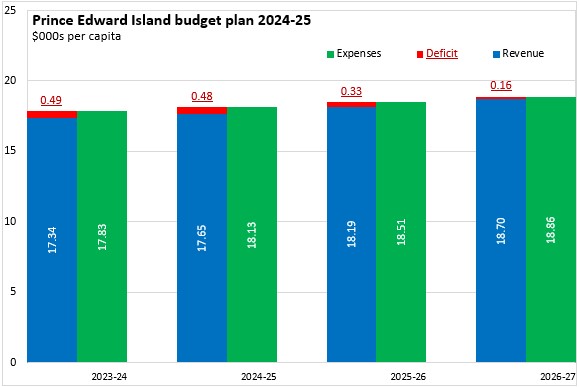

Prince Edward Island's expenditures for 2024-25 amount to $18,128 per capita against revenues of $17,652 per capita, leaving a deficit of $477 per capita.

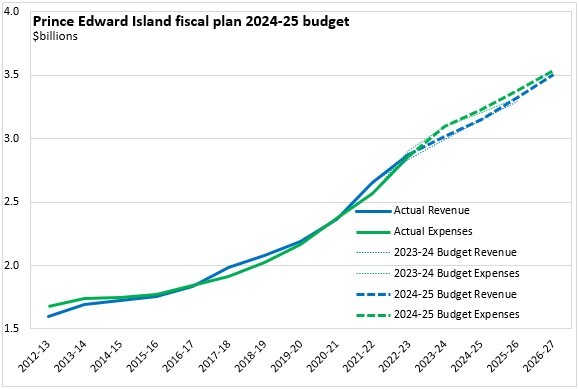

Compared to the fiscal outlook from the 2023-24 Budget, the 2024-25 fiscal plan is little changed with slight growth in the outlooks for revenue and expenditures in 2025-26.

Prince Edward Island's deficit of $85.5 million in 2023-24 was slightly better than expected in last year's fiscal plan. The deficits for 2024-25 and 2025-26 are now projected to be somewhat larger than planned, when compared with last year's fiscal outlook.

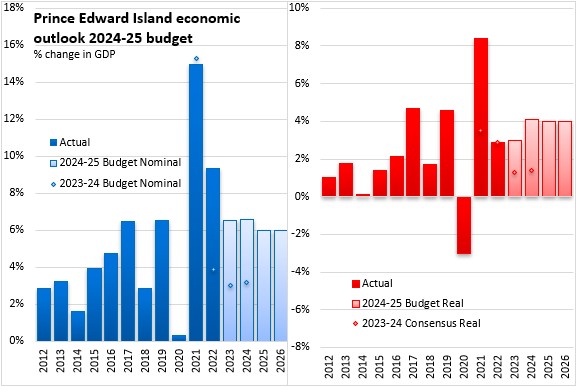

Prince Edward Island's economic growth is projected to return to pre-pandemic trends in 2024 as continued (albeit slower) population growth keeps labour markets and consumer spending growth strong while inflation cools. Although there has been substantial price growth, Prince Edward Island's housing markets remain relatively affordable and attractive for migrants. Economic diversification is expected to contribute to rising manufacturing shipments and exports. The Prince Edward Island Budget assumes that real GDP will grow by 4.1% in 2024 and by 4.0% in each of the next two years. Nominal GDP growth is projected to accelerate slightly to 6.6% in 2024 before slowing to 6.0% in each of the next two years.

Key Measures and Initiatives

Prince Edward Island's Budget for 2024-25 prioritizes health care improvements, building housing, helping with costs, promoting learning, making communities safer and strengthening industries. Key initiatives include:

Improving health care

- Mental health services - $3M

- Adding patient medical homes - $10.5M

- Supports for seniors - $4.9M

- Enhancing access to care - $3.7M

- Wage parity between private and government nursing homes - $4.5M

- Integrating associate physicians and physician assistants - $2.4M

- Training and upskilling RCWs, LPNs, Paramedics and RNs - $2.2M

- Implementation of a medical school - $9.9M

- Recruitment of health care professionals - $6.2M

- More doctors and residency seats - $7.1M

Building

- Expanding shelter spaces and improving supports - $6.9M

- Adding affordable units - $10M

- Tax rebates for newly constructed multi-unit residential buildings - $6.7M

- Supports for social housing- $1.6M

- Develop a land use plan - $200K

Helping with everyday costs

- Tax system changes to index brackets/credits and lower rates - $14.6M

- Improving supports for social assistance and AccessAbility support clients - $3.1M

- Introducing a PEI children’s benefit - $1.1M

- Incentives for heat pumps, hot water heaters and insulation - $7.3M

- Adding public transit routes and minigating fare increases - $1M

- Expanding seniors independence initiative - $380K

Learning

- Adding front-line staff to education - $7M

- Implementing a vision care program for elementary school aged children - $708K

- Support for the school food programs - $1M

- Childcare supports and spaces - $4.3M

Safer Communities

- Gender-based violence action plan - $2.4M

- Impaired driving enforcement - $773K

- Supporting municipal police services - $150K

Strengthening industries

- Growing the Bioscience Sector - $2M

- Expanding EV charging network - $1M

- Developing coastal management plans - $500K

- Tourism season expansion - $500K

- Strengthening agriculture with energy systems pilot and land purchase supports - $1M

- Supporting diversity and inclusion - $205K

Prince Edward Island Budget 2024-25

<--- Return to Archive