The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 06, 2024BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 5%, with the Bank rate at 5.25% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening.

Growth slowed in the fourth quarter in the global economy. US economic growth slowed but has remained robust with strength in consumption and exports. Euro area economic growth was flat following a decline in the third quarter. Inflation has continued to ease in both jurisdictions. Bond yields have increased since the previous rate announcement while corporate credit spreads have narrowed.

Canadian economic growth was stronger than expected in the fourth quarter, though remains weak and below potential. Real GDP declined 0.5% in Q3 then grew 1.0% in Q4. Final domestic demand fell in Q4 on a large decline in business investment. Consumption growth was modest while export growth was strong. Employment growth continues to be slower than population growth, creating more balance in the labour market. The Bank of Canada notes that the income data are indicating that the Canadian economy is in excess supply.

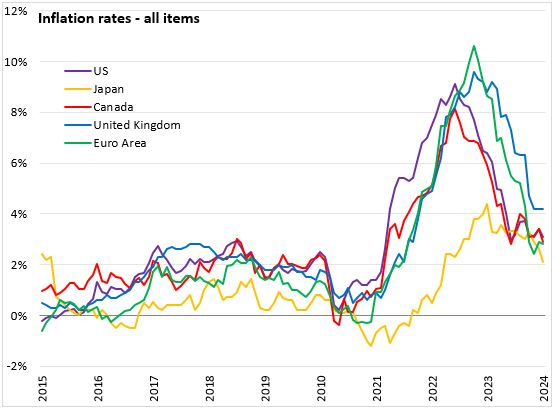

Inflation eased to 2.9% in January due to further moderation of prices for goods. Shelter price inflation remains the biggest contributor to year-over-year inflation. Underlying inflationary pressures persist and the Bank continues to expect inflation to remain close to 3% for the first half of 2024 before gradually easing.

Risks to the outlook for inflation remain, particularly the persistence of underlying inflation. The Governing Council will wait to see further and sustained easing in core inflation before considering lowering the policy interest rate. The Bank also continues to monitor the balance between demand and supply, inflation expectations, wage growth, and corporate pricing behaviour.

The next scheduled date for announcing the overnight rate target is April 10, 2024. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection at that time.

Bank of Canada: Rate Announcement

<--- Return to Archive