The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 13, 2024CANADA NATIONAL BALANCE SHEET ACCOUNTS, Q4 2023

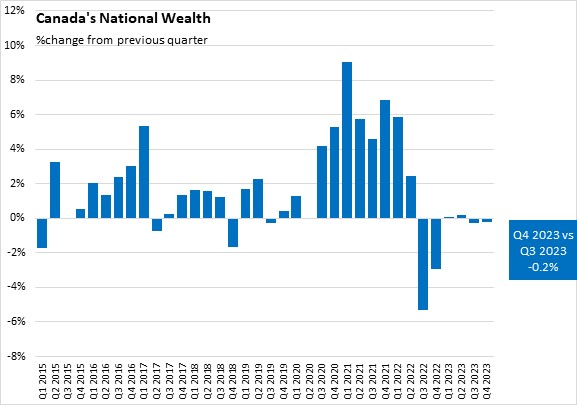

In the fourth quarter of 2023, Canadian national wealth (the total value of non-financial assets) edged down 0.2% to $16,821.3 billion. This follows a decline of 0.3% in the third quarter of 2023. The residential real estate continues to decline on declining housing prices, this decline was offset by growth in the value of Canada's produced assets, particularly energy and mineral reserves, on elevated gold and uranium prices.

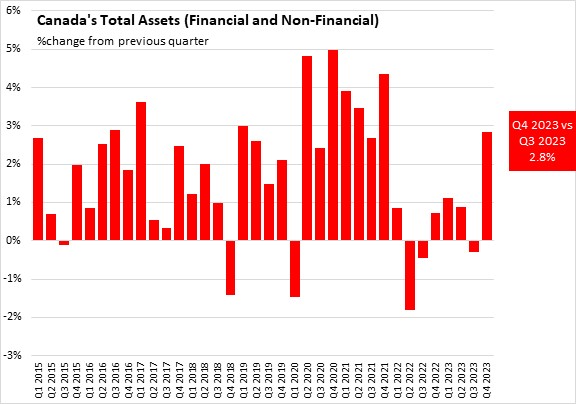

Total assets, including financial and non-financial assets rose by 2.8% to $63,601.9 billion at the end of Q4 2023, following a 0.3% decline in Q3 2023.

Household sector

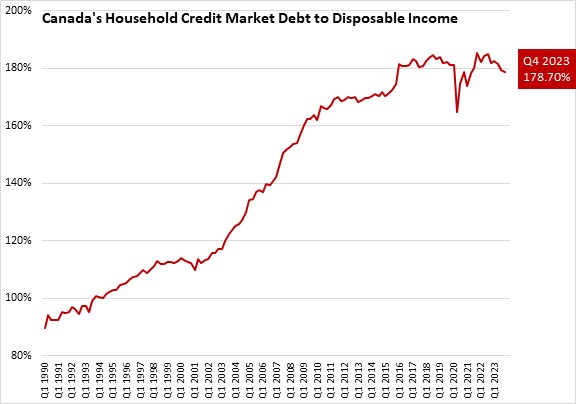

Household credit market debt as a proportion of household disposable income decreased to 178.70% in Q4 2023.

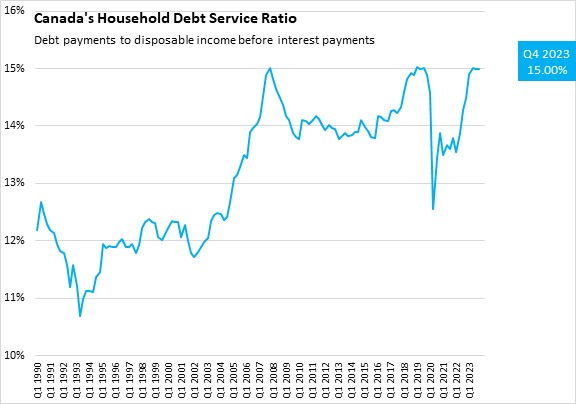

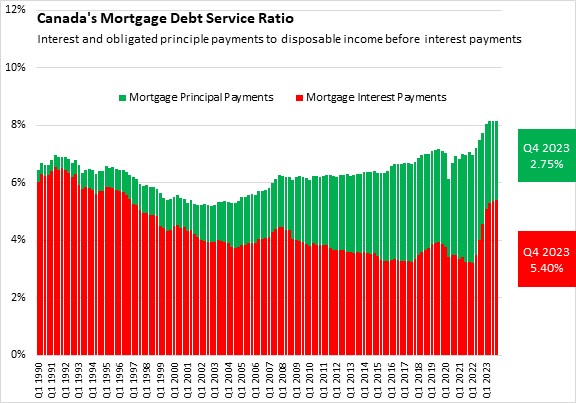

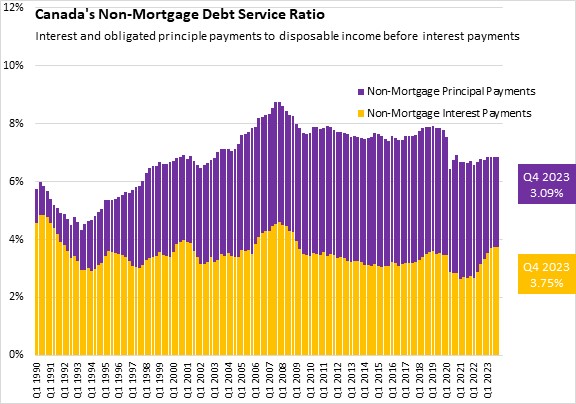

In Q4 2023, household debt payments increased to 15.00% of disposable income. Mortgage interest payments were up 3 basis points to 5.40% of disposable income, while non-mortgage interest payments remained same at 3.75% of disposable income. Principle payments for mortgages contracted and non-mortgage loans were unchanged as a share of disposable income.

Government sector

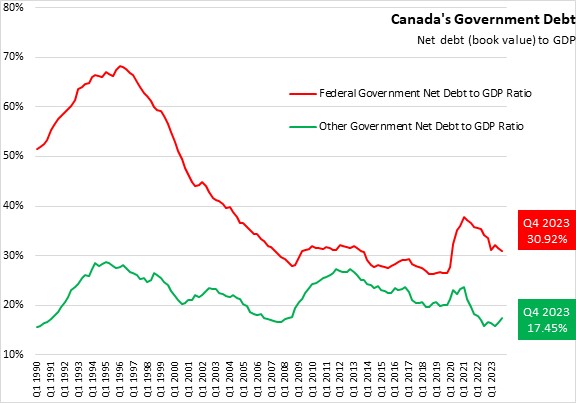

At the end of Q4 2023, federal government net debt (book value) decreased to 30.92% of GDP. Net debt of other levels of government increased to 17.45% of GDP.

Corporate sector

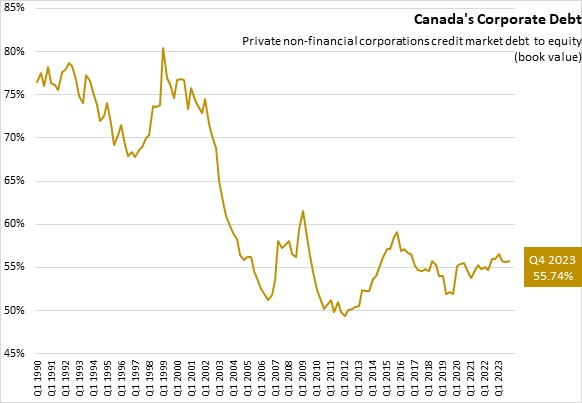

The credit market debt to equity ratio of non-financial private corporations rose to 55.74 cents of credit market debt for every dollar of equity in Q4 2023, up from 55.65 cents in Q3 2023.

Source: Statistics Canada. Table 11-10-0065-01 Debt service indicators of households, national balance sheet accounts; Table 36-10-0580-01 National Balance Sheet Accounts (x 1,000,000); Table 38-10-0235-01 Financial indicators of households and non-profit institutions serving households, national balance sheet accounts; Table 38-10-0236-01 Financial indicators of corporate sector, national balance sheet accounts; Table 38-10-0237-01 Financial indicators of general government sector, national balance sheet accounts; Table 38-10-0238-01 Household sector credit market summary table, seasonally adjusted estimates

<--- Return to Archive