The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 21, 2024BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%.

UK measure of global GDP was estimated to have grown by 0.4% in Q4 2023 with divergence in growth in advanced economies. US has grown faster than had been expected but was expected to slow in the first quarter of 2024 with slowing retail sales and private consumption. Euro Area GDP had been flat in 2023 Q4. China GDP has grown 1.0% in Q4 2023 and was expected to remain at around that rate in early March. With the conflict in the Middle East and disruptions in shipping through the Red Sea, there are limited news in energy prices since February. Brent spot oil price had increased as OPEC and other oil producers were expected to extend production cuts.

UK real GDP has fallen by 0.3% in Q4 2023 and followed a decline in Q3 of 0.1%. Consumption was weaker than expected over 2023, but there are early signs of gradual recovery. Retail sales are volatile but increased in January by 3.4% from a decline in December. Based on the small sample size gathered by LFS, unemployment rate was estimated to have fallen over the past six months to 3.9% in the three months to January. Employment growth has ben resilient, suggesting that companies are retaining their employees to meet future demand.

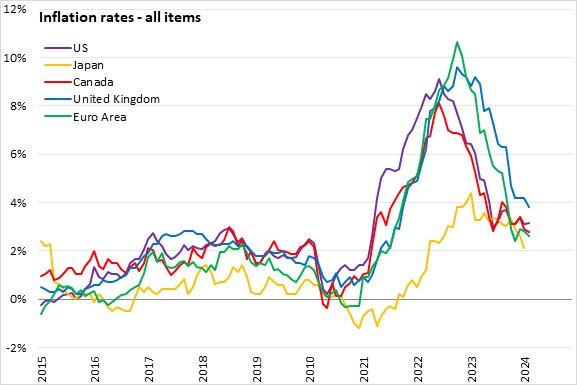

The spring Budget had taken place on March 6 along with the economic and fiscal outlook. Bank staff had estimated that by cutting the main rate of employee and self-employed national insurance contributions among other fiscal measures, the level of GDP would increase by around 0.25% over the coming years. CPI inflation had been expected to fall temporarily to the 2.0% target in 2024 Q2 before increasing again in Q3 and Q4, to around 2.75% owning to persistence in domestic inflationary pressures.

The MPC will continue to monitor for persistent inflationary pressures, including tightness of labour market conditions, behaviour of wage growth and services inflation. The Bank of England no longer indicates that further tightening could be necessary, but cautions that monetary policy will need to remain restrictive for an extended period long to achieve the 2% inflation target sustainably over the medium term.

The next scheduled monetary policy meeting will be on May 9, 2024.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive