The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

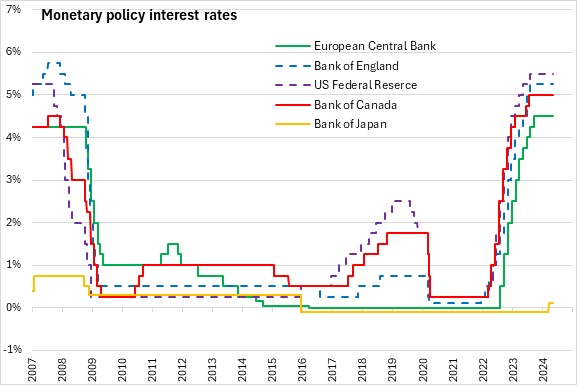

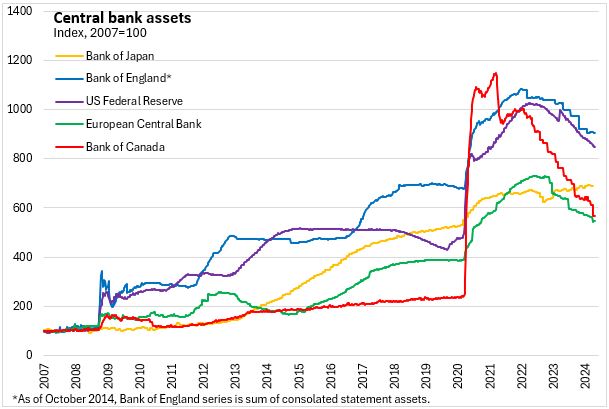

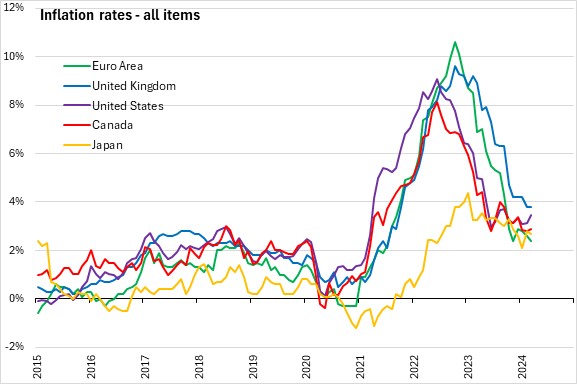

May 01, 2024US MONETARY POLICY At its scheduled Federal Open Market Committee (FOMC) meeting, the Federal Reserve announced that it will maintain the target range for the federal funds rate 5.25% to 5.50%. Reductions in the target range were not considered appropriate at this time as the Committee has yet to see sustained movements towards the 2% inflation target. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May 2022. Beginning in June, the Committee will reduce the monthly redemption cap on Treasury securities from $60 billion to $25 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage-backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities.

Recent economic indicators show that US economy has been expanding at a steady pace. Over the past year, inflation has eased, but remains elevated above the 2% target rate. The United States Consumer Price Index (not seasonally adjusted) for All Urban Consumers increased 3.5% year-over-year in March 2024. Job gains have remained strong with unemployment remaining low. The US unemployment rate was down 0.1 percentage points to 3.8% in March 2024. Although the US unemployment rate has remained at or below 4% throughout 2022 and 2023, there has been a gradual rise since the beginning of 2023. US real GDP growth was estimated at 1.6% (seasonally adjusted annualized rate) in Q1 2024 in the first estimate.

The Committee will continue to monitor economic developments and is prepared to adjust the monetary policy measures as appropriate, taking into account information on labor market conditions, inflation pressures and inflation expectations, and financial and international developments. The next scheduled FOMC meeting will be held on June 11-12, 2024.

Source: US Federal Reserve, FOMC Statement

<--- Return to Archive