The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

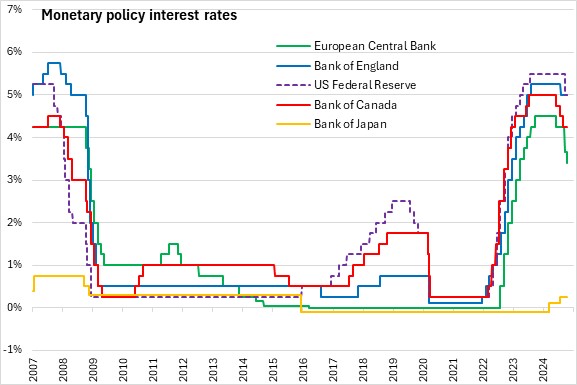

October 17, 2024EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would reduce the three key ECB interest rates by 25 basis points. The interest rates on the main refinancing operations, the marginal lending facility and the deposit facility will be at 3.40%, 3.65% and 3.25% respectively effective October 18.

In the second GDP estimate for Q2 2024, Eurostat estimates the seasonally adjusted annualized growth rate for real GDP was +0.8% for the Euro Area. Euro Area real GDP growth was driven by export growth and governmnet spending, offset by import growth and falling investment and weak consumer spending.

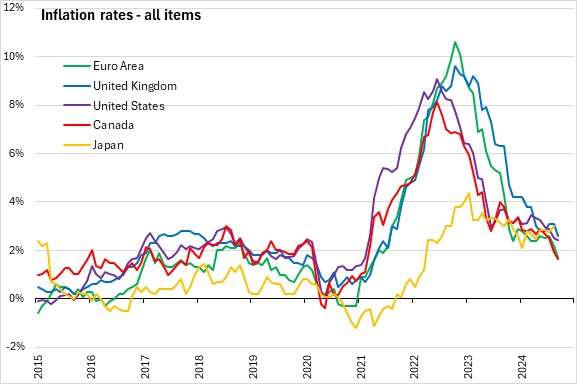

The year over year inflation rate fell to 1.7% in the Euro Area in September 2024, its lowest level since April 2021. In September 2024, the highest contribution to the annual inflation rate came from services, followed by food, alcohol & tobacco, non-energy industrial goods and energy. ECB expects inflation to accelerate in the coming months as base period effects of lower energy prices disappear. As labour cost pressures ease, inflation is then expected to return to 2%.

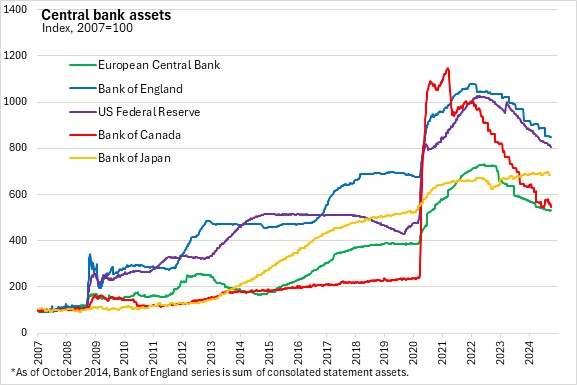

The asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities. The Governing Council intends to reduce the Pandemic Emergency Purcase Programme (PEPP) portfolio by €7.5 billion per month on average and to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council notes that future policy rate decisions will be based on its assessment of the inflation outlook (including the dynamics of underlying inflation), incoming economic and financial data, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on December 12, 2024.

Source: European Central Bank: Monetary Policy Decisions

<--- Return to Archive