The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 30, 2024SURVEY OF FINANCIAL SECURITY, 2023 Statistics Canada has updated the Survey of Financial Security to 2023, providing estimates of household assets, debts and net worth for Canada and the Provinces.

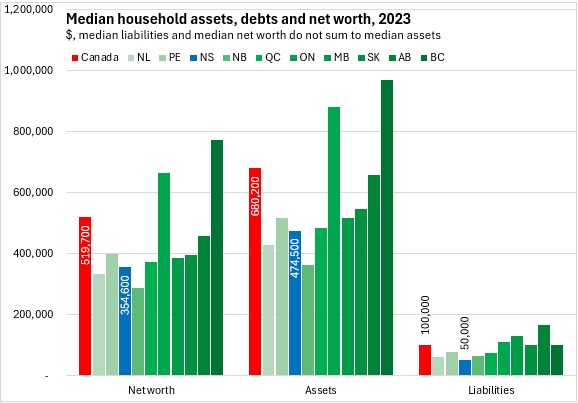

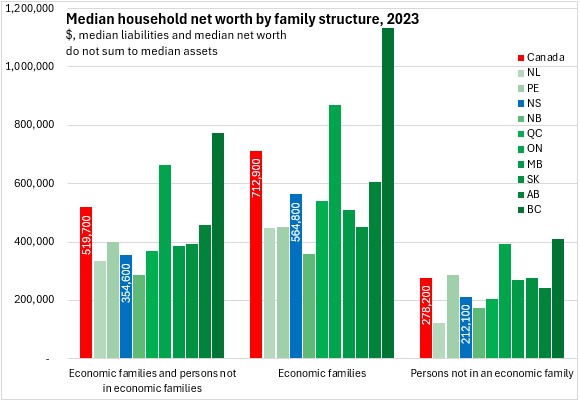

Median household net worth in Nova Scotia was $354,600 in 2023. This was 68.2% of national net worth ($519,700) and ahead of only New Brunswick and Newfoundland and Labrador. Median net worth was substantially higher in Ontario and British Columbia.

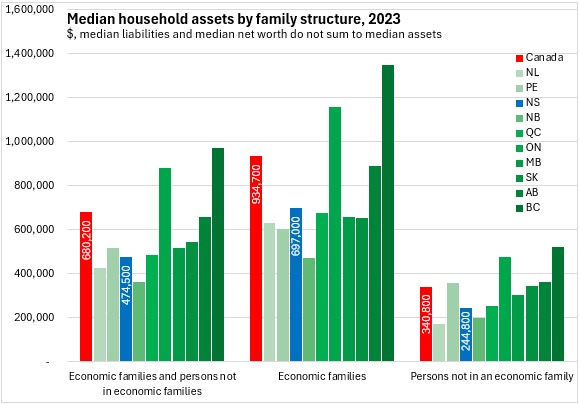

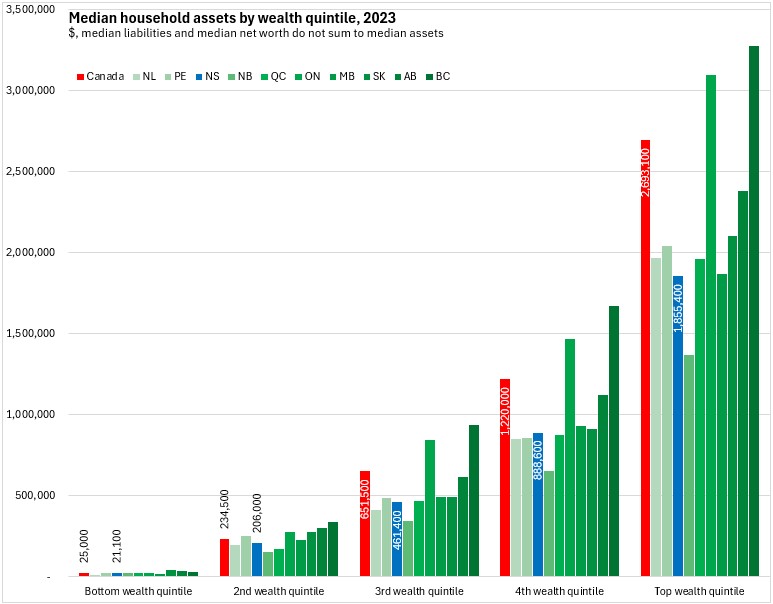

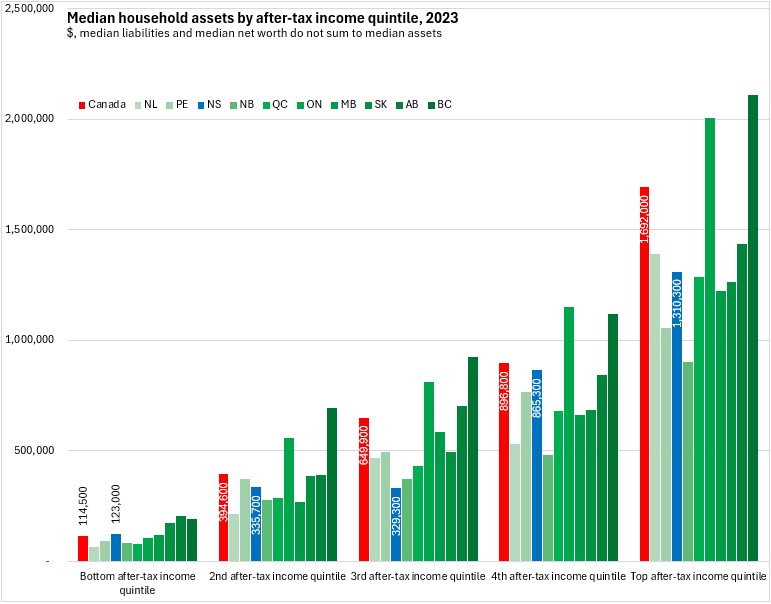

Median household assets in Nova Scotia were $474,500, or 69.8% of the $680,200 national median household assets in 2023. Assets were lowest in New Brunswick and Newfoundland and Labrador (followed by Nova Scotia). Asset values were highest in Ontario and British Columbia.

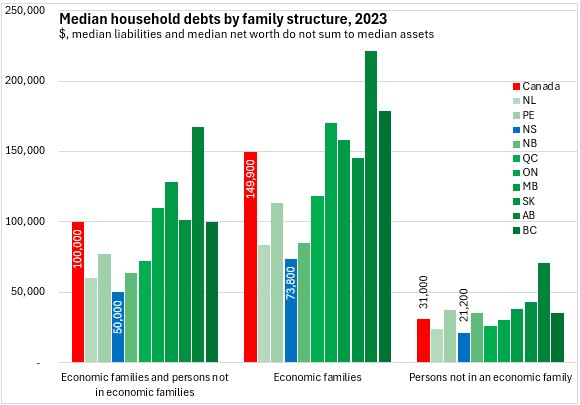

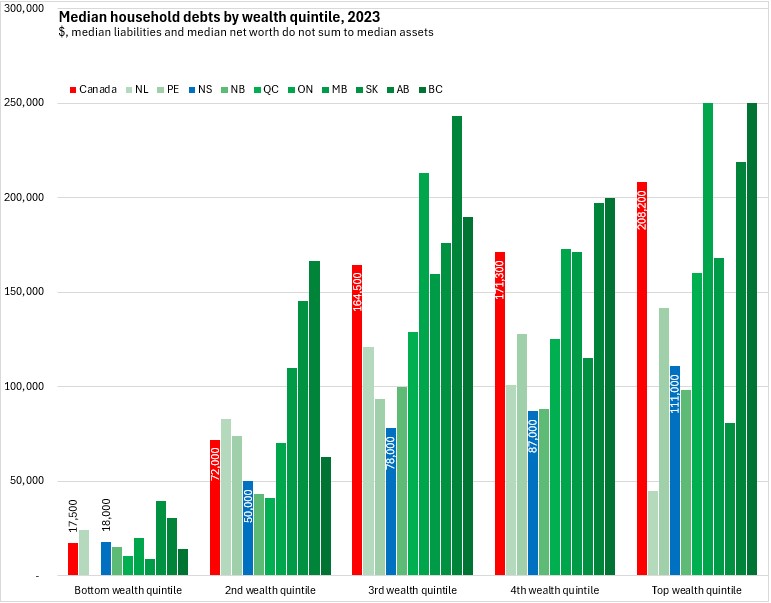

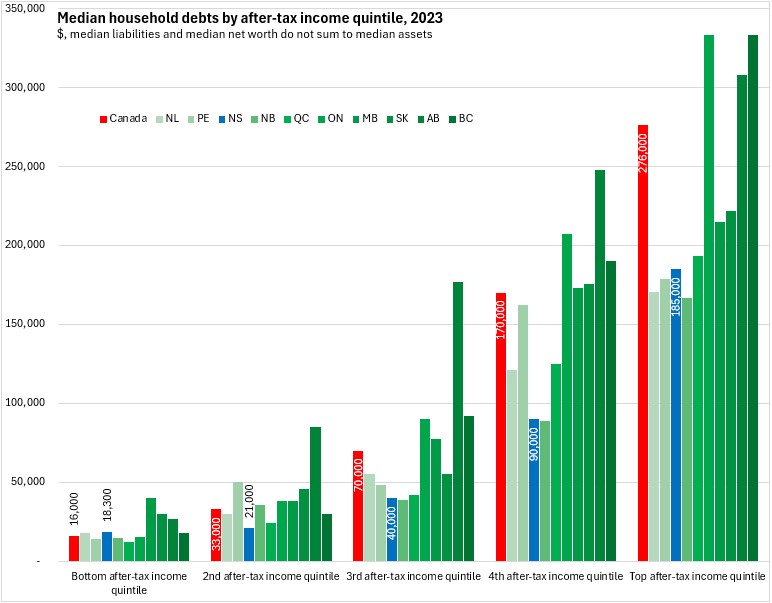

Median household debts were $50,000 in Nova Scotia in 2023 - the lowest among provinces and half the national median debt. Median household debt was highest in Alberta.

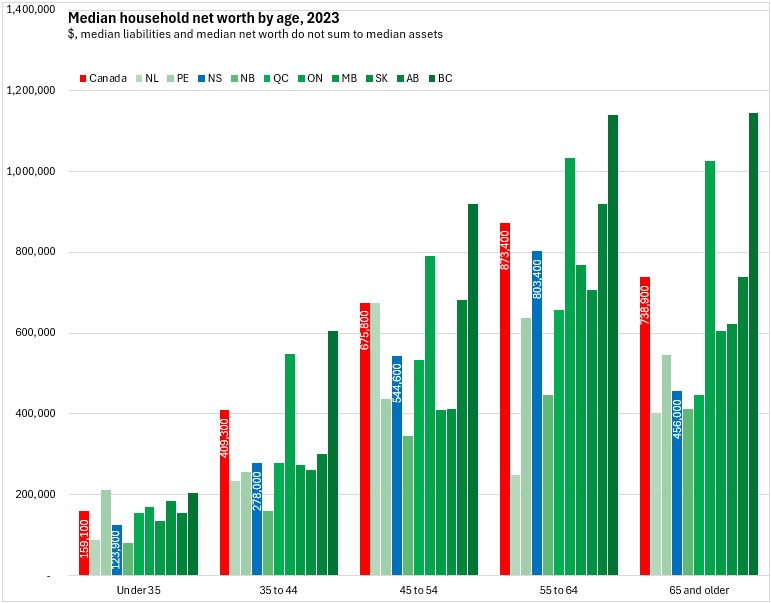

Median net worth rises with age and then falls when households are over 65 years old (this was not the case in Ontario and British Columbia).

Nova Scotian households aged 55-64 had the highest net worth in 2023 at $803,400 while those under 35 had the lowest median net worth at $123,900. Households aged 65 and older had a substantially lower median net worth at $456,000.

At all age cohorts, Nova Scotians' median net worth was lower than national medians for those of similar ages.

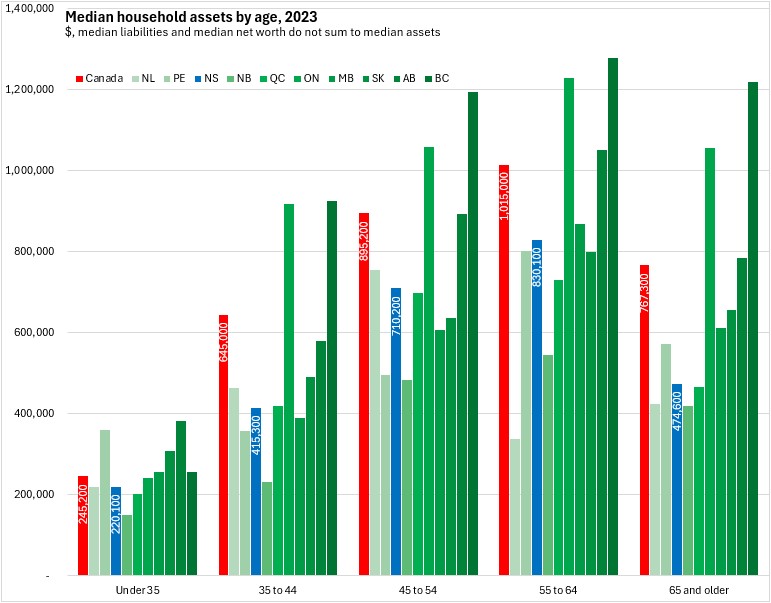

Nova Scotia's median household assets rise with age, peaking at $830,100 for those aged 55 to 64 years old in 2023. Nova Scotians' median assets were lower than national medians for all age cohorts.

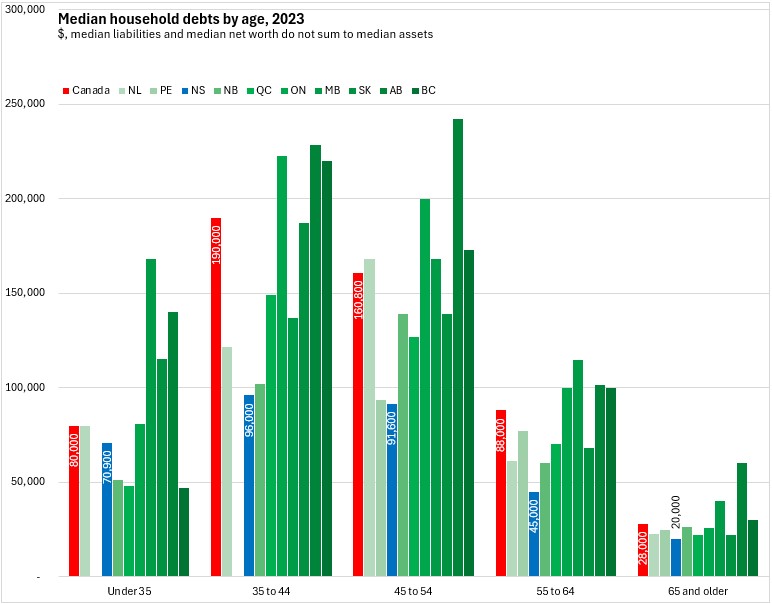

Median household debts of Nova Scotians are higher for those aged 35-44 years old and 45-54 years old in 2023. Median household debts for those aged 55 and older were substantially lower (particularly for Nova Scotians aged 65 and older).

At all age cohorts except those under 35, Nova Scotians' median household debts were the lowest among provinces (though Prince Edward Island does not report values for any cohorts under age 45).

Persons in economic families have substantially higher net worth than persons not in economic families - this was the case for each province in 2023. Nova Scotian economic families had the fourth highest median net worth among provinces (after British Columbia, Ontario and Alberta). New Brunswick economic families had the lowest median net worth among provinces.

Nova Scotian persons not in an economic family had the fourth lowest median net worth among provinces, ahead of Newfoundland and Labrador, New Brunswick and Québec.

Nova Scotia economic families had the fourth highest median assets among their provincial counterparts while Nova Scotians not in a census family had the third lowest median assets in 2023.

For both economic families and persons not in an economic family, Nova Scotia reported the lowest median household debt among provinces in 2023.

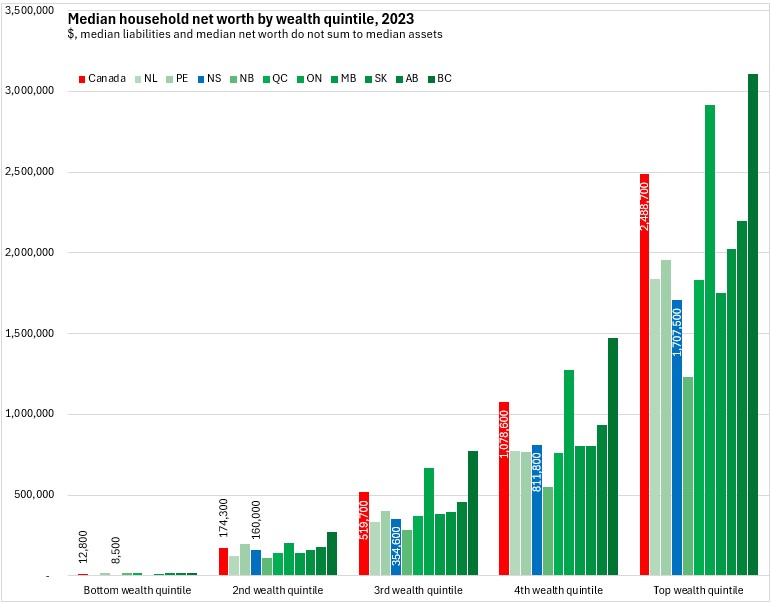

The Survey of Financial Security divides households into 5 equally-sized quintiles of wealth and of after-tax income. Those in Nova Scotia's highest wealth and income quintiles report the highest median values for net worth. This was due to higher median asset values which grew faster with income or wealth than did median household debts.

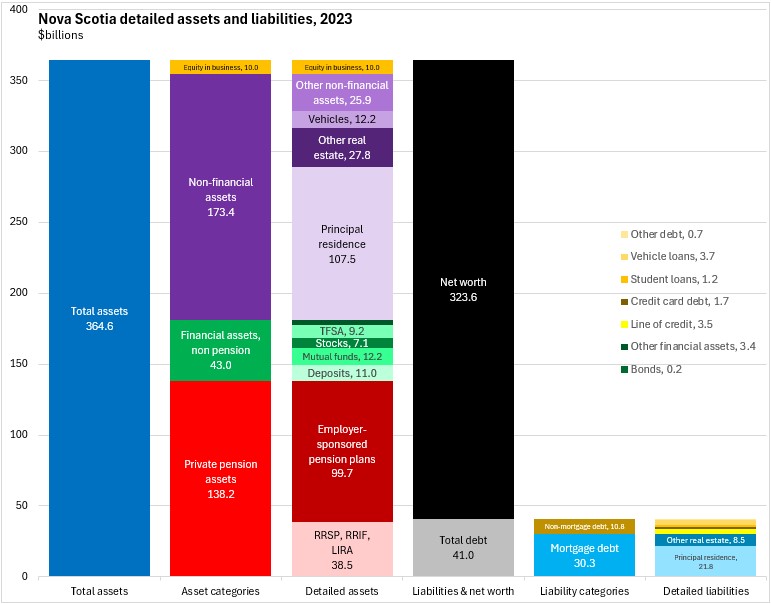

Nova Scotian's total assets amounted to a value of $364.6 billion in 2023. Non-financial assets were the largest category of assets at $173.4 billion (of which, value of principal residence was the largest category). Nova Scotians' private pension assets amounted to $138.2 billion with employer-sponsored pension plans accounting for the largest amount. Nova Scotians also reported $43.0 billion in non-pension financial assets with mutual funds/income trusts, bank deposits, TFSAs and stocks accounting for the largest values.

Nova Scotians' total debts amounted to $41.0 billion in 2023 - the largest portions of which were accounted for by mortgages ($30.3 billion).

Were Nova Scotians to liquidate their $364.6 billion in household assets and use the proceeds to repay their $41.0 billion in debts, they would be left with a net worth of $323.6 billion.

Statistics Canada. Table 11-10-0016-01 Assets and debts held by economic family type, by age group, Canada, provinces and selected census metropolitan areas, Survey of Financial Security (x 1,000,000); Table 11-10-0049-01 Assets and debts by net worth quintile, Canada, provinces and selected census metropolitan areas, Survey of Financial Security (x 1,000,000); Table 11-10-0057-01 Assets and debts by after-tax income quintile, Canada, provinces and selected census metropolitan areas, Survey of Financial Security (x 1,000,000)

<--- Return to Archive