The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

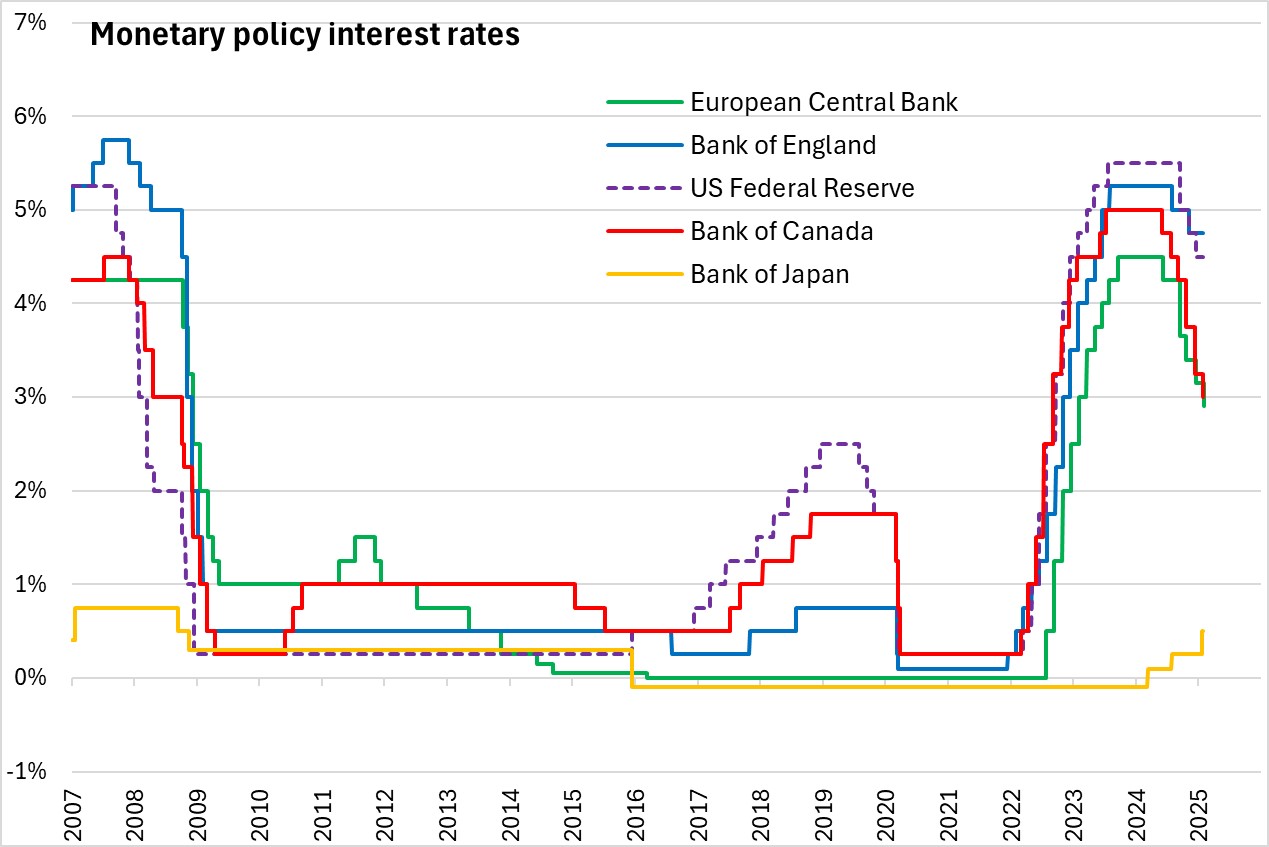

January 30, 2025EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would reduce the three key ECB interest rates by 25 basis points. The interest rates on the deposit facility, main refinancing operations and the marginal lending facility will be at 2.75%, 2.90%, 3.15% respectively effective February 5th.

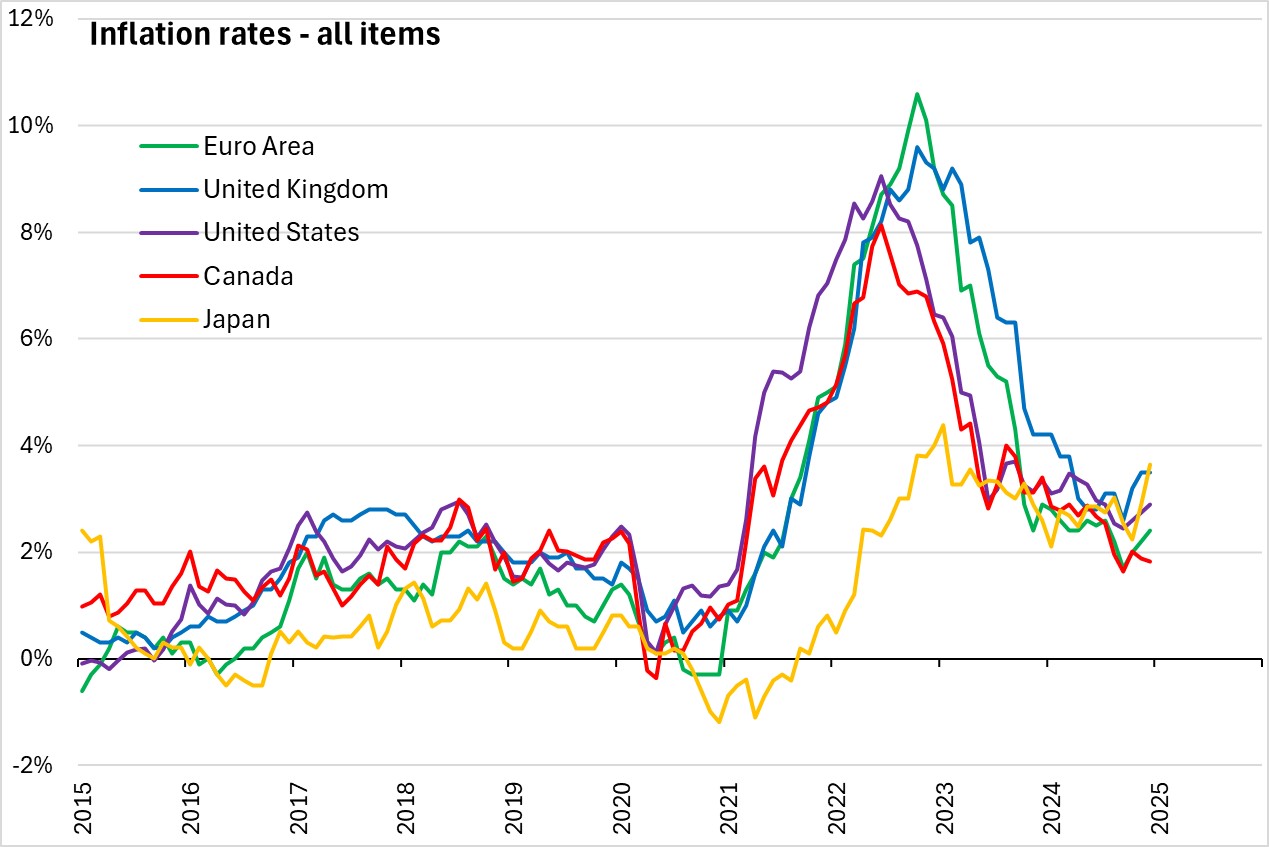

The economic activity stagnated in the fourth quarter of 2024 according to preliminary flash estimates and is set to remain weak in the near term. Manufacturing continues its decline while services activity is growing. Weak consumer confidence has limited household spending. Economic activity is still projected to recover. Unemployment remains low at 6.3% in December and even though the labour market has softened, it remains robust. In the scenario that trade tensions do not escalate, exports should aid the recovery process.

Annual inflation increased to 2.4% in December 2024, up from 2.2% in November. The increase was expected and primarily reflected past sharp drops in energy prices falling out of the calculation. Underlying inflation indicators have been in line with the ECB's medium term target. Domestic inflation has remained high with wages and some service prices still adjusting to past inflation surges. Inflation is expected to fluctuate around its current level in the near term.

Economic activity could be slowed by greater frictions in the global trade by dampening exports. Lower confidence could prevent consumption and investment from recovering at a faster pace. Inflation could turn out higher if wages or profits increase by more than expected.

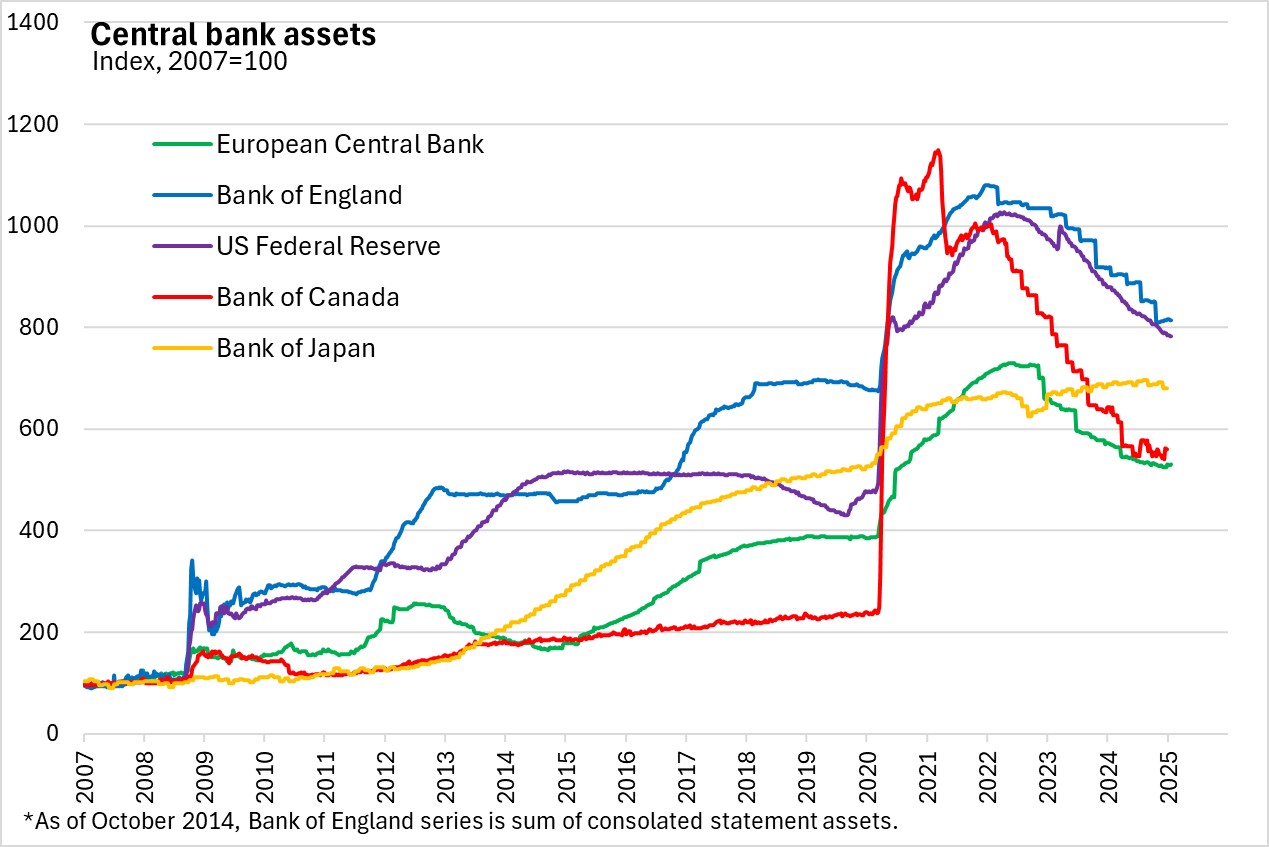

The asset purchase programme (APP) and Pandemic Emergency Purchase Programme (PEPP) portfolios are declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities. On December 18, 2024 banks repaid the remaining amounts borrowed under the targeted long-term refinancing operations, thus concluding this part of the balance sheet normalisation process.

The Governing Council notes it is determined to see inflation sustainably stabilise at its 2.0% medium-term target. It will follow a meeting-by-meeting approach in determining the appropriate monetary policy stance, and in particular interest rate decisions will be based on assessments of the inflation outlook, in light of incoming economic and financial data. There is no pre-committed rate path. The next scheduled monetary policy meeting will be on March 6, 2025.

Source: European Central Bank: Monetary Policy Decisions; Monetary Policy Statement (Press Conference)

<--- Return to Archive