The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 30, 2025HOUSEHOLD WEALTH, Q3 2024 Household Assets, Liabilities and Net Worth

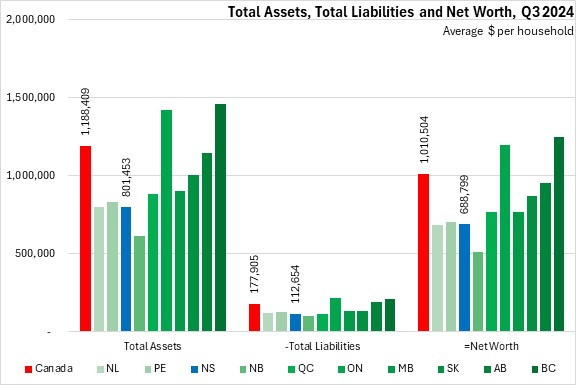

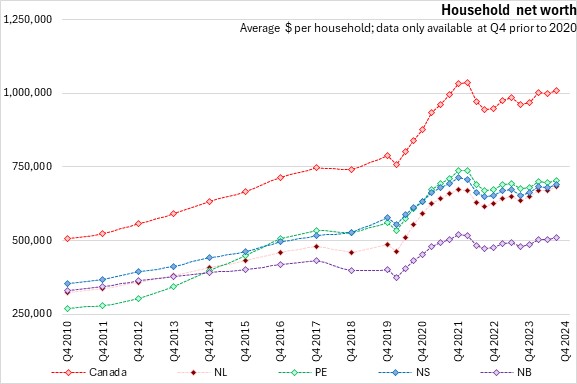

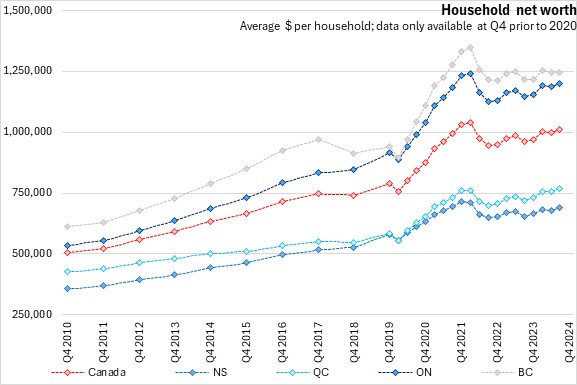

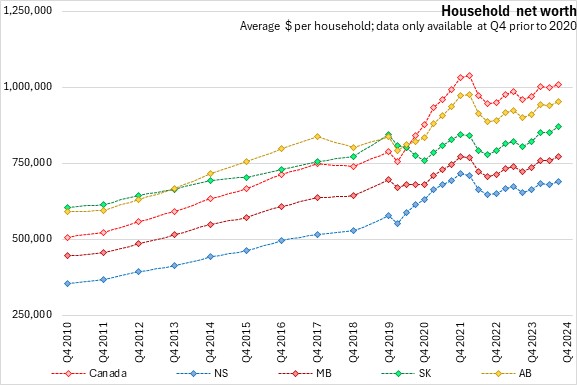

Canada’s average assets were $1,188,409 in Q3 2024. Nova Scotia’s assets were well below the national average at $801,453. Nova Scotia had the second lowest liabilities at $112,654 per household. As a result, Nova Scotia's net worth came to $688,799 per household, the second highest among the Atlantic provinces. British Columbia and Ontario had the highest per household wealth among all provinces while New Brunswick had the lowest net worth per household.

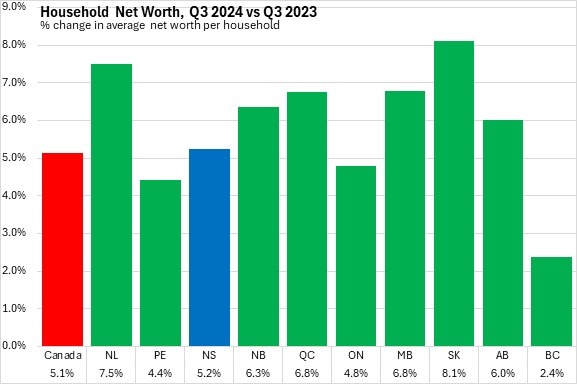

Nova Scotia's net worth increased by 5.2% from Q3 2023 to Q3 2024, higher than the national average (+5.1%). All provinces reported gains over the same quarter the previous year. Saskatchewan and Newfoundland and Labrador reported the fastest gains in net worth. British Columbia reported the slowest gains.

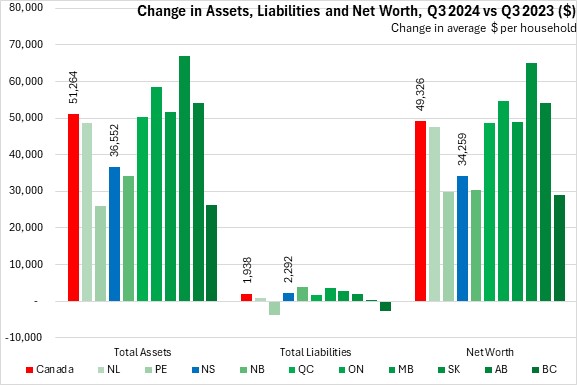

Compared to Q3 2023, national assets per household increased by $51,264 while liabilities increased by $1,938, bringing national net worth up by $49,326. Nova Scotia’s assets increased by $36,552 per household while liabilities grew by $2,292 from Q3 2023 to Q3 2024, increasing Nova Scotia's net worth per household by $34,259.

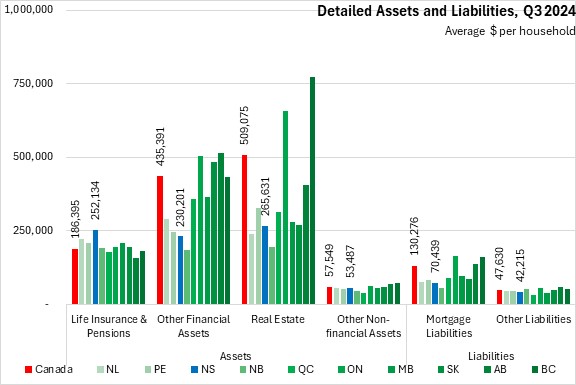

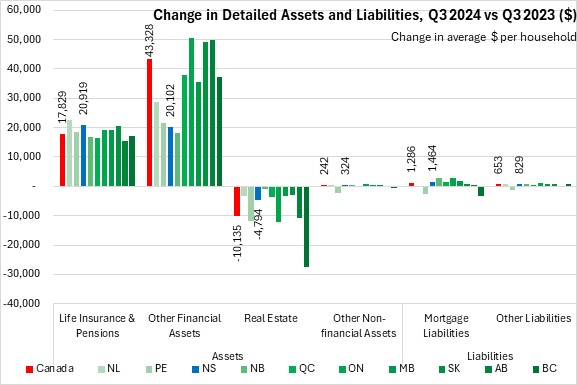

In detailed assets and liabilities Nova Scotians continued to have the highest life insurance and pension assets per household. British Columbia and Ontario had real estate assets far above the national average of $509,075.

The national level for mortgage liabilities in Q3 2024 was $130,276. Nova Scotia mortgage liabilities per household were the second lowest among provinces at $70,439. Other non-mortgage liabilities for Nova Scotia were below national average at $42,215 per household.

Nova Scotia's per household life insurance and pension assets increased by $20,919 from Q3 2023 to Q3 2024. Nova Scotia’s other financial assets increased by $20,102 over this period. National life insurance/pension assets were up $17,829 per household with gains in all provinces (steepest in Newfoundland and Labrador) while other national financial assets were up by $43,328 per household with gains in all provinces (led by Ontario, Alberta and Saskatchewan).

Nova Scotia’s real estate asset values fell by $4,794 per household from Q3 2023 to Q3 2024. Nationally, average real estate assets per household decreased by $10,135 per household with the largest decline in British Columbia.

Nova Scotia's mortgage liabilities rose by $1,464. The national average mortgage liability per household increased by $1,286. Nova Scotia's other liabilities increased by $829 while the national average over the four quarters increased by $653.

Household net worth grew in all provinces from Q2 2024 to Q3 2024.

Source: Statistics Canada. Table 36-10-0661-01 Distributions of household economic accounts, wealth, Canada, regions and provinces, quarterly (x 1,000,000)

<--- Return to Archive