The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 31, 2025US PERSONAL INCOME AND OUTLAY, DECEMBER AND ANNUAL 2024 Month over month (December 2024 vs November 2024, seasonally adjusted annualized rates)

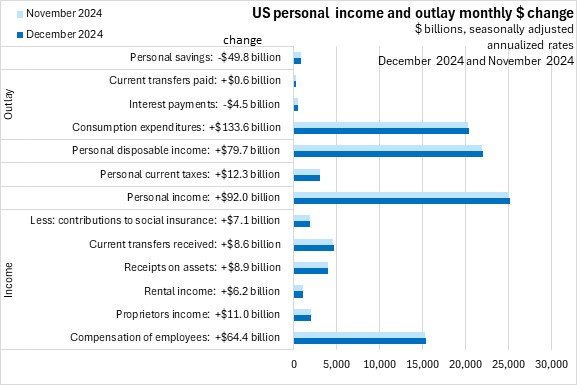

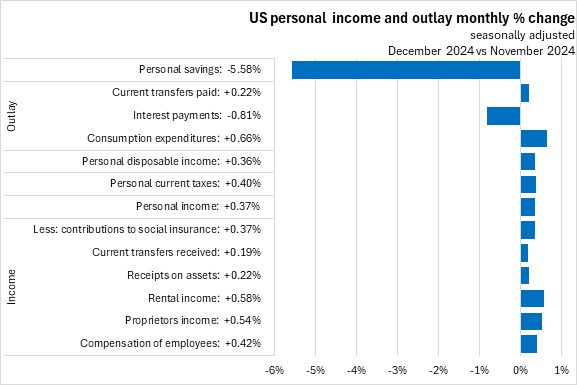

The US Bureau of Economic Analysis reported that US personal income increased by $92.0 billion (+0.37%). Employee compensation was up $64.4 billion (+0.42%). Personal disposable income was up $79.7 billion (+0.36%) while personal consumption expenditures (PCE) grew by $133.6 billion (+0.66%).

US personal savings decreased by $49.8 billion (-5.58%).

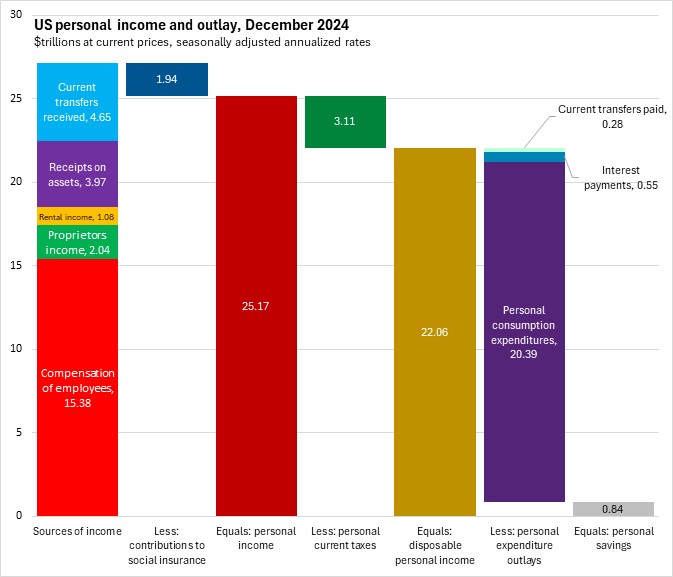

US personal income is calculated as the sum of employee compensation ($15.38 trillion), proprietors' income ($2.04 trillion), rental income ($1.08 trillion), receipts on assets ($3.97 trillion) and current transfers received ($4.65 trillion), less contributions to social insurance programs ($1.94 trillion). Personal income ($25.17 trillion) less personal current taxes ($3.11 trillion) equals disposable income ($22.06 trillion).

The outlay of US personal disposable income consists of personal consumption expenditures ($20.39 trillion), interest payments ($0.55 trillion) and current transfers paid ($0.28 trillion) with personal savings ($0.84 trillion) accounting for the remaining amount.

Trends

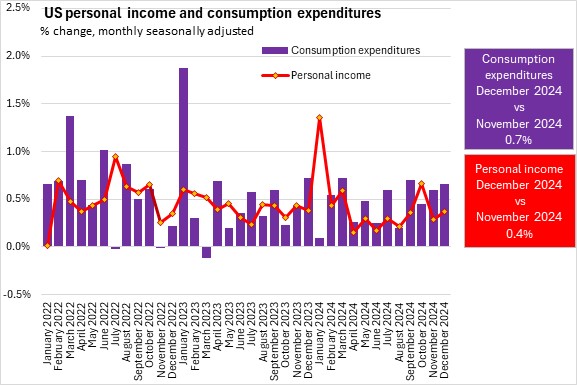

In December, US personal consumption expenditures growth was greater than growth in personal income.

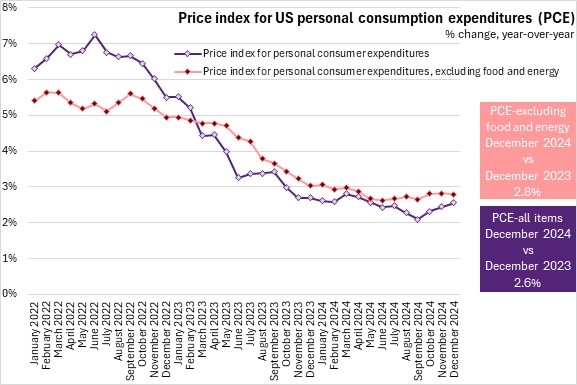

Growth in the price index for personal consumption expenditures (all items) rose to 2.6% year-over-year. Year-over-year growth in the price index for all items excluding food and energy was little changed at 2.8%, and outpaced all items PCE inflation for the 22nd consecutive month.

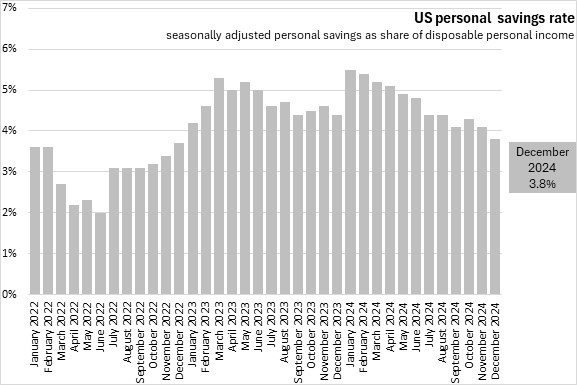

With growth in personal income lagging consumer spending, the US personal savings rate declined to 3.8% of disposable personal income.

Annual (2024 vs 2023)

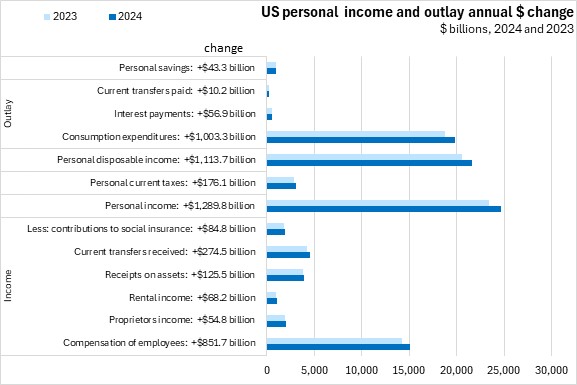

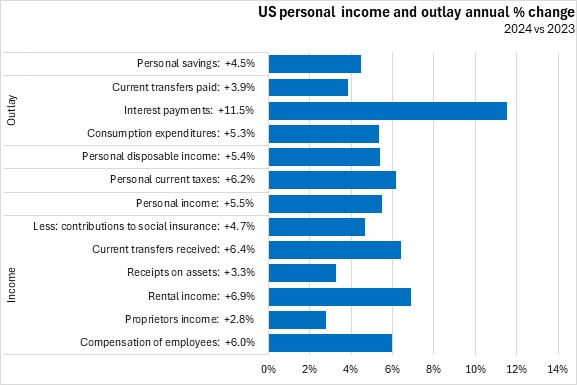

In 2024, US personal income increased by 5.5% from the level reported for 2023. There were gains from all income sources led by growth in rental income (+6.9%). With an increase in personal current taxes (+6.2%), annual growth in personal disposable income (+5.4%) was slightly behind growth in total personal income (+5.5%).

US personal consumption expenditures increased by 5.3% in 2024. This was outpaced by an 11.5% increase in interest payments.

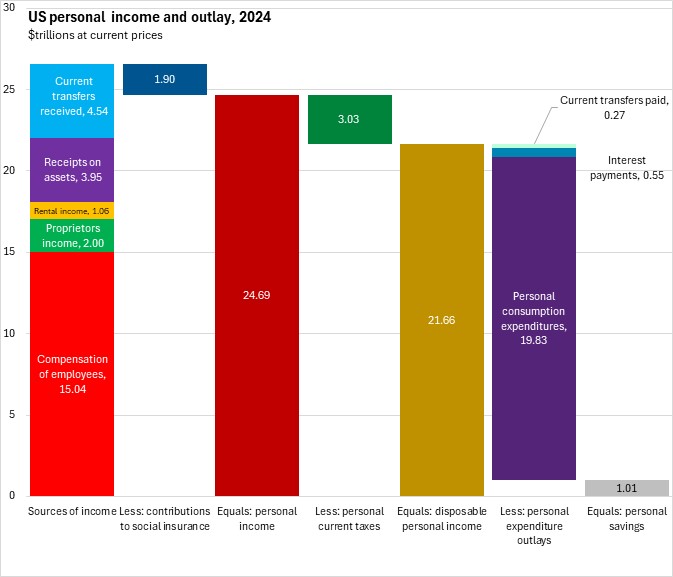

In 2024, sources of US personal income were: employee compensation ($15.04 trillion), proprietors' income ($2.00 trillion), rental income ($1.06 trillion), receipts on assets ($3.95 trillion) and current transfers received ($4.54 trillion), less contributions to social insurance programs ($1.90 trillion). Personal income equaled $24.69 trillion. Personal current taxes were $3.03 trillion and the outlay of US personal disposable income consists of personal consumption expenditures ($19.83 trillion), interest payments ($0.55 trillion) and current transfers paid ($0.27 trillion) with personal savings ($1.01 trillion) accounting for the remaining amount.

US Bureau of Economic Analysis. Press release, December 2024; Data retrieved Federal Bank of St Louis, Table 2.6. Personal Income and Its Disposition, Monthly NIPA.

<--- Return to Archive