The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 10, 2025LABOUR PRODUCTIVITY AND HOURS WORKED, 2023 [REVISED] Statistics Canada has revised labour productivity accounts for 2023.

The data are consistent with provincial and territorial real GDP by industry data for 2023 as well as the Survey of Employment, Payroll and Hours and the Labour Force Survey. Data reported below focus on business sector industries and do not include either government or non-profit institutions. For example, education refers only to private educational institutions and not government-funded schools.

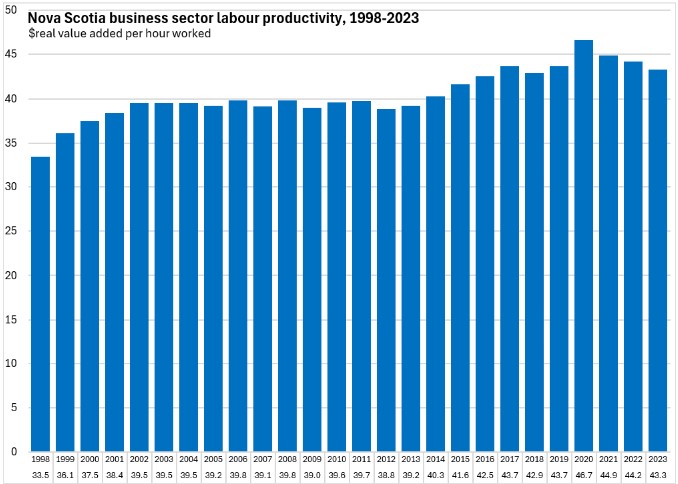

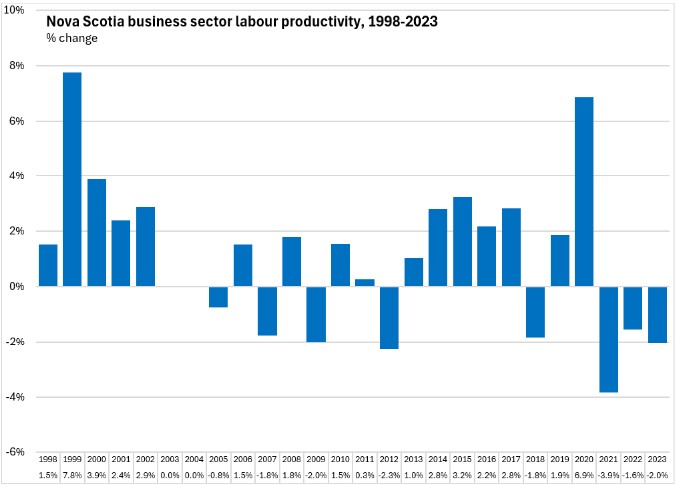

Large employment losses in high contact service industries in 2020 distorted hours worked and productivity results for all provinces. Loss of employment hours in labour-intensive and lower productivity industries increased business sector average productivity by 6.9% in 2020. Employment recovered in these labour intensive industries over 2021-2023, lowering business sector labour productivity below pre-pandemic levels.

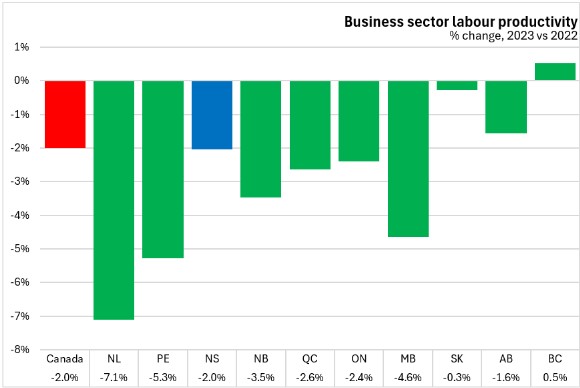

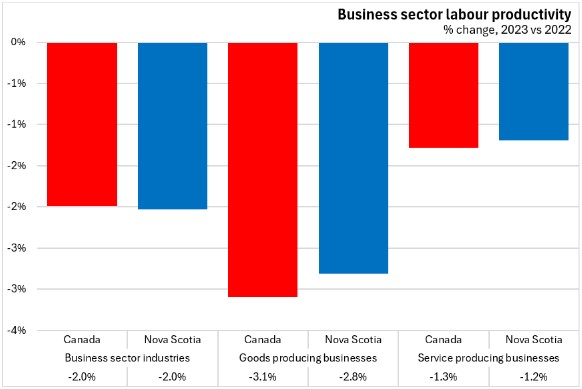

Nova Scotia's business sector labour productivity fell by 2.0% in 2023, following declines of 3.9% in 2021 and 1.6% in 2022. Nationally, business sector labour productivity was also down 2.0% with declines in every province except British Columbia. Newfoundland and Labrador and Prince Edward Island reported the steepest labour productivity declines in 2023.

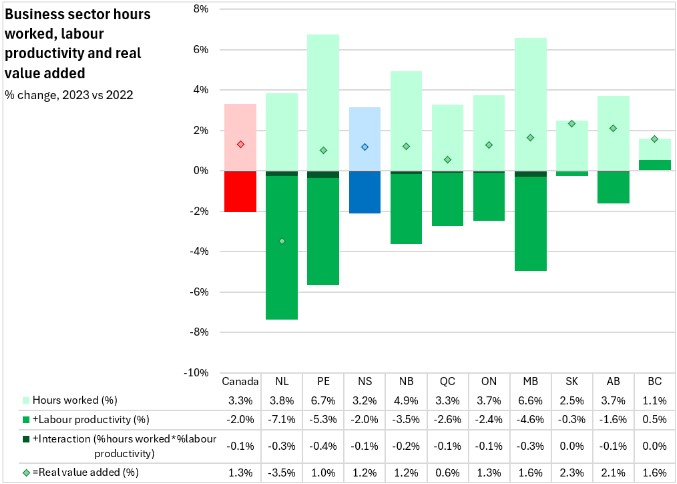

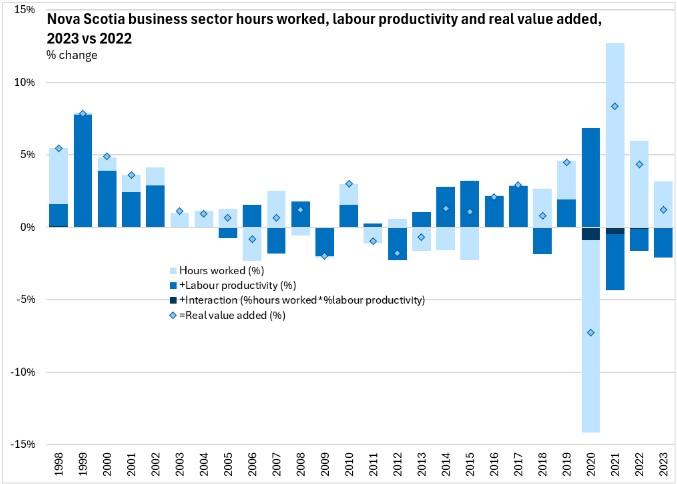

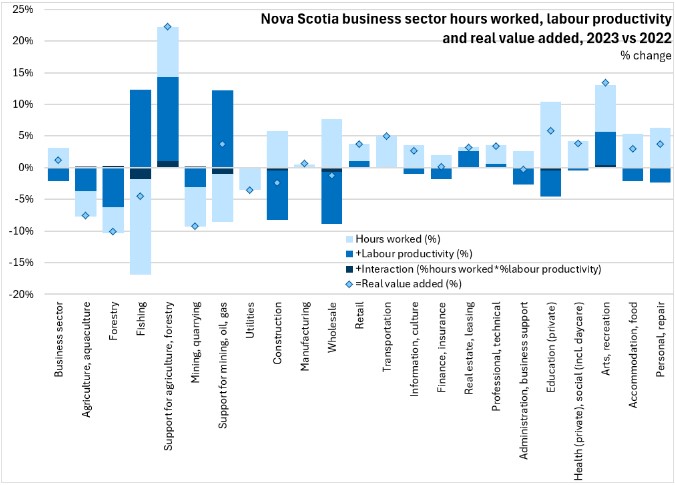

Hours worked in Nova Scotia's business sector increased by 3.2% while real value added grew at a slower pace at 1.2%.

All provinces reported gains in business sector hours worked from 2022 to 2023. For all provinces except Newfoundland and Labrador, gains to real value added from rising hours worked were offset by declining labour productivity. In Newfoundland and Labrador, declining productivity was stronger than rising work hours, contributing to a decline in business sector real value added.

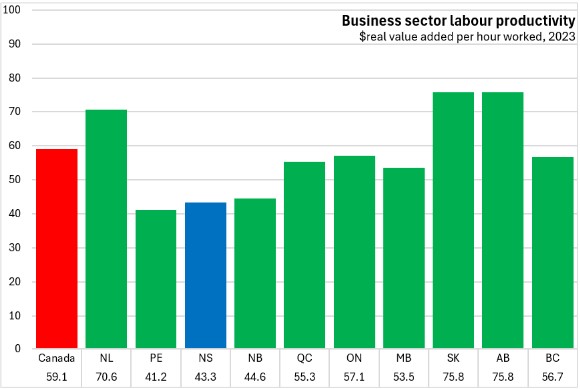

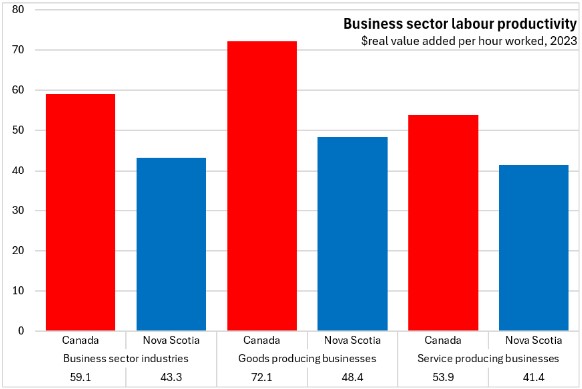

Labour productivity represents the amount of real value added generated per hour worked. Nova Scotia's business sector labour productivity was $43.3 in real value added per hour worked in 2023 - the second lowest among provinces (ahead of Prince Edward Island).

National business sector labour productivity was $59.1 in real value added per hour worked. Labour productivity is considerably higher in resource-producing provinces (Newfoundland and Labrador, Saskatchewan, Alberta) as resource industries generate large amounts of real value added with comparatively few hours worked. Labour productivity was lower in all three Maritime provinces.

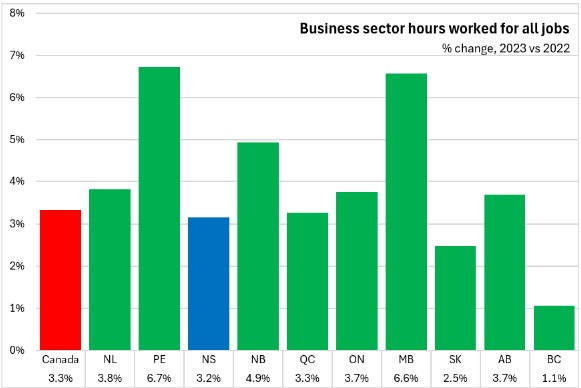

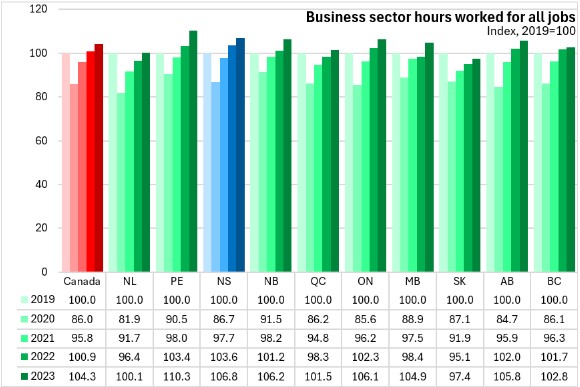

Business sector hours worked increased 3.2% in Nova Scotia in 2023 - just below the national pace (3.3%). All provinces reported higher hours worked with the fastest growth in Prince Edward Island. British Columbia reported the slowest gains in hours worked.

Compared with 2019, Nova Scotia's busines sector hours worked have grown faster than the national average. Only Prince Edward Island reported a stronger increase in business sector hours worked over this period. Saskatchewan is the only province where business sector hours worked remain below their 2019 levels.

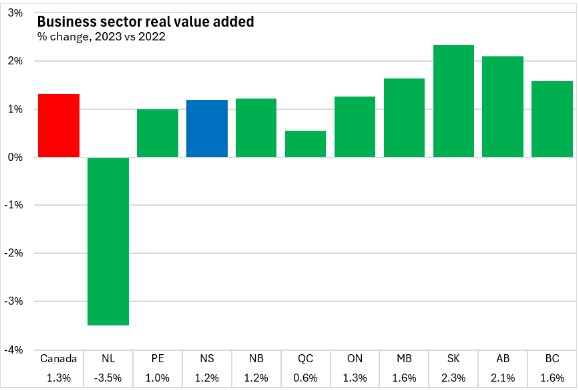

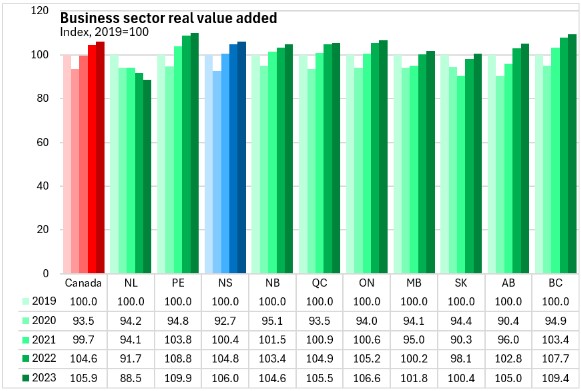

Nova Scotia's business sector real value added increased by 1.2% from 2022 to 2023 - about the same as the national pace of 1.3%. Saskatchewan had the largest growth in business sector real value added while Newfoundland and Labrador reported the only decline.

Compared with pre-pandemic levels from 2019, Nova Scotia's business sector real value added was 6.0% higher in 2023. Nationally, business sector real value added was 5.9% higher in 2023 than in 2019 with gains in all provinces except Newfoundland and Labrador. Real value added for Prince Edward Island and British Columbia have grown the most compared to 2019.

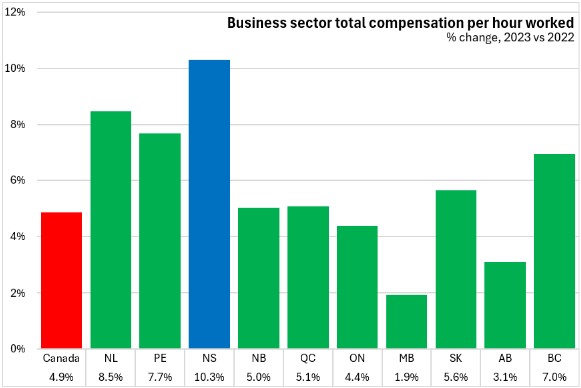

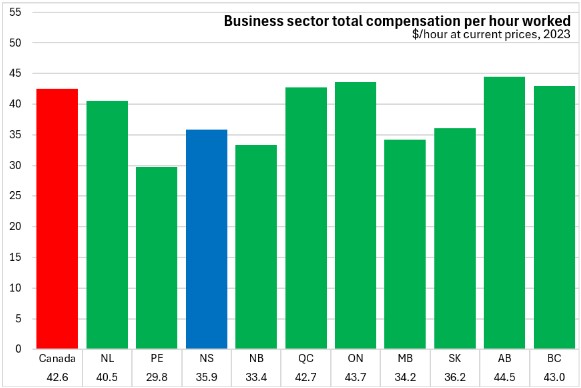

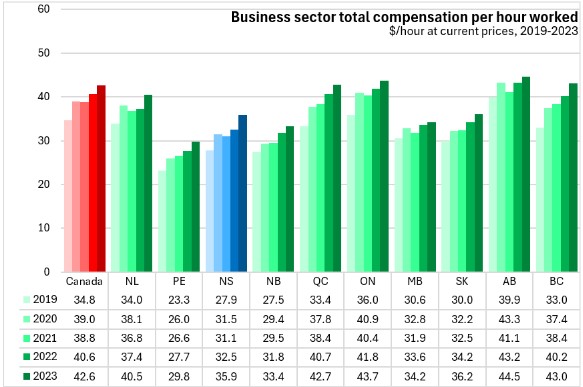

Business sector employee compensation per hour worked increased by 10.3% in Nova Scotia in 2023, which was the fastest among provinces (national: 4.9%). All provinces reported rising business sector employee compensation per hour worked with Manitoba reporting the slowest growth.

Nova Scotia's total employee compensation in the business sector was $35.88/hour worked in 2023. This was 84.3% of the national average ($42.57/hour). Employee compensation per hour worked was highest in Alberta and lowest in Prince Edward Island.

Nova Scotia's total compensation per hour worked increased by 28.6% from 2019 to 2023. Nationally, employee compensation per hour worked increased by 22.4% with gains in all provinces. British Columbia reported the fastest gains in employee compensation per hour worked over this period (followed by Nova Scotia) while Manitoba and Alberta reported the slowest growth.

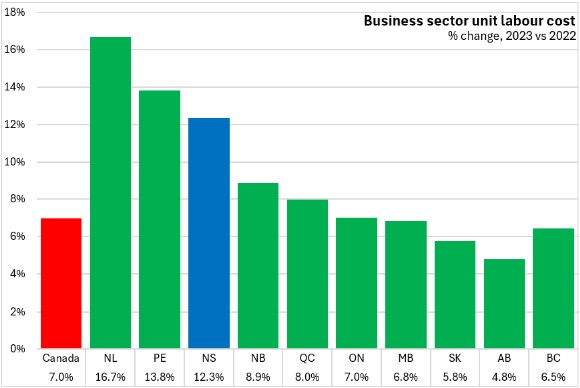

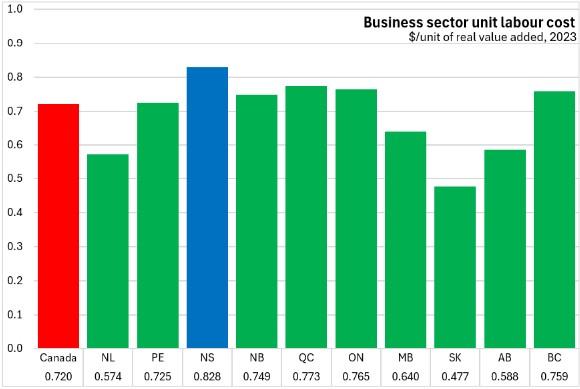

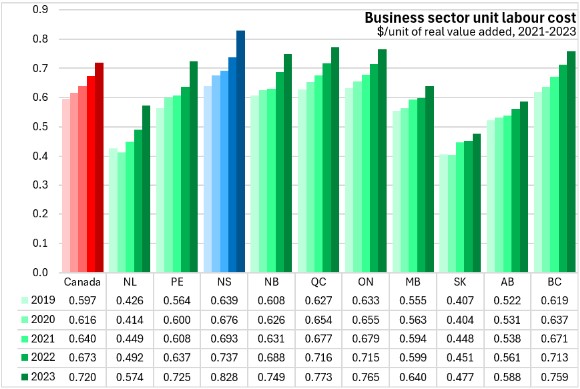

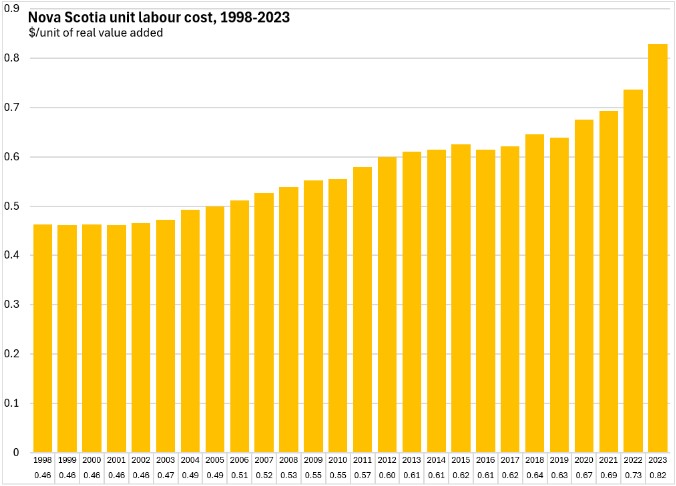

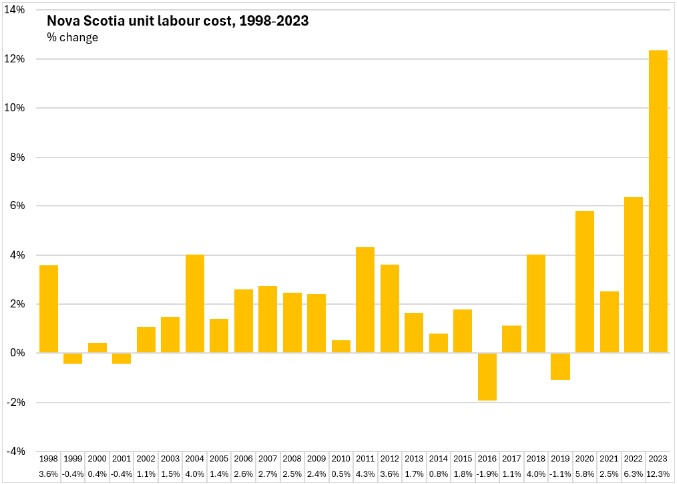

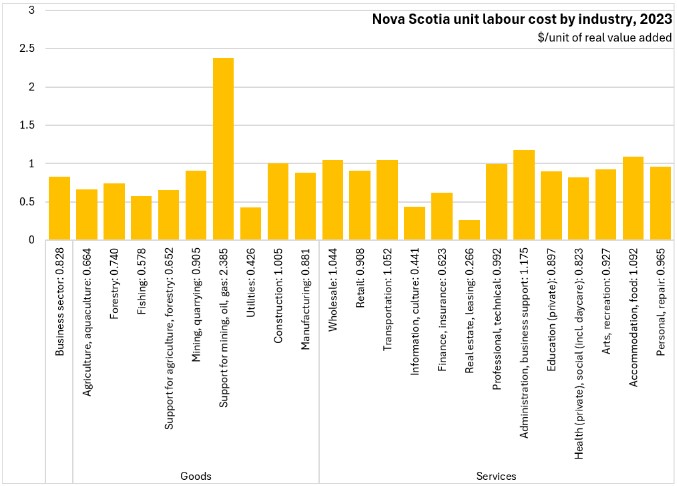

Unit labour costs represent the amount of labour compensation required to generate $1 in business sector real value added. Unit labour costs rise when employee compensation per hour rises. Unit labour costs fall when labour productivity improves.

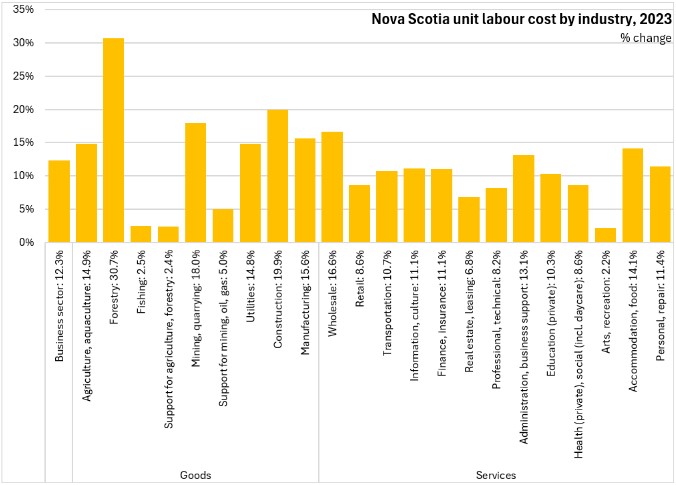

In 2023, Nova Scotia's business sector unit labour costs increased by 12.3% - faster than the national pace of 7.0%. Unit labour costs were up in all provinces, led by Newfoundland and Labrador. Alberta reported the slowest growth in unit labour costs.

Nova Scotia's unit labour costs were $0.828 per $1 of real value added in 2023. This was the highest among provinces. Saskatchewan had the lowest unit labour costs.

Nova Scotia's unit labour costs rose in each year from 2019 to 2023, rising by 29.6% over 2019 levels in 2023. National unit labour costs were up by 20.6% with the fastest gains in the Atlantic Provinces and Québec. Alberta reported the slowest increases in unit labour costs over this period.

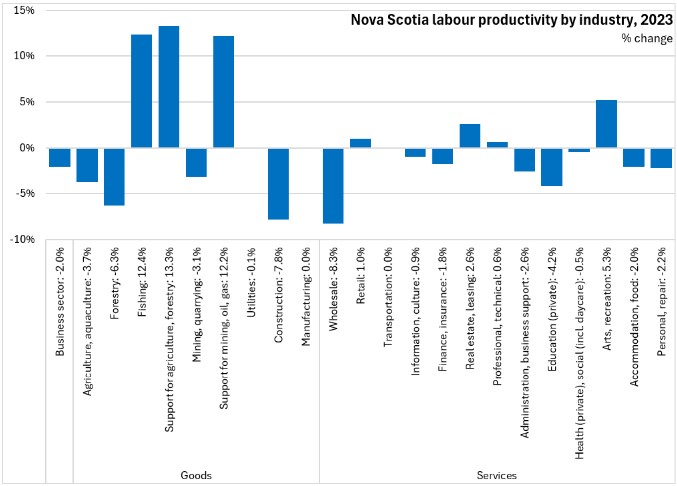

Nova Scotia's business sector labour productivity declined in 2023 for both service industries (-1.2%) and goods industries (-2.8%). Nova Scotia's decline in service industry productivity was slower than the national pace, as was the decline in goods industry productivity.

Nova Scotia's labour productivity gap relative to the national average reflects both lower goods industry productivity (67.1% of the national average) and services industry productivity (76.8% of the national average). This reflects different industrial composition between Nova Scotia and Canada. For example, Canada's relatively high goods industry productivity is elevated by resource extraction industries that are much more prevalent in some other provinces.

Prior to the pandemic, Nova Scotia's labour productivity had been a consistent driver of growth in real value added. After the pandemic anomalies of 2020, Nova Scotia's productivity has been declining in each year and has fallen just below pre-pandemic levels.

After the severe distortions in 2020, Nova Scotia's economic growth has come from the strong rebound in hours worked, offsetting the normalization in labour productivity.

Nova Scotia's unit labour cost growth has been particularly acute in the last four years.

In 2023, most Nova Scotia industries reported rising hours worked and lower labour productivity. Labour productivity growth was fastest in Nova Scotia's fishing industry in 2023. Wholesale trade reported the largest productivity decline in 2023.

In 2023, Nova Scotia's labour productivity growth was strongest in fishing as well as (relatively small) support industries for agriculture/forestry and mining/oil/gas. There were notably productivity declines in agriculture/aquaculture, forestry, mining, construction, wholesale trade and private educational services.

There was a notable drop in hours worked for agriculture/aquaculture and fishing while arts/recreation, construction, wholesale trade, accommodation/food, transportation and private education all reported faster gains in hours worked.

Nova Scotia's higher unit labour cost is observed across many industries. The highest unit labour costs were in support for mining/oil/gas (a relatively small industry) as well as administrative/business support (which includes call centres), accommodation/food, transportation, wholesale trade, construction and professional/technical services. The lowest unit labour costs were in real estate/leasing, information/culture and utilities.

In the last year, unit labour costs grew fastest for forestry, construction and mining. The slowest unit labour cost growth rates were reported in arts/recreation, fishing and support for agriculture/forestry.

Source: Statistics Canada. Table 36-10-0480-01 Labour productivity and related measures by business sector industry and by non-commercial activity consistent with the industry accounts

<--- Return to Archive