The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 03, 2025ALBERTA BUDGET 2025-26 The Province of Alberta tabled its provincial budget for 2025-26 on February 27, 2025.

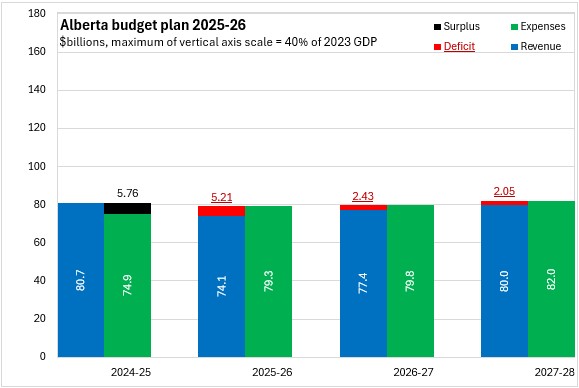

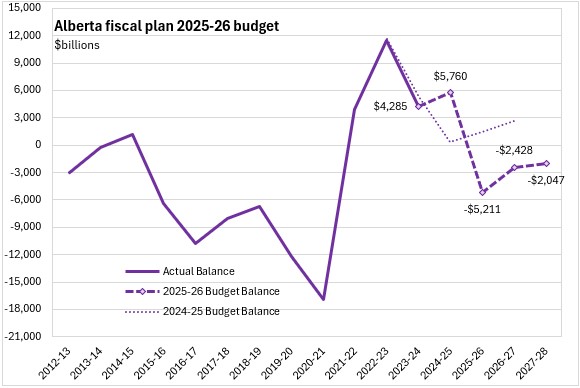

Alberta's Budget for 2025-26 estimates a deficit of $5.21 billion, falling from a $5.76 billion surplus now forecasted for 2024-25. For 2025-26, Alberta's provincial revenues are projected to decline by 8.1% while expenditures rise by 5.9%.

For 2026-27, Alberta's revenues are projected to return to growth at 4.4% while expenditure increases are limited to 0.6%, narrowing the deficit to $2.43 billion. For 2027-28, Alberta's revenues are projected to slightly outpace expenditure growth, narrowing the deficit further to $2.05 billion.

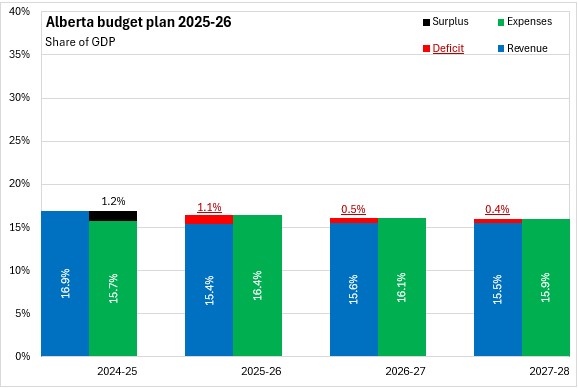

Measured as a share of GDP, the footprint of provincial government in the Alberta economy amounts to 16.4% of GDP in 2025-26 . This is projected to contract to 15.9% of GDP by 2027-28. Alberta's 2025-26 deficit amounts to 1.1% of provincial GDP estimated for 2025. In subsequent years, the deficit is projected to contract to 0.5% of GDP in 2026-27 and to 0.4% in 2027-28.

Alberta's net debt to GDP ratio is projected to rise slightly to 8.7% in 2025-26. Although it is projected to rise in the next two fiscal years as well, Alberta's debt is forecast to remain below 10% of the province's GDP.

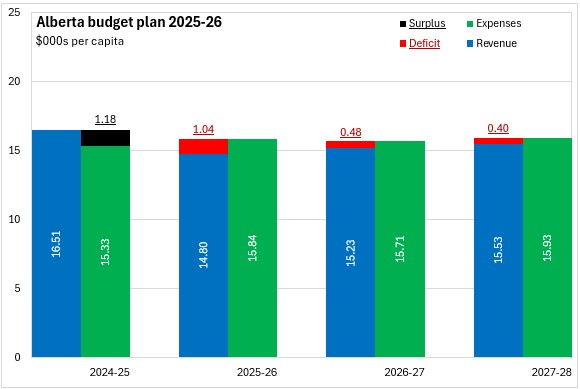

Alberta's 2025-26 Budget expenditures amount to $15,841 per capita, funded by revenues of $14,801 per capita and a deficit of $1,040 per capita. Expenditures per capita are projected to remain stable in the next two fiscal years while per capita revenues rise and per capita deficits narrow.

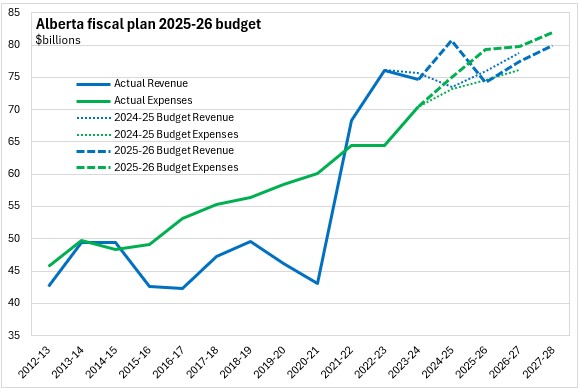

In 2024-25, Alberta's revenues were considerably stronger than anticipated in the Budget, outperforming estimates by $7.16 billion (9.7%). Expenditures grew as well, but by only $1.76 billion (2.4%). This led to a $5.39 billion improvement in the fiscal position, shifting from the initially-planned surplus of $367 million to a forecast surplus of $5.76 billion.

For 2025-26, Alberta's revenues are projected to decline, falling even below levels anticipated in the 2024-25 Budget while expenditures continue to rise above previously-projected levels.

The contraction in revenues along with continued increases in expenditures have resulted in estimates of wider deficits than were previously anticipated.

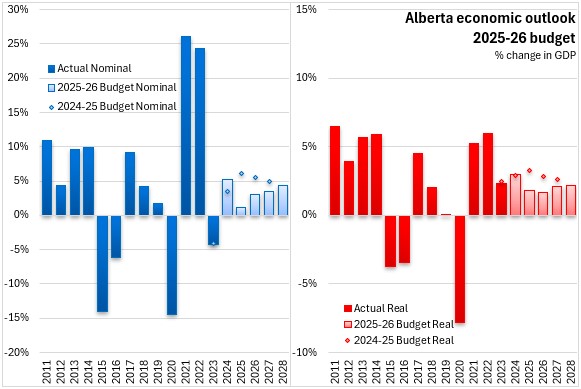

Alberta's economic outlook is highly sensitive to expectations of US tariffs and associated retaliatory measures as well as volatile oil prices.

Alberta's economic outlook for the 2025-26 Budget makes assumptions for a moderate trade conflict with an average tariff of 15% on Canadian goods (exception 10% on energy products), but this is highly uncertain. This is expected to slow Alberta's economic growth considerably in the next three years, though annual growth remains positive over this period with real GDP rising 1.8% in 2025 and 1.7% in 2026. Alberta's economic outlook assumes little growth in oil prices in the coming years, rising slowly to $71.50 USD/bbl (WTI) by 2027-28. Strong non-residential investments are expected to sustain economic growth as the Bank of Canada continues to lower its target for the overnight interest rate through to the end of 2025 and energy producers can take advantage of healthy balance sheets and resilient demand. However, manufacturing and agricultural industries are expected to face stronger impacts from the assumed tariffs. Alberta's economic outlook also assumes that slowing population gains will rebalance the labour market.

Key Measures and Initiatives

Alberta's Budget features a significant reduction in personal income taxes - introducing a new tax bracket for income under $60,000, taxed at a rate of 8% effective January 1, 2025 (two years ahead of the previously-announced schedule). This is expected to reduce personal income tax revenues by $1.2 billion annually. Beyond this, the Alberta Budget for 2025-26 prioritizes a strong workforce, border security, post-secondary investment, community building and investments in industry. Key measures include:

Supporting a strong workforce

- $26.1 billion capital plan over 3 years, supporting 26,500 direct and 12,000 indirect jobs per year

- $135 million for apprenticeships, adult learning and other skilled trade programs

- $2 billion in 2025-26 for the early learning and child care system, fostering labour force participation

Securing borders

- $29 million for a new interdiction patrol team along the Alberta-US border

- $15 million over 2 years for vehicle inspection stations located near the Alberta-US border

Post-secondary investment

- $78 million per year for 3 years for more apprenticeship seats

- $113 million for scholarships and student grants

- $4 million for First Nations Colleges grants

Building communities

- $17.2 million to increase grants in lieu of property taxes up to 75% (currently 50%) with a commitment to increase this to 100% next year

- $820 million in 2025-26 and $2.5 billion over 3 years for local government infrastructure priorities

Investment in business and industry

- $45 million over 3 years for the Investment and Growth Fund

- $1.8 million for crop research

- $780,000 for small and medium sized meat processors

- $3.1 million to expand the University of Calgary's veterinary diagnostic laboratory

Alberta Budget 2025-26

<--- Return to Archive