The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 01, 2025INCOME AND FINANCIAL DATA OF INDIVIDUAL T1 TAXFILERS, 2023 Statistics Canada has released preliminary data from the 2023 personal income tax returns (T1). This information reports on annual income as well as on charitable donations and Registered Retirement Savings Plan (RRSP) contributions for the 2023 taxation year. Data are not adjusted for inflation.

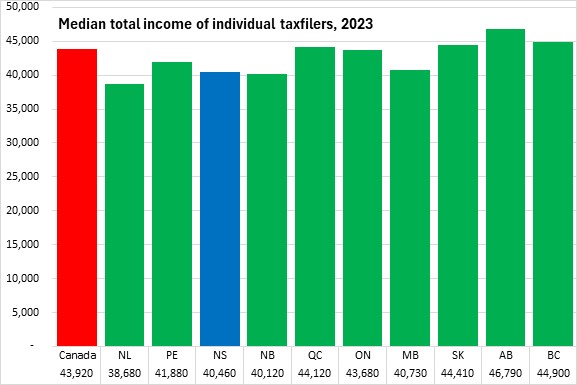

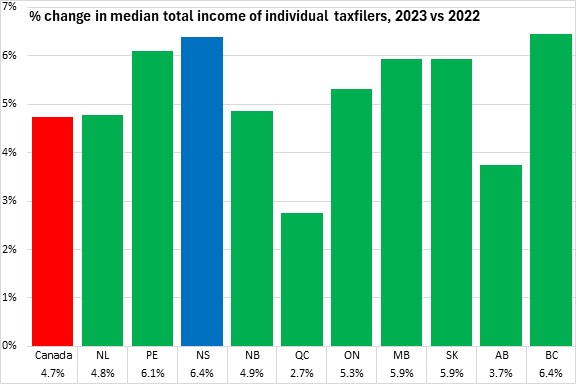

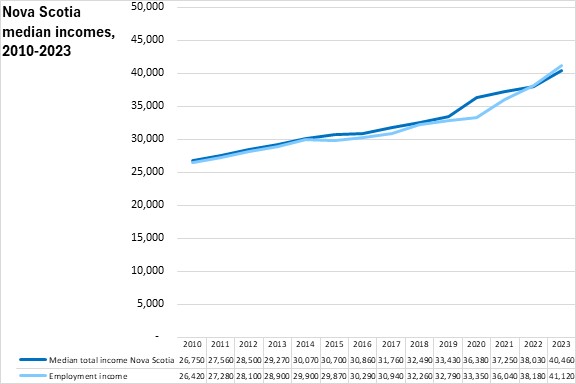

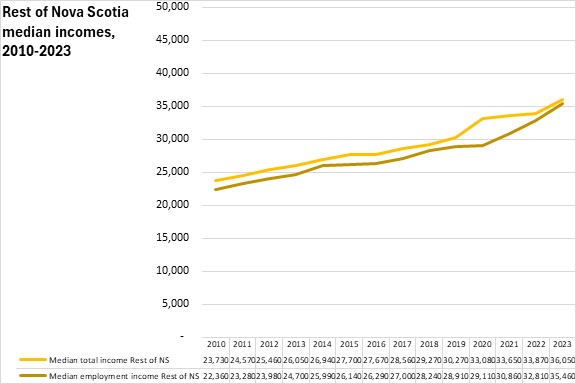

In 2023, the median total income of individuals in Nova Scotia (including both market income sources and government transfer income) was $40,460. This was the third lowest median total income among provinces (ahead of New Brunswick and Newfoundland and Labrador). National median income was $43,920 with the highest median income in Alberta.

From 2022 to 2023, Nova Scotia's median income increased by 6.4% - just behind British Columbia for the fastest growth among provinces. National median income increased by 4.7%. All provinces reported increases in median income. Québec reported the slowest gain in 2023 (after posting the fastest growth in 2022).

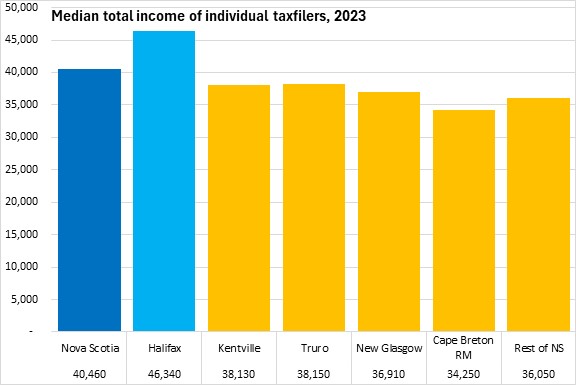

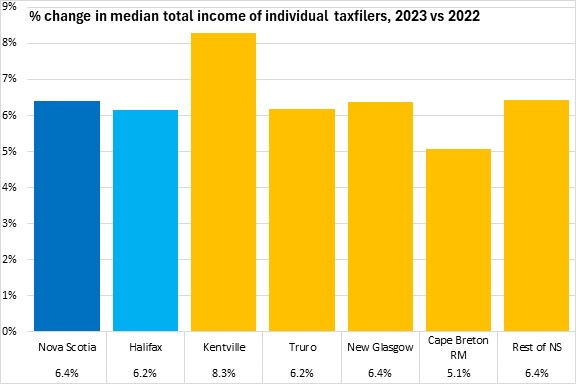

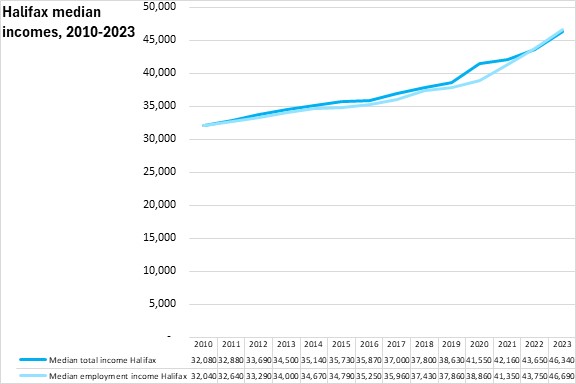

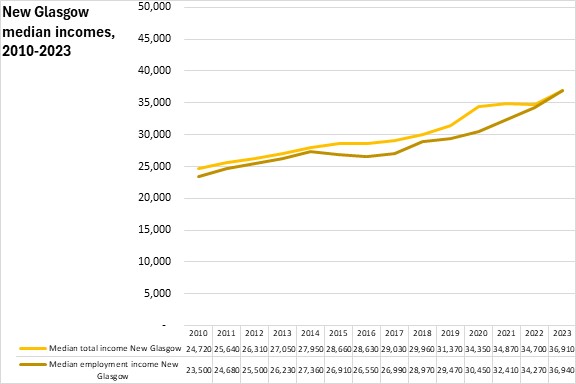

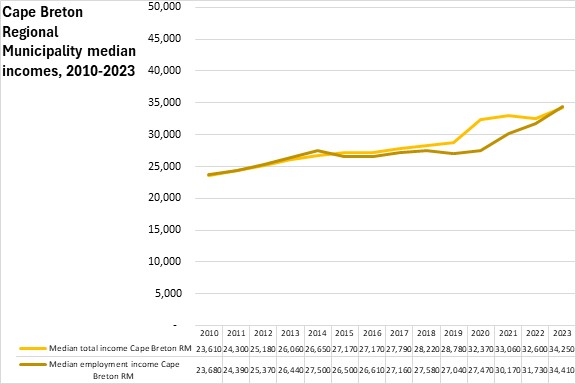

Across Nova Scotia, median total income was higher in Halifax than in the rest of the province. Taxfilers in the Cape Breton Regional Municipality reported the lowest median incomes on their 2023 returns.

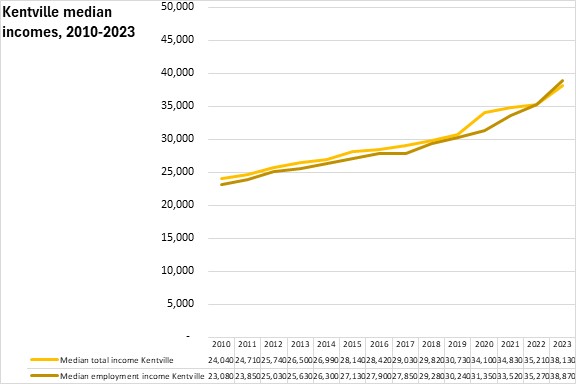

Median income growth from 2022 to 2023 was fastest in the Kentville Census Agglomeration and slowest in the Cape Breton Regional Municipality. Median total income increased for all regions of Nova Scotia.

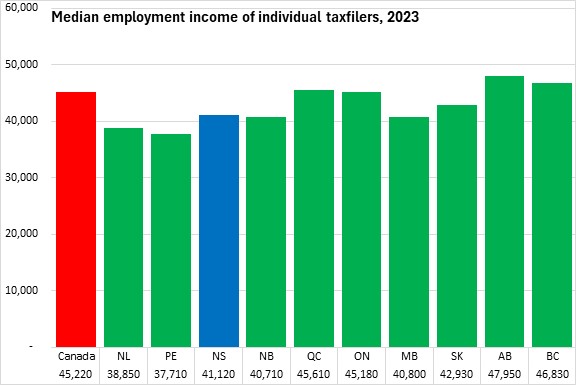

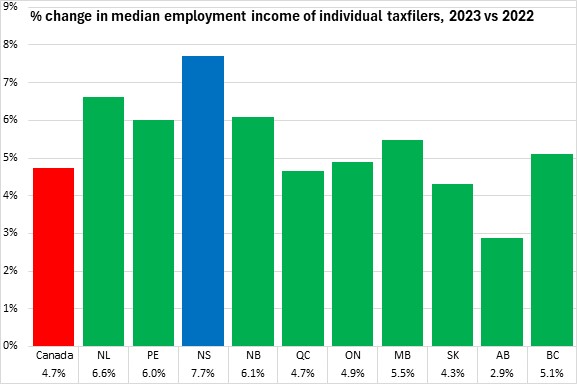

Median employment income of individuals in Nova Scotia was $41,120 in 2023. National median employment income was $45,220 in 2023 with the highest median in Alberta and the lowest in Prince Edward Island.

Median employment income was up 7.7% in Nova Scotia in 2023 - the fastest growth among provinces. National median employment income increased by 4.7% with increases in all provinces. Alberta reported slower growth than in other provinces.

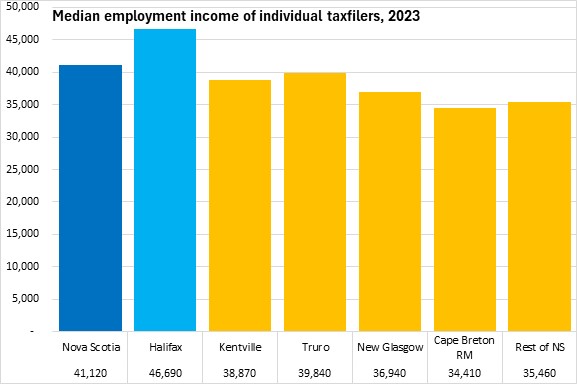

Across Nova Scotia, median employment income was highest in Halifax in 2023 ($46,990) and lowest in the Cape Breton Regional Municipality ($34,410).

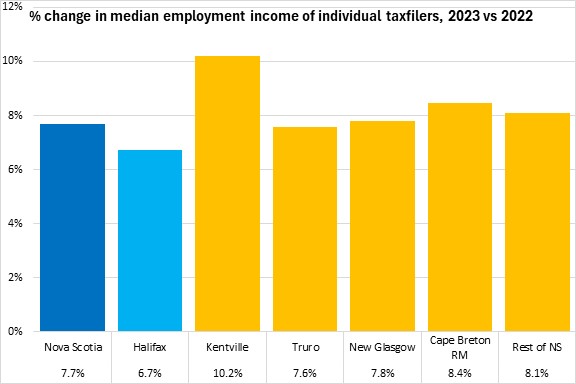

Growth in median employment income was fastest in the Kentville Census Agglomeration and slowest in Halifax.

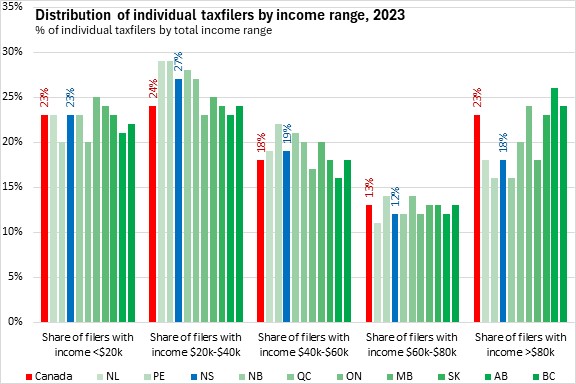

Compared to national averages, a higher portion of Nova Scotian taxfilers report total income under $60,000 and a lower portion of Nova Scotian taxfilers report total income over $60,000. The share of Nova Scotia taxfilers with incomes above $80,000 is notably lower than the national share.

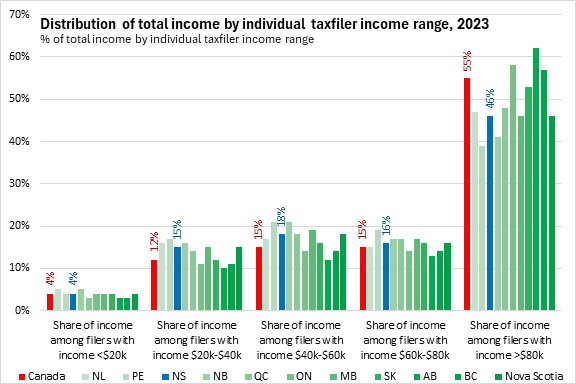

Although 23% of Nova Scotia taxfilers reported total income under $20,000, this group's income was just 4% of the total income reported in 2023. In contrast, the 18% of Nova Scotia taxfilers with incomes above $80,000 accounted for 46% of the total income reported in 2023.

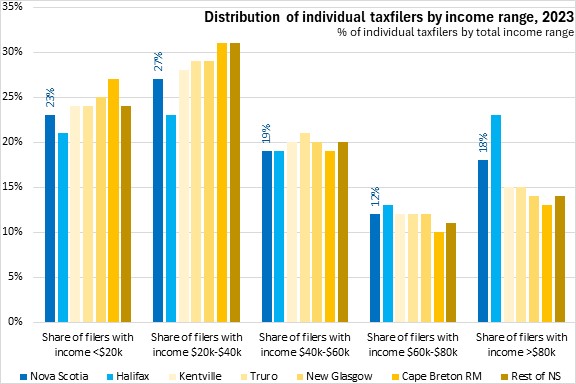

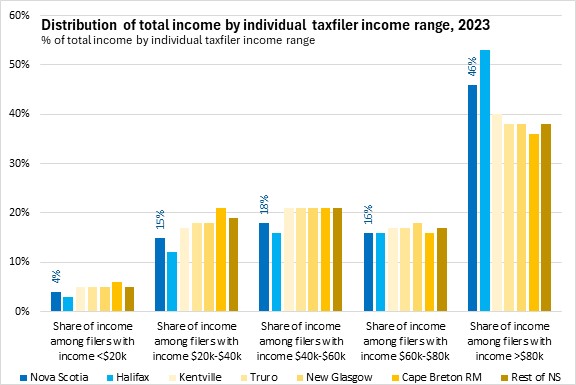

Across Nova Scotia, the 2023 income distribution skewed higher in Halifax. Higher portions of Haligonians reported incomes over $80,000 and lower portions reported incomes under $40,000. Cape Breton Regional Municipality reported the highest percentage of earners with less than $40,000 in total income.

In Halifax, 53% of total income reported was from the 23% of individuals with $80,000 or more in total income. In the Cape Breton Regional Municipality, 36% of total income was reported by the 13% of taxfilers with total incomes above $80,000.

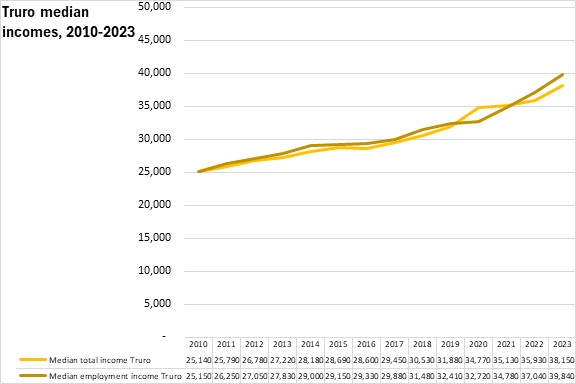

Due to the employment losses and extraordinary support payments during the first waves of the COVID pandemic in 2020, there was a divergence in median total income (lifted by support payments) and median employment income (reduced by substantial employment losses). By 2022, median employment and total income converged again for most parts of the province, then accelerated in 2023. Median employment incomes exceeded median total incomes in all regions except rural Nova Scotia (the areas outside Halifax, Cape Breton, Kentville, Truro and New Glasgow). Median employment incomes exceeded median total incomes by more substantial margins in the Truro and Kentville Census Agglomerations.

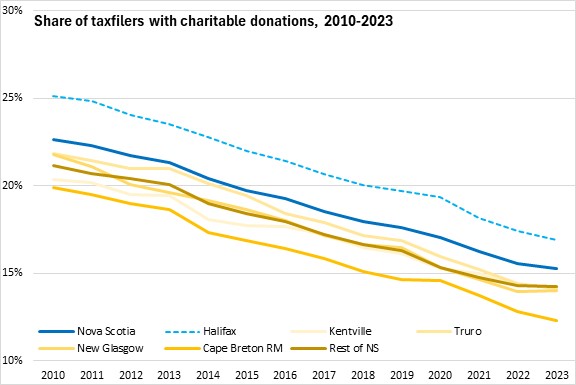

Charitable donations

As charitable donations are reported on the T1 tax return, this information allows examination of Canadians' charitable contributions.

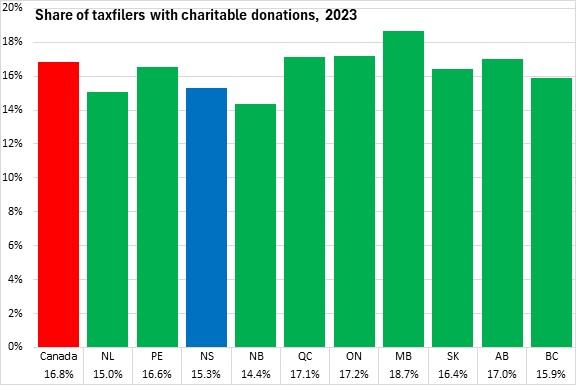

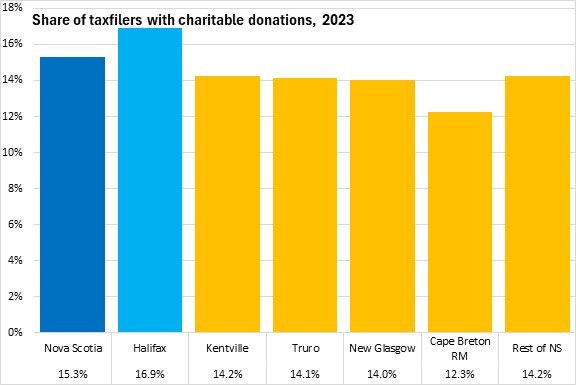

In Nova Scotia, 15.3% of taxfilers claimed charitable donations in 2023. This was below the national average (16.8%). New Brunswick reported the lowest percentage of charitable donations among taxfilers while Manitoba reported the highest.

Across Nova Scotia, the portion of taxfilers with charitable donations was highest in Halifax and lowest in the Cape Breton Regional Municipality.

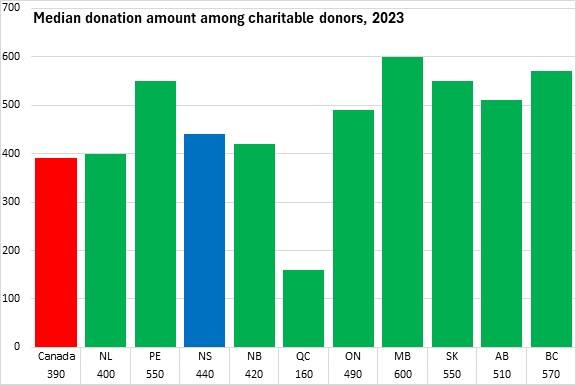

Despite a lower share of taxfilers claiming charitable donations from Nova Scotia, the median donation amount among donors ($440) was higher than the national median ($390). Median charitable donations were highest in the four westernmost provinces and notably lower in Québec.

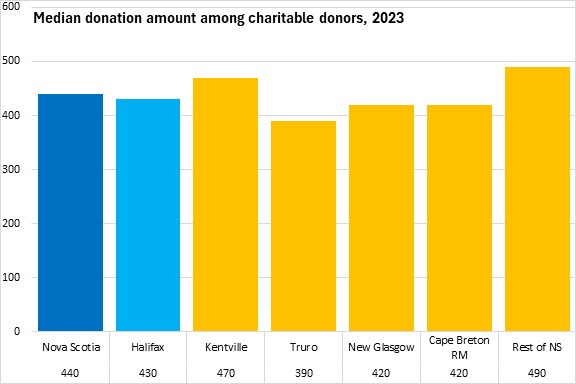

Across Nova Scotia, median charitable donations were highest in the Kentville Census Agglomeration as well as in rural areas (outside Halifax, Cape Breton, Kentville, Truro and New Glasgow). Charitable donors in the Truro Census Agglomeration reported the lowest median contributions.

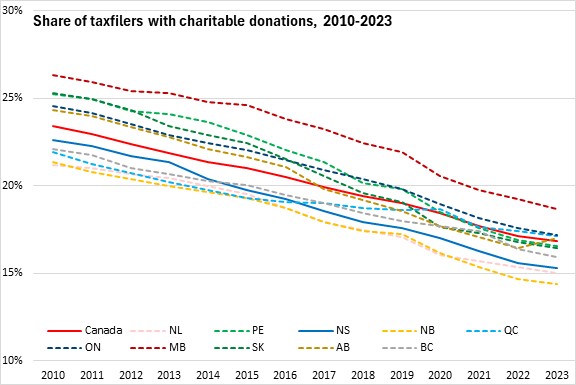

Over time, the portion of taxfilers claiming charitable donations has declined - for almost every province as well as for every region in Nova Scotia. The exceptions were a increases in the share of Albertans as well as residents of the New Glasgow Census Agglomeration making charitable donations in 2023.

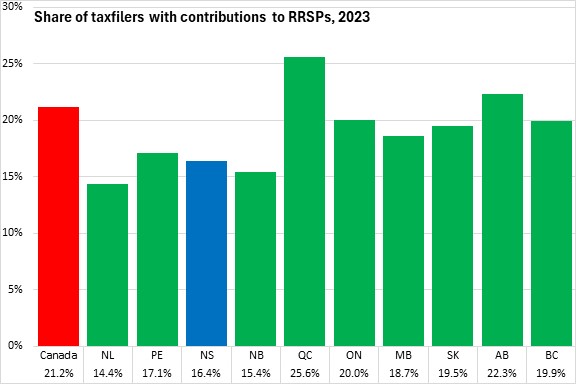

Registered Retirement Savings Plan (RRSP) contributions

As RRSP contributions are also reported on the T1 personal income tax return, this data illustrates savings behaviour.

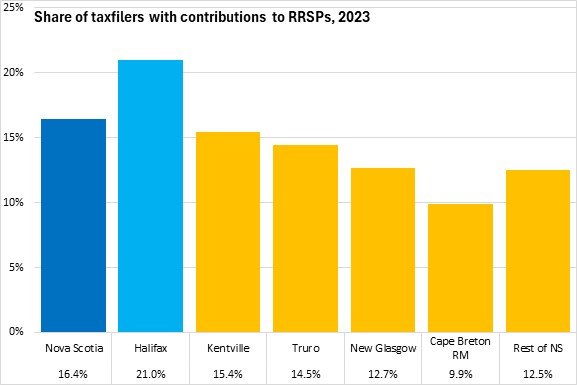

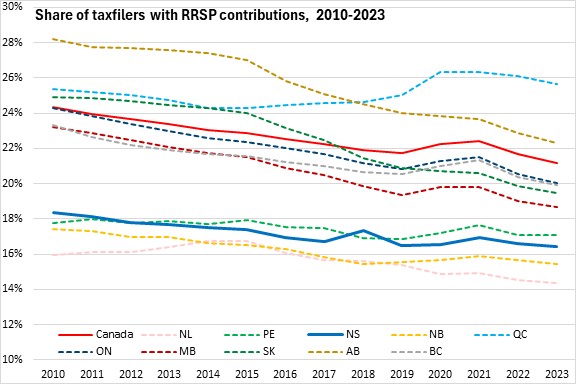

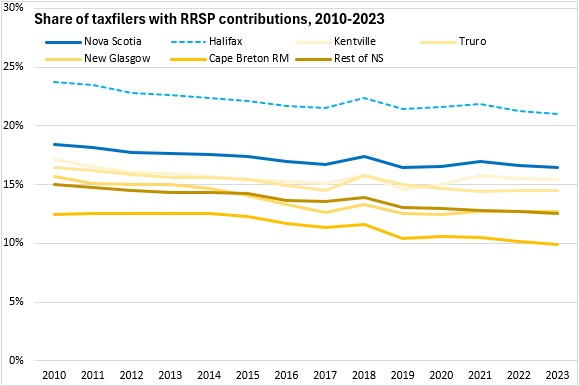

In 2023, 16.4% of Nova Scotia taxfilers made RRSP contributions. This was third lowest among provinces (ahead of New Brunswick and Newfoundland and Labrador). RRSP contributions were most prevalent among Québec taxfilers.

Halifax reported a higher portion of taxfilers with RRSP contributions in 2023 (21.0%) while the Cape Breton Regional Municipality had the lowest prevalence of RRSP contributions (9.9% of taxfilers).

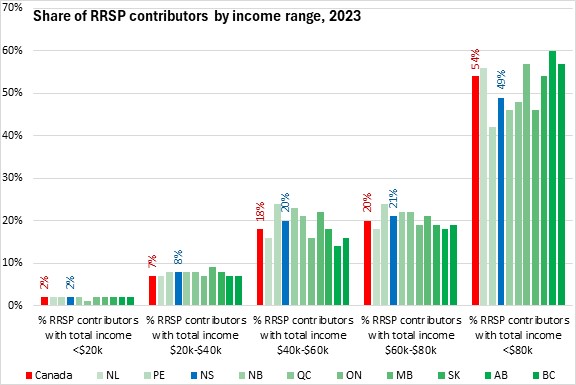

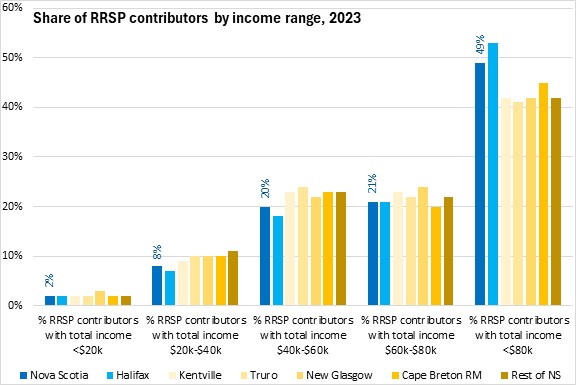

The share of Nova Scotians making RRSP contributions was equal to or higher than the national shares for all income cohorts except those reporting incomes over $80,000.

The share of Halifax taxfilers with over $80,000 in income making RRSP contributions was notably higher than the share of earners in the same income cohort across the rest of the province. Halifax taxfilers with incomes ranging from $20,000 to $60,000 were notably less likely to contribute to RRSPs than their counterparts with similar incomes across the rest of the province.

The portion of the population making RRSP contributions has declined in Nova Scotia in 2023 after small gains in 2020 and 2021. Many (not all) provinces reported a decline in the share of taxfilers reporting RRSP contribution in 2023, with the exception of Prince Edward Island (unchanged).

In Nova Scotia, there were unusual spikes in the portion of the population reporting RRSP contributions in 2018 as well as in 2021. Otherwise, the share of taxfilers reporting RRSP contributions has been trending down.

Source: Statistics Canada. Table 11-10-0047-01 Summary characteristics of Canadian tax filers (preliminary T1 Family File); Table 11-10-0044-01 Selected characteristics of tax filers with Registered Retirement Savings Plan (RRSP) contributions; Table 11-10-0003-01 Tax filers with charitable donations by income

<--- Return to Archive