The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

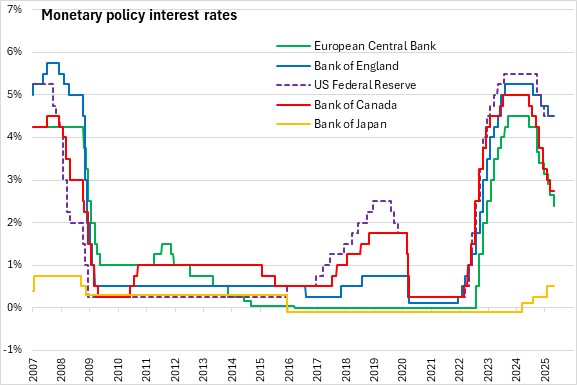

May 01, 2025BANK OF JAPAN MONETARY POLICY On May 1, 2025, the Policy Board of the Bank of Japan decided to maintain their uncollateralized overnight call rate at around 0.5%.

The Bank of Japan projects the economy to moderate. The growth is slowed by global trade policies slowing down domestic and overseas economy, although accommodative financial conditions are expected to provide support. Thereafter, Japan's economic growth rate is likely to rise, with overseas economies returning to a moderate growth path.

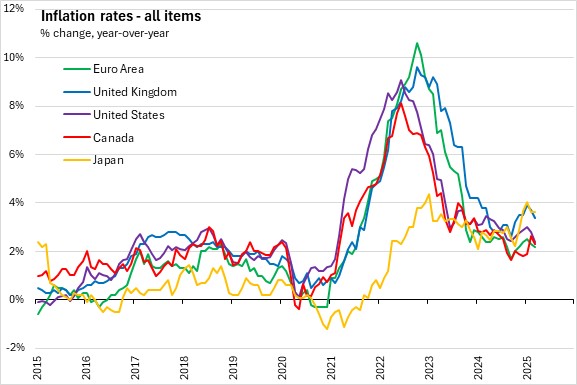

Housing investment has been relatively weak and public investment has been flat. Year-over-year inflation has been in the range of 3.0%-3.5% recently with the rise in food prices and pass on wage increases to selling prices. Consumer price index is likely to be in the range of 2.0%-2.5% for 2025, in the range of 1.5%-2.0% in 2026, and in around 2.0% in 2027. With economy decelerating, underlying CPI inflation is expected to slow in the near term. After, underlying CPI inflation is expected to gradually increase with projected labour shortages as economic growth rises.

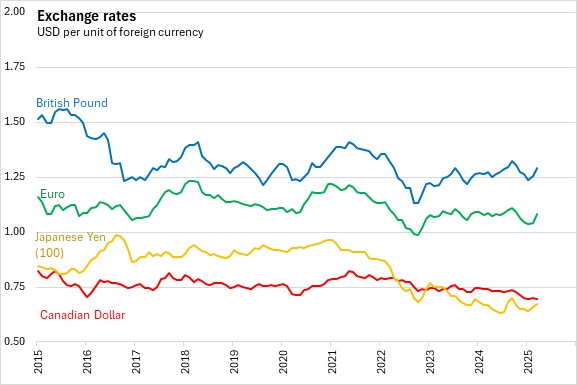

The risk to the monetary policy would come from Japan's economic activity and prices, as well as the overseas economies. Japanese firms' behavior has also shifted towards raising wages and prices with exchange rate developments more likely to affect prices.

The Bank of Japan is focused on developments in the financial and foreign exchange markets and their impact on Japan's economic activity and prices.

The Bank will release their next monetary policy statement on June 17, 2025.

Source: Bank of Japan, Statement on Monetary Policy; Outlook for Economic Activity

<--- Return to Archive