The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

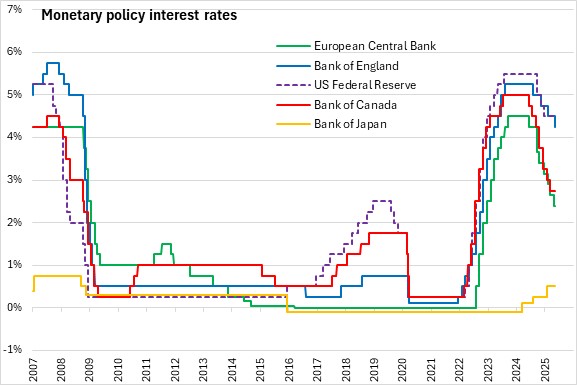

May 08, 2025BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to lower the Bank Rate by 25 basis points to 4.25%.

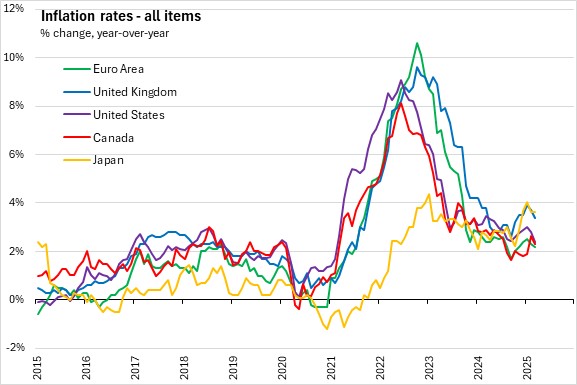

The global trade policy uncertainty and tariffs remain, and the prospects of global growth have weakened. However, negative impacts on UK growth and inflation are likely to be smaller. Underlying GDP growth has slowed since the middle of 2024 and the labour market has continued to loosen. The progress on disinflation in domestic price and wage pressures has generally continued. CPI inflation fell to 2.6% in March 2025. Previous increases in energy prices are still likely to drive up CPI inflation from April onwards, to 3.5% for Q3 2025.

UK GDP has grown stronger than expected in February (0.5%), and the Bank now estimated that headline GDP growth in Q1 2025 had been 0.6%, while underlying growth is estimated at around zero.

The Bank of England looked at two scenarios that the economy could take. The first scenario looks at a greater or longer lasting weakness in demand relative to supply, reflecting global and domestic uncertainties. Underlying GDP growth had been weak and global trade policy uncertainty had risen sharply. Household savings would rise, and consumption would weaken. In the second scenario, persistence in wage and price setting would push near-term headline CPI inflation and from weakness in supply could intensify inflation persistence.

The Committee would continue to monitor closely the risks of inflation persistence and what the evidence might reveal about the balance between aggregate supply and demand in the economy. Monetary policy would need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term had dissipated further. The Committee would decide the appropriate degree of monetary policy restrictiveness at each meeting.

The next scheduled monetary policy meeting will be on June 19, 2025.

Source: Bank of England, Monetary Policy Summary, May 2025; Monetary Policy Report, May 2025

<--- Return to Archive