The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 09, 2025LABOUR MARKET TRENDS, APRIL 2025 April labour force survey results reflect the period from April 13 to 19, 2025.

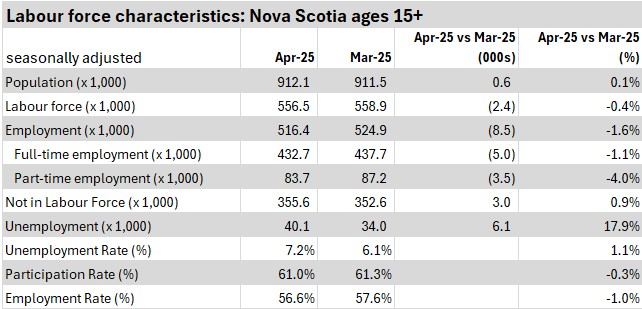

Ages 15+ (April 2025 vs March 2025, seasonally adjusted)

Nova Scotia's seasonally adjusted employment fell by 8,500 (-1.6%) to 516,400 in April following an increase of 2,000 (+0.4%) in the previous month.

The change in employment was mostly attributable to a decrease in full-time employment (-5,000), with a smaller decline in part-time employment (-3,500). Note that changes in full-time and part-time employment can also reflect changing hours for the same job.

Nova Scotia’s labour force fell by 2,400 (-0.4%) to 556,500 in April 2025.

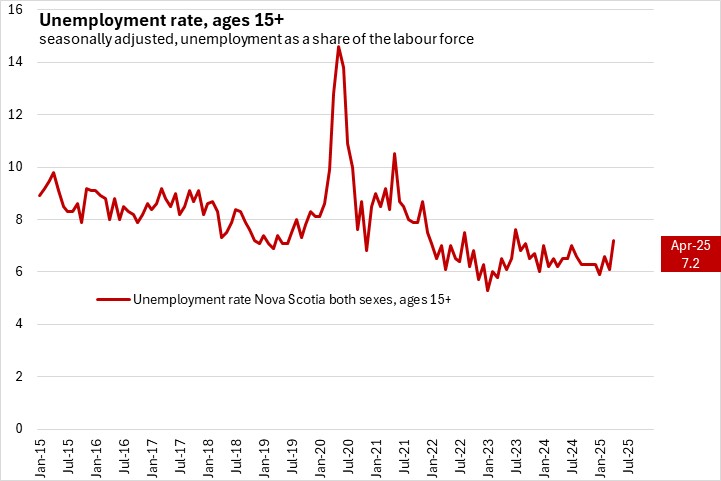

With employment falling faster than labour force, Nova Scotia's unemployment rate increased 1.1 percentage points to 7.2% in April 2025.

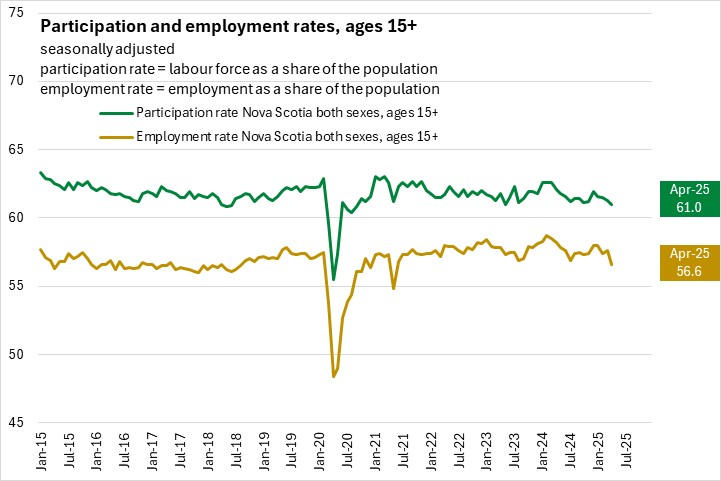

Nova Scotia's labour force participation rate was down 0.3 percentage points to 61.0% and the employment rate was down 1.0 percentage points to 56.6% in April 2025.

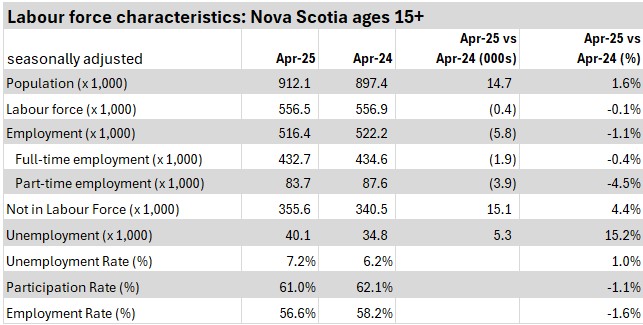

Ages 15+ (April 2025 vs April 2024, seasonally adjusted)

Compared with April 2024, Nova Scotia's population over the age of 15 increased by 14,700 (+1.6%), while the labour force declined by 400 (-0.1%), and employment declined by 5,800 (-1.1%). The unemployment rate increased by 1.0 percentage points while the participation rate fell by 1.1 percentage points and the employment rate fell by 1.6 percentage points.

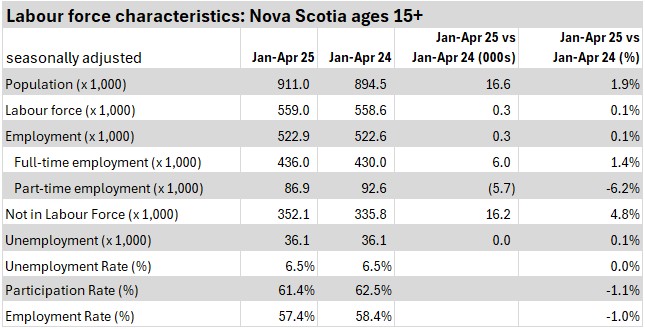

Ages 15+ (January-April 2025 vs January-April 2024, seasonally adjusted)

Compared with January-April 2024, Nova Scotia's population over the age of 15 increased by 16,600 (+1.9%), while the labour force grew by 300 (+0.1%), and employment increased by 300 (+0.1%). The unemployment rate was unchanged, while the participation rate fell by 1.1 percentage points and the employment rate fell by 1.0 percentage points.

Note: Year-to-date estimates are calculated as averages of monthly data and rounded to the nearest tenth. Year-to-date changes in the table are also rounded to the nearest tenth.

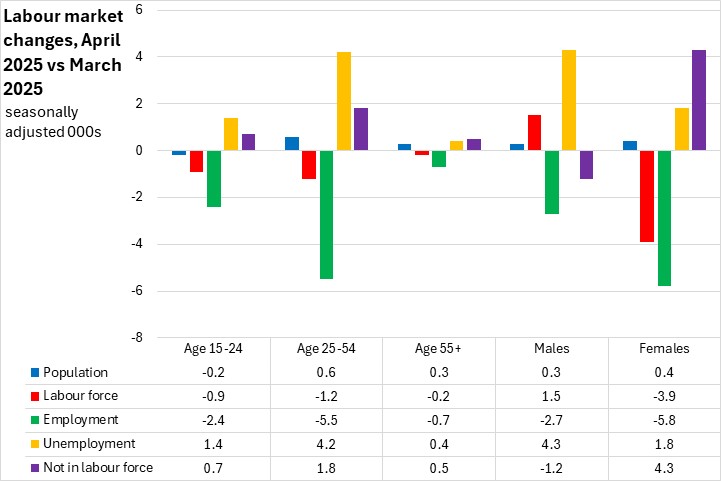

Age Cohorts (April 2025 vs March 2025, seasonally adjusted)

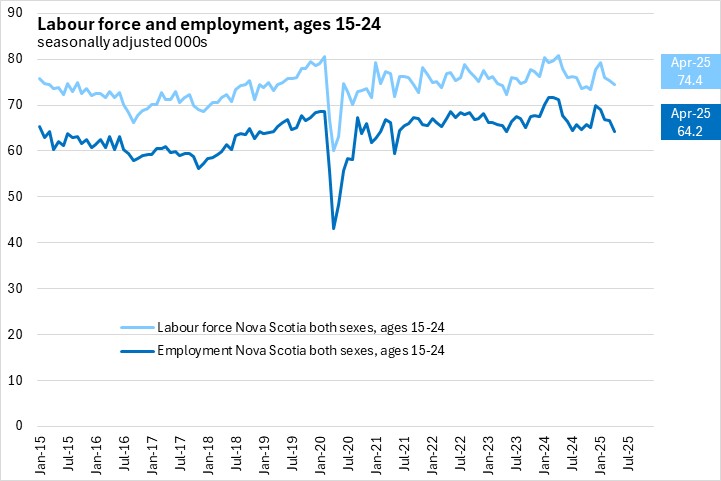

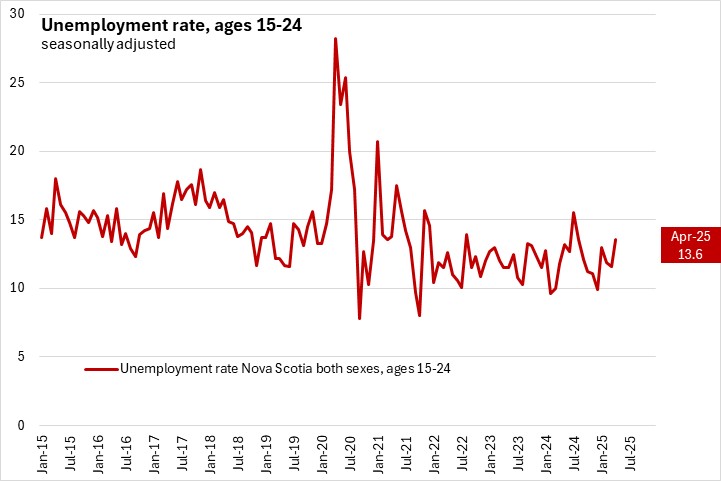

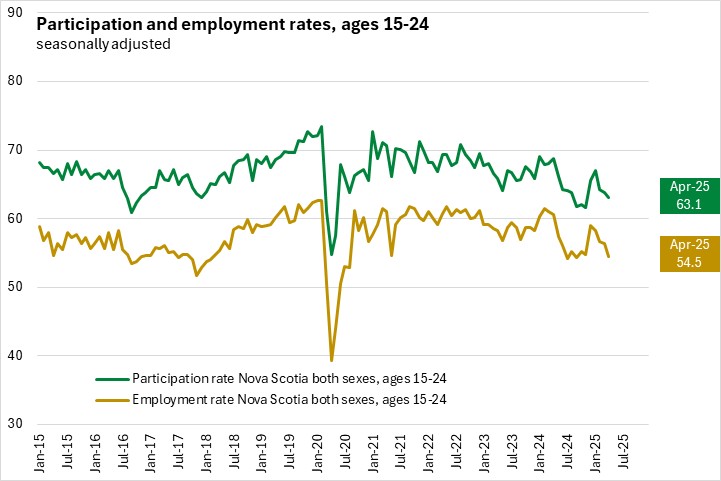

Among youth (ages 15-24), employment was down 2,400 (-3.6%) while the labour force fell by 900 (-1.2%). As employment fell faster than the labour force, the youth unemployment rate increased 2.0 percentage points to 13.6% in April 2025. The youth participation rate fell 0.7 percentage points to 63.1% while the youth employment rate was down 1.9 percentage points to 54.5%.

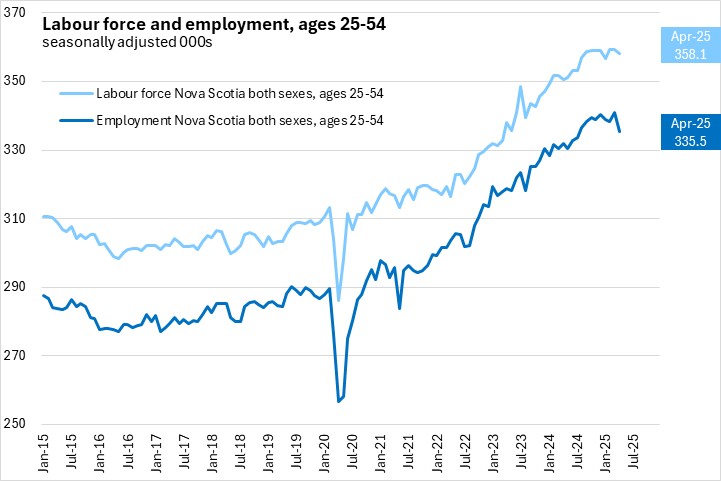

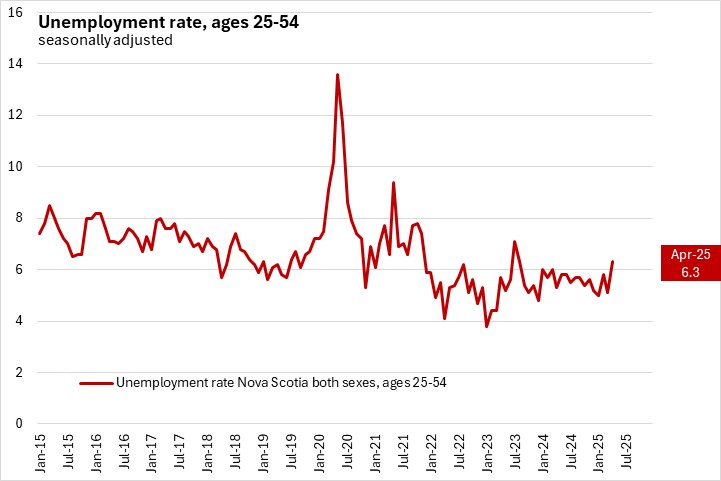

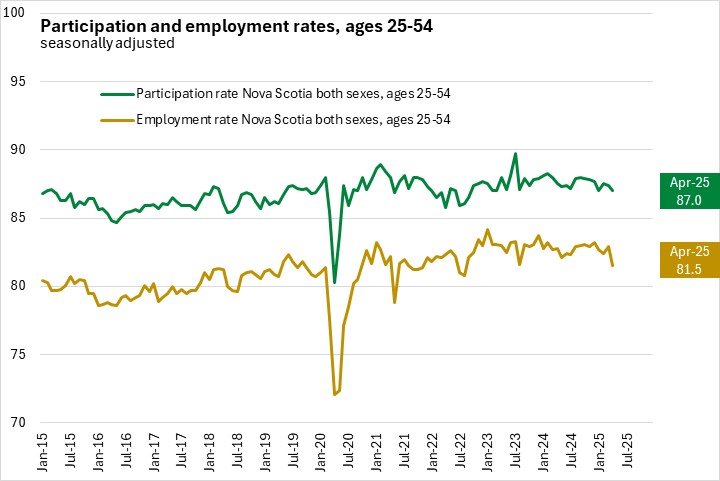

The population aged 25-54 makes up the largest part of the labour force. In the core age group, employment was down 5,500 (-1.6%) while the labour force fell 1,200 (-0.3%). With employment falling faster than the labour force, the core aged unemployment rate rose 1.2 percentage points to 6.3% in April 2025. The core aged participation rate was down 0.4 percentage points to 87.0% and the core aged employment rate was down 1.4 percentage points to 81.5%.

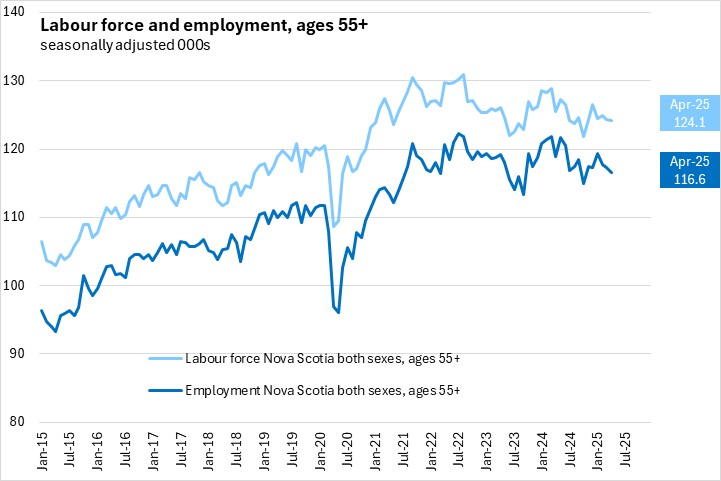

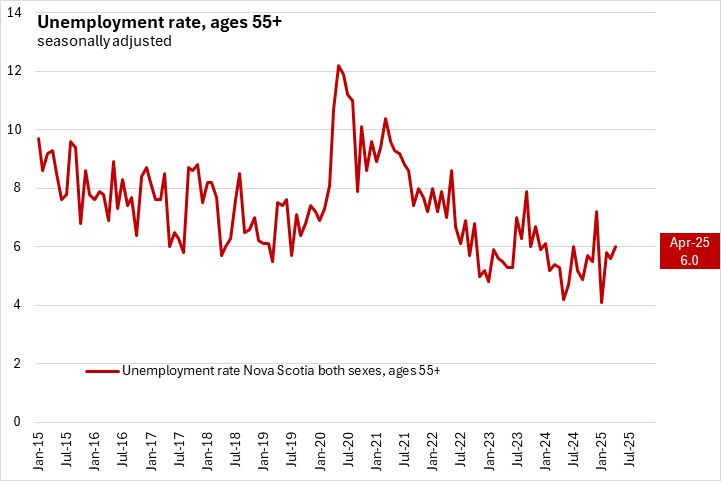

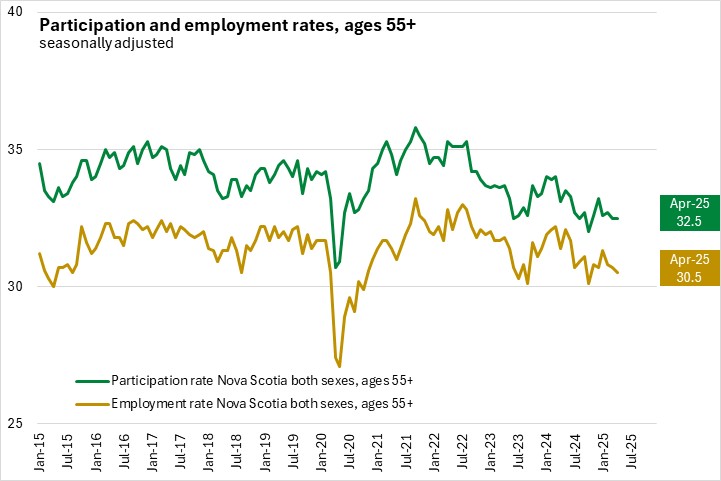

Among older workers (aged 55+) the labour force declined by 200 (-0.2%) while employment fell by 700 (-0.6%). With employment falling faster than labour force, the older worker unemployment rate rose 0.4 percentage points to 6.0%. The older worker participation rate was unchanged at 32.5% and the employment rate for older workers declined 0.2 percentage point to 30.5%.

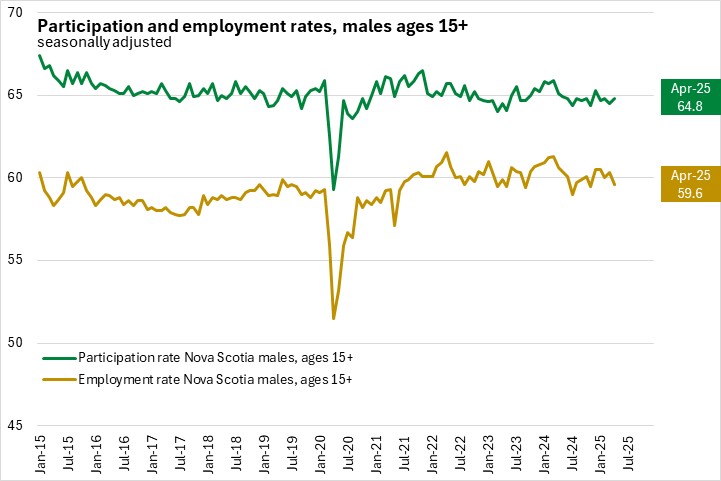

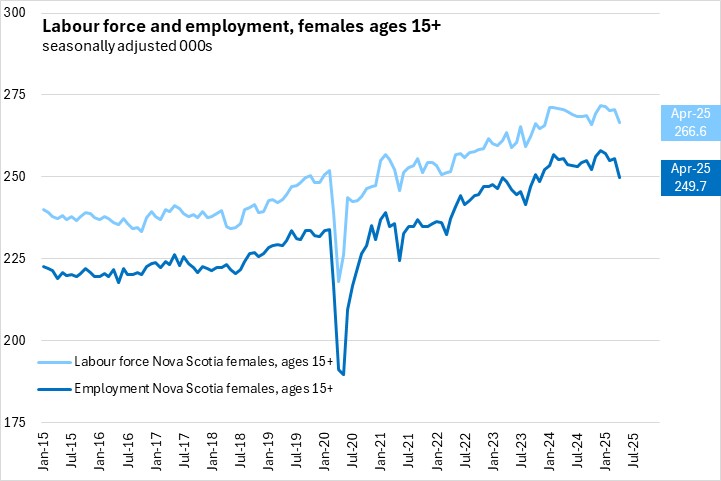

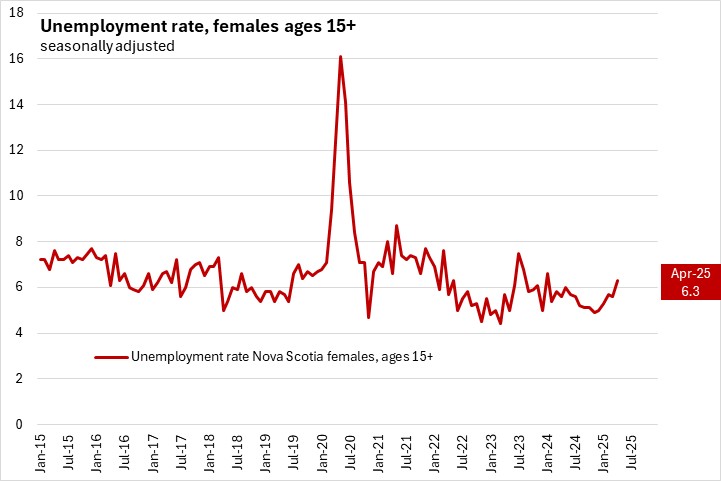

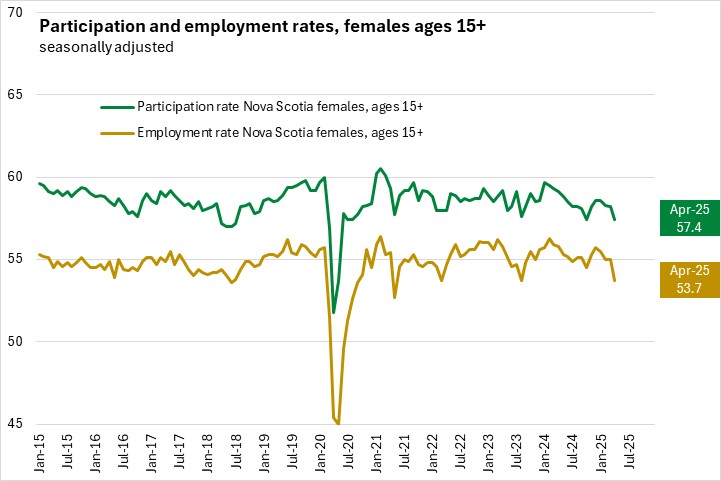

Males and Females (Ages 15+, April 2025 vs March 2025, seasonally adjusted)

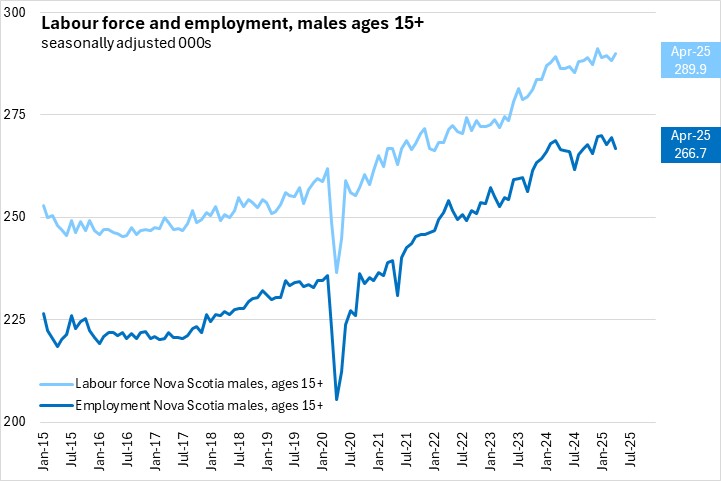

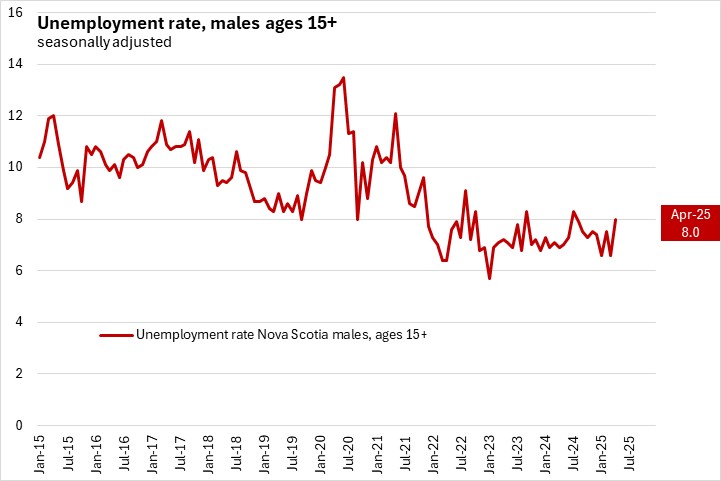

Monthly employment fell by 2,700 (-1.0%) for males while the labour force increased by 1,500 (-0.5%) from March. With employment falling on a larger labour force, the male unemployment rate rose 1.4 percentage points to 8.0% in April. The male participation rose by 0.3 percentage points to 64.8%, while the employment rate fell by 0.7 percentage points to 59.6%.

Females reported an employment decline of 5,800 (-2.3%) and a labour force decline of 3,900 (-1.4%). With employment falling faster than labour force, the female unemployment rate rose 0.7 percentage point to 6.3% in April. The female participation rate fell by 0.8 percentage point to 57.4% and the female employment rate fell by 1.3 percentage points to 53.7%.

April's decline in employment was due to declines among all worker age cohorts, led by core-aged workers. Females reported a larger decline in employment than males, however the male labour force grew while the female shrunk, resulting in a larger change in unemployment for males. There was a notable rise among females not in the labour force in April.

All age cohorts reported lower labour force in April, with the larget declines among core-aged and youth workers. April's labour force decline was due to a decline in the female labour force, partially offset by an increase among males.

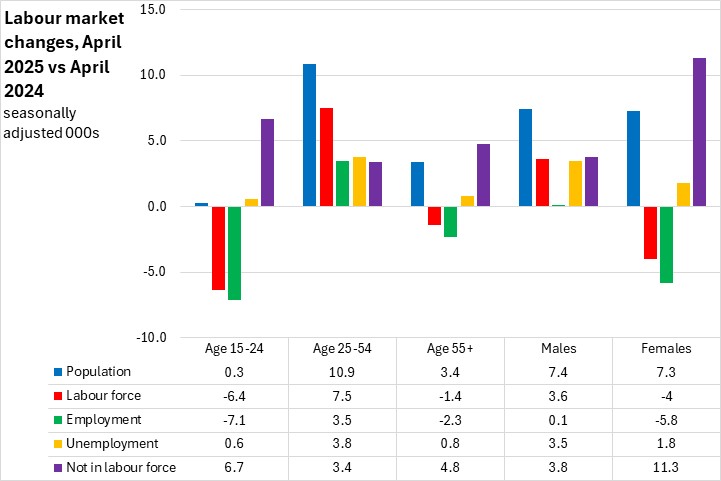

Age and sex cohorts (April 2025 vs April 2024, seasonally adjusted)

Compared with April 2024, employment growth for core-aged workers (whose population has also grown the most over this period) was offset by declines among youth and older workers. Youth reported larger declines in labour force and employment than older workers compared to one year ago. Females reported lower labour force and employment compared to one year ago, with males seeing gains in labour force, and to a lesser extent, employment.

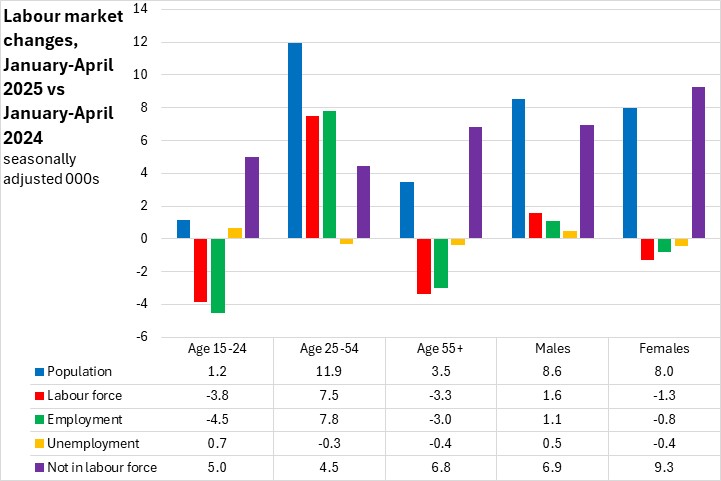

Age and sex cohorts (January-April 2025 vs January-April 2024, seasonally adjusted)

Compared with January-April 2024, labour force and employment growth was highest among core-aged workers (whose population is also growing more than others). Labour force growth lagged employment growth for core-aged workers. Older workers saw a smaller decline in employment than labour force, whereas youth reported greater employment declines compared to labour force. Core-aged and older workers saw declines in unemployment, while younger workers saw increasing unemployment levels. All age cohorts reported notable rises in the number of persons not in the labour force. Labour force and employment rose for males and declined for females compared to January-April 2024.

Class of Worker and Industry (April 2025 vs March 2025, seasonally adjusted)

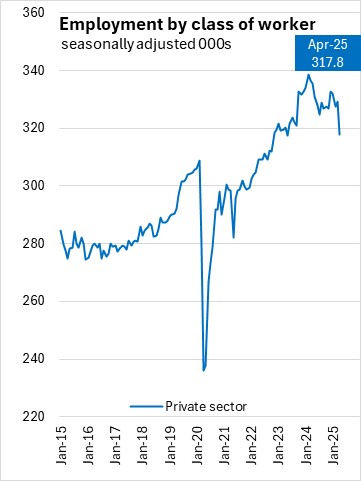

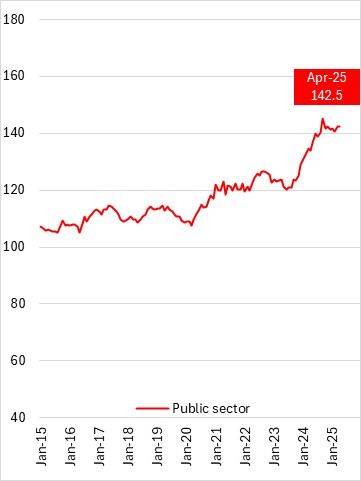

The April 2025 employment decline was due to decreasing private sector (-11,400, -3.5%) workers. Self employment increased by 2,700 (+5.1%) in April, while public sector employment rose by 100 (+0.1%).

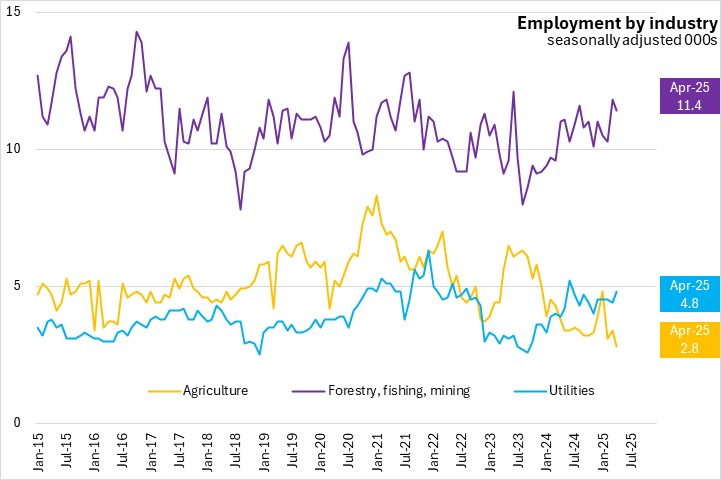

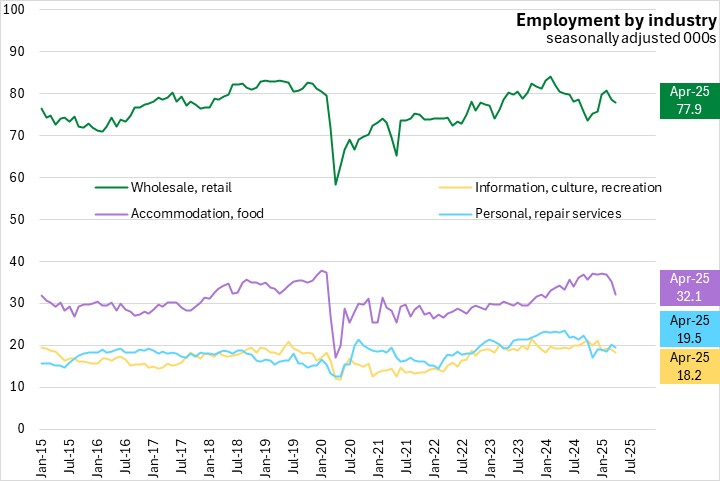

Classified by industry, the only employment gains from March to April were in professional/technical services, public administration, health/social assistance, and utilities. There were widespread declines, led by accommodation/food services, construction, and education.

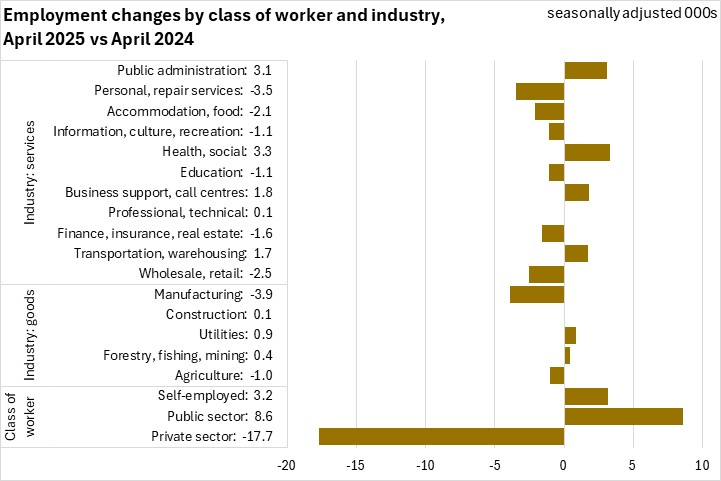

Class of Worker and Industry (April 2025 vs April 2024, seasonally adjusted)

Compared to April 2024, there were employment losses for private sector workers (-17,700 or -5.3%), with gains for public sector workers (+8,600 or +6.4%) and the self-employed (+3,200 or +6.1%).

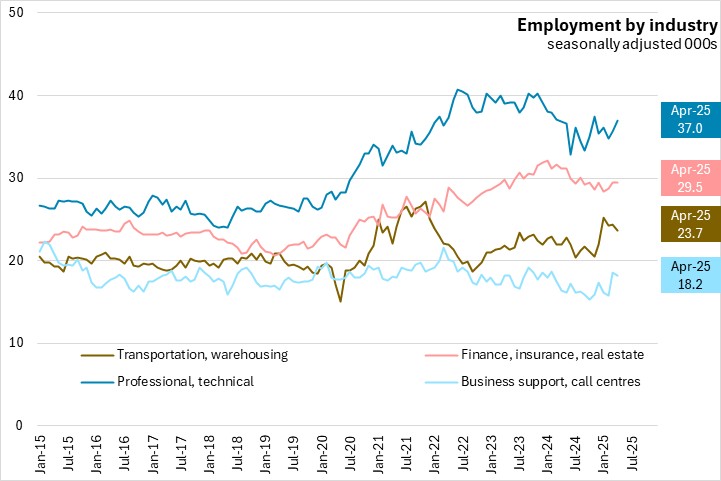

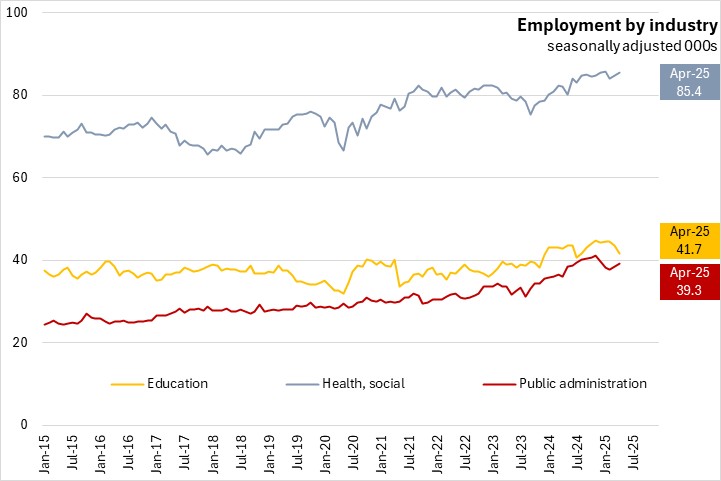

Over the last 12 months, employment was up the most for public administration, health/social assistance, and business support/call centers. The largest declines were in manufacturing, personal/repair services, and wholesale/retail.

Class of Worker and Industry (January-April 2025 vs January-April 2024, seasonally adjusted)

Compared to January-April 2024, gains were strongest for public sector workers (+8,800 or +6.6%), with smaller gains in self employment (+1,000 or +1.8%). There was a decline in private sector workers (-9,500 or -2.8%).

Gains in employment were strongest in construction, health care/social assistance, accomodations/food services, and public administration. The largest declines were in personal/repair services, wholesale/retail, and manufacturing.

Hours worked and employment (April 2025, unadjusted)

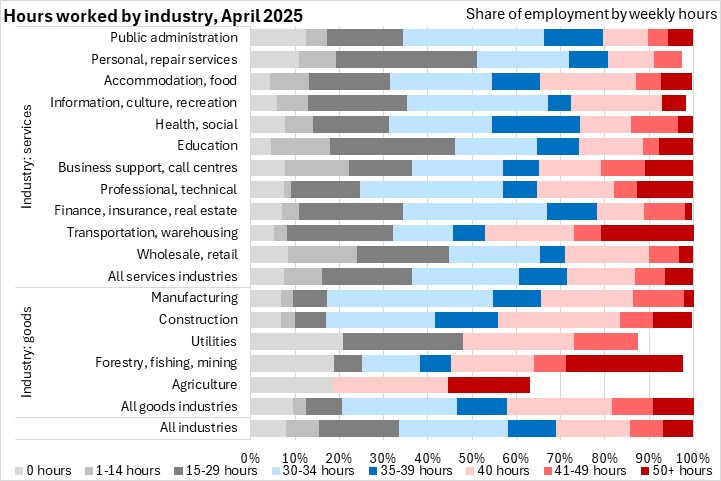

Compared to the provincial average, a larger share of workers in goods producing industries, as well as transportation/warehousing, professional/technical services, and business support/call centers worked more than 40 hours per week in April 2025.

Note that some data on those working few hours in utilities, forestry/fishing/mining and agriculture were suppressed.

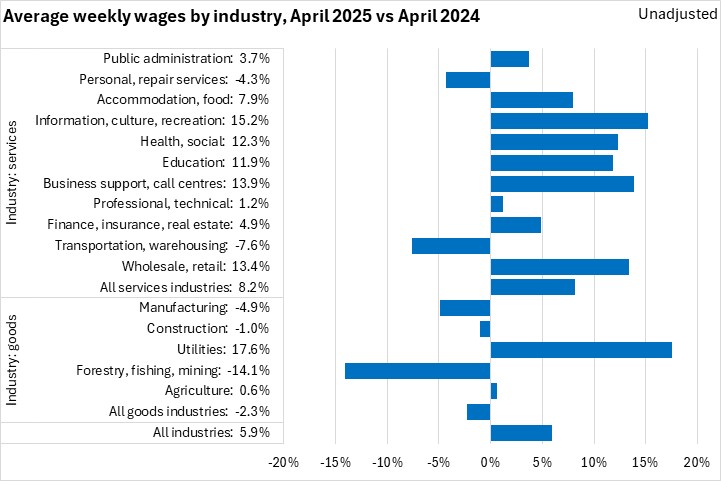

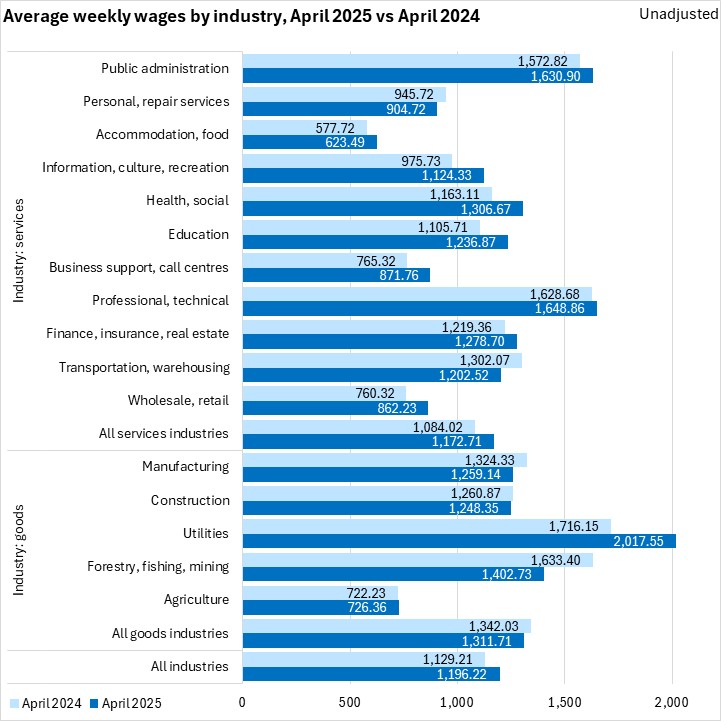

Average weekly earnings (unadjusted, both full time and part time, April 2025 vs April 2024)

Average weekly earnings increased by 5.9% from April 2024 to April 2025. The fastest gains in average weekly earnings were in utilities, information/culture/recreation, and business support/call centers. The largest declines in average weekly wages were in forestry/fishing/mining.

The increase in Nova Scotia's all items consumer price index was 2.3% from March 2024 to March 2025.

Average weekly earnings across all employees were $1,196.22 in April 2025. The highest average weekly earnings (both full and part time employees) were reported in utilities, public administration, and professional/technical services. The lowest average weekly earnings were in accommodation/food services and agriculture.

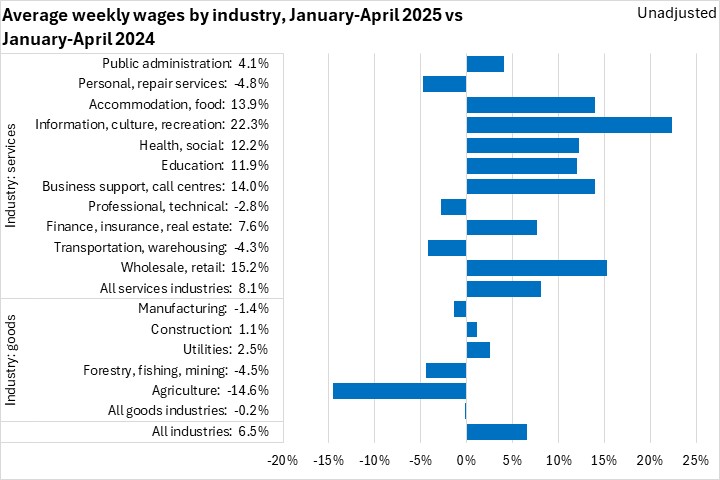

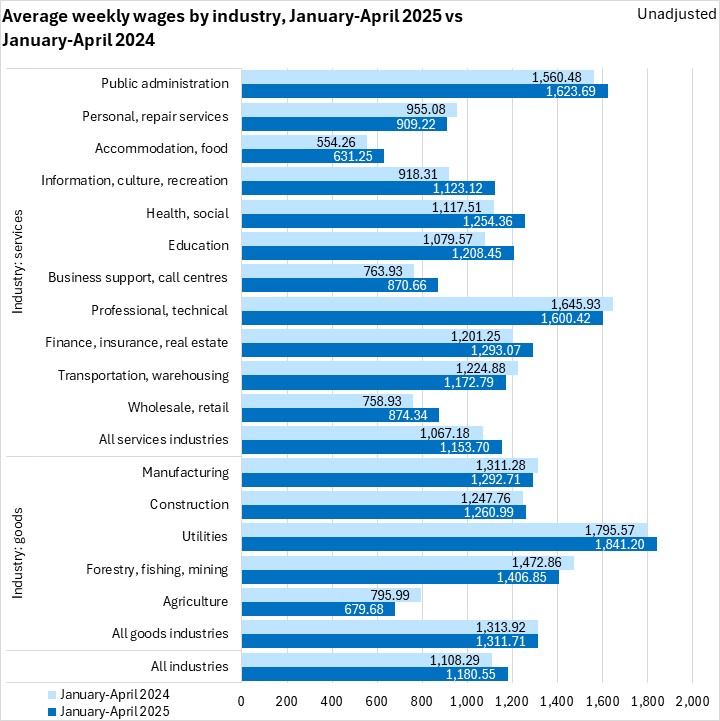

Average weekly earnings (unadjusted, both full time and part time, January-April 2025 vs January-April 2024)

Average weekly earnings increased 6.5% in the first four months of 2025 compared to the same period of 2024. The fastest gains in average weekly earnings were in information/culture/recreation, business support/call centers, and wholesale/retail. Agriculture reported the fastest decline in average weekly earnings in January-April 2025.

Average weekly earnings in the first three months of 2025 were highest in utilities, professional/technical services, and public administration. The lowest average weekly earnings were in accommodation/food services, and agriculture in January-April 2025.

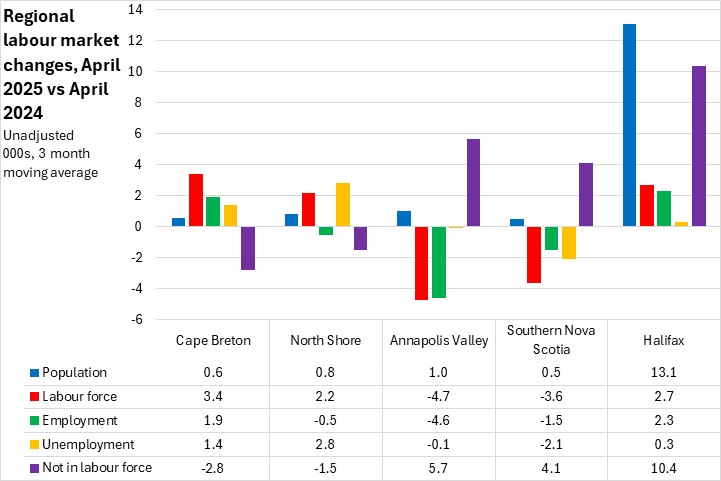

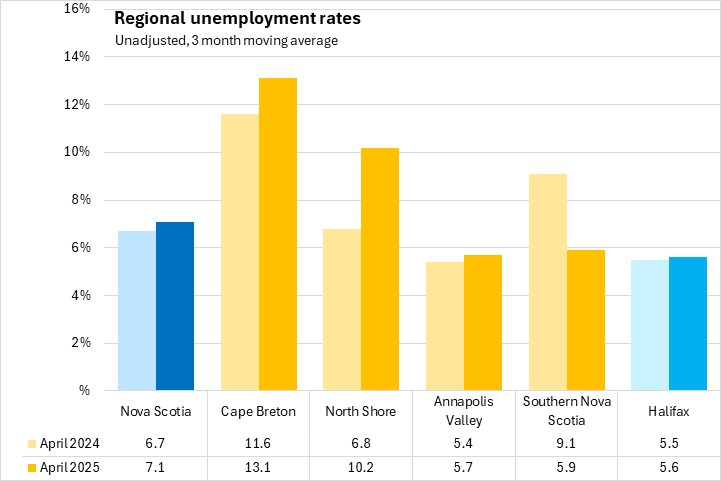

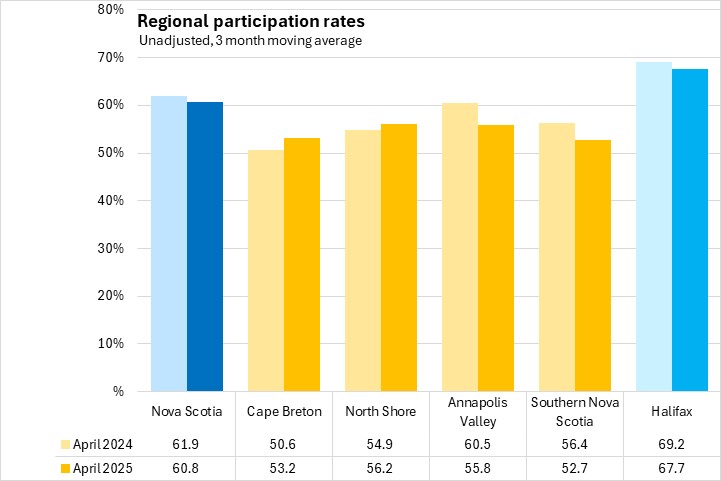

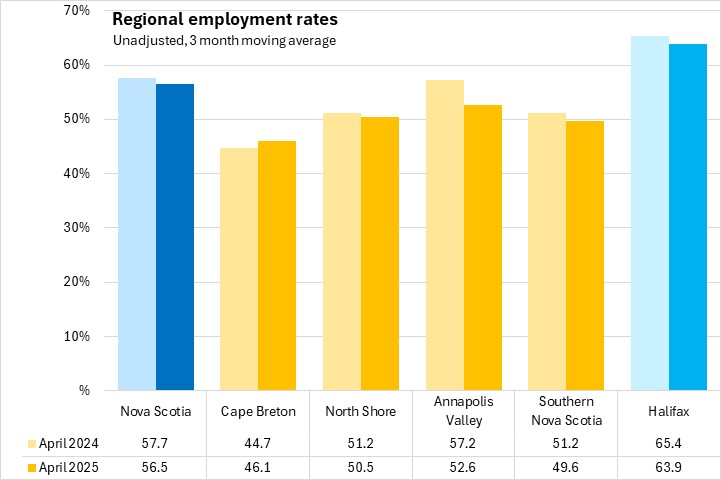

Regions (April 2025 vs April 2024, unadjusted 3 month moving average)

Compared with April 2024, labour force increases were concentrated in Cape Breton and Halifax, with smaller gains in North Shore. Halifax, North Shore and Cape Breton labour force growth outpaced employment growth, resulting in higher unemployment, with falling unemployment rates in all other regions. Annapolis Valley and Southern Nova Scotia reported falling labour force compared to one year ago. Halifax saw the strongest population growth, and a large increase in the number of people not in the labour force.

Unemployment rates were up in all regions with the exception of Southern Nova Scotia.

Participation rates were up in Cape Breton and North Shore, and down in Annapolis Valley, Southern Nova Scotia and Halifax compared to one year ago.

Employment rates were up in Cape Breton, and down in all other regions of Nova Scotia.

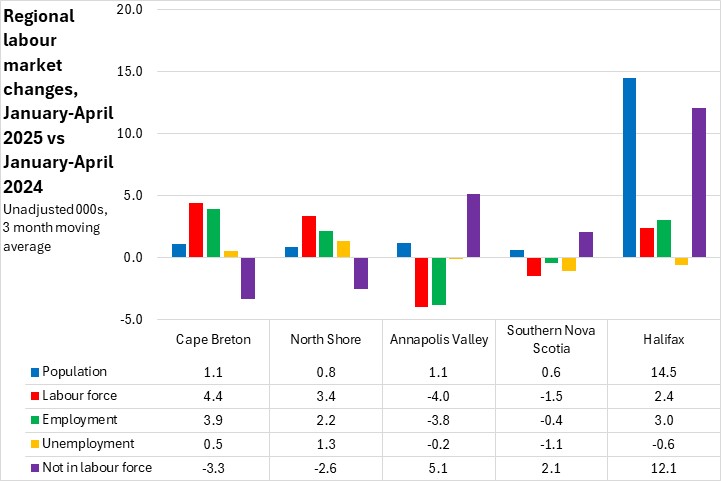

Regions (January-April 2025 vs January-April 2024, unadjusted 3 month moving average)

Compared with January-April 2024, labour force increases were concentrated in Cape Breton and the North Shore, with smaller gains in Halifax. Cape Breton reported the largest contribution to employment growth for the period, followed by Halifax and North Shore regions. Declining labour force and employment in the Annapolis Valley and Southern regions have resulted in more people not in the labour force. Halifax saw the strongest population growth, and a large increase in the number of people not in the labour force.

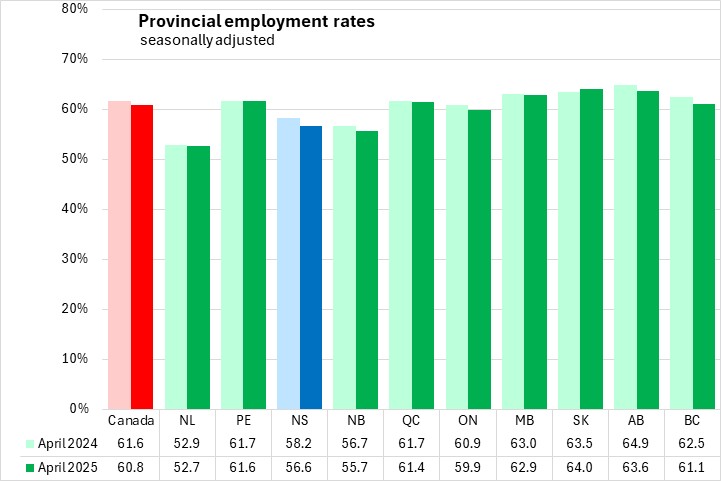

Provincial Comparisons (seasonally adjusted)

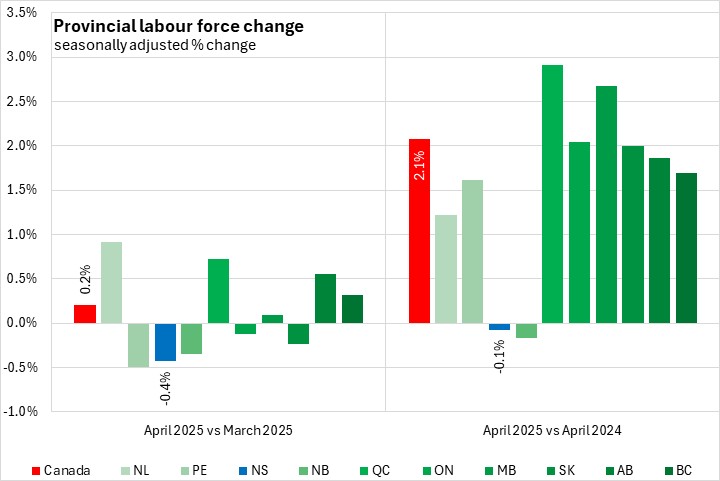

Canada's labour force was up 0.2% from March with five provinces reporting growth in April 2025. Newfoundland and Labrador reported the fastest growth while the largest decline was in Prince Edward Island.

Compared with April 2024, the national labour force was up 2.1%, with every province except New Brunswick and Nova Scotia reporting increases. Québec reported the fastest increase.

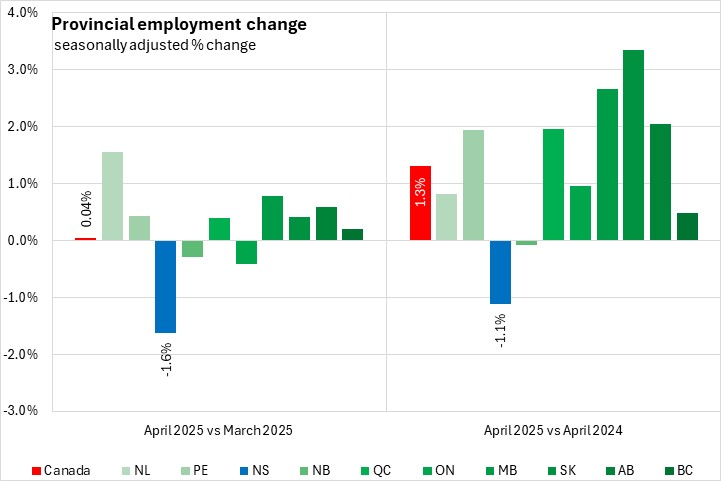

Canada's employment increased by 0.04% in April 2025. Seven provinces reported higher employment in April, led by Newfoundland and Labrador, while Nova Scotia reported the fastest decline. Compared with April 2024, the national gain was 1.3% with the fastest growth in Saskatchewan. The largest decline was in Nova Scotia.

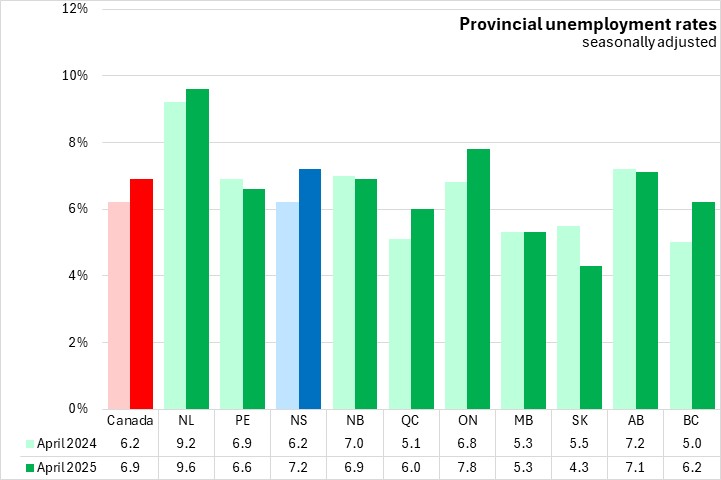

The national unemployment rate was 6.9% in April 2025, up from 6.2% in April 2024. Saskatchewan had the lowest unemployment rate while Newfoundland and Labrador reported the highest unemployment rate in April 2025.

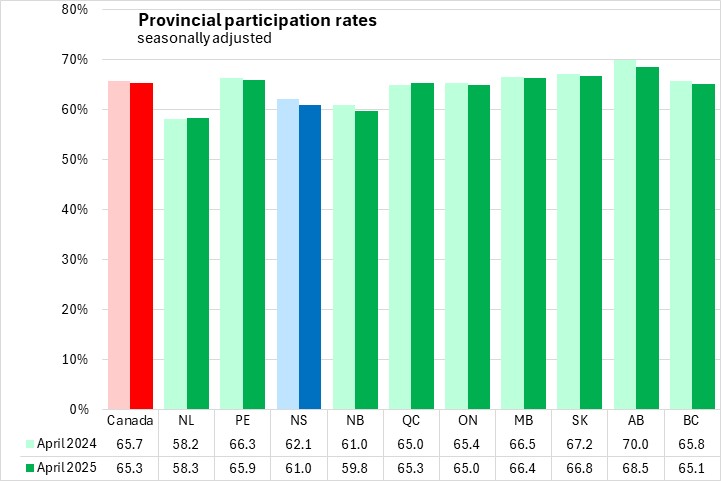

The national participation rate was 65.3% in April 2025. The highest participation rate was in Alberta while the lowest was in Newfoundland and Labrador.

The national employment rate was 60.8% in April 2025. Saskatchewan reported the highest employment rate while Newfoundland and Labrador reported the lowest.

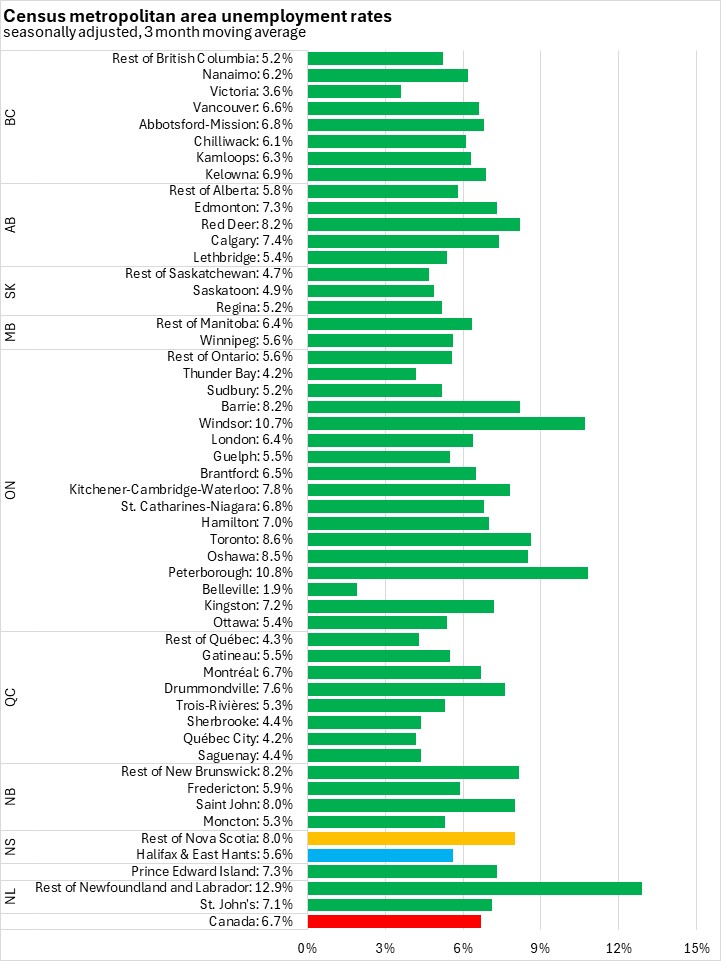

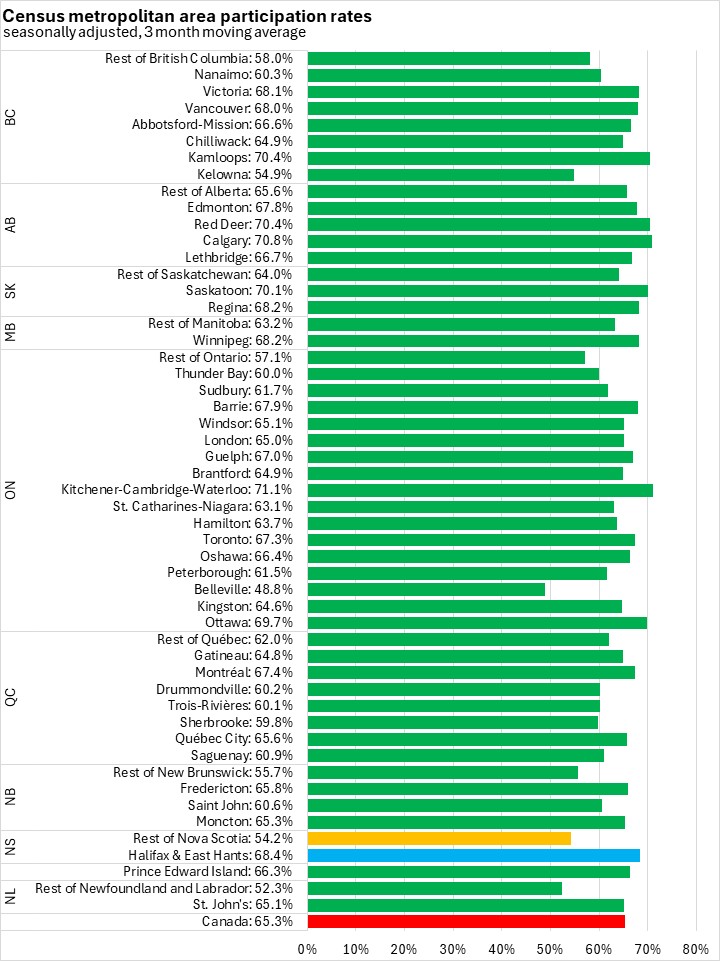

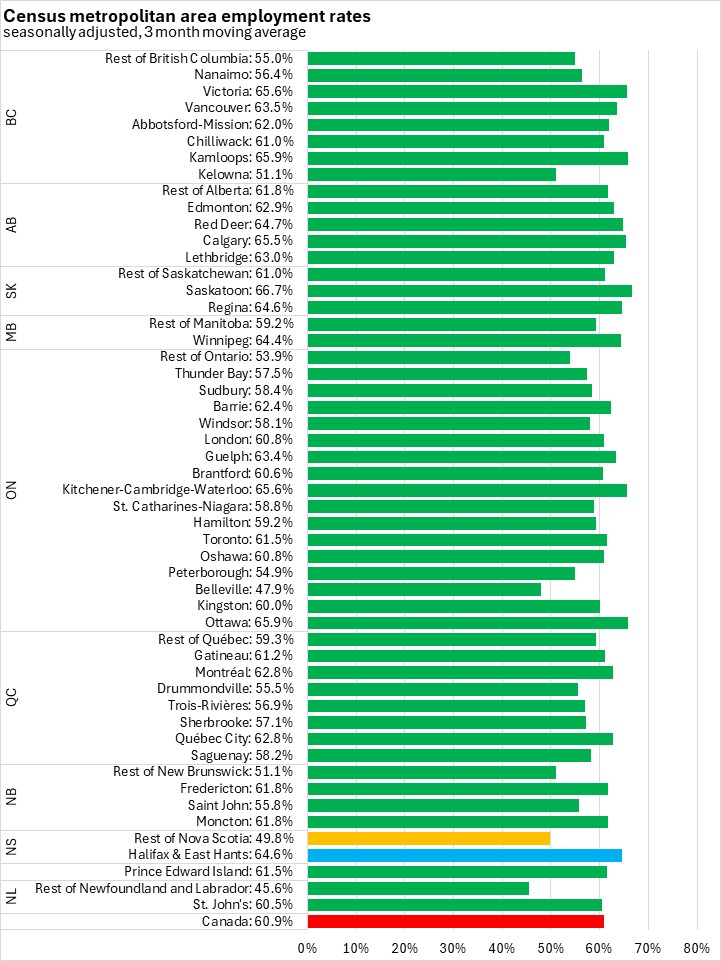

Census Metropolitan Areas (April 2025, seasonally adjusted 3 month moving average)

The Halifax unemployment rate was 5.6% in the seasonally adjusted April 2025 three month moving average. Outside of Halifax the unemployment rate was 8.0%. In central and western provinces, unemployment rates in Census Metropolitan Areas are similar to or higher than unemployment rates outside CMAs. In the Atlantic Provinces unemployment rates are typically higher outside CMAs.

Halifax's participation rate was 68.4% in the seasonally adjusted April 2025 three month moving average, while participation rates were 54.2% across the rest of the province.

Halifax reported an employment rate of 64.6% in the seasonally adjusted April 2025 three month moving average, while the employment rate was 49.8% outside the city.

Sources: Statistics Canada. Table 14-10-0036-01 Actual hours worked by industry, monthly, unadjusted for seasonality; Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality; Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle, last 5 months; Table 14-10-0380-01 Labour force characteristics, three-month moving average, seasonally adjusted; Table 14-10-0387-01 Labour force characteristics, three-month moving average, unadjusted for seasonality, last 5 months; Table 14-10-0355-01 Employment by industry, monthly, seasonally adjusted and unadjusted, and trend-cycle, last 5 months (x 1,000); Table 14-10-0288-01 Employment by class of worker, monthly, seasonally adjusted and unadjusted, last 5 months (x 1,000); Table: 14-10-0459-01 Labour force characteristics, three month moving average, seasonally adjusted (x 1,000)

<--- Return to Archive