The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 16, 2025ONTARIO BUDGET 2025-26 The Province of Ontario released its provincial budget for 2025-26 on May 15, 2025. This is the last 2025-26 provincial budget to be tabled.

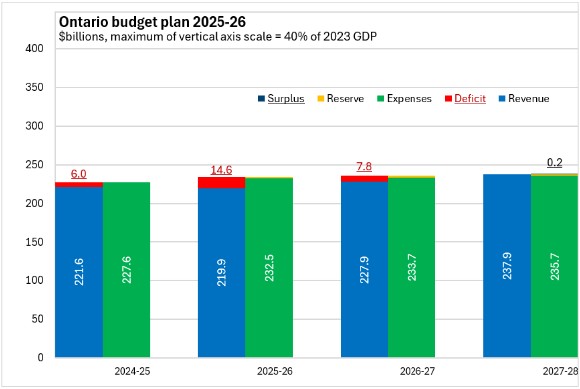

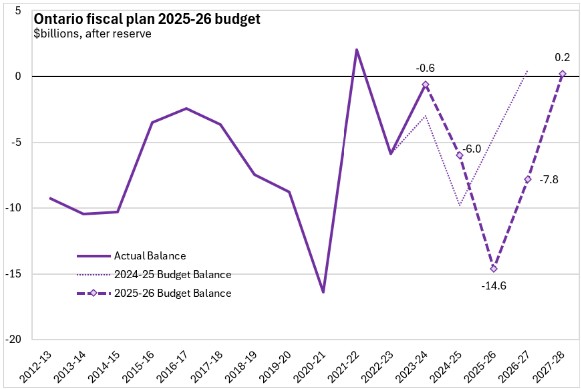

Ontario's 2025-26 budget anticipates a deficit of $14.6 billion, widening from the $6.0 billion deficit projected for 2024-25. In the next two fiscal years, Ontario expects its deficit to be eliminated, posting a small surplus of $0.2 billion in 2027-28 (after a reserve of $2 billion).

Ontario's 2025-26 estimates expect that revenues will contract by 0.8% (after rising 6.0% in 2024-25) while expenditures will grow by 2.2% (after at 8.5% expansion in 2024-25). Revenues are projected to rise by 3.6% in 2026-27 and 4.4% in 2027-28 while expenditures are projected to grow by 0.5% in 2026-27 and by 0.9% in 2027-28.

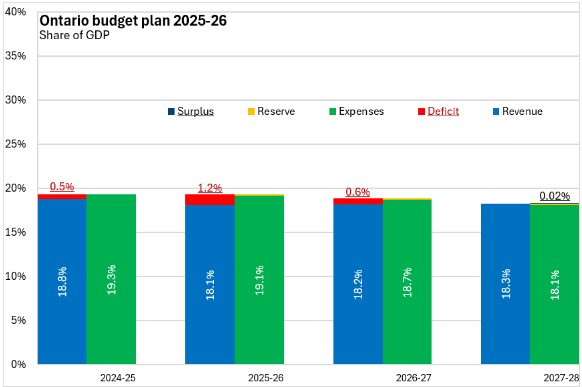

Measured as a share of GDP, the footprint of provincial government in Ontario's economy amounts to 19.3% of GDP in 2025-26. This is projected to shrink slightly to 18.3% of GDP by 2027-28.

Ontario's deficit for 2025-26 amounts to 1.2% of 2025 nominal GDP.

Ontario's net debt is expected to amount to 37.9% of GDP in 2025-26, adhering with the province's target of a debt-to-GDP ratio of under 40%. By 2027-28, the Ontario Budget's planning projection assumes a slight rise in net debt to 38.6% of GDP.

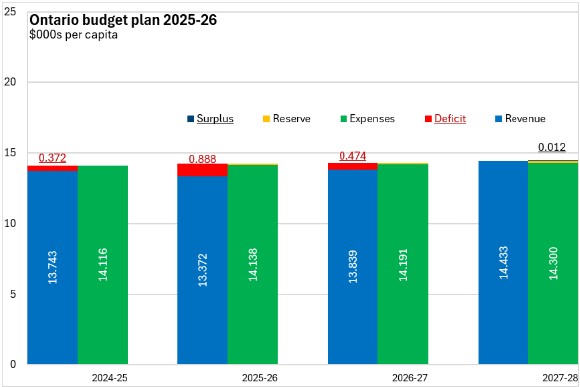

Ontario's 2025-26 Budget expenditures amount to $14,138 per capita (along with $122 per capita in reserve), funded by revenues of $13,372 per capita and a deficit of $888 per capita. Expenditures per capita are projected to rise by $161 by 2027-28 while per capita revenues rise $1,061.

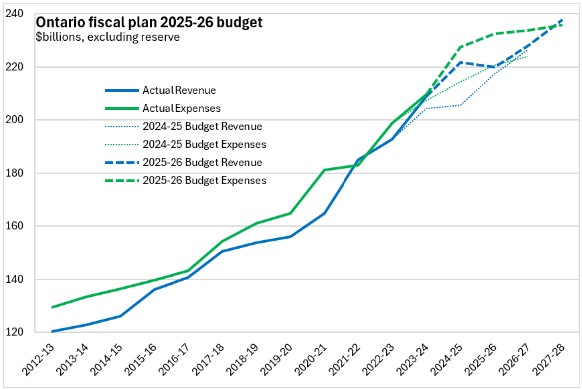

Compared with last year's fiscal plan, Ontario's revenues and expenditures were substantially elevated in 2024-25. While revenues are projected to decline back to their previously-anticipated levels, expenditures are expected to remain at their elevated levels.

With similar revenues and higher expenditures, Ontario's deficit outlook has deteriorated compared to the 2024-25 projection. The 2025-26 deficit is substantially larger and return to balance is delayed by a year to 2027-28.

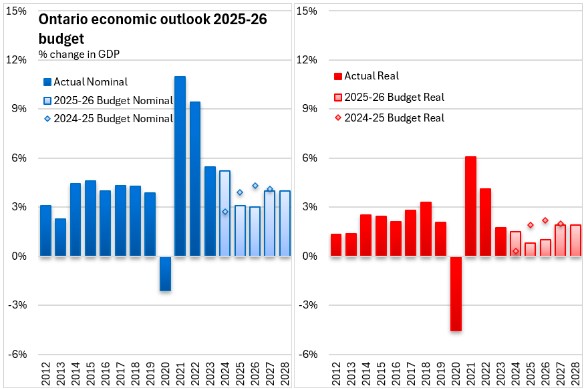

Despite stronger than expected performance in 2024, Ontario's budget economic outlook has softened considerably for 2025 and 2026 because of the threats of US tariffs. Ontario's real GDP is projected to grow by 0.8% in 2025 and 1.0% in 2026. Nominal GDP is projected to increase 3.1% in 2025 and 3.0% in 2026. Uncertainty and weakened business confidence resulting from trade tensions are assumed to combine with slowed population growth to soften the employment outlook. Strong wage gains are expected to provide some support to household consumption spending while accommodative interest rates support housing markets.

The Ontario economic and fiscal outlook considers high and low case alternatives that represent different US trade policy outcomes. In the Faster Growth Scenario, US tariffs and countermeasures are removed in the near term through negotiations, though uncertainty persists. The Faster Growth Scenario results in Ontario's real GDP growth accelerating to 1.6% in 2025 and to 1.8% in 2026. The Slower Growth Scenario applies 25% US tariffs to all Canadian goods (except 10% tariffs for energy) along with 25% retaliatory tariffs applied by Canada to $30 billion worth of US imports. The Slower Growth Scenario does not consider additional global trade disruptions due to US tariffs on other countries. Under the Slower Growth Scenario, Ontario's real GDP is flat in 2025 and contracts by 0.4% in 2026.

Key Measures and Initiatives

Ontario's 2025-26 Budget prioritizes business relief/support, workers, families, communities, the economy and improved services. Key measures include:

Business relief and support

- Raising the Ontario Made Manufacturing Investment Tax Credit from 10% to 15% for Canadian-controlled private corporations and extending the 15% credit for non-Canadian controlled private corporations making eligible investments (combined cost: $13 billion over 5 years)

- Deferring collection of some provincially-administered taxes for 6 months (to October 1, 2025)

- Reducing Workplace Safety and Insurance Board premiums and delivering $4 billion in surplus funds to safe employers in 2025

- Creating an Ontario Shortline Railway Investment Tax Credit

- Adding $15 million to the Life Sciences Innovation Fund

- Introducing the Ontario Grape Support Program and enhancing the Wine Support Program (total program funding of $420 million over 5 years)

Workers, families and communities

- Making the province's gasoline and fuel tax cuts permanent

- Investing an additional $1 billion over the next three years in the Skills Development Fund Capital and Training Streams

- Better Jobs Ontario: providing financial support to cover expenses like tuition, transportation and child care for eligible job seekers

- Investing $20 million in 2025-26 to establish new training and support centres for laid-off workers

- Creating a new Trade-Impacted Communities Program with $40 million in grants for affected communities and industries

Unleashing the economy

- $200 billion in capital investments over 10 years ($33 billion in 2025-26).

- $30 billion to support the planning and construction of highways

- $61 billion for public transit

- $56 billion in health infrastructure

- $30 billion for schools and child care spaces.

- $5 billion more for the Building Ontario Fund

- Creating the Protecting Ontario Account; $5 billion for strategic sectors of the economy that are facing significant tariff-related business disruptions

- Adding $600 million to the Invest Ontario Fund

- Investing $500 million in a new Critical Minerals Processing Fund

- Tripling the maximum amount of loan guarantees through the Indigenous Opportunities Financing Program to $3 billion

- Investing $70 million over four years in the Indigenous Participation Fund

- Investing an additional $90 million in venture capital (VC) funding through Venture Ontario

- Investing $50 million over three years to create the Ontario Together Trade Fund for expanding interprovincial trade

- Investing $200 million in the new Ontario Shipbuilding Grant Program

- Launching a new round of the Hydrogen Innovation Fund with $30 million

- Extending the investment in the Ontario Automotive Modernization Program and the Ontario Vehicle Innovation Network Delivering Better Services

Better services

- Adding $400 million to the Municipal Housing Infrastructure Program and Housing-Enabling Water Systems Fund

- Investing $280 million over two years for the expanding Integrated Community Health Service Centres to reduce backlogs

- $235 million in 2025-26 to establish and expand up to 80 additional primary care teams

- Establishing an Ontario Fertility Treatment Tax Credit, a refundable tax credit for 25 per cent of eligible fertility treatment expenses up to $20,000

- Adding $207 million to the Ontario Research Fund - Research Infrastructure

- Permanently removing tolls from the provincially owned Highway 407 East

- Planning for the next generation of passenger rail service for the Greater Golden Horseshoe

- Buying two new H-135 helicopters for the Niagara Regional Police Service and the Windsor Police Service efforts on the border ($57 million)

Ontario Budget 2025-26

<--- Return to Archive